A life insurance calculator sets the stage for this enthralling narrative, offering readers a glimpse into a powerful tool for financial planning. Imagine a world where you can easily estimate your life insurance needs and understand the costs involved. This is the power of a life insurance calculator, a digital companion that empowers you to make informed decisions about protecting your loved ones.

These calculators work by taking into account various factors such as your age, health, desired coverage amount, and policy term. By inputting this information, you can receive personalized estimates of premiums and coverage options, allowing you to explore different scenarios and make informed choices.

Introduction to Life Insurance Calculators

Life insurance calculators are online tools that help individuals estimate the amount of life insurance they need. These calculators use a variety of factors to determine the appropriate coverage amount, including age, health, income, dependents, and financial obligations.

Life insurance calculators are valuable resources for individuals who are considering purchasing life insurance. They provide a quick and easy way to get an idea of the coverage they may need.

Benefits of Using a Life Insurance Calculator

Life insurance calculators offer several benefits, including:

- Estimate Coverage Needs: Calculators provide a personalized estimate of the amount of life insurance needed based on individual circumstances.

- Identify Potential Shortfalls: They can highlight potential gaps in existing coverage, ensuring adequate financial protection for loved ones.

- Compare Different Policies: Calculators can help compare different life insurance policies from various providers, facilitating informed decision-making.

- Simplify the Decision-Making Process: By providing a clear picture of coverage needs, calculators streamline the process of selecting the right life insurance policy.

Types of Life Insurance Calculators

Life insurance calculators come in various forms, each catering to specific needs:

- Basic Life Insurance Calculators: These calculators use basic information like age, income, and dependents to provide a general estimate of coverage needs. They are simple to use and offer a quick overview of potential coverage requirements.

- Advanced Life Insurance Calculators: These calculators incorporate more detailed information, such as debt, assets, and financial goals, to provide a more comprehensive estimate of coverage needs. They offer greater accuracy and insight into individual financial situations.

- Term Life Insurance Calculators: These calculators focus specifically on term life insurance policies, which provide coverage for a specific period. They help determine the appropriate term length and coverage amount for individual needs.

- Whole Life Insurance Calculators: These calculators are designed for whole life insurance policies, which provide permanent coverage and accumulate cash value. They consider factors such as premiums, interest rates, and death benefits to estimate the cost and potential returns of whole life insurance.

Factors Considered in Life Insurance Calculations

Life insurance premiums are determined by a complex interplay of factors, ensuring that the cost reflects the individual’s risk profile. The calculation takes into account various aspects, including age, health, lifestyle, coverage amount, and policy term.

Age

Age is a significant factor influencing life insurance premiums. As individuals age, their life expectancy decreases, increasing the likelihood of a claim. Consequently, older individuals generally pay higher premiums compared to younger individuals. This reflects the higher probability of a claim occurring within the policy term.

Health

Health status plays a crucial role in determining premiums. Individuals with pre-existing medical conditions or unhealthy habits, such as smoking, are considered higher risk and often face higher premiums. Life insurance companies conduct thorough health assessments to evaluate an individual’s risk profile.

Lifestyle

Lifestyle choices can impact life insurance premiums. Individuals engaging in high-risk activities, such as extreme sports or dangerous hobbies, may be considered higher risk and pay higher premiums. Similarly, individuals with unhealthy habits like smoking or excessive alcohol consumption may face higher premiums due to the increased risk of health issues.

Coverage Amount

The amount of coverage desired significantly influences premiums. A higher coverage amount translates to a larger potential payout for the beneficiary, increasing the risk for the insurance company. As a result, higher coverage amounts typically lead to higher premiums.

Policy Term

The duration of the policy, known as the policy term, also impacts premiums. Longer policy terms generally result in higher premiums. This is because the insurance company assumes a greater risk over a longer period, potentially facing a claim for a more extended time.

Choosing the Right Life Insurance Policy: Life Insurance Calculator

The right life insurance policy can provide financial security for your loved ones in the event of your passing. Choosing the right policy involves understanding the different types of policies available and considering your individual needs and financial situation.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own characteristics and benefits. Here’s a comparison of some common types:

- Term Life Insurance: This type provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit. Term life insurance is generally more affordable than permanent life insurance, but it doesn’t build cash value.

- Whole Life Insurance: This type offers lifelong coverage, meaning your beneficiaries receive a death benefit regardless of when you pass away. Whole life insurance also accumulates cash value, which you can borrow against or withdraw from. It’s generally more expensive than term life insurance, but it provides long-term financial security.

