Auto insurance New York sets the stage for this comprehensive guide, offering drivers a clear understanding of the state’s insurance landscape. From mandatory coverage requirements to navigating the intricacies of premium calculations, this guide provides valuable insights for navigating the New York auto insurance market.

This guide delves into the intricacies of New York’s auto insurance regulations, covering topics such as mandatory coverage requirements, no-fault insurance, and the various types of insurance available. It explores factors that influence premium rates, including driving history, vehicle type, and personal demographics. The guide also offers practical advice on choosing the right policy, filing claims, and utilizing driver safety programs to reduce premiums. Furthermore, it provides tips for saving money on insurance, navigating the market, and understanding consumer protections.

New York Auto Insurance Laws and Regulations

New York has a comprehensive set of auto insurance laws and regulations designed to protect drivers, passengers, and pedestrians. These laws are designed to ensure that all drivers have adequate financial coverage in case of an accident. This ensures that victims of accidents have access to necessary medical care and compensation for damages.

Mandatory Coverage Requirements

New York State law mandates that all vehicle owners have specific types of auto insurance coverage. These coverages are designed to protect both the policyholder and others involved in an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical expenses, lost wages, and property damage. New York requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $10,000 for property damage liability.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your own medical expenses, lost wages, and other related expenses regardless of who is at fault in an accident. New York requires a minimum of $50,000 in PIP coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It provides coverage for your medical expenses, lost wages, and property damage. New York requires that you purchase this coverage, and it must be at least equal to your liability coverage limits.

New York State’s No-Fault Insurance System

New York’s no-fault insurance system is designed to streamline the claims process and reduce litigation after an accident. Under this system, drivers are required to file claims with their own insurance company for medical expenses and lost wages, regardless of who is at fault. This system aims to speed up the process of getting necessary medical care and compensation without waiting for fault to be determined.

Types of Auto Insurance in New York

New York offers a variety of auto insurance options to meet different needs and budgets. Here is a breakdown of the most common types:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is optional in New York but often required by lenders if you have a car loan.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It is also optional but may be required by lenders.

- Rental Reimbursement Coverage: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident. This coverage can be helpful if you rely on your vehicle for work or other essential activities.

- Roadside Assistance Coverage: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies. It can include services like towing, jump-starts, and tire changes.

Penalties for Driving Without Insurance

Driving without the required minimum auto insurance in New York is illegal and carries significant penalties. These penalties can include:

- Fines: You can be fined up to $1,500 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to three years for driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Criminal Charges: In some cases, driving without insurance can lead to criminal charges.

- Increased Insurance Premiums: If you are caught driving without insurance, your insurance premiums may be significantly higher in the future.

Filing a Claim and Managing Insurance Coverage in New York

Navigating the process of filing an auto insurance claim and managing your coverage in New York can feel overwhelming, but understanding the steps involved can make the experience smoother. This section will guide you through the process of filing a claim, dealing with insurance adjusters, handling claim settlements, changing or canceling your policy, and the importance of maintaining accurate insurance records.

Filing an Auto Insurance Claim in New York

Filing a claim with your auto insurance company in New York is a straightforward process. You can typically file a claim online, by phone, or by mail. The process involves providing details about the accident, your vehicle, and any injuries sustained.

- Report the Accident to Your Insurance Company: The first step is to report the accident to your insurance company as soon as possible. This is typically done by phone or online. Be prepared to provide information about the date, time, and location of the accident, as well as details about the other vehicles involved and any injuries sustained.

- Gather Necessary Information: Before you file your claim, gather as much information as possible about the accident. This includes the names, addresses, and insurance information of the other drivers involved, any witness information, and photos or videos of the accident scene and the damage to your vehicle.

- Complete and Submit the Claim Form: Once you have gathered all the necessary information, you can complete and submit the claim form. This form will ask for details about the accident, your vehicle, and any injuries sustained.

- Cooperate with the Insurance Adjuster: After you file your claim, an insurance adjuster will contact you to investigate the accident. Be prepared to provide them with any additional information they may require, such as police reports, medical records, and repair estimates.

- Negotiate a Settlement: Once the insurance adjuster has completed their investigation, they will make a settlement offer. You have the right to negotiate this offer, and you may want to consult with an attorney if you are not satisfied with the initial offer.

Dealing with Insurance Adjusters, Auto insurance new york

Insurance adjusters play a crucial role in the claims process, evaluating the damage to your vehicle and determining the appropriate compensation. It’s important to be prepared and understand your rights when dealing with them.

- Be Polite and Cooperative: Maintaining a respectful and cooperative attitude with the insurance adjuster can facilitate a smoother claims process.

- Document All Communications: Keep detailed records of all communications with the insurance adjuster, including dates, times, and the content of conversations.

