Motorcycle insurance cost is a crucial consideration for any rider, and understanding the factors that influence it is essential for making informed decisions. From the type of motorcycle you own to your riding experience and safety record, numerous variables contribute to your insurance premium. This guide delves into the intricacies of motorcycle insurance, providing insights into the different types of coverage available, cost-saving strategies, and navigating the claims process.

Whether you’re a seasoned rider or a first-time enthusiast, this comprehensive resource will empower you to choose the right insurance policy, understand your coverage options, and make informed decisions to protect yourself and your investment.

Factors Influencing Motorcycle Insurance Cost

Motorcycle insurance, like any other type of insurance, is designed to protect you financially in the event of an accident or other unforeseen event. The cost of motorcycle insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Factors Determining Motorcycle Insurance Cost

The cost of motorcycle insurance is influenced by a variety of factors, including your personal characteristics, the motorcycle itself, and your driving history. Here are some of the key factors that insurance companies consider when calculating your premium:

- Your Age and Gender: Younger riders, particularly males, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger riders due to their higher risk profile. This is because younger riders have less experience on the road and may be more likely to engage in risky behavior.

- Your Driving History: Your driving record is a significant factor in determining your insurance cost. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or other traffic violations can lead to higher premiums. This is because your driving history provides insurance companies with an indication of your driving habits and risk assessment.

- Your Location: The location where you live can also affect your motorcycle insurance cost. Areas with high traffic density, a higher rate of accidents, or a higher prevalence of theft may have higher insurance premiums. This is because insurance companies assess the risk of potential claims based on geographic location.

- Your Motorcycle Type: The type of motorcycle you own plays a crucial role in determining your insurance cost. High-performance motorcycles, such as sportbikes or cruisers, are generally more expensive to insure than smaller, less powerful motorcycles. This is because these motorcycles are often associated with higher speeds and potentially more severe accidents. The cost of repairs and replacement parts for these motorcycles can also be significantly higher.

- Your Coverage: The type and amount of coverage you choose will directly impact your insurance cost. Comprehensive coverage, which protects against damage from theft, vandalism, and natural disasters, will generally be more expensive than liability coverage, which only covers damage to other vehicles or property in the event of an accident. Additionally, higher coverage limits will typically result in higher premiums.

- Your Credit Score: In some states, insurance companies may use your credit score as a factor in determining your insurance premium. This is because studies have shown that individuals with lower credit scores tend to have higher insurance claims. However, this practice is not universal and may vary depending on the state and insurance company.

Impact of Factors on Premiums

The factors mentioned above can have a significant impact on your motorcycle insurance premiums. For example, a young rider with a history of traffic violations and a high-performance motorcycle will likely face much higher premiums than an older rider with a clean driving record and a smaller motorcycle.

- Example: Let’s consider two riders, both 25 years old, living in the same city. Rider A has a clean driving record and owns a standard motorcycle. Rider B has a history of speeding tickets and owns a high-performance sportbike. Rider B is likely to pay significantly higher premiums than Rider A due to the increased risk associated with his driving history and motorcycle type.

Cost Comparison for Different Motorcycle Types, Motorcycle insurance cost

The cost of motorcycle insurance can vary considerably depending on the type of motorcycle you own. As mentioned earlier, high-performance motorcycles are generally more expensive to insure than smaller, less powerful motorcycles.

- Example: A sportbike with a powerful engine and advanced features may have an insurance premium that is 2-3 times higher than a standard cruiser or touring motorcycle.

Table Summarizing Key Factors and Their Influence on Insurance Cost

| Factor | Influence on Insurance Cost |

|---|---|

| Age and Gender | Younger riders, particularly males, typically pay higher premiums. |

| Driving History | A clean driving record leads to lower premiums, while accidents or violations result in higher premiums. |

| Location | Areas with higher risk factors (e.g., traffic density, accident rates) may have higher premiums. |

| Motorcycle Type | High-performance motorcycles are generally more expensive to insure than smaller motorcycles. |

| Coverage | Comprehensive coverage and higher coverage limits will typically result in higher premiums. |

| Credit Score | In some states, lower credit scores may be associated with higher insurance premiums. |

Choosing the Right Insurance Policy

Finding the right motorcycle insurance policy can be a daunting task, especially with the multitude of options available. It’s essential to consider your individual needs, risk factors, and budget to make an informed decision. The right policy should provide adequate coverage while remaining affordable and manageable.