- Universal Life Insurance: This type offers flexible premiums and death benefit amounts. You can adjust your premium payments and death benefit to suit your changing needs. Universal life insurance also builds cash value, but the growth rate is variable.

- Variable Life Insurance: This type allows you to invest your premium payments in sub-accounts that track the performance of various investment options. The death benefit and cash value are not guaranteed and fluctuate based on the performance of your investments.

Factors to Consider When Choosing a Policy, Life insurance calculator

When selecting a life insurance policy, consider the following factors:

- Coverage Needs: Determine the amount of coverage you need to protect your loved ones financially. This depends on your income, debts, dependents, and other financial obligations.

- Budget: Consider your monthly budget and how much you can afford to pay in premiums. Life insurance premiums vary depending on the type of policy, coverage amount, your age, health, and other factors.

- Investment Options: If you’re considering a permanent life insurance policy, explore the investment options available. These options can vary based on the insurer and the type of policy.

- Riders: Riders are optional additions to your life insurance policy that can provide additional benefits. Some common riders include accidental death benefit, terminal illness benefit, and long-term care rider.

Tips for Finding the Most Suitable Policy

Finding the most suitable life insurance policy involves comparing quotes from multiple insurers, understanding the policy terms, and consulting with a financial advisor.

- Compare Quotes: Get quotes from several life insurance companies to compare premiums, coverage options, and policy terms.

- Understand the Policy Terms: Carefully review the policy documents, including the death benefit, premium payments, policy exclusions, and any riders.

- Consult a Financial Advisor: A financial advisor can help you assess your insurance needs, evaluate different policies, and make informed decisions.

