Guaranteed life insurance offers a unique and compelling way to secure your family’s financial future. It provides peace of mind knowing that your loved ones will be financially protected in the event of your passing. This type of insurance guarantees a death benefit, ensuring that your beneficiaries receive a specific sum of money, regardless of market fluctuations or your health status.

Guaranteed life insurance comes in various forms, each with its own set of features and benefits. Understanding the different types available and how they work is crucial in making an informed decision that aligns with your specific needs and financial goals.

What is Guaranteed Life Insurance?

Guaranteed life insurance is a type of life insurance that offers a guaranteed death benefit, regardless of what happens to the insured person’s health or the performance of the insurance company. It is a form of permanent life insurance, meaning it provides coverage for your entire life, as long as you continue to pay your premiums.

Guaranteed life insurance provides peace of mind knowing that your beneficiaries will receive a specific death benefit, no matter what. This type of insurance is ideal for individuals who want a predictable and secure financial safety net for their loved ones.

Key Features of Guaranteed Life Insurance

Guaranteed life insurance differs from other types of life insurance in several key ways.

- Guaranteed Death Benefit: The death benefit is fixed and guaranteed, regardless of the insured person’s health or the performance of the insurance company. This means your beneficiaries will receive the promised amount, even if your health deteriorates or the insurance company experiences financial difficulties.

- Guaranteed Premiums: Guaranteed life insurance policies typically come with fixed premiums, meaning the cost of your policy will not increase over time. This helps you budget for your insurance expenses and avoid unexpected premium hikes.

- Cash Value Accumulation: Many guaranteed life insurance policies also offer a cash value component. This cash value grows over time and can be borrowed against or withdrawn, providing you with a source of funds for various needs. This feature can be particularly useful for retirement planning or covering unexpected expenses.

Benefits of Guaranteed Life Insurance

Guaranteed life insurance offers several advantages that can provide financial security and peace of mind for you and your loved ones. It can act as a safety net, ensuring that your beneficiaries are financially protected in the event of your passing.

Financial Security

Guaranteed life insurance provides financial security by guaranteeing a death benefit, regardless of your health or lifestyle changes in the future. This means that your beneficiaries will receive a predetermined amount of money upon your death, even if you develop a health condition or engage in risky activities later on. This predictability is particularly valuable for families who rely on your income, as it helps ensure their financial stability.

Protection for Beneficiaries

Guaranteed life insurance protects your beneficiaries from financial hardship by providing a lump sum payment that can be used to cover various expenses, such as:

- Funeral costs

- Outstanding debts, such as mortgages, loans, or credit card bills

- Living expenses for surviving family members

- Educational costs for children

- Business expenses, if you are a business owner

This financial assistance can significantly alleviate the burden on your loved ones and help them transition into a new chapter without facing undue financial stress.

Types of Guaranteed Life Insurance

Guaranteed life insurance offers a range of options to meet different needs and budgets. Understanding the different types is crucial to choosing the policy that aligns with your individual circumstances and financial goals.