Comparing Insurance Providers and Their Offerings

Once you understand your needs, it’s crucial to compare different insurance providers and their offerings. Each provider has its own set of policies, coverage options, and pricing structures.

It’s important to consider factors such as:

- Coverage Options: Some providers offer more comprehensive coverage than others, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage.

- Deductibles: A higher deductible usually translates to lower premiums, but you’ll have to pay more out of pocket if you need to file a claim.

- Discounts: Many providers offer discounts for safe driving records, anti-theft devices, multiple policies, and rider training courses.

- Customer Service: Research the provider’s reputation for customer service and claim handling.

- Financial Stability: Look for providers with a strong financial rating, indicating their ability to pay claims in the event of an accident.

You can use online comparison tools or contact multiple providers directly to gather quotes and compare their offerings.

Negotiating Insurance Premiums and Securing Discounts

Negotiating insurance premiums can help you save money. While some providers are more flexible than others, here are some strategies you can use:

- Shop Around: Get quotes from multiple providers to compare prices and coverage options.

- Bundle Policies: Combining your motorcycle insurance with other policies, such as car or home insurance, can often result in discounts.

- Improve Your Credit Score: A good credit score can sometimes qualify you for lower premiums.

- Consider a Higher Deductible: A higher deductible will typically lead to lower premiums.

- Ask About Discounts: Inquire about available discounts for safe driving, anti-theft devices, rider training courses, and other factors that may apply to you.

- Negotiate: If you’ve found a policy that meets your needs but the premium seems high, don’t hesitate to negotiate with the provider. Be polite but firm, and explain your reasons for wanting a lower price.

It’s important to remember that insurance is a contract, and you have the right to negotiate the terms. Be prepared to walk away if you don’t feel comfortable with the final price.

Understanding Deductibles and Coverage Limits: Motorcycle Insurance Cost

Motorcycle insurance, like any other type of insurance, involves balancing risk and cost. Two crucial aspects of this balance are deductibles and coverage limits. These elements determine how much you pay out-of-pocket in case of an accident and how much your insurance company will cover.

Deductibles

Deductibles are the amount of money you agree to pay out-of-pocket before your insurance company starts covering the costs of an accident. A higher deductible typically leads to lower premiums, while a lower deductible means higher premiums.

The higher your deductible, the lower your monthly premium will be, and vice versa.

For example, if you have a $500 deductible and your motorcycle sustains $2,000 worth of damage, you will pay the first $500 and your insurance company will cover the remaining $1,500.

Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a particular type of claim. This limit can vary depending on the type of coverage, such as liability, collision, or comprehensive.

Choosing appropriate coverage limits is crucial as they directly impact the amount of financial protection you have in case of an accident.

For example, if you have a $100,000 liability coverage limit and cause an accident resulting in $150,000 in damages, you will be responsible for the remaining $50,000.

Examples of Deductibles and Coverage Limits in Real-Life Claims Scenarios

Here are some examples of how deductibles and coverage limits work in real-life claims scenarios:

* Scenario 1: Collision Coverage

* You have a $500 deductible and $10,000 collision coverage limit.

* You crash your motorcycle, causing $7,000 in damage.

* You pay $500 (deductible), and your insurance company pays the remaining $6,500.

* Scenario 2: Liability Coverage

* You have a $100,000 liability coverage limit.

* You cause an accident, and the other driver sustains $75,000 in injuries.

* Your insurance company covers the full $75,000.

* Scenario 3: Comprehensive Coverage

* You have a $250 deductible and $5,000 comprehensive coverage limit.

* Your motorcycle is stolen, and the estimated value is $4,000.

* You pay $250 (deductible), and your insurance company pays the remaining $3,750.

Deductibles and Coverage Limits Table

| Coverage Type | Deductible | Coverage Limit |

|---|---|---|

| Collision | $250 – $1,000 | $5,000 – $25,000 |

| Comprehensive | $100 – $500 | $2,500 – $10,000 |

| Liability | N/A | $25,000 – $100,000 |

Motorcycle Safety and Insurance Discounts

Motorcycle safety is not just about protecting yourself on the road, it also plays a significant role in influencing your insurance premiums. Insurance companies recognize that safe riders pose a lower risk, leading to reduced costs. By prioritizing safety, you can potentially save money on your motorcycle insurance.

