Business liability insurance cost is a crucial aspect of any successful business. It provides a financial safety net in case of unforeseen events that could lead to legal claims, lawsuits, or financial losses. Understanding the factors that influence this cost and choosing the right coverage can make a significant difference in protecting your business and its assets.

From general liability to product liability and professional liability, various types of coverage cater to different business needs. This comprehensive guide will delve into the intricacies of business liability insurance cost, exploring its importance, determining factors, coverage options, and essential risk management strategies.

Factors Influencing Cost

The cost of business liability insurance is influenced by a variety of factors that insurers use to assess the risk associated with your business. These factors are designed to help insurers determine the likelihood of a claim and the potential severity of financial losses.

Understanding these factors is crucial for businesses to make informed decisions about their insurance coverage and potentially reduce their premiums.

Business liability insurance costs can vary significantly depending on the industry and the specific risks involved. While researching ways to manage these costs, you might find yourself drawn to a bit of a distraction, like the captivating beauty of Exquisite House Plants Featuring Red and Green Leaves.

However, returning to the task at hand, it’s important to remember that understanding your business’s specific liabilities is crucial for securing the right insurance coverage and minimizing your overall costs.

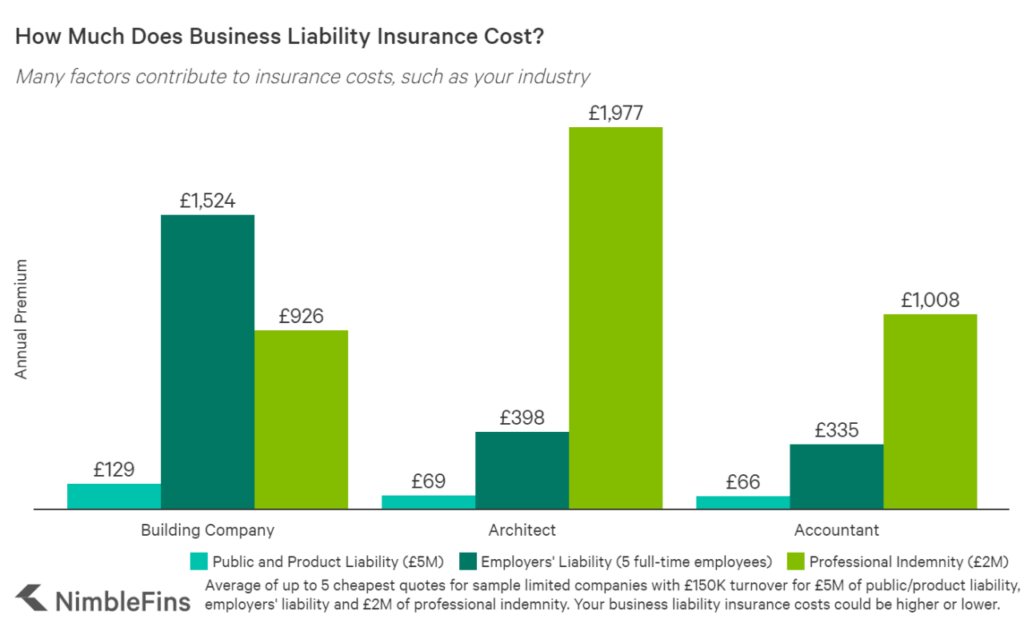

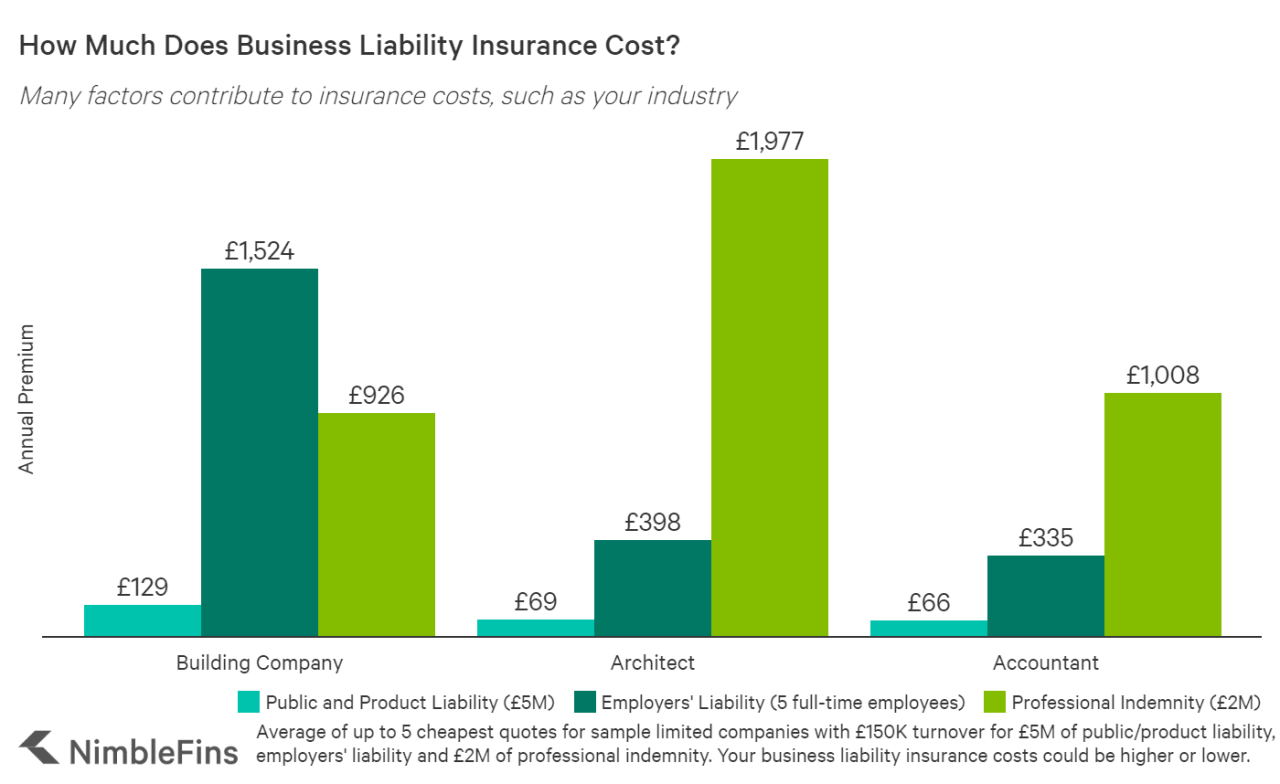

Industry

The industry in which your business operates plays a significant role in determining the cost of liability insurance. Some industries are inherently riskier than others, leading to higher premiums.

- For example, construction companies face a higher risk of accidents and injuries than retail businesses.

- Similarly, healthcare providers face a greater risk of medical malpractice claims than restaurants.

Insurers use industry-specific data and statistics to assess the likelihood of claims and the potential severity of losses.