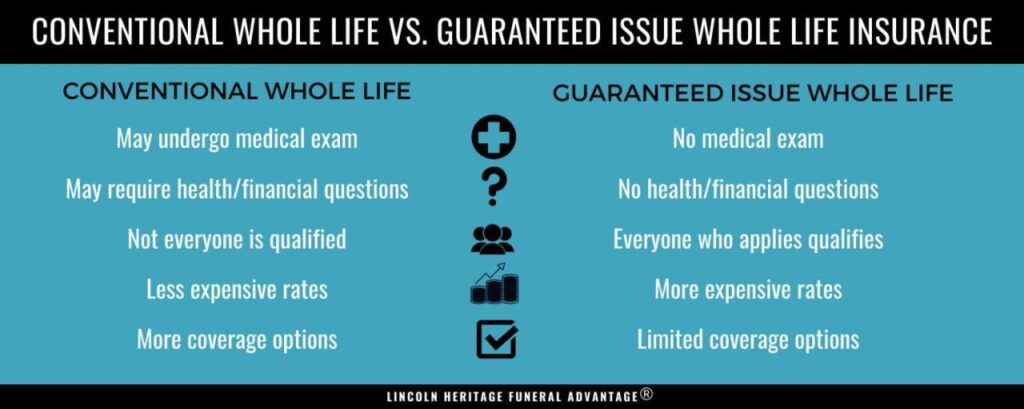

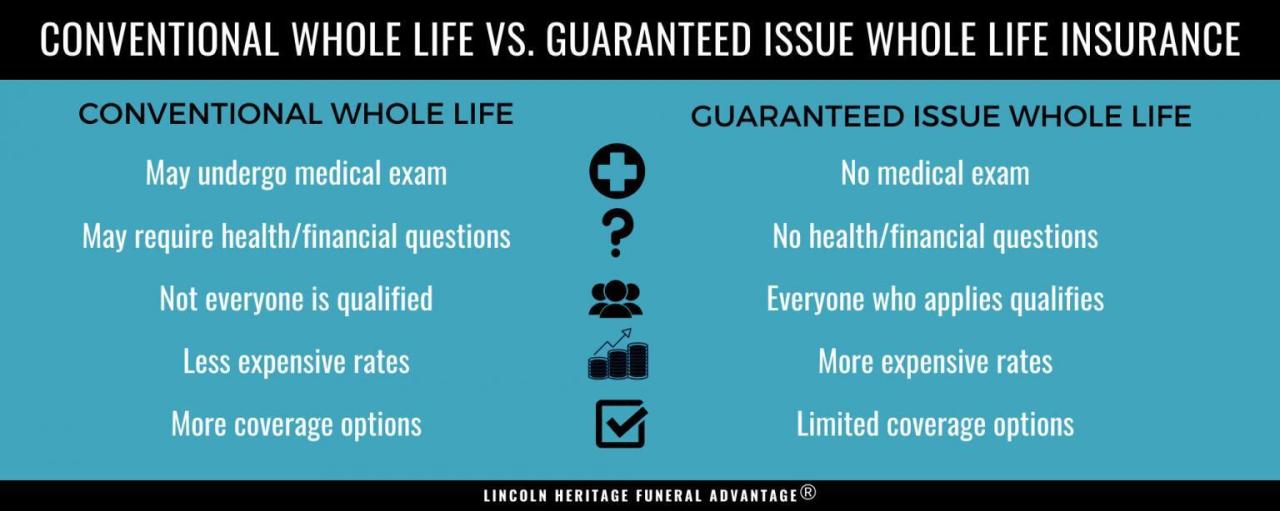

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides lifelong coverage. It accumulates cash value that grows tax-deferred and can be borrowed against.

Pros

- Lifelong coverage: Provides coverage for your entire life, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

- Cash value accumulation: Builds cash value that grows tax-deferred, offering potential for long-term savings and investment.

- Loan options: Allows you to borrow against your cash value, providing access to funds for various needs.

- Guaranteed premiums: Premiums remain fixed for the life of the policy, providing predictable budgeting.

Cons

- Higher premiums: Premiums tend to be higher than term life insurance, making it less affordable for some individuals.

- Lower returns: Cash value growth can be slower compared to other investment options.

- Complexity: Policies can be complex and require careful consideration to understand their features and benefits.

Universal Life Insurance, Guaranteed life insurance

Universal life insurance is a flexible permanent life insurance policy that offers more control over premiums and death benefits. It allows you to adjust your premiums and death benefit, depending on your changing needs.

Pros

Cons

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is a more affordable option than permanent life insurance and is primarily designed to protect your family financially during your working years.

Pros

Cons

Final Summary

Ultimately, guaranteed life insurance offers a valuable tool for individuals seeking financial security and peace of mind. By understanding the various types, benefits, and considerations involved, you can make a well-informed decision that ensures your loved ones are protected and financially secure for the future.

Guaranteed life insurance offers peace of mind knowing your loved ones will be financially protected in the event of your passing. If you’re seeking a reputable provider for such coverage, consider central insurance , which has a strong track record of reliability and customer satisfaction.

Central Insurance can help you find the right guaranteed life insurance policy to meet your individual needs and budget.