Safety Features and Practices

Your riding habits and the safety features on your motorcycle can significantly impact your insurance costs. Here’s a breakdown of how specific elements contribute to safer riding and potentially lower premiums:

- Anti-lock Braking System (ABS): ABS helps prevent wheel lock-up during braking, enhancing control and reducing the risk of accidents. Many insurers offer discounts for motorcycles equipped with ABS.

- Motorcycle Safety Courses: Completing a motorcycle safety course demonstrates your commitment to safe riding practices. Insurance companies often reward this commitment with discounts.

- Defensive Riding Techniques: Mastering defensive riding techniques, such as scanning the road ahead, anticipating potential hazards, and maintaining a safe following distance, can significantly reduce your risk of accidents. While insurers may not directly offer discounts for defensive riding, it can indirectly lower your premiums by reducing the likelihood of claims.

- Protective Gear: Wearing a helmet, gloves, boots, and protective clothing significantly reduces the severity of injuries in case of an accident. While insurers might not directly offer discounts for wearing protective gear, it can positively impact your risk profile, potentially leading to lower premiums in the long run.

Common Insurance Discounts for Safe Riders

Insurance companies often offer various discounts to encourage safe riding practices. These discounts can significantly reduce your overall insurance premiums.

- Motorcycle Safety Course Discount: Completing a recognized motorcycle safety course demonstrates your commitment to safe riding and can earn you a significant discount on your insurance premiums.

- Anti-lock Braking System (ABS) Discount: Motorcycles equipped with ABS are generally considered safer due to their enhanced braking capabilities. Insurers often offer discounts for motorcycles with ABS, reflecting the reduced risk they pose.

- Multi-Policy Discount: Bundling your motorcycle insurance with other policies, such as car insurance or home insurance, from the same provider can often result in a multi-policy discount.

- Good Driver Discount: Maintaining a clean driving record with no accidents or violations can earn you a good driver discount on your motorcycle insurance. This reflects your history of safe driving practices.

- Loyalty Discount: Staying with the same insurance company for an extended period can often earn you a loyalty discount. This rewards your long-term commitment to the company.

Tips for Improving Motorcycle Safety and Maximizing Discounts

Here are some practical tips to enhance your motorcycle safety and potentially maximize your insurance discounts:

- Take a Motorcycle Safety Course: Enroll in a recognized motorcycle safety course to learn essential riding skills, traffic laws, and defensive riding techniques. This investment in your safety can also earn you a significant insurance discount.

- Maintain Your Motorcycle: Regular maintenance, including checking tire pressure, fluids, and brakes, ensures your motorcycle is in optimal condition for safe riding. This can also help you avoid potential accidents and claims, potentially impacting your insurance premiums.

- Ride Responsibly: Always ride within your limits, avoid distractions, and adhere to traffic laws. Responsible riding habits not only protect you but also contribute to a safer environment for everyone on the road.

- Consider Motorcycle Safety Gear: Invest in high-quality motorcycle safety gear, including a helmet, gloves, boots, and protective clothing. This gear can significantly reduce the severity of injuries in case of an accident, potentially leading to lower insurance costs in the long run.

- Shop Around for Insurance: Compare quotes from multiple insurance providers to find the best rates and discounts tailored to your specific needs and riding habits.

Cost-Saving Strategies for Motorcycle Insurance

Saving money on motorcycle insurance is possible without sacrificing essential coverage. By understanding the factors that influence your premium and employing smart strategies, you can significantly reduce your insurance costs.

Comparison Shopping

Comparing quotes from multiple insurers is a fundamental step in securing the best deal. Each insurer uses its own pricing algorithms, considering factors such as your riding history, motorcycle type, and location. By obtaining quotes from various insurers, you can identify the most competitive rates and potentially save hundreds of dollars annually.

Bundling Policies

Bundling your motorcycle insurance with other policies, such as auto or home insurance, can lead to significant discounts. Insurers often offer discounts for multiple policyholders, as they see you as a lower-risk customer. This strategy can be particularly beneficial if you already have other insurance policies with the same insurer.

Improving Your Credit Score

Your credit score can influence your insurance premium, though this varies by state. Insurers use credit scores as a proxy for risk assessment, believing that individuals with good credit are more financially responsible and less likely to file claims. By improving your credit score, you can potentially qualify for lower premiums.

Increasing Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, as you are taking on more financial responsibility in case of an accident. However, ensure that you can comfortably afford the increased deductible in the event of a claim.