Life Insurance Calculator Tools and Resources

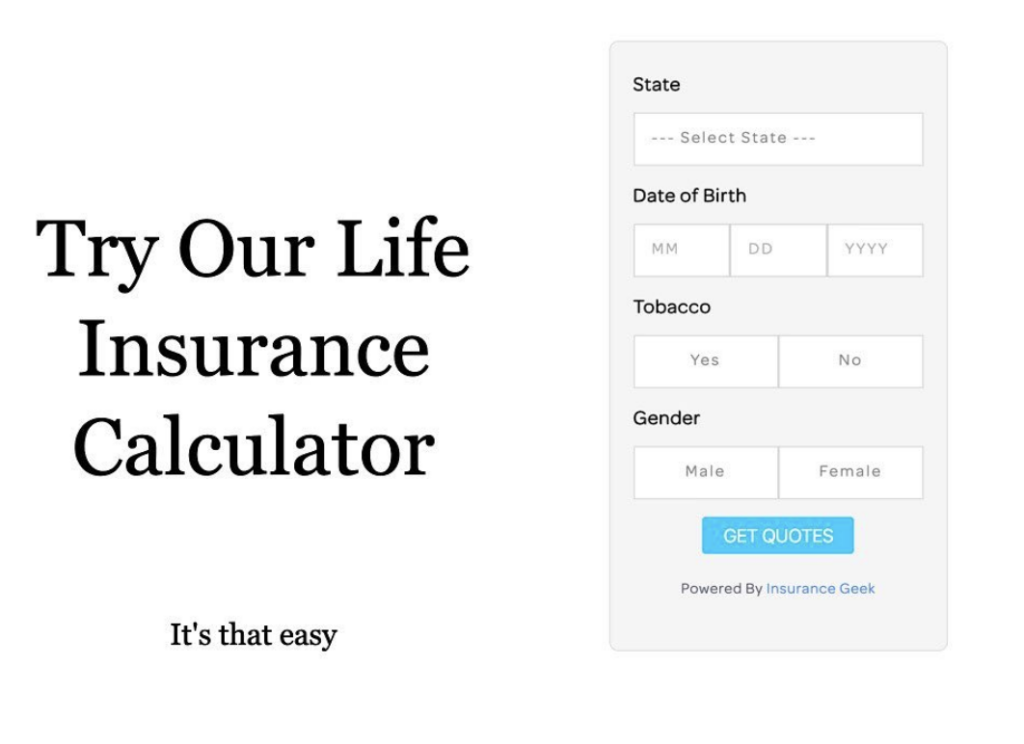

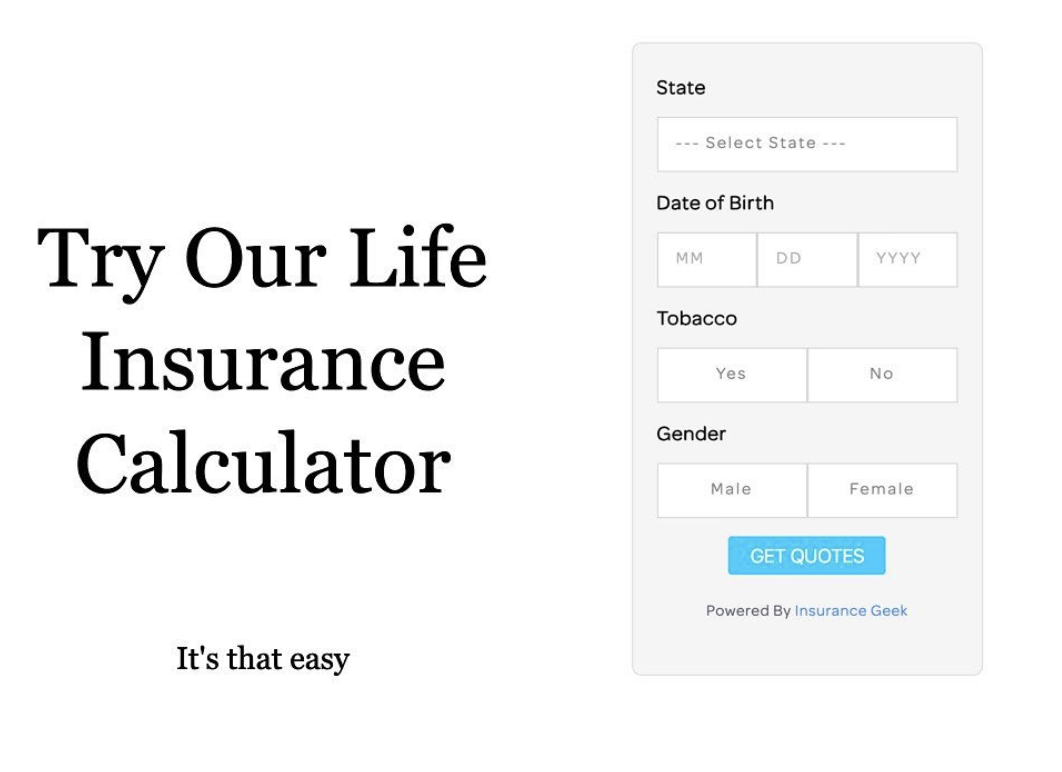

Life insurance calculators are valuable tools that can help you determine the right amount of coverage for your needs. They are generally easy to use, requiring only basic information such as your age, income, dependents, and desired coverage amount. While these calculators provide a good starting point, it is important to consult with a financial advisor for personalized guidance.

Life Insurance Calculator Websites and Applications

Several reputable websites and applications offer life insurance calculators. These tools can help you estimate your life insurance needs and compare different policies.

- Website Name: NerdWallet

- Features: NerdWallet’s life insurance calculator is user-friendly and provides estimates for term life and whole life insurance. It allows you to adjust various factors, such as coverage amount, policy term, and your health status, to see how they affect your premium.

- User Reviews: NerdWallet is generally well-regarded for its comprehensive financial resources, including its life insurance calculator. Users appreciate its ease of use and informative results.

- Website Name: Bankrate

- Features: Bankrate’s life insurance calculator offers a similar experience to NerdWallet, providing estimates for term and whole life insurance. It allows you to compare quotes from multiple insurers and adjust various factors to see their impact on your premium.

- User Reviews: Bankrate is a reputable source for financial information, and its life insurance calculator is often praised for its straightforward approach and helpful comparisons.

- Website Name: Policygenius

- Features: Policygenius is a popular platform for comparing life insurance quotes. Its life insurance calculator provides estimates for various policy types, including term, whole, and universal life insurance. It also allows you to compare quotes from multiple insurers and adjust factors such as coverage amount, policy term, and health status.

- User Reviews: Policygenius is known for its user-friendly interface and comprehensive coverage of life insurance options. Users appreciate its ability to compare quotes and find the best deals.

- Website Name: AccuQuote

- Features: AccuQuote is a leading provider of life insurance quotes and information. Its life insurance calculator allows you to estimate your needs and compare quotes from multiple insurers. It offers various policy types, including term, whole, and universal life insurance.

