Auto insurance quotes comparison is an essential step in securing the right coverage at a price that fits your budget. Understanding how different factors influence quotes, exploring available coverage options, and comparing offers from multiple insurers can save you significant money in the long run.

This guide will delve into the intricacies of auto insurance quotes comparison, equipping you with the knowledge and tools to make informed decisions. From navigating online comparison platforms to understanding the fine print, we’ll cover everything you need to know to find the best auto insurance policy for your needs.

Understanding Auto Insurance Quotes: Auto Insurance Quotes Comparison

Getting an auto insurance quote can seem confusing, but it’s actually a straightforward process. Insurance companies use various factors to determine your rates, and understanding these factors can help you get the best possible price for your coverage.

Factors Influencing Auto Insurance Quotes

The cost of your auto insurance policy is determined by several factors. These factors are used to assess your risk as a driver and help the insurance company determine how likely you are to file a claim.

- Your driving history: This includes your driving record, such as accidents, traffic violations, and DUI convictions. A clean driving record generally results in lower premiums.

- Your age and gender: Statistics show that younger and inexperienced drivers are more likely to be involved in accidents. Similarly, some studies suggest that men tend to have higher accident rates than women.

- Your location: Insurance rates vary by state and even by city or zip code. Areas with higher crime rates or more traffic congestion may have higher insurance premiums.

- Your vehicle: The make, model, year, and safety features of your car all play a role in determining your insurance rates. Newer cars with advanced safety features typically have lower insurance costs.

- Your credit score: In some states, insurance companies can use your credit score to assess your risk. A good credit score can often lead to lower insurance premiums.

- Your coverage choices: The amount and type of coverage you choose will also affect your insurance rates. Higher coverage limits generally mean higher premiums.

Common Auto Insurance Coverage Options

Auto insurance policies typically include several coverage options, each designed to protect you and your vehicle in different situations.

- Liability coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It is typically required by law.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is often optional, but it can be beneficial if you have a financed or leased vehicle.

- Comprehensive coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, or natural disasters. It is often optional, but it can be helpful if you have a newer or more expensive vehicle.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses. It is often optional, but it can provide valuable protection in case of an accident with an uninsured driver.

- Medical payments coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is often optional, but it can help cover costs that may not be fully covered by your health insurance.

- Personal injury protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault. It is often required by law in some states.

Impact of Coverage Options on Insurance Costs, Auto insurance quotes comparison

The coverage options you choose can significantly affect your insurance premiums. For example, if you choose a higher deductible for your collision and comprehensive coverage, you will generally pay lower premiums. However, you will also have to pay more out of pocket if you need to file a claim. Similarly, choosing higher liability limits will generally increase your premiums but provide more financial protection in case of a serious accident.

Methods of Comparison

Comparing auto insurance quotes can be a daunting task, but thankfully, various methods and tools are available to simplify the process. This section explores different ways to compare quotes, highlighting the advantages and disadvantages of each approach.

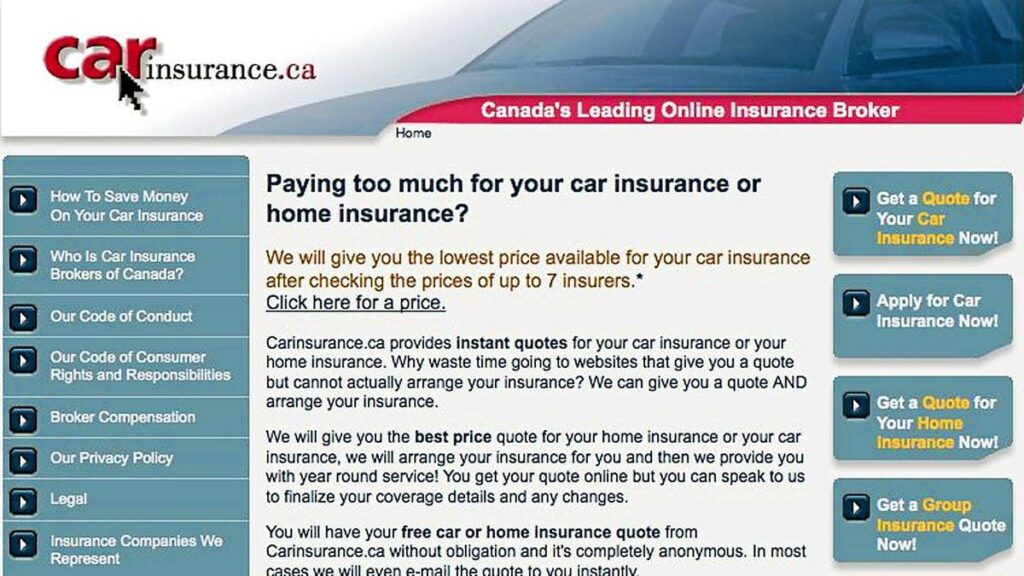

Online Comparison Platforms

Online comparison platforms are websites designed to gather information from multiple insurance companies and present you with a range of quotes side-by-side. This method is convenient and time-saving, allowing you to compare quotes quickly and easily from the comfort of your home.

- Pros:

- Convenient and time-saving

- Provides a comprehensive comparison of quotes from various insurers

- Often allows for personalized adjustments based on your specific needs and preferences

- Can be accessed from any device with internet access

- Cons:

- May not include all insurance companies in your area

- Some platforms may prioritize certain insurers based on partnerships or advertising deals

- The information provided may not be entirely accurate or up-to-date

Reputable Insurance Comparison Websites

Numerous reputable websites specialize in helping consumers compare auto insurance quotes. These websites often partner with a wide range of insurance companies, ensuring you have access to a broad selection of options.

- Example Websites:

- Bankrate

- NerdWallet

- Insurance.com

- The Zebra

- Policygenius

Direct Contact with Insurers

Instead of relying on comparison platforms, you can directly contact individual insurance companies to obtain quotes. This method allows for more personalized interactions and a deeper understanding of the policies offered.

- Pros:

- Ensures you are getting information directly from the source

- Allows for detailed discussions about your specific needs and coverage requirements

- May offer opportunities for negotiation and personalized discounts

- Cons:

- Time-consuming, requiring individual contact with each insurer

- May not provide a comprehensive comparison of all available options

- Can be difficult to compare quotes accurately without a side-by-side presentation

Concluding Remarks

By diligently comparing auto insurance quotes, understanding the key factors influencing pricing, and making informed choices, you can secure a policy that provides comprehensive coverage without breaking the bank. Remember to regularly review and update your policy to ensure it continues to meet your changing needs and driving habits.

Comparing auto insurance quotes can feel like a jungle, but it doesn’t have to be a stressful experience. Just like choosing the perfect houseplant, taking the time to research and compare different options can lead to the best results.

If you’re looking for a pop of color to brighten your home, consider Exquisite House Plants Featuring Red and Green Leaves. They’ll bring a touch of nature indoors while you compare quotes and find the right auto insurance policy for your needs.