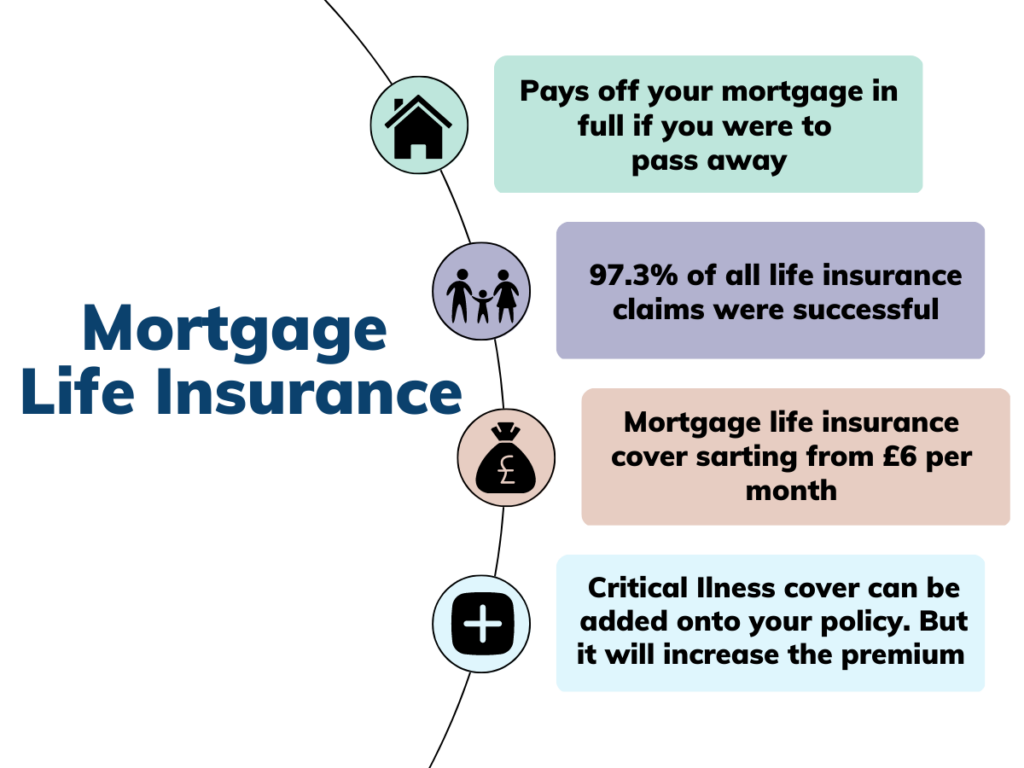

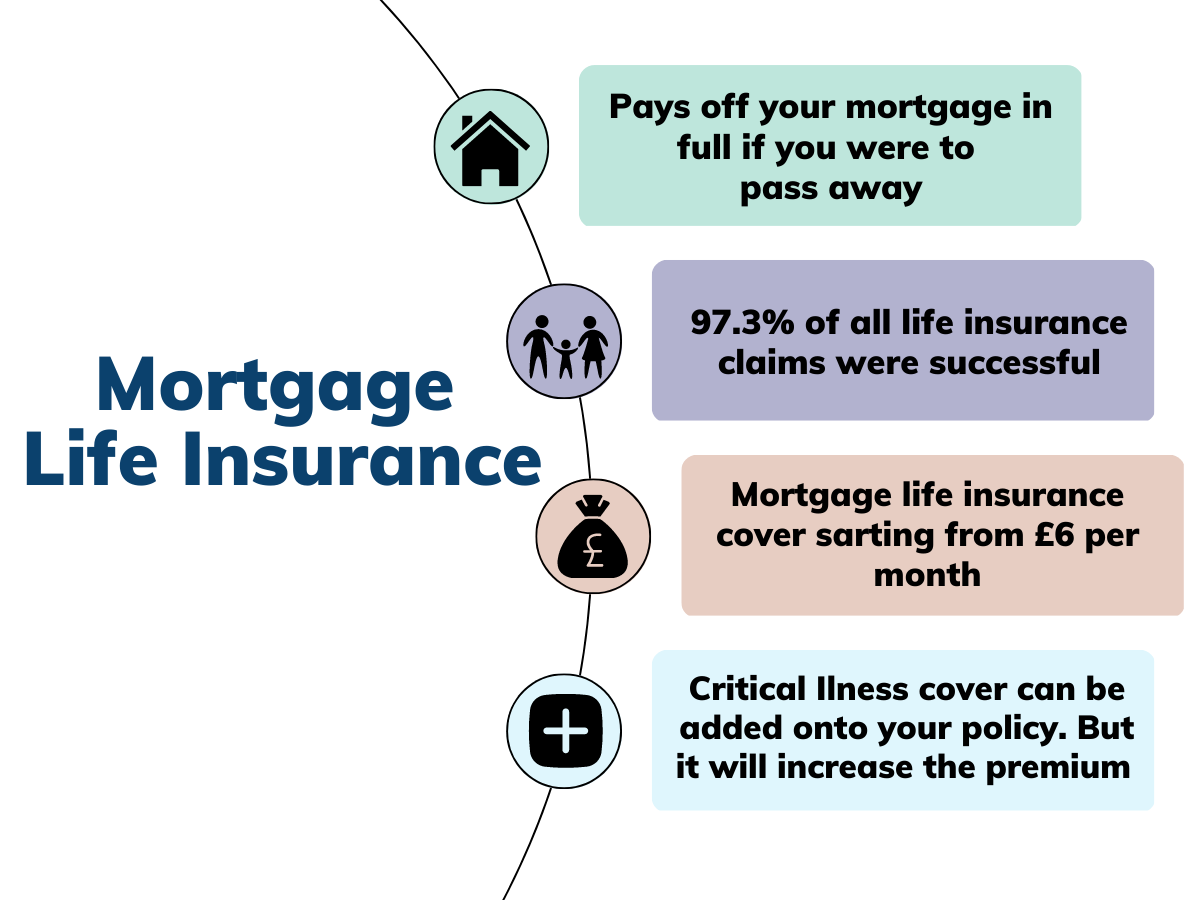

Mortgage life insurance is a type of life insurance designed specifically to cover your outstanding mortgage balance in the event of your death. It provides peace of mind for your family, ensuring they are not burdened with the financial strain of a mortgage after you are gone. Unlike traditional life insurance, which can be used for various purposes, mortgage life insurance is solely focused on paying off your mortgage debt.

Mortgage life insurance can be particularly beneficial for families with young children, those with significant mortgage debt, or individuals with health concerns who may find it difficult to obtain traditional life insurance. By securing a mortgage life insurance policy, you can ensure your family’s financial stability and protect their future.

What is Mortgage Life Insurance?

Mortgage life insurance is a type of life insurance designed specifically to pay off your mortgage if you pass away. It’s a straightforward way to ensure your loved ones aren’t burdened with your mortgage debt after you’re gone.

Mortgage Life Insurance vs. Other Life Insurance

Mortgage life insurance differs from traditional life insurance in a few key ways:

- Coverage Amount: Mortgage life insurance typically provides coverage equal to your outstanding mortgage balance, while traditional life insurance can provide coverage for a specific amount you choose.

- Purpose: Mortgage life insurance is designed to cover your mortgage debt, while traditional life insurance can be used for a variety of purposes, such as funeral expenses, income replacement, or other financial needs.

- Premiums: Mortgage life insurance premiums are usually lower than traditional life insurance premiums, as they only cover the mortgage debt.

When is Mortgage Life Insurance Beneficial?

Mortgage life insurance can be a valuable tool in several situations:

- Large Mortgage: If you have a significant mortgage balance, mortgage life insurance can offer peace of mind knowing your family won’t be left with a large debt if you pass away.

- Young Family: If you have young children, mortgage life insurance can help ensure they have a roof over their heads and financial stability in the event of your death.

- Sole Earner: If you are the sole earner in your household, mortgage life insurance can provide vital financial protection for your family.

- Limited Financial Resources: If you have limited financial resources, mortgage life insurance can be a more affordable option than traditional life insurance.

How Mortgage Life Insurance Works

Mortgage life insurance provides financial protection for your loved ones in case of your death. It helps ensure that your mortgage is paid off, preventing them from facing the burden of debt or losing their home.

The Process of Obtaining a Mortgage Life Insurance Policy

To obtain a mortgage life insurance policy, you’ll need to go through a straightforward application process. This typically involves providing information about yourself, your mortgage, and your health.

The process can be summarized as follows:

- Contact an insurