Indexed universal life insurance, a unique type of permanent life insurance, offers a blend of death benefit protection and potential for cash value growth. Unlike traditional universal life insurance, indexed universal life insurance links its cash value growth to the performance of a specific market index, such as the S&P 500. This approach aims to provide a hedge against inflation while potentially delivering competitive returns.

The policy’s cash value is influenced by the index’s performance, but with some limitations. Policyholders typically have the option to choose from various indexes, each with its own potential for growth and risk profile. The participation rate, a percentage that determines the extent to which the policy benefits from the index’s gains, also plays a significant role in returns. Furthermore, the policy often features a cap, which limits the maximum growth potential, and a floor, which protects the cash value from losses.

What is Indexed Universal Life Insurance?

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance policy that combines the death benefit coverage of traditional life insurance with the potential for cash value growth linked to the performance of a specific market index, such as the S&P 500. It’s like having a safety net with a chance to grow your savings alongside the market.

How Indexed Universal Life Insurance Works

IUL policies offer a flexible way to build cash value that can be borrowed against or withdrawn for various needs. Unlike traditional universal life insurance, where the cash value grows at a fixed interest rate, IUL’s cash value growth is tied to the performance of a chosen index.

How the Policy’s Cash Value Grows

The cash value in an IUL policy grows based on the performance of the chosen index, but with a cap on potential gains and a guarantee against losses. This means that your cash value can grow along with the index, but it won’t exceed the maximum cap. On the other hand, if the index goes down, your cash value will remain protected and won’t lose value.

The Role of the Underlying Index

The underlying index plays a crucial role in determining the returns on your IUL policy. The index’s performance dictates the potential growth of your cash value. The most common index used is the S&P 500, which tracks the performance of 500 large-cap U.S. companies. However, IUL policies may offer a range of indices to choose from, allowing you to tailor your policy to your risk tolerance and investment goals.