- Understand Your Rights: Be aware of your rights as an insured individual and don’t hesitate to ask questions if you are unsure about anything.

- Get Everything in Writing: Obtain written confirmation of any agreements or promises made by the insurance adjuster.

Handling Claim Settlements

Once the insurance adjuster has completed their investigation, they will make a settlement offer. You have the right to negotiate this offer and may want to seek legal advice if you are unsure about its fairness.

- Review the Settlement Offer Carefully: Before accepting any settlement offer, carefully review the terms and conditions. Ensure that it covers all of your losses, including vehicle repairs, medical expenses, and lost wages.

- Negotiate if Necessary: If you are not satisfied with the initial settlement offer, you have the right to negotiate. Be prepared to provide supporting documentation, such as repair estimates, medical bills, and wage statements.

- Consult with an Attorney: If you are unable to reach a satisfactory settlement with the insurance company, you may want to consult with an attorney. An attorney can help you understand your rights and negotiate a fair settlement on your behalf.

Changing or Canceling an Auto Insurance Policy in New York

You may need to change or cancel your auto insurance policy for various reasons, such as purchasing a new vehicle, moving to a new location, or simply finding a better deal.

- Notify Your Insurance Company in Writing: When changing or canceling your policy, it is crucial to notify your insurance company in writing. This can be done by mail, email, or fax.

- Provide the Effective Date: Clearly state the effective date for the change or cancellation in your written notice.

- Understand Cancellation Fees: Be aware of any cancellation fees that may apply. These fees vary depending on your insurance company and the type of policy you have.

- Obtain Proof of Cancellation: Request written confirmation from your insurance company confirming the cancellation of your policy.

Maintaining Accurate Insurance Records and Documentation

Maintaining accurate insurance records and documentation is essential for managing your coverage effectively and ensuring you are adequately protected.

- Keep Your Policy Documents: Store your insurance policy documents in a safe and accessible location. This includes your policy declaration page, which Artikels your coverage details.

- Document All Communications: Keep detailed records of all communications with your insurance company, including dates, times, and the content of conversations.

- Review Your Policy Regularly: Regularly review your insurance policy to ensure that your coverage still meets your needs.

- Update Your Information: Notify your insurance company of any changes to your personal information, such as your address, phone number, or vehicle ownership.

New York Auto Insurance for Specific Situations: Auto Insurance New York

New York State’s auto insurance laws and regulations are designed to provide comprehensive coverage to all drivers, but certain situations require additional considerations. This section explores specific insurance needs for drivers in unique circumstances, including those with multiple vehicles, high-value cars, carpooling or ride-sharing services, a history of driving offenses, and those leasing or financing a vehicle.

Multiple Vehicles or High-Value Cars

Drivers with multiple vehicles or high-value cars should consider additional coverage options to protect their investments.

- Comprehensive and Collision Coverage: These coverages protect against damage caused by incidents like theft, vandalism, fire, and natural disasters. For high-value cars, it’s crucial to ensure sufficient coverage to replace or repair the vehicle in case of an accident.

- Gap Insurance: This coverage helps bridge the gap between the actual cash value of a vehicle and the amount owed on a loan or lease if the vehicle is totaled. This is especially important for high-value cars or vehicles with loans that have a longer repayment term.

- Increased Liability Limits: Higher liability limits offer greater financial protection in case of an accident that results in significant injuries or property damage. This is particularly relevant for drivers with multiple vehicles or high-value cars, as the potential financial liability is greater.

Carpooling or Ride-Sharing Services

Drivers involved in carpooling or ride-sharing services need specific insurance policies to cover their activities.

- Commercial Auto Insurance: Ride-sharing services like Uber and Lyft require commercial auto insurance policies that cover them while driving for the platform. These policies provide coverage for passengers, property damage, and liability claims. Carpooling services, while not as regulated as ride-sharing, may also require commercial auto insurance depending on the nature of the service and the state’s regulations.

- Personal Auto Insurance: Drivers who use their personal vehicles for carpooling or ride-sharing services may need to notify their insurance company. Their personal auto insurance policy may not cover them while driving for commercial purposes, and the company may require additional coverage or higher premiums. It’s crucial to understand the specific coverage limits and exclusions of their personal auto insurance policy.

Drivers with a History of DUI or Other Serious Driving Offenses

Drivers with a history of DUI or other serious driving offenses may face challenges obtaining affordable auto insurance.

- Higher Premiums: Insurance companies consider driving history as a significant risk factor. Drivers with DUI convictions or other serious offenses will likely face higher premiums due to their increased risk of accidents. The severity of the offense and the driver’s past record significantly impact the premium increase.

- Limited Coverage Options: Some insurance companies may be hesitant to insure drivers with a history of driving offenses, or they may offer limited coverage options with higher deductibles. It’s important to compare quotes from multiple insurance companies and carefully review the coverage details.

