Get Home and Car Insurance Quotes Online

Home and car insurance quotes online have revolutionized the way people shop for insurance. Gone are the days of calling multiple agents and waiting for quotes to arrive in the mail. Today, you can easily compare quotes from various insurance providers online, saving time and potentially finding better rates. This convenient approach allows you to access a wide range of options, compare coverage details, and make informed decisions about your insurance needs.

This comprehensive guide will explore the benefits of comparing quotes online, explain key factors that influence insurance premiums, and provide tips for navigating the online quoting process. We'll also discuss the importance of understanding policy terms and conditions, the advantages of bundling home and car insurance, and how to protect your personal information when using online platforms.

The Importance of Comparing Quotes: Home And Car Insurance Quotes Online

Getting multiple quotes from different insurance providers is crucial for securing the best possible coverage at the most competitive price. By comparing quotes, you can gain valuable insights into the market, understand the various coverage options available, and ultimately, save a significant amount of money on your insurance premiums.

Saving Money

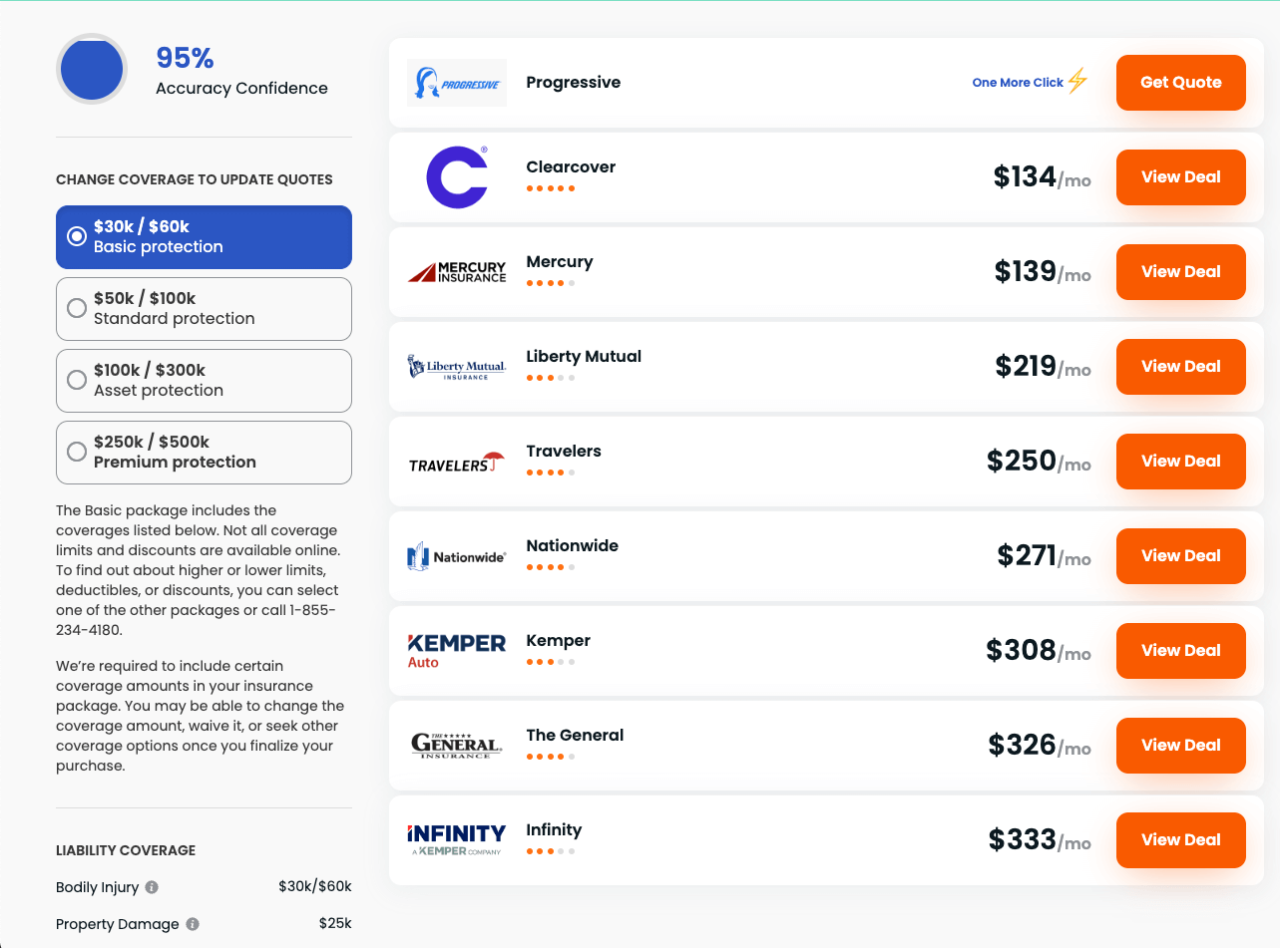

Comparing quotes can help you save money on insurance premiums in several ways. By shopping around and getting quotes from multiple insurers, you can see how different companies price their policies and identify the most affordable options. This competitive process often leads to significant savings, as insurers strive to attract customers with competitive rates.For example, imagine you're looking for car insurance and get quotes from three different companies. Company A offers a premium of $1,000 per year, Company B offers $800 per year, and Company C offers $750 per year. By comparing these quotes, you can see that choosing Company C would save you $250 per year compared to Company A.

Real-World Examples

Many individuals have successfully saved money by comparing insurance quotes. A recent study by the National Association of Insurance Commissioners (NAIC) found that 75% of consumers who compared quotes saved an average of $400 per year on their car insurance. Additionally, a survey by the Insurance Information Institute (III) revealed that 60% of homeowners who compared quotes saved an average of $300 per year on their homeowners insurance.Understanding Home Insurance Quotes

Getting a home insurance quote might seem daunting, but it's essential to understand the factors that influence your premium and how you can get the best value. Understanding these elements allows you to make informed decisions and potentially save money on your home insurance.Factors Influencing Home Insurance Premiums

The cost of your home insurance is determined by various factors, including the location, property value, and coverage options you choose.- Location: Your home's location significantly impacts your premium. Areas prone to natural disasters like earthquakes, hurricanes, or floods will generally have higher premiums due to the increased risk. Similarly, neighborhoods with high crime rates or a history of property damage may also have higher premiums.