- User Reviews: AccuQuote is generally well-regarded for its extensive network of insurance providers and its ability to provide accurate quotes. Users appreciate its straightforward approach and helpful comparisons.

- Website Name: Life Insurance.com

- Features: Life Insurance.com offers a variety of life insurance calculators, including a simple needs-based calculator and a more detailed calculator that allows you to adjust various factors. It also provides information on different types of life insurance policies and helps you compare quotes from multiple insurers.

- User Reviews: Life Insurance.com is a popular resource for information on life insurance. Users appreciate its comprehensive coverage of topics and its ability to provide personalized recommendations.

Additional Resources for Learning More About Life Insurance

Beyond life insurance calculators, several resources can provide valuable information on life insurance.

- The National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that regulates the insurance industry in the United States. Its website provides information on life insurance, including consumer guides, regulations, and FAQs.

- The Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance to consumers and the media. Its website offers a variety of resources on life insurance, including articles, infographics, and videos.

- The Life Insurance Marketing and Research Association (LIMRA): LIMRA is a non-profit organization that provides research and education on life insurance. Its website offers a variety of resources, including articles, reports, and webinars.

Future Trends in Life Insurance Calculators

The life insurance industry is undergoing a rapid transformation driven by technological advancements, particularly in the realm of artificial intelligence (AI) and machine learning (ML). These technologies are poised to revolutionize life insurance calculations, making them more accurate, personalized, and accessible.

Impact of AI and ML on Life Insurance Calculations

AI and ML are transforming life insurance calculations by automating complex processes, enhancing accuracy, and enabling personalized risk assessments. These technologies can analyze vast datasets, identify patterns, and make predictions about an individual’s life expectancy, health status, and risk factors.

- Automated Underwriting: AI-powered systems can automate the underwriting process, which traditionally involves manual review of medical records and other data. This automation streamlines the process, reducing processing time and costs while ensuring consistency and accuracy. For example, AI can analyze medical records, identify potential risk factors, and assign risk scores, enabling faster and more efficient underwriting decisions.

- Personalized Risk Assessment: AI can personalize risk assessments by considering a wide range of factors beyond traditional demographics and medical history. This includes lifestyle choices, genetic information, and even social media data. By analyzing these factors, AI can create a more comprehensive and accurate risk profile for each individual, leading to more personalized and fair pricing. For example, AI can analyze an individual’s fitness tracker data to assess their health habits and predict their life expectancy, leading to potentially lower premiums for healthier individuals.

- Enhanced Accuracy: AI and ML algorithms can identify complex relationships and patterns in data that may be missed by human analysts. This allows for more accurate predictions of life expectancy, mortality rates, and other factors crucial to life insurance calculations. For example, AI can analyze a large dataset of mortality rates, identifying previously unknown correlations between specific medical conditions and life expectancy, leading to more accurate premium calculations.

Personalized Risk Assessments and Dynamic Premium Adjustments

AI and ML are paving the way for personalized risk assessments and dynamic premium adjustments, making life insurance more responsive to individual needs and circumstances.

- Real-time Risk Monitoring: AI can continuously monitor an individual’s health and lifestyle data, such as fitness tracker data, wearable device information, and social media activity, to provide real-time updates on their risk profile. This allows for dynamic premium adjustments based on individual changes in health and lifestyle, ensuring premiums reflect current risk levels.

- Predictive Analytics: AI can predict future health risks and mortality rates based on individual data and population trends. This allows for proactive risk management and tailored insurance plans that address potential future health challenges. For example, AI can predict the likelihood of developing certain diseases based on an individual’s genetic information and lifestyle, leading to customized insurance plans that offer additional coverage for those at higher risk.

Final Review

In the end, a life insurance calculator is more than just a tool; it’s a gateway to peace of mind. By understanding your life insurance needs and exploring different options, you can make confident decisions that secure the financial well-being of your family. Embrace the power of knowledge, and let a life insurance calculator guide you toward a brighter future.

A life insurance calculator can help you determine the right amount of coverage for your needs, ensuring your loved ones are financially secure in the event of your passing. Similarly, when it comes to your furry family members, choosing the best pet insurance company can provide peace of mind knowing your pet will receive the best care, regardless of unexpected medical expenses.

Just as a life insurance calculator helps you plan for the future, researching and comparing pet insurance plans can help you make informed decisions to protect your beloved pet’s health and well-being.