- SR-22 Insurance: In New York, drivers with a DUI conviction may be required to file an SR-22 form with the Department of Motor Vehicles (DMV). This form proves that the driver has the required minimum liability insurance coverage and helps ensure financial responsibility. Insurance companies provide SR-22 certificates to meet this requirement, and it typically involves higher premiums.

Leasing or Financing a Vehicle

Drivers who lease or finance a vehicle need to consider specific insurance requirements to protect their financial interests.

- Gap Insurance: This coverage is essential for leased or financed vehicles as it protects against financial loss if the vehicle is totaled. If the vehicle’s value is less than the amount owed on the loan or lease, gap insurance covers the difference. This helps prevent the driver from being responsible for paying the remaining balance on the loan or lease.

- Collision and Comprehensive Coverage: Leasing or financing a vehicle often requires collision and comprehensive coverage. These coverages protect against damage caused by accidents and other events like theft or vandalism. This helps ensure the driver is financially protected in case of damage to the vehicle.

- Loan/Lease Payment Protection: Some insurance companies offer loan or lease payment protection, which covers the monthly payments in case of a covered accident or disability. This can provide financial peace of mind if the driver is unable to make their payments due to an unforeseen event.

Tips for Saving Money on Auto Insurance in New York

Navigating the complexities of auto insurance in New York can be daunting, but understanding the various ways to save money on your premiums can significantly impact your budget. By taking advantage of available discounts, making informed choices, and implementing strategic strategies, you can lower your insurance costs without compromising coverage.

Bundling Auto Insurance with Other Types of Insurance

Bundling your auto insurance with other types of insurance, such as homeowners, renters, or life insurance, is a common strategy for reducing premiums. Insurance companies often offer discounts for bundling multiple policies, as it incentivizes customers to consolidate their insurance needs with one provider.

Bundling can save you a substantial amount of money, especially if you’re already paying for multiple insurance policies.

Impact of Increasing Deductibles on Premium Costs

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can significantly lower your premium. A higher deductible means you’ll pay more in the event of an accident, but it also means you’ll pay less for your insurance policy each month.

For example, increasing your deductible from $500 to $1,000 could result in a 15-20% reduction in your premium.

Negotiating Discounts with Insurance Companies

Negotiating with insurance companies can be a powerful tool for saving money. Many companies offer discounts for various factors, such as good driving records, safety features in your car, and even completing a defensive driving course.

- Good Driving Record: Maintaining a clean driving record, free of accidents and violations, is crucial for securing lower premiums. Insurance companies often offer discounts for drivers with no accidents or tickets for a specific period.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often eligible for discounts. These features demonstrate a commitment to safety and can lower your insurance risk.

- Defensive Driving Course: Completing a certified defensive driving course can demonstrate your commitment to safe driving practices and potentially earn you a discount on your insurance premium.

Navigating the New York Auto Insurance Market

Finding the right auto insurance in New York can be a daunting task, given the vast array of companies and policies available. This section will guide you through the process of navigating the New York auto insurance market and help you make informed decisions about your coverage.