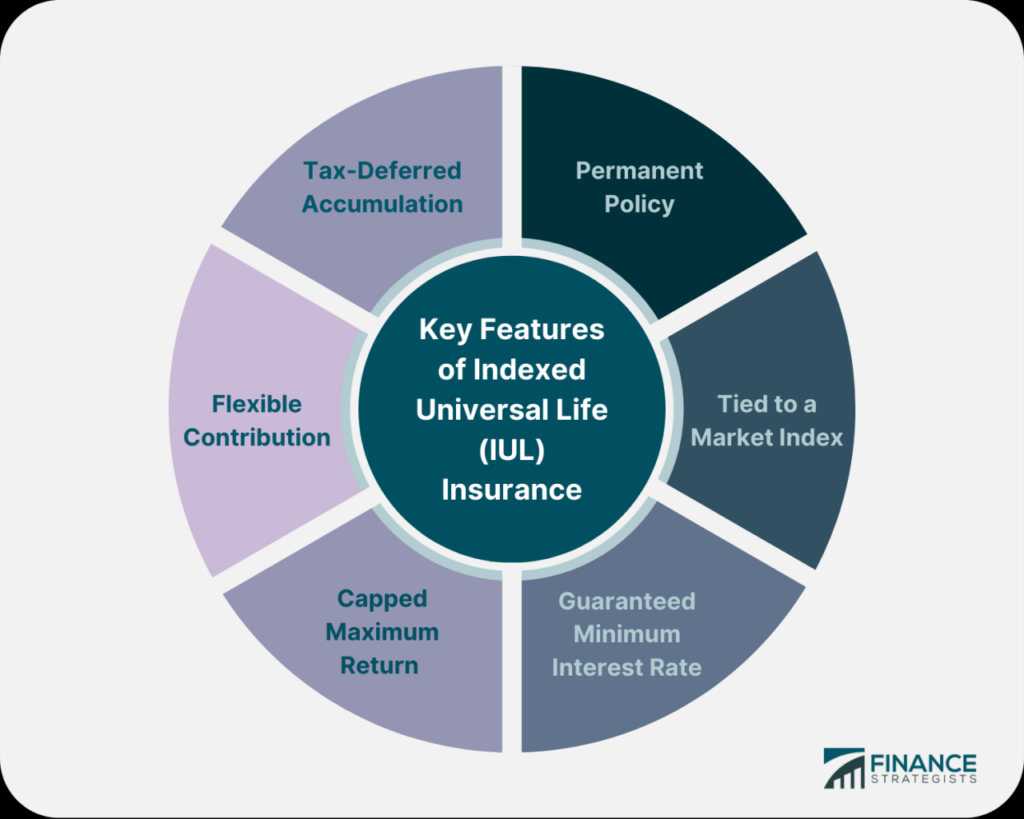

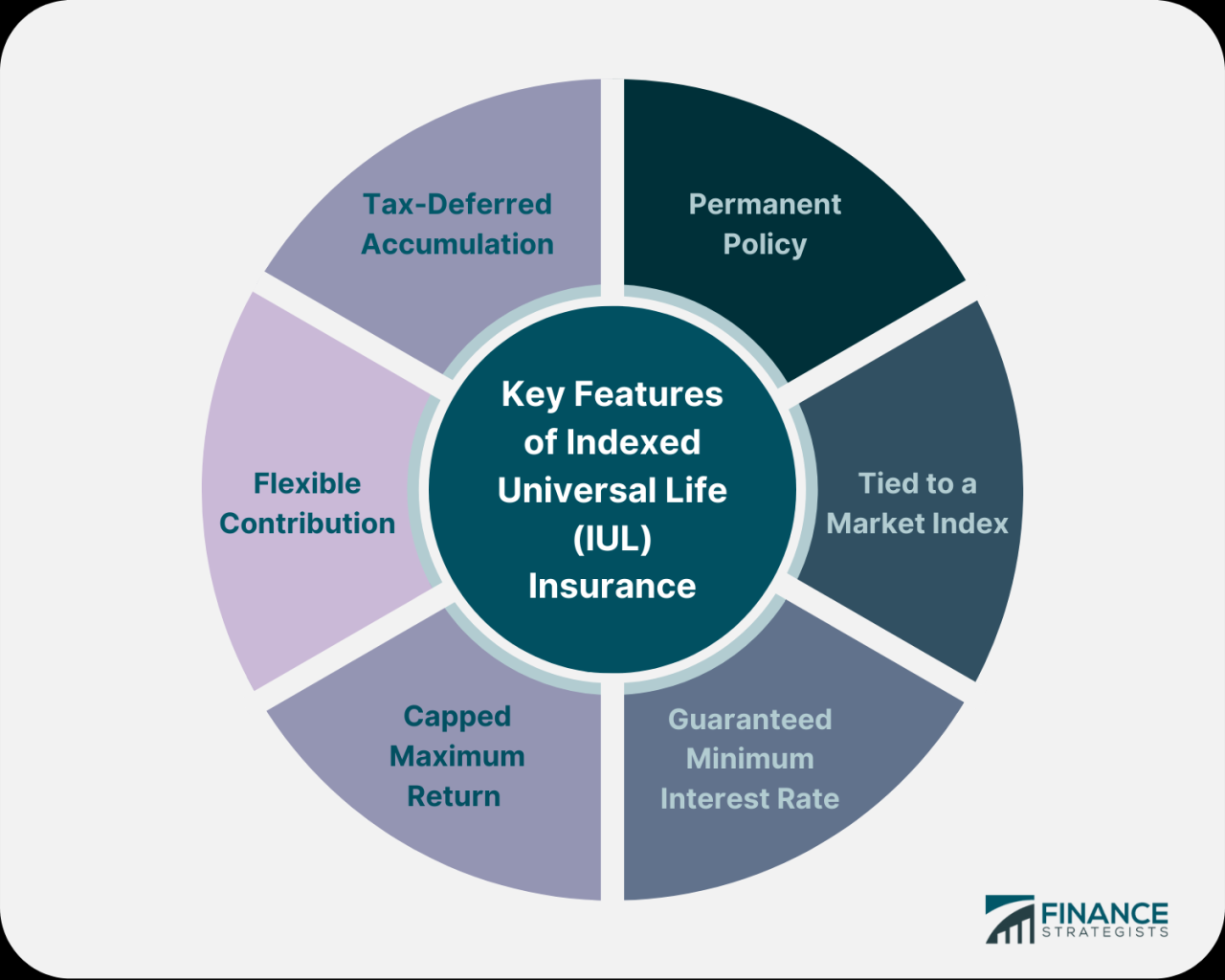

Key Features of Indexed Universal Life Insurance

Indexed universal life insurance (IUL) offers a unique blend of death benefit protection and potential for growth. It stands out from traditional life insurance due to its connection to the performance of specific market indexes. This feature allows policyholders to participate in potential market gains while providing downside protection.

