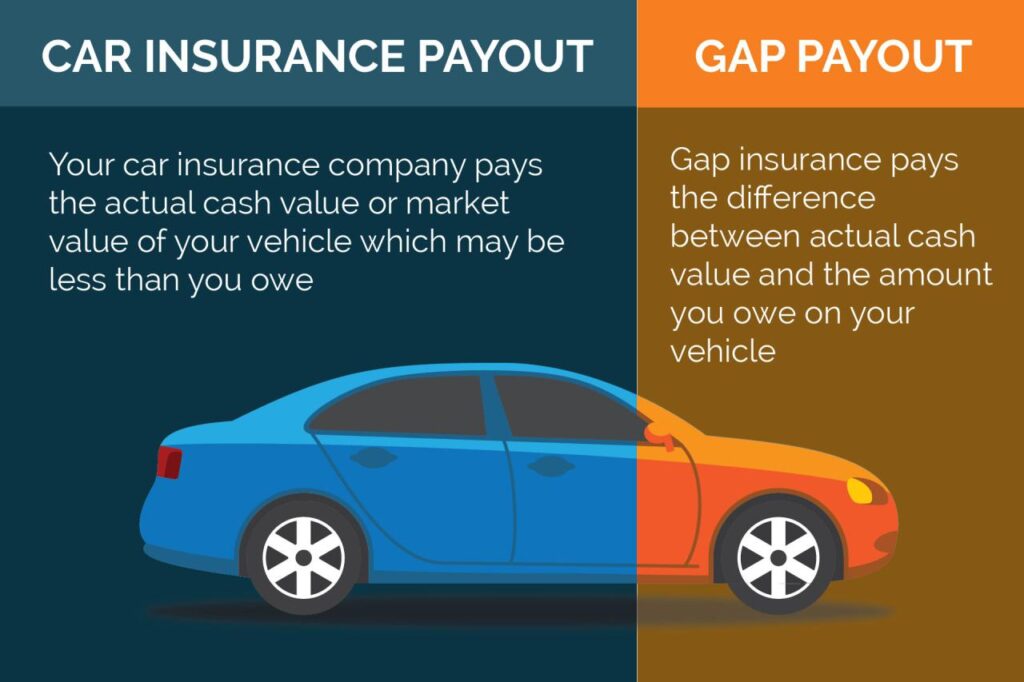

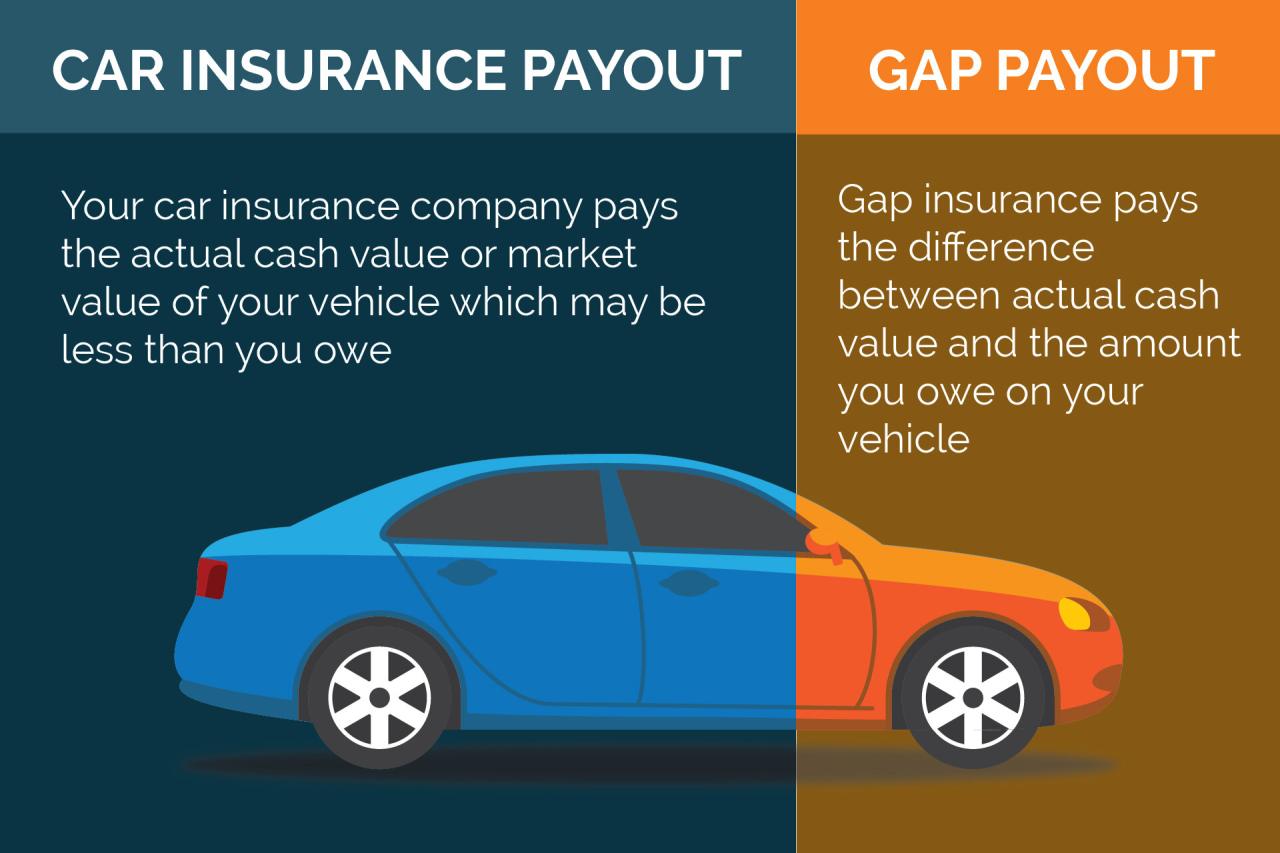

How does gap insurance work sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Gap insurance, often called Guaranteed Auto Protection (GAP), can be a valuable tool for car owners, especially those who have financed their vehicles. This type of insurance covers the difference between the actual cash value (ACV) of your car and the amount you still owe on your auto loan after an accident or theft. Imagine this: you get into an accident and your car is totaled. Your insurance company pays out the ACV, but it’s less than what you still owe on the loan. This is where gap insurance comes in, bridging the financial gap and protecting you from potential debt.

Understanding how gap insurance works can be the key to financial peace of mind in the unfortunate event of a car accident or theft. It provides a safety net, ensuring that you’re not left with a hefty loan balance after your car is deemed a total loss. In this article, we’ll delve into the intricacies of gap insurance, explaining its purpose, how it works, and when it’s most beneficial. We’ll also explore the different types of gap insurance available, their pros and cons, and how to choose the right provider for your needs.

How Gap Insurance Works: How Does Gap Insurance Work

Gap insurance is a type of insurance that covers the difference between the actual cash value (ACV) of your vehicle and the amount you owe on your auto loan or lease. This can be helpful if your vehicle is totaled in an accident, as the insurance payout may not be enough to cover the outstanding loan balance.

Calculating Gap Insurance Premiums

Gap insurance premiums are calculated based on several factors, including:

- The make, model, and year of your vehicle

- Your driving history

- The amount of your loan or lease

- The interest rate on your loan

- Your location

The higher the risk of your vehicle being totaled, the higher the gap insurance premium will be. For example, if you drive a high-performance sports car in a city with a lot of traffic, you are more likely to be involved in an accident, so your premium will be higher.