Taking a Motorcycle Safety Course

Completing a motorcycle safety course can demonstrate your commitment to safe riding practices. Many insurers offer discounts to riders who have successfully completed an approved safety course. These courses not only improve your riding skills but also demonstrate your commitment to safety, which can lead to lower insurance premiums.

Maintaining a Clean Driving Record

A clean driving record is essential for securing affordable motorcycle insurance. Any traffic violations, accidents, or claims can increase your premium. By adhering to traffic laws and practicing safe riding habits, you can maintain a clean record and enjoy lower insurance rates.

Choosing a Motorcycle with Safety Features

Certain motorcycle models are equipped with safety features that can lower your insurance premium. For example, motorcycles with anti-lock brakes (ABS) or electronic stability control (ESC) are often considered safer and can qualify for discounts.

Storing Your Motorcycle Securely

Storing your motorcycle in a secure location can reduce your insurance risk. Insurers may offer discounts for motorcycles stored in a garage or secured with an alarm system.

Riding Less Frequently

If you ride your motorcycle less frequently, you may be eligible for discounts. Some insurers offer lower premiums for riders who use their motorcycles for recreational purposes rather than daily commutes.

Exploring Other Discounts

Insurers often offer various discounts beyond those mentioned above. These can include discounts for military personnel, good student discounts, and discounts for having multiple vehicles insured with the same company.

Concluding Remarks

In conclusion, navigating the world of motorcycle insurance requires careful consideration of various factors. By understanding the key elements that influence costs, exploring different coverage options, and implementing cost-saving strategies, you can ensure you have the right protection at an affordable price. Remember to prioritize safety, seek discounts, and stay informed about emerging trends in the motorcycle insurance industry. With a well-informed approach, you can confidently ride knowing you’re protected on the open road.

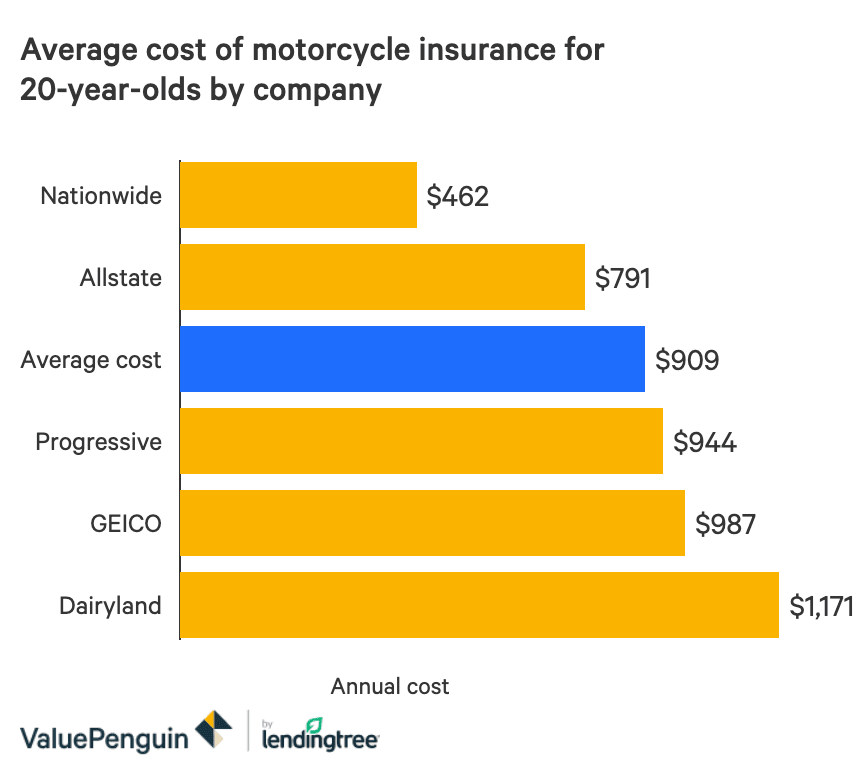

Motorcycle insurance costs can vary greatly depending on factors like your age, riding experience, and the type of bike you own. While you might be tempted to go for the cheapest option, it’s worth considering the reputation and coverage offered by different insurers.

To help you find the best auto insurance for your needs, check out this comprehensive guide to best auto insurances. This knowledge can help you make informed decisions when it comes to your motorcycle insurance as well, ensuring you have the right coverage at a price that works for you.