Dental insurance plans are a crucial aspect of maintaining good oral health, providing financial protection against unexpected dental costs. Understanding the different types of plans, their benefits, and factors to consider when choosing one is essential for making informed decisions about your dental care.

This guide delves into the intricacies of dental insurance, exploring various plan types, key features, benefits, and considerations for selecting the right coverage. We’ll also provide insights into common dental procedures covered, terminology, and tips for maintaining your insurance.

Key Features of Dental Insurance Plans

Dental insurance plans offer financial protection against the costs associated with dental care. They operate by covering a portion of the expenses for various dental procedures, helping individuals manage their out-of-pocket costs. Understanding the key features of these plans is crucial for making informed decisions about coverage and cost.

Annual Maximum Coverage

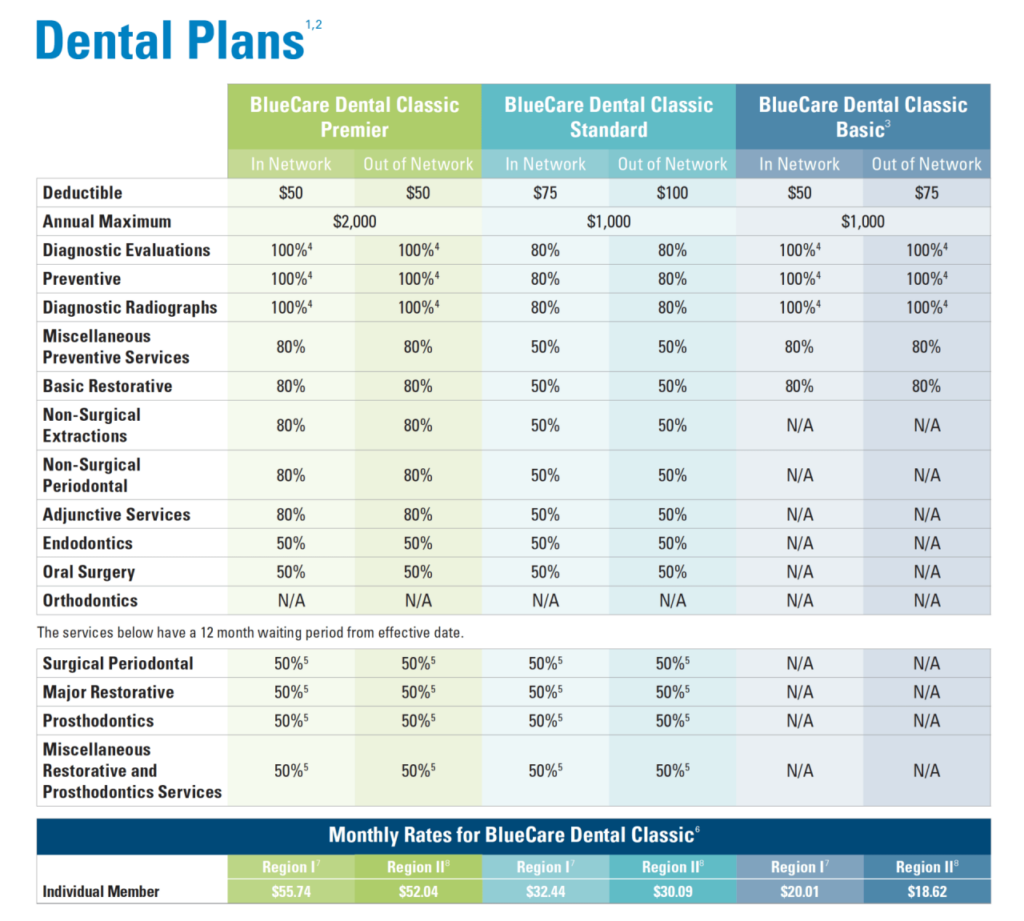

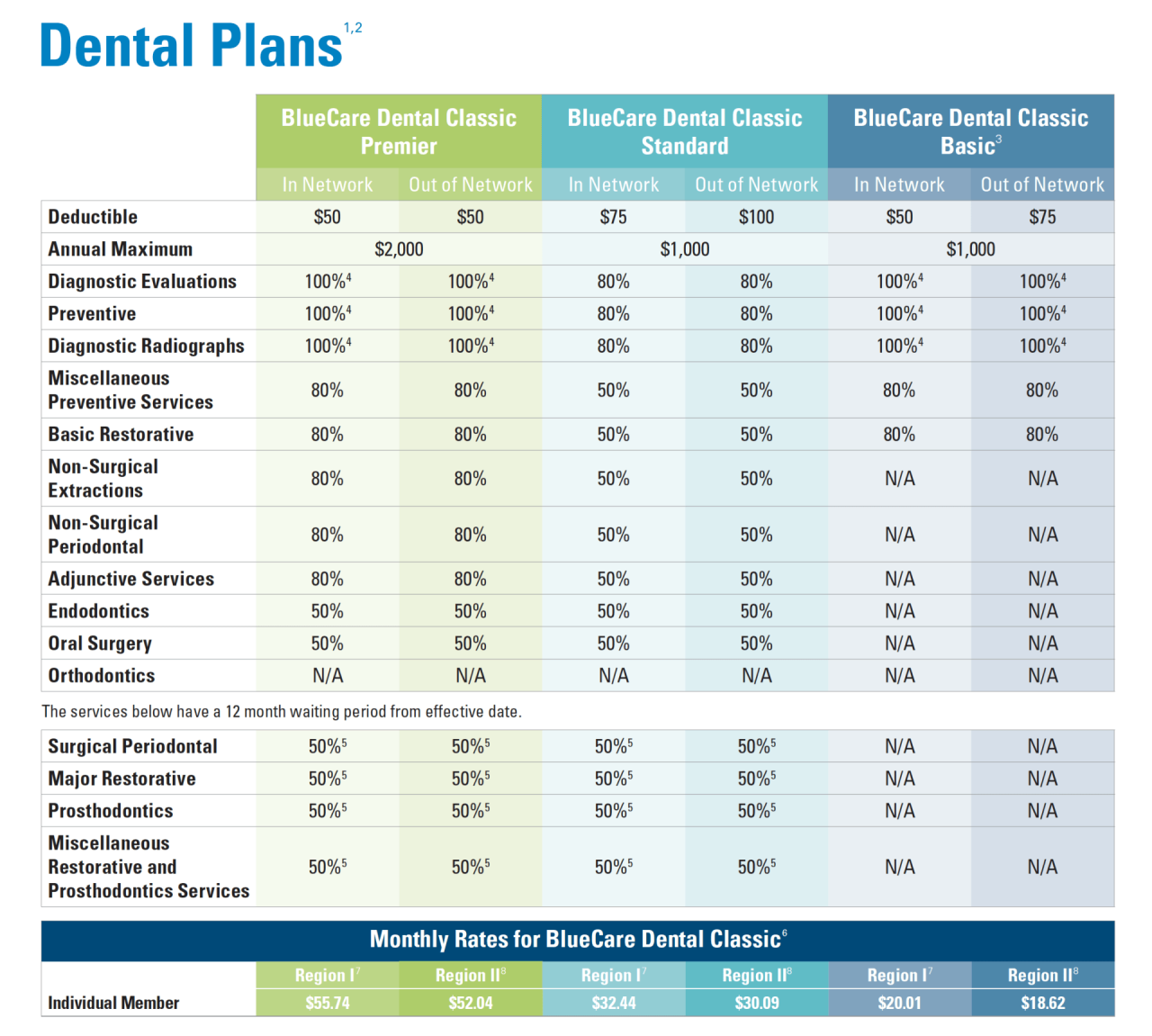

The annual maximum coverage is the total amount your dental insurance plan will pay towards your dental expenses in a year. It represents the maximum benefit you can receive. Once the annual maximum is reached, you will be responsible for the remaining costs of any further dental procedures.

For example, if your annual maximum is $1,500 and you incur $2,000 in dental expenses, the insurance will cover $1,500, and you will be responsible for the remaining $500.

Deductibles

A deductible is the amount you must pay out-of-pocket before your dental insurance starts covering your dental expenses. It’s a fixed amount that applies to each benefit period, which is usually a calendar year.

For example, if your deductible is $100 and you need a filling that costs $200, you will pay the first $100, and your insurance will cover the remaining $100.

Co-pays

A co-pay is a fixed amount you pay for each dental service you receive, regardless of the total cost of the service. Co-pays are usually applied to routine services like cleanings and checkups.

For instance, if your co-pay for a cleaning is $20, you will pay $20, and your insurance will cover the remaining cost of the cleaning.

Waiting Periods

Waiting periods are the time you must wait after enrolling in a dental insurance plan before certain benefits become effective. They are typically applied to major dental procedures, such as crowns, bridges, and implants.

For example, a waiting period of six months for major procedures means that you will have to wait six months after enrolling in the plan before the insurance will cover these procedures.

Exclusions and Limitations

Dental insurance plans often have exclusions and limitations that specify what services they do not cover. These can include cosmetic procedures, procedures deemed unnecessary by the insurance company, or procedures that are not medically necessary.