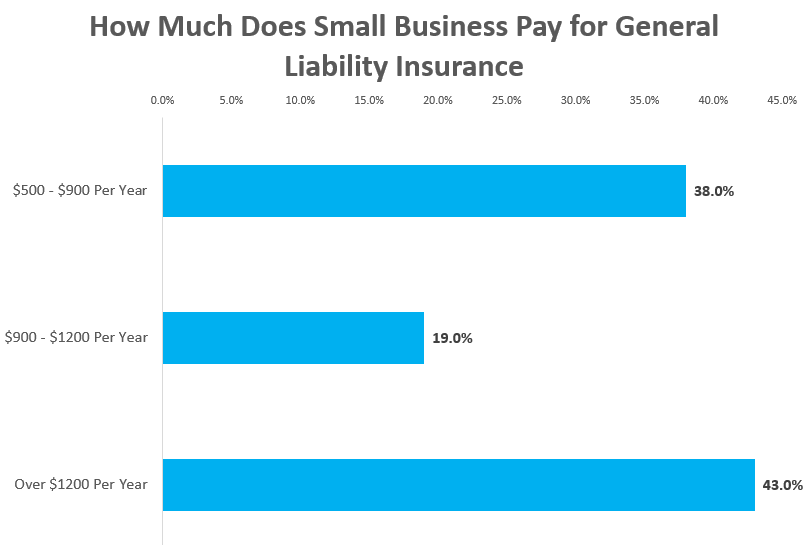

Business Size

The size of your business also impacts your liability insurance cost.

- Larger businesses typically have higher premiums due to the greater number of employees, potential for larger claims, and more complex operations.

- Smaller businesses, on the other hand, may benefit from lower premiums as they typically have fewer employees and simpler operations.

However, it’s important to note that the size of your business is not the only factor. Other factors, such as the type of business and its risk profile, also play a significant role.

Location

The geographic location of your business can also influence the cost of liability insurance.

- Businesses located in areas with higher crime rates or natural disaster risks may face higher premiums.

- For example, businesses located in earthquake-prone areas may have to pay higher premiums to cover potential earthquake damage.

Insurers use data on local crime rates, natural disaster history, and other relevant factors to assess the risk associated with a particular location.

Claims History

Your business’s claims history is a major factor in determining your liability insurance cost.

- Businesses with a history of claims, especially large or frequent claims, are likely to face higher premiums.

- This is because insurers view businesses with a history of claims as higher risk.

On the other hand, businesses with a clean claims history may qualify for discounts or lower premiums.

Specific Risk Factors

Certain specific risk factors can significantly increase your liability insurance cost. These factors are often related to the nature of your business operations.

- For example, businesses that handle hazardous materials, such as chemicals or explosives, are likely to face higher premiums due to the increased risk of accidents and injuries.

- Similarly, businesses that engage in high-risk activities, such as construction or transportation, may also have higher premiums.

Insurers carefully evaluate these risk factors to determine the appropriate premium for your business.

Coverage Options and Limits

Business liability insurance policies offer a range of coverage options that can be tailored to meet the specific needs of your business. Understanding these options is crucial to ensure you have the appropriate protection in case of an incident. This section will delve into the key coverage options, including limits, deductibles, and exclusions, and explain how they affect the financial protection your policy provides.

Policy Limits, Business liability insurance cost

Policy limits represent the maximum amount your insurer will pay for covered losses in a given policy period. These limits are set for different types of coverage, such as bodily injury, property damage, and legal defense costs.

For example, a policy might have a $1 million limit for bodily injury liability and a $500,000 limit for property damage liability. This means the insurer will pay up to $1 million for claims related to bodily injury and up to $500,000 for claims related to property damage.

It’s essential to choose policy limits that are high enough to cover potential liabilities arising from your business operations.

Deductibles

A deductible is the amount you agree to pay out of pocket for covered losses before your insurance policy kicks in. Deductibles are typically lower for smaller businesses and higher for larger businesses, reflecting the potential for higher claims.

Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

The purpose of deductibles is to encourage policyholders to take precautions to prevent losses and to minimize the number of small claims.

Exclusions

Exclusions are specific situations or events that are not covered by your liability insurance policy. Common exclusions include:

- Intentional acts

- Losses arising from criminal activity

- Losses caused by war or terrorism

- Losses due to pollution or environmental damage

It’s essential to review your policy carefully to understand the exclusions that apply to your business.

Impact of Claims on Cost

The cost of business liability insurance is not static. It can fluctuate based on various factors, including the number and severity of claims filed against your business. Claims filed against your business can significantly impact your future insurance premiums. Insurance companies use a risk-based pricing model, meaning that businesses with a higher risk of claims will generally pay higher premiums.