- Property Value: The value of your home is another crucial factor. Higher property values usually mean higher premiums because the insurance company is responsible for a larger payout in case of damage or loss. It's important to accurately assess the value of your home, including the cost of rebuilding it, to ensure adequate coverage.

- Coverage Options: The type and amount of coverage you choose will influence your premium. You can select different levels of coverage, from basic protection against fire and theft to more comprehensive coverage that includes damage from natural disasters and liability for accidents on your property. Choosing a higher level of coverage will generally result in a higher premium, but it will also provide greater financial protection in the event of a claim.

Lowering Home Insurance Costs

You can take steps to lower your home insurance costs without compromising your coverage.- Preventative Measures: Investing in home safety measures like installing smoke detectors, burglar alarms, and fire extinguishers can demonstrate to insurance companies that you're taking steps to mitigate risks. These measures can qualify you for discounts, leading to lower premiums.

- Discounts: Insurance companies offer various discounts to encourage good practices and responsible behavior. Some common discounts include:

- Bundling: Bundling your home and car insurance with the same company often results in significant discounts.

- Security Systems: Installing a security system with a monitored alarm can lead to substantial discounts on your premium.

- Loyalty: Maintaining a long-term relationship with your insurance company can earn you loyalty discounts.

- Safety Features: Homes with features like fire sprinklers or impact-resistant roofing can qualify for discounts.

- Good Credit: In some areas, insurance companies may offer discounts to policyholders with good credit scores.

Common Home Insurance Coverage Options

Understanding different coverage options is essential for choosing the right plan for your needs.- Dwelling Coverage: This is the most important coverage, protecting your home's structure from damage caused by covered perils, such as fire, theft, or natural disasters. It covers the cost of repairs or rebuilding your home.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry, from damage or theft. It usually has a limit on the amount of coverage, so it's important to ensure you have enough coverage for your valuable possessions.

- Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or you are found liable for damages to someone else's property. It's essential for protecting yourself from lawsuits and significant financial burdens.

- Additional Living Expenses: This coverage helps cover your expenses if you need to live elsewhere temporarily while your home is being repaired after a covered event. It can help pay for hotel rooms, meals, and other essential expenses.

- Flood Insurance: This coverage is typically separate from standard home insurance and is essential for homes located in flood-prone areas. Flood insurance protects your home from damage caused by flooding, which is often excluded from standard policies.