For example, cosmetic procedures like teeth whitening or veneers are typically not covered by dental insurance.

Cost and Coverage Considerations: Dental Insurance Plan

Dental insurance plans, like any other insurance, vary in cost and coverage. Several factors influence the price you pay and the benefits you receive. Understanding these factors will help you choose a plan that best fits your needs and budget.

Factors Influencing Dental Insurance Costs

The cost of your dental insurance plan depends on various factors, including:

- Age: Younger individuals generally have healthier teeth and require less dental care, resulting in lower premiums. As you age, the risk of dental issues increases, leading to higher premiums.

- Location: The cost of living and healthcare expenses in different regions vary significantly. Plans in high-cost areas tend to be more expensive.

- Plan Type: Dental insurance plans are categorized into different types, such as dental HMOs, PPOs, and Indemnity plans. Each type offers varying levels of coverage and cost structures.

- Coverage Level: The extent of coverage offered by a plan directly impacts the premium. Plans with comprehensive coverage, including preventive, basic, and major services, usually have higher premiums than plans with limited coverage.

Coverage and Cost Comparisons, Dental insurance plan

Different dental insurance plans offer varying levels of benefits at different costs. Here’s a comparison of common plan types and their coverage:

| Plan Type | Coverage Level | Cost |

|---|---|---|

| Dental HMO | Limited network, lower premiums, preventive care covered, limited coverage for major procedures. | Lower premiums, but limited choices and potential higher out-of-pocket expenses for non-network providers. |

| Dental PPO | Larger network, higher premiums, broader coverage, discounts for in-network providers. | Higher premiums, but more flexibility in choosing providers and potentially lower out-of-pocket expenses. |

| Indemnity Plan | Most flexibility, highest premiums, reimburses a percentage of costs, limited network restrictions. | Highest premiums, but greater freedom in choosing providers and potentially higher out-of-pocket expenses. |

Real-World Scenarios

Let’s consider some real-world scenarios to understand how coverage and cost interact:

Scenario 1: A young individual with healthy teeth may opt for a Dental HMO plan with lower premiums, as preventive care is covered. However, if they require extensive dental work, they may face higher out-of-pocket expenses.

Scenario 2: An older individual with pre-existing dental issues might choose a Dental PPO plan with broader coverage and discounts for in-network providers. This allows them to access specialized care while managing costs.

Scenario 3: A family with diverse dental needs might prefer an Indemnity plan, offering flexibility in choosing providers and potentially higher reimbursements for major procedures. However, they need to be prepared for higher premiums.

Understanding Dental Insurance Terminology

Navigating the world of dental insurance can feel like deciphering a foreign language. But don’t worry, we’re here to help you understand the common terms you’ll encounter. This will help you make informed decisions about your dental care and coverage.

Dental Insurance Terminology

Understanding the key terms associated with dental insurance plans is crucial for making informed decisions about your dental care. Here’s a breakdown of common terms:

- Premium: This is the regular payment you make to your insurance company to maintain your coverage. It’s usually paid monthly, quarterly, or annually.

- Deductible: This is the amount you pay out-of-pocket for dental services before your insurance coverage kicks in. Once you’ve met your deductible, your insurance will start covering a portion of your dental expenses.

- Co-pay: This is a fixed amount you pay for each dental service you receive, even after you’ve met your deductible. Co-pays help to share the cost of dental care between you and your insurance company.

- Out-of-pocket maximum: This is the maximum amount you’ll pay for dental care in a year. Once you’ve reached this limit, your insurance will cover 100% of your remaining dental expenses for the rest of the year.

- Network: This refers to the group of dentists and dental providers who have agreements with your insurance company. You typically receive lower costs and better coverage when you see a dentist within your network.

- Pre-existing conditions: These are health conditions you had before enrolling in a dental insurance plan. Some plans may have limitations or exclusions for pre-existing conditions, so it’s essential to review your policy carefully.

Ending Remarks

By understanding the fundamentals of dental insurance plans, you can empower yourself to make informed choices that align with your individual needs and budget. Whether you’re seeking preventative care, coverage for major procedures, or simply financial peace of mind, a well-chosen dental insurance plan can be a valuable investment in your overall health and well-being.

Dental insurance plans can help you manage the cost of dental care, just like lenders mortgage insurance can help protect you from financial loss if you default on your mortgage. To stay up-to-date on the latest developments in the mortgage insurance market, check out lenders mortgage insurance news.

Similarly, it’s essential to understand the coverage and limitations of your dental insurance plan to make informed decisions about your oral health.