Filing a Gap Insurance Claim, How does gap insurance work

To file a gap insurance claim, you will need to contact your insurance company and provide them with the following information:

- Your policy number

- The date and time of the accident

- The location of the accident

- A police report (if applicable)

- A copy of your loan or lease agreement

The insurance company will then investigate the claim and determine if you are eligible for coverage. If you are eligible, they will pay the difference between the ACV of your vehicle and the amount you owe on your loan or lease.

Gap insurance can help cover the difference between your car’s actual cash value and what you owe on your auto loan if your car is totaled. To find the right gap insurance policy, it’s important to shop around and compare quotes from various auto insurance companies near you.

You can use resources like auto insurance companies near me to find reputable providers in your area. Once you’ve chosen a company, make sure to ask about their gap insurance options and how they can help you protect your financial investment.

Pros and Cons of Gap Insurance

Gap insurance can be a valuable tool to protect yourself financially in the event of a total loss of your vehicle. It can bridge the gap between what your insurance pays out and what you still owe on your loan or lease. However, like any financial product, it’s important to weigh the potential benefits against the costs to determine if it’s right for you.

Advantages of Gap Insurance

Purchasing gap insurance can offer several advantages, including:

- Protection Against Negative Equity: Gap insurance can help you avoid being stuck with a large debt if your vehicle is totaled and your insurance payout doesn’t cover the remaining loan balance. For example, if you financed $25,000 for a car and it’s totaled after a year, your insurance payout might only be $18,000 due to depreciation. Gap insurance would cover the remaining $7,000, preventing you from being responsible for that debt.