- Earthquake Insurance: This coverage is also usually separate from standard home insurance and is important for homes located in earthquake-prone areas. Earthquake insurance protects your home from damage caused by earthquakes, which can be very expensive to repair.

Understanding Car Insurance Quotes

Getting a car insurance quote can feel overwhelming, especially with so many factors influencing the price. Understanding the key factors that determine your premium can help you get the best possible rate.Factors Affecting Car Insurance Premiums

Car insurance premiums are calculated based on a variety of factors, including:- Driving History: Your driving record is one of the most significant factors influencing your premium. A clean record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive also plays a crucial role. Luxury cars or high-performance vehicles are often considered riskier to insure due to their higher repair costs and potential for theft.

- Location: Where you live can impact your insurance premium. Areas with higher crime rates or more traffic congestion may have higher insurance rates due to the increased risk of accidents or theft.

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Gender can also play a role, with men generally paying higher premiums than women.

- Credit Score: In some states, insurers may use your credit score as a factor in determining your premium. A good credit score is often associated with responsible behavior, which can translate into lower insurance rates.

Lowering Car Insurance Costs

There are several steps you can take to potentially lower your car insurance costs:- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Many insurers offer discounts for completing these courses.

- Safety Features: Vehicles equipped with safety features like anti-theft systems, airbags, and anti-lock brakes are generally considered safer and may qualify for discounts.

- Increase Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can result in lower premiums.

- Bundle Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Shop Around: Compare quotes from multiple insurers to find the best rates. Online comparison tools can streamline this process.

Common Car Insurance Coverage Options

Car insurance policies typically include a variety of coverage options:- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers the other driver's medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs to your vehicle if it's damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

Online Quoting Tools and Platforms

Comparing Online Quoting Tools and Platforms

Different online quoting tools and platforms vary in their features, ease of use, and data security measures. Here's a comparison of some key factors:- Features: Some platforms offer a wider range of coverage options, including specialized insurance types like renters insurance or flood insurance. Others may provide additional features like policy management tools, claims reporting, and 24/7 customer support.

- Ease of Use: The user interface and navigation should be intuitive and straightforward. Platforms with clear instructions, interactive forms, and helpful tooltips make the quoting process easier.

- Data Security: It's crucial to choose platforms that employ robust security measures to protect your personal and financial information. Look for platforms that use encryption, secure servers, and two-factor authentication.

Advantages and Disadvantages of Online Quoting Tools

Using online quoting tools has several advantages:- Convenience: You can get quotes anytime, anywhere, without scheduling appointments or waiting for agents to call back.

- Comparison: Online platforms allow you to compare quotes from multiple insurers side-by-side, making it easier to find the best value.

- Transparency: You can access detailed information about coverage options, policy terms, and pricing, giving you greater control over your insurance choices.

- Limited Personalization: While online platforms offer personalized quotes, they may not fully capture all your individual needs and circumstances.

- Potential for Errors: Providing inaccurate information during the quoting process can lead to incorrect quotes or policy coverage.

- Lack of Personal Interaction: Online platforms lack the personalized advice and support that traditional insurance agents can provide.

Navigating Online Quoting Platforms

To ensure you get accurate quotes and the best possible coverage, follow these tips when using online quoting platforms:- Be Accurate: Provide all necessary information truthfully and accurately. This includes your personal details, property information, driving history, and any relevant claims history.

- Read the Fine Print: Carefully review the policy terms, conditions, and exclusions before making a decision. Pay attention to coverage limits, deductibles, and any limitations on coverage.

- Compare Quotes: Don't settle for the first quote you receive. Compare quotes from multiple insurers to ensure you're getting the best deal.

- Ask Questions: If you have any questions or concerns, contact the insurer directly or seek advice from a licensed insurance agent.

Understanding Policy Terms and Conditions

Before you finalize your home or car insurance policy, it's crucial to understand the terms and conditions Artikeld in the policy document. These terms define your coverage, responsibilities, and limitations.Key Policy Terms, Home and car insurance quotes online

Understanding key policy terms is essential to ensure you have the right coverage and avoid surprises later. Here are some common terms:- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible for your car insurance and you get into an accident with $1,000 worth of damage, you'll pay the first $500 and your insurance will cover the remaining $500.