Indexed Account

The core of IUL lies in its “indexed account.” This account links your policy’s cash value to the performance of a chosen market index, such as the S&P 500. The account’s value fluctuates based on the index’s performance, offering the potential for growth. However, the link is not direct. Instead, the account’s growth is determined by a “participation rate,” which is a percentage of the index’s gains that is credited to your account.

Index Options

IUL policies typically offer a range of index options, allowing you to tailor your investment strategy based on your risk tolerance and market outlook. Common index options include:

- S&P 500: A broad market index representing the 500 largest publicly traded companies in the United States.

- Nasdaq 100: A technology-heavy index tracking the 100 largest non-financial companies listed on the Nasdaq Stock Market.

- Russell 2000: An index that tracks the performance of the smallest 2000 companies in the Russell 3000 Index.

- Other Indices: Some IUL policies may offer options to track other indexes, such as the Dow Jones Industrial Average or specific sector indexes.

Participation Rate

The “participation rate” is a crucial factor determining your potential returns. It represents the percentage of the index’s gains that are credited to your indexed account. For example, if the participation rate is 80%, and the chosen index rises by 10% in a year, your indexed account will grow by 8% (80% of 10%). This rate can vary depending on the policy and the chosen index. It is essential to understand the participation rate as it directly impacts the potential growth of your indexed account.

Cap and Floor

IUL policies typically incorporate “cap” and “floor” features to manage potential gains and losses.

Cap

The “cap” sets a maximum limit on the annual growth of your indexed account. For example, if the cap is 10%, even if the chosen index rises by 15%, your indexed account will only grow by 10% for that year. Caps protect the insurance company from excessive payouts during periods of strong market performance.

Floor

The “floor” provides downside protection, ensuring that your indexed account does not lose value if the chosen index declines. The floor is typically set at 0%, meaning your account value will not fall below the initial investment amount. However, some policies may offer a negative floor, which means your account could experience a small loss if the index declines significantly.

Disadvantages of Indexed Universal Life Insurance

While Indexed Universal Life Insurance (IUL) offers potential benefits, it’s crucial to understand its drawbacks. These disadvantages can significantly impact your financial goals if not carefully considered.

Limited Returns in a Low-Interest Rate Environment

IUL policies typically link their returns to the performance of a specific index, such as the S&P 500. However, in periods of low interest rates, the potential for growth can be limited. The index’s performance might not generate substantial returns, potentially resulting in minimal or even negative growth for your policy’s cash value.

Fees and Expenses Impacting Returns

IUL policies come with various fees and expenses, including administrative fees, mortality charges, and expense charges. These fees can significantly impact your policy’s overall returns. While the fees may seem small, they can compound over time, reducing your potential gains.

Complexity of the Product

IUL policies are complex financial instruments with numerous features and components. Understanding the intricacies of these policies can be challenging, even for experienced investors. It’s crucial to seek professional financial advice and thoroughly review the policy’s terms and conditions before making a decision.

Risk of Policy Lapse Due to Insufficient Premium Payments

IUL policies require regular premium payments to maintain coverage and build cash value. If you fail to make premium payments, your policy may lapse, resulting in the loss of coverage and your accumulated cash value. It’s essential to ensure you can consistently afford the premium payments throughout the policy’s term.

Understanding the Risks

While Indexed Universal Life Insurance (IUL) offers potential growth tied to the performance of a chosen market index, it’s essential to understand the inherent risks associated with this type of insurance. These risks can impact your returns and the overall value of your policy.

Potential for Losses in the Underlying Index

The value of your IUL policy is directly linked to the performance of the underlying index you choose. If the market index experiences a decline, your policy’s cash value may also decrease. This means you could potentially lose money on your investment.

Impact of Participation Rate on Returns

The participation rate represents the percentage of the index’s performance that your IUL policy will reflect. A lower participation rate means your policy will earn a smaller portion of the index’s gains. This can significantly impact your returns, especially during periods of strong market growth.

Fees and Expenses, Indexed universal life insurance

IUL policies come with various fees and expenses, such as administrative fees, mortality charges, and expense charges. These fees can erode your policy’s cash value and reduce your overall returns. It’s crucial to carefully review the fee structure of any IUL policy before making a decision.

Risk of Policy Lapse

If you fail to make premium payments on time, your IUL policy may lapse. This means you will lose your policy’s cash value and any accumulated death benefit. Policy lapse can have serious financial consequences, especially if you rely on the policy for financial security.

Comparing Indexed Universal Life to Other Life Insurance Options

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that offers the potential for growth based on the performance of a specific market index, such as the S&P 500. However, it is essential to understand how IUL compares to other life insurance options before making a decision.

