Car Insurance Rate Quotes Find the Best Deal

Car insurance rate quotes are the foundation of securing the right coverage for your vehicle. Understanding how these quotes are calculated and how to compare them is crucial to finding the best deal. Factors like your driving history, vehicle type, and location all play a role in determining your rates, and comparing quotes from multiple insurers can save you significant money in the long run.

This guide will walk you through the process of obtaining, analyzing, and ultimately choosing the car insurance policy that best suits your individual needs and budget.

The Importance of Regular Reviews

Your car insurance policy is a crucial financial document that protects you from financial losses in case of an accident or other unforeseen events. However, your needs and circumstances can change over time, and your current policy may no longer be the most suitable for your situation. That's why it's essential to review your car insurance policy periodically to ensure you have the right coverage and are paying a fair price. Regular reviews help you stay on top of your insurance needs and ensure you're getting the best value for your money. They also allow you to make adjustments to your policy based on changing circumstances, such as a new car purchase, a change in driving habits, or an increase in your assets.

Factors to Consider When Reviewing Your Policy

It's important to review your car insurance policy at least once a year, or even more frequently if you experience any significant life changes. Here's a checklist of factors to consider when reviewing your policy:- Your driving record: If you've had a clean driving record for a while, you may be eligible for discounts.

- Your car's value: If your car has depreciated in value, you may be able to lower your coverage limits and save on your premium.

- Your coverage needs: Your insurance needs may change based on factors such as your age, family size, and the value of your assets.

- Your budget: As your financial situation changes, you may need to adjust your insurance budget.

- Available discounts: Many insurance companies offer discounts for things like good driving records, safety features, and multiple policies.

- Competitor rates: It's always a good idea to compare rates from different insurance companies to ensure you're getting the best deal.

Adjusting Your Coverage Based on Changing Circumstances

Your car insurance policy should reflect your current needs and circumstances. Here are some common scenarios where you may need to adjust your coverage:- New Car Purchase: When you purchase a new car, you'll need to update your insurance policy to reflect the new vehicle's value and any additional features. You may also need to increase your coverage limits to protect your investment.

- Change in Driving Habits: If you're driving less frequently or commuting shorter distances, you may be able to reduce your coverage limits and save on your premium. Conversely, if you're driving more often or taking longer trips, you may need to increase your coverage.

- Change in Marital Status: Getting married or divorced can affect your insurance rates. If you're adding a spouse to your policy, you may be eligible for discounts. If you're getting divorced, you may need to adjust your coverage limits to reflect your individual needs.

- Increase in Assets: As your assets increase, you may need to increase your liability coverage to protect yourself from financial losses in case of an accident. This is particularly important if you own valuable assets such as a home, investments, or a business.

Car Insurance in Specific Situations

Car insurance needs can vary significantly depending on your individual circumstances. Factors like your age, driving history, and the type of vehicle you own all play a role in determining your insurance rates. It's essential to understand these factors and tailor your insurance coverage accordingly.Car Insurance Needs for Different Drivers

Car insurance needs differ based on your driving experience and risk profile. Here's a breakdown of common scenarios:| Driver Type | Insurance Needs |

|---|---|

| New Drivers | Higher coverage limits, potentially higher premiums due to lack of driving experience. Consider additional coverage like accident forgiveness. |

| High-Risk Drivers | May face higher premiums due to factors like speeding tickets, accidents, or DUI convictions. Seek discounts for defensive driving courses or accident forgiveness. |

| Seniors | May benefit from discounts for safe driving records and senior-specific programs. Consider coverage for medical expenses or accident forgiveness. |

Car Insurance for Specific Vehicle Types

Obtaining car insurance for unique vehicles requires specific considerations.Classic Cars

Classic car insurance typically involves specialized coverage tailored to the vehicle's value and historical significance.- Agreed Value Coverage: This coverage ensures your classic car is insured for its actual value, regardless of market fluctuations.

- Specialized Coverage: Policies may include coverage for parts, restoration, and transportation, which are crucial for classic car owners.

Motorcycles

Motorcycle insurance differs from standard car insurance due to the inherent risks associated with riding.- Higher Deductibles: Motorcyclists often opt for higher deductibles to lower their premiums.

- Specialized Coverage: Policies may include coverage for rider safety gear, motorcycle accessories, and towing services.

Geographic Location and Car Insurance Rates

Your location significantly impacts car insurance rates. Factors like population density, traffic volume, and crime rates influence insurance costs.- Urban Areas: Higher car insurance rates due to increased risk of accidents and theft.

- Rural Areas: Lower car insurance rates due to lower traffic density and fewer accidents.

Car Insurance and Technology: Car Insurance Rate Quotes

Telematics Devices and Usage-Based Insurance, Car insurance rate quotes

Telematics devices, also known as black boxes, are small devices installed in vehicles that collect data on driving behavior, such as speed, braking, acceleration, and mileage. This data is then used to calculate insurance premiums based on actual driving habits.- Usage-Based Insurance (UBI): UBI programs use telematics data to offer discounts to safe drivers. For example, drivers who maintain a consistent driving speed, avoid hard braking, and drive during off-peak hours may receive lower premiums.