Factors Considered in Claim Assessment

Insurance companies carefully evaluate claims to determine their impact on premiums. Here are some key factors they consider:

- Severity of the claim: The amount of financial loss incurred due to the claim, including medical expenses, property damage, and lost wages, is a significant factor. For instance, a claim involving a severe injury with substantial medical bills will likely have a greater impact on premiums than a minor claim.

- Negligence: The extent to which the business was at fault for the incident that led to the claim is crucial. If the business is found to be negligent or responsible for the claim, it will likely face higher premiums. For example, a business that fails to maintain a safe work environment and causes an employee injury will likely see a higher premium increase compared to a business with a clean safety record.

- Coverage limits: The amount of coverage purchased for the specific type of liability insurance will also affect premium adjustments. If the claim exceeds the coverage limit, the business may have to pay the difference out of pocket, leading to higher premiums in the future. For example, a business with a lower liability coverage limit might see a steeper increase in premiums after a large claim than a business with higher coverage.

Managing Claims Effectively

Managing claims effectively is crucial for minimizing their impact on future insurance costs. Here are some strategies:

- Promptly report claims: Delaying reporting a claim can result in higher premiums. It’s crucial to report claims as soon as possible to allow the insurance company to investigate and process them efficiently.

- Cooperate with the insurance company: Providing all necessary documentation and information promptly and accurately will expedite the claim process and minimize the risk of complications. This can help avoid unnecessary delays and potential disputes, ultimately leading to a smoother claims resolution.

- Negotiate settlements: Work closely with your insurance company and legal counsel to negotiate fair settlements for claims. By proactively addressing claims and negotiating settlements, you can mitigate the impact on your premiums. For example, a business that actively participates in negotiations and reaches a reasonable settlement can potentially avoid a large premium increase compared to a business that contests every aspect of the claim.

Role of Insurance Brokers

Insurance brokers play a crucial role in helping businesses find suitable liability insurance by acting as intermediaries between businesses and insurance companies. They possess specialized knowledge and expertise in the insurance industry, enabling them to navigate the complex world of insurance policies and provide businesses with tailored solutions.

Benefits of Working with an Insurance Broker

Working with an insurance broker offers several benefits for businesses seeking liability insurance. Brokers possess extensive knowledge of the insurance market, allowing them to identify the most competitive and suitable policies based on the specific needs of the business. They can also leverage their negotiation skills to secure favorable terms and premiums for their clients.

- Expertise: Brokers are insurance specialists who understand the intricacies of various liability insurance policies and can effectively evaluate risks and coverage options.

- Market Knowledge: Brokers have access to a wide range of insurance carriers and their products, enabling them to compare and contrast policies to find the best fit for a business’s unique requirements.

- Negotiation Skills: Brokers act as advocates for their clients, negotiating with insurance companies to secure favorable premiums and policy terms.

Customization of Policies

Brokers can assist businesses in customizing liability insurance policies to meet their specific needs. They understand the nuances of different industries and business operations, allowing them to tailor policies to address unique risks and exposures.

- Industry-Specific Coverage: Brokers can identify and recommend coverage options that are tailored to the specific risks faced by businesses in different industries.

- Risk Assessment: Brokers can conduct thorough risk assessments to identify potential liabilities and recommend appropriate coverage levels.

- Policy Modifications: Brokers can work with insurance carriers to modify policy terms and conditions to meet the specific needs of the business.

Epilogue: Business Liability Insurance Cost

Navigating the world of business liability insurance can seem daunting, but with a clear understanding of its complexities and the right guidance, businesses can secure adequate protection. By prioritizing risk management, obtaining competitive quotes, and staying informed about industry trends, you can ensure your business is adequately insured against potential liabilities. Remember, investing in comprehensive liability insurance is not just an expense but a wise investment in the long-term security and stability of your business.