Comparing Indexed Universal Life to Traditional Whole Life Insurance

- Traditional whole life insurance is a type of permanent life insurance that offers a guaranteed death benefit and cash value accumulation. It provides a fixed rate of return, typically lower than the potential return offered by IUL.

- IUL, on the other hand, offers the potential for higher returns based on the performance of the chosen index, but it does not guarantee a specific rate of return.

- Both types of insurance offer a death benefit and cash value accumulation, but IUL is generally more flexible in terms of premium payments and death benefit adjustments.

Comparing Indexed Universal Life to Universal Life Insurance

- Universal life insurance is another type of permanent life insurance that offers flexible premiums and death benefit adjustments.

- However, unlike IUL, universal life insurance typically invests the cash value in a variety of investment options, including mutual funds and bonds, which can be more volatile than the index-linked investments offered by IUL.

- IUL is often considered a less risky option than universal life insurance, as it offers the potential for growth without the same level of volatility.

Comparing Indexed Universal Life to Term Life Insurance

- Term life insurance is a type of life insurance that provides coverage for a specific period, such as 10, 20, or 30 years.

- It is typically less expensive than permanent life insurance, but it does not offer any cash value accumulation.

- IUL is a more expensive option than term life insurance, but it offers the potential for growth and a death benefit that continues beyond the term of the policy.

Advantages and Disadvantages of Each Option

| Option | Advantages | Disadvantages |

|---|---|---|

| Traditional Whole Life Insurance |

|

|

| Universal Life Insurance |

|

|

| Term Life Insurance |

|

|

| Indexed Universal Life Insurance |

|

|

Choosing the Right Indexed Universal Life Insurance Policy

Selecting the right indexed universal life (IUL) insurance policy is crucial, as it can significantly impact your financial security and long-term goals. Choosing a policy that aligns with your individual needs and financial situation is essential.

Understanding Your Financial Goals and Risk Tolerance

Before diving into the specifics of IUL policies, it’s vital to understand your financial goals and risk tolerance. This involves determining your financial objectives, such as retirement planning, estate planning, or providing for your family. Assessing your risk tolerance helps you determine how much risk you’re comfortable taking with your investments.

Comparing Different Policies from Various Insurance Companies

Once you have a clear understanding of your financial goals and risk tolerance, it’s time to compare different IUL policies from various insurance companies. This involves considering factors such as the policy’s death benefit, premium payments, cash value growth potential, and fees.

- Death Benefit: This is the amount your beneficiaries will receive upon your death. Consider the amount of coverage you need based on your family’s financial needs and your current financial situation.

- Premium Payments: Determine the premium payment structure that best suits your budget and financial circumstances.

- Cash Value Growth Potential: The cash value of your policy can grow over time, potentially providing you with a source of funds for retirement or other financial needs.

- Fees: Be aware of the various fees associated with IUL policies, such as administrative fees, mortality charges, and surrender charges. Compare fees across different companies to find the most cost-effective option.

Working with a Qualified Financial Advisor

Navigating the complex world of IUL insurance can be challenging. It’s highly recommended to work with a qualified financial advisor who specializes in life insurance and has experience with IUL policies.

Factors to Consider When Choosing a Policy

- Policy Features: Explore the various features offered by different IUL policies, such as the ability to adjust your death benefit, withdraw cash value, or borrow against the policy.

- Financial Strength of the Insurance Company: Ensure the insurance company issuing the policy is financially sound and has a strong track record of paying claims.

- Transparency and Disclosure: Review the policy documents carefully to ensure you understand all the terms and conditions.

- Customer Service and Support: Choose a company with a reputation for excellent customer service and support.

Closing Summary

Indexed universal life insurance presents a complex but potentially rewarding life insurance option. While it offers the potential for growth and tax-deferred benefits, it’s crucial to carefully consider the potential risks and limitations. Before making any decisions, consulting with a qualified financial advisor is highly recommended to ensure the policy aligns with your financial goals and risk tolerance.

Indexed universal life insurance offers a flexible way to build cash value and potentially earn returns tied to the performance of a specific market index. While considering your financial needs, it’s also important to factor in insurance for your biggest asset, your home.

If you live in California, you might want to explore options for california homeowners insurance , as the state’s unique climate and seismic activity require specific coverage considerations. Returning to indexed universal life insurance, remember that this type of policy can provide both death benefit and living benefits, allowing you to access your accumulated cash value for various needs.