- Peace of Mind: Knowing that you have gap insurance can provide peace of mind in the event of a total loss. You won’t have to worry about being financially burdened with a large debt on a vehicle that’s no longer drivable.

- Potential Savings: Gap insurance can potentially save you money in the long run if you end up in a situation where your insurance payout is less than your loan balance. You’ll avoid having to make additional payments to cover the difference.

Disadvantages of Gap Insurance

While gap insurance can offer protection, it also comes with some potential drawbacks:

- Cost: Gap insurance is an additional expense, and the cost can vary depending on the vehicle, the loan amount, and the insurance provider. This extra cost might not be worth it for all drivers, especially if you have a lower loan balance or a shorter loan term.

- Limited Coverage: Gap insurance typically only covers the difference between the insurance payout and the loan balance. It doesn’t cover other expenses, such as deductibles, towing fees, or rental car costs.

- Potential Overlap: If you have comprehensive and collision coverage on your insurance policy, you may already have some protection against negative equity. It’s important to review your existing coverage before purchasing gap insurance to avoid unnecessary duplication.

Comparison of Pros and Cons

Here’s a table summarizing the pros and cons of gap insurance:

| Pros | Cons |

|---|---|

| Protection against negative equity | Additional cost |

| Peace of mind | Limited coverage |

| Potential savings | Potential overlap with existing insurance |

Choosing a Gap Insurance Provider

Selecting the right gap insurance provider is crucial, as it can significantly impact the coverage you receive and the overall cost. It’s not just about finding the cheapest option; you need to ensure the provider offers comprehensive coverage and reliable customer service.

Factors to Consider

Several factors should be considered when choosing a gap insurance provider.

- Reputation and Financial Stability: Look for a provider with a solid track record and strong financial standing. This ensures they’ll be around to honor their commitments when you need them.

- Coverage Options: Compare different coverage options, including the amount of coverage offered, the types of vehicles covered, and any limitations or exclusions.

- Pricing and Payment Options: Compare quotes from different providers and consider factors like monthly premiums, upfront costs, and payment flexibility.

- Customer Service and Claims Process: Research the provider’s customer service reputation and the ease of filing and processing claims. You want a provider that offers prompt and helpful assistance.

- Transparency and Disclosure: Ensure the provider provides clear and concise information about their policies, including terms and conditions, exclusions, and any potential fees or charges.

Importance of Comparing Quotes

Comparing quotes from multiple gap insurance providers is essential for finding the best value for your money.

- Competitive Pricing: Comparing quotes allows you to see the range of premiums offered and identify the most competitive options.

- Coverage Variations: Different providers may offer different levels of coverage, deductibles, and limitations. Comparing quotes helps you understand these variations and choose a policy that aligns with your needs.

- Finding the Best Deal: By comparing quotes, you can ensure you’re not overpaying for gap insurance and secure a policy that offers the best value for your specific situation.

Essential Features to Look for

When evaluating gap insurance policies, it’s crucial to look for specific features that ensure comprehensive coverage and protect your financial interests.

- Adequate Coverage Amount: The coverage amount should be sufficient to cover the difference between your vehicle’s actual cash value (ACV) and the outstanding loan balance.

- Comprehensive Coverage: The policy should cover a wide range of scenarios, including total loss due to accidents, theft, or natural disasters.

- Reasonable Deductible: Consider a deductible that you can comfortably afford in case of a claim. A higher deductible may result in lower premiums but could also increase your out-of-pocket expenses.

- No-Fault Coverage: Look for policies that offer no-fault coverage, meaning you’re covered regardless of who’s at fault in an accident.

- Clear Terms and Conditions: The policy should clearly Artikel all terms and conditions, including exclusions, limitations, and any potential fees or charges.

Last Recap

In conclusion, gap insurance can be a valuable asset for car owners, especially those who have financed their vehicles. It offers a safety net in the event of a total loss, ensuring you’re not left with a significant loan balance. While it may seem like an added expense, the potential savings it provides can outweigh the cost, particularly if you’re in a situation where the ACV of your car is significantly lower than the outstanding loan amount. By carefully considering your individual needs and comparing quotes from different providers, you can determine if gap insurance is right for you. Remember, being informed and prepared is crucial for navigating the complexities of auto insurance and protecting your financial well-being.