- Coverage Limits: These are the maximum amounts your insurance company will pay for covered losses. For example, if your car insurance policy has a $50,000 liability limit, your insurance company will only pay up to $50,000 for damages you cause to another person's property or injuries you cause to another person in an accident.

- Exclusions: These are specific events or situations that are not covered by your insurance policy. For instance, most home insurance policies exclude coverage for damage caused by earthquakes or floods, unless you have purchased additional coverage for these specific events.

Reading and Understanding Policy Documents

It's crucial to carefully read and understand your policy documents before finalizing your insurance purchase. This includes:- The Declaration Page: This page summarizes your policy details, including your name, address, policy number, coverage limits, and deductibles.

- The Coverage Sections: These sections detail the specific types of coverage you have, such as liability, collision, comprehensive, and medical payments coverage.

- The Exclusions and Conditions: These sections Artikel the situations and events that are not covered by your policy and any specific conditions you must meet to receive coverage.

Identifying and Interpreting Key Policy Provisions

Here's a guide to help you identify and interpret key policy provisions:- Look for clear and concise language: Insurance policies can be complex, but you should be able to understand the main points without needing to consult a lawyer.

- Pay attention to definitions: Insurance policies often define specific terms, so make sure you understand what they mean in the context of your policy.

- Review the exclusions carefully: It's important to understand what is not covered by your policy so you can take steps to protect yourself from potential risks.

- Ask questions if you're unsure: Don't hesitate to contact your insurance agent or company if you have any questions about your policy.

Bundling Home and Car Insurance

Bundling your home and car insurance policies with the same provider can offer significant advantages, including potential discounts and savings. This strategy can simplify your insurance management and provide a streamlined approach to coverage.Potential Discounts and Savings

Bundling your home and car insurance policies can lead to substantial savings. Insurance companies often offer discounts to policyholders who bundle their coverage. These discounts can vary depending on the insurer and the specific policies being bundled.- Multi-Policy Discount: This is the most common discount offered for bundling. It typically ranges from 5% to 25% of your total premium.

- Loyalty Discount: Some insurers offer additional discounts to customers who bundle their policies and maintain a long-term relationship with the company.

- Combined Deductible: Bundling can sometimes allow you to apply a single deductible to both your home and car insurance claims, which can save you money in the event of an incident.

Comparison of Bundling Options

Here's a comparison of bundling options from different insurance providers, highlighting their key features and potential savings:| Insurance Provider | Multi-Policy Discount | Other Bundling Benefits | Example Savings |

|---|---|---|---|

| Provider A | 15% | Loyalty discount, combined deductible | $200 per year |

| Provider B | 10% | Free roadside assistance, discounts for safety features | $150 per year |

| Provider C | 20% | Online account management, discounts for good driving record | $250 per year |

Getting Personalized Quotes

Obtaining accurate and personalized insurance quotes is crucial for finding the best coverage at the right price. When you provide detailed and accurate information about yourself, your home, and your car, insurance companies can create a quote that accurately reflects your individual needs and risk profile.

Getting quotes for home and car insurance online can be a great way to save time and money. While you're exploring options for your insurance needs, why not take a break and unleash your creative side? DIY Costumes: A Guide to Creative Costuming offers fantastic inspiration for crafting unique and personalized costumes for any occasion. Once you've found the perfect insurance coverage, you'll be ready to tackle any costume challenge with confidence!

Providing Accurate Information

The accuracy of your insurance quote depends on the accuracy of the information you provide. It's important to be thorough and honest when filling out your quote request, as any inaccuracies can lead to an inaccurate quote and potentially higher premiums later on. This includes details about:

- Your Personal Information: Your name, address, date of birth, contact information, and driving history.

- Your Home: The address, age, size, type of construction, and any security features. You should also include information about any valuable possessions you own, such as jewelry or artwork.

- Your Car: The make, model, year, mileage, and any safety features. It's also important to mention any modifications you've made to your car, as this can impact its value and insurance cost.

- Your Driving History: This includes any accidents, violations, and driving experience.

Understanding Personalized Quotes

Personalized quotes are tailored to your specific needs and circumstances. Insurance companies use a complex algorithm that considers factors like your age, location, driving history, and the value of your property to calculate your premium. By providing accurate information, you can ensure that your quote reflects your individual risk profile and that you are not overpaying for coverage.

Getting quotes for home and car insurance online can save you time and money, but remember to also consider ways to reduce your overall expenses. If soaring temperatures are causing your energy bills to climb, try building a DIY air conditioner to keep your home cool on a budget. After all, lowering your energy costs can free up more funds for other priorities, like insurance premiums.