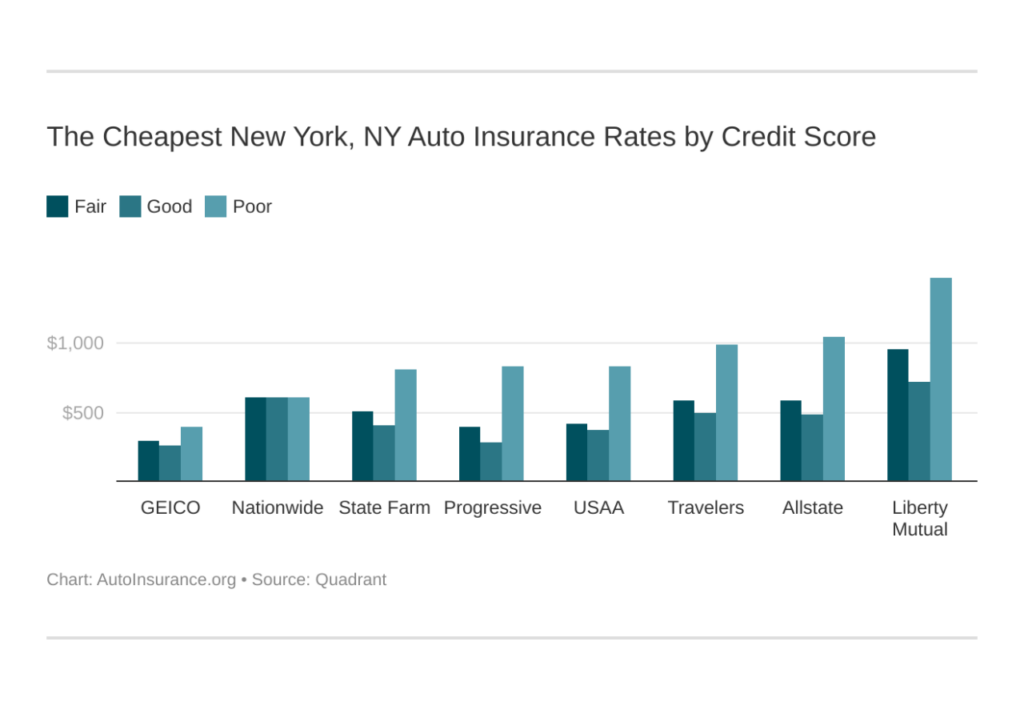

Comparing Top Auto Insurance Companies in New York

Understanding the strengths and weaknesses of different insurance companies is crucial for making an informed decision. The following table compares some of the top auto insurance companies in New York based on key factors like customer satisfaction, claim handling efficiency, and overall cost.

| Company | Customer Satisfaction | Claim Handling Efficiency | Overall Cost | Resources |

|---|---|---|---|---|

| Geico | High | Fast and efficient | Competitive | Geico Website |

| State Farm | High | Fast and efficient | Competitive | State Farm Website |

| Progressive | High | Fast and efficient | Competitive | Progressive Website |

| Allstate | Moderate | Average | Average | Allstate Website |

| Liberty Mutual | Moderate | Average | Average | Liberty Mutual Website |

The Future of Auto Insurance in New York

The New York auto insurance landscape is poised for significant transformation as emerging technologies and evolving consumer expectations reshape the industry. Autonomous vehicles, telematics, and usage-based insurance are key drivers of this change, presenting both challenges and opportunities for drivers and insurance providers alike.

Impact of Autonomous Vehicles

The advent of autonomous vehicles (AVs) will fundamentally alter the auto insurance landscape. As AVs become more prevalent, the traditional model of insurance based on driver behavior and risk assessment will need to evolve.

- Reduced Accidents: AVs are expected to significantly reduce the number of accidents due to their advanced safety features and ability to react faster than humans. This could lead to lower insurance premiums for AV owners.

- Liability Shifts: Determining liability in an accident involving an AV will be complex. Insurance companies will need to adapt their policies to address potential liability scenarios involving manufacturers, software developers, and other stakeholders.

- New Insurance Models: Insurance companies may develop specialized insurance products tailored to AVs, potentially offering coverage based on factors such as vehicle mileage, driving conditions, and software updates.

Telematics and Usage-Based Insurance

Telematics, the use of technology to collect and analyze data from vehicles, is already playing a significant role in auto insurance. Usage-based insurance (UBI) programs leverage telematics data to personalize premiums based on driving behavior.

- Personalized Pricing: UBI programs can offer lower premiums to drivers with safe driving habits, rewarding responsible behavior.

- Real-Time Risk Assessment: Telematics data allows insurers to assess risk in real time, providing insights into driving patterns and potential hazards.

- Data-Driven Claims: Telematics can help streamline the claims process by providing data on accident circumstances, reducing fraud and disputes.

Adapting to Changing Consumer Expectations

Consumers are increasingly demanding personalized experiences and digital convenience. Insurance companies are adapting to these expectations by:

- Digital Platforms: Developing user-friendly online platforms and mobile apps for policy management, claims reporting, and customer support.

- Data Transparency: Providing customers with access to their driving data and personalized insights to help them improve their driving behavior and potentially reduce their premiums.

- Value-Added Services: Offering additional services beyond basic insurance coverage, such as roadside assistance, telematics-based safety features, and driver education programs.

Challenges and Opportunities

The future of auto insurance in New York presents both challenges and opportunities:

- Data Privacy: Balancing the use of telematics data for insurance purposes with consumer privacy concerns will be crucial.

- Regulation: Insurance regulators will need to adapt existing regulations to address the complexities of autonomous vehicles and emerging technologies.

- Innovation: Insurance companies that embrace innovation and invest in new technologies will be better positioned to thrive in the evolving market.

Conclusion

Navigating the New York auto insurance market can be a complex endeavor, but this guide empowers drivers with the knowledge and tools to make informed decisions. By understanding the regulations, factors influencing premiums, and available resources, drivers can secure the best possible coverage at a reasonable cost. Remember to research different insurance companies, compare quotes, and leverage available discounts to optimize your policy and ensure you have the right protection on the road.

Finding the right auto insurance in New York can feel like a jungle, but with the right research, you can find the coverage you need. Sometimes, a little greenery can help you relax during the process, and Exquisite House Plants Featuring Red and Green Leaves can add a touch of vibrant color to your home office while you’re comparing quotes.

Once you’ve found the perfect policy, you can sit back and enjoy your new house plants – and your peace of mind knowing you’re protected on the road.