- Real-Time Feedback: Some telematics devices provide real-time feedback to drivers, alerting them to risky driving behaviors. This can help drivers improve their driving habits and potentially reduce the risk of accidents.

- Accident Detection and Assistance: Telematics devices can detect accidents and automatically notify emergency services, providing immediate assistance in case of an accident.

Online Platforms and Digital Insurance

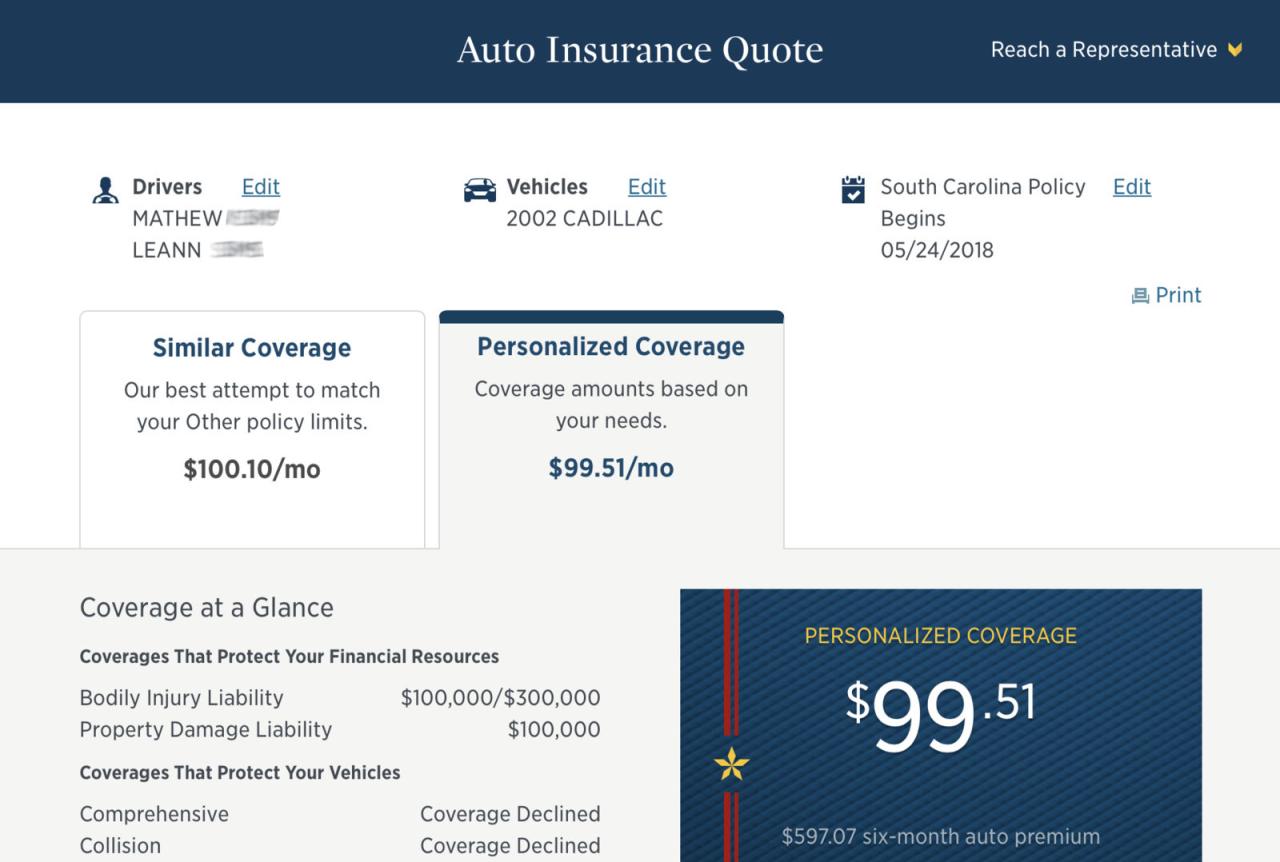

The rise of online platforms has made it easier than ever to obtain and manage car insurance. Online insurance providers offer a streamlined and convenient experience, allowing customers to get quotes, compare policies, purchase coverage, and manage their accounts online.- Comparison Websites: Comparison websites allow users to compare quotes from multiple insurers, making it easier to find the best deal.

- Digital Insurance Agents: Some online platforms provide digital insurance agents who can assist customers with selecting the right coverage and answering questions.

- Mobile Apps: Many insurers offer mobile apps that allow customers to access their insurance information, file claims, and communicate with their insurance providers on the go.

Navigating the world of car insurance can seem overwhelming, but with the right information and a proactive approach, you can secure the best possible coverage at a price that fits your budget. By understanding the factors that influence rates, comparing quotes, and exploring available discounts, you can make informed decisions that protect your vehicle and your wallet.

Getting car insurance rate quotes can be a time-consuming process, but it's essential to compare rates from different providers to find the best deal. If you're a member of the military or a veteran, you might be eligible for a free car insurance quote from USAA. This can be a great way to save money on your car insurance, so be sure to check out their rates alongside other insurers.

Car insurance rate quotes can vary significantly based on factors like your driving history, vehicle type, and location. If you're looking for competitive rates, consider exploring cheap car insurance online quotes from different insurers. By comparing quotes, you can find the best coverage at a price that fits your budget.

Post a Comment