Tailoring Your Quote Request

To ensure you get the most accurate and personalized quotes, you should tailor your request to your specific needs. This includes:

- Considering your coverage needs: Determine what type of coverage you need and what deductibles you are comfortable with. For example, if you have a high-value car, you may need more comprehensive coverage than someone with a standard vehicle.

- Exploring different insurance companies: Compare quotes from multiple companies to ensure you are getting the best value for your money.

- Taking advantage of discounts: Many insurance companies offer discounts for things like safe driving records, security systems, and bundling policies. Make sure to inquire about any available discounts to reduce your premium.

- Reviewing your quote carefully: Once you receive a quote, review it carefully to ensure you understand the coverage details and premiums. If anything is unclear, don't hesitate to contact the insurance company for clarification.

Protecting Your Personal Information

When you're shopping for home and car insurance online, you'll need to provide personal information, which makes data security and privacy crucial. Understanding how to protect your information is essential for a safe and secure online experience.Identifying Reputable Insurance Providers

It's important to choose insurance providers that prioritize data security. Here are some tips to help you identify reputable companies:- Look for industry certifications: Reputable providers often have certifications like the ISO 27001 standard, which demonstrates their commitment to information security. These certifications show that the company has implemented robust security measures to protect your data.

- Read online reviews: Customer reviews can provide valuable insights into a company's practices and how they handle customer data. Look for feedback related to data security and privacy.

- Check their privacy policy: A clear and comprehensive privacy policy Artikels how the company collects, uses, and protects your information. Pay attention to sections on data encryption, data retention, and how they handle data breaches.

- Look for a secure website: A secure website will have a padlock icon in the address bar and the URL will start with "https." This indicates that the website uses encryption to protect your data during transmission.

Safeguarding Your Personal Information

Here are some steps you can take to protect your personal information when using online quoting platforms:- Use strong passwords: Create unique and strong passwords for each online account. Avoid using common words or phrases and use a mix of uppercase and lowercase letters, numbers, and symbols.

- Enable two-factor authentication: This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password. This makes it much harder for unauthorized individuals to access your accounts.

- Be cautious of phishing scams: Phishing scams often involve fake emails or websites that try to trick you into providing your personal information. Be wary of any suspicious emails or links and always verify the authenticity of a website before entering any personal details.

- Avoid public Wi-Fi for sensitive tasks: Public Wi-Fi networks are not always secure. Avoid accessing sensitive information or making online purchases on public Wi-Fi, as it could be vulnerable to eavesdropping.

- Monitor your accounts regularly: Check your account statements and activity regularly for any suspicious transactions or unauthorized access. This can help you detect any security breaches early on.

Reviewing and Adjusting Your Policy

Your insurance needs can change over time, so it's important to review and adjust your policies regularly. This ensures you have adequate coverage and avoid paying for unnecessary protection. Life events such as buying a new home or vehicle, getting married, or having a child can impact your insurance requirements.Adjusting Your Policy for Life Changes

Significant life changes often require adjustments to your insurance policies. These changes can affect your coverage needs and premiums. For example, buying a new home might necessitate increasing your homeowners insurance coverage to reflect the new property's value. Similarly, getting married could lead to a change in your auto insurance policy, as you may need to add your spouse as a driver.Tips for Making Necessary Adjustments

- Review your policies annually: Make it a habit to review your insurance policies at least once a year. This helps you stay informed about your coverage and identify any areas that need updating.

- Contact your insurance agent: Discuss any life changes with your insurance agent. They can help you understand how these changes impact your coverage and suggest appropriate adjustments to your policies.

- Document changes in writing: When making changes to your policy, ensure you receive written confirmation from your insurance company. This documentation serves as proof of your updated coverage.

- Shop around for better rates: Even if you've made adjustments to your existing policies, it's still beneficial to shop around for better rates. Other insurance companies might offer more competitive pricing for your specific needs.

By understanding the process of obtaining home and car insurance quotes online, you can take control of your insurance needs and make informed decisions. Comparing quotes, exploring different coverage options, and understanding policy terms are crucial steps to ensuring you have the right protection at the best possible price. With a little research and effort, you can find the insurance coverage that meets your specific needs and budget, providing peace of mind and financial security.

.jpg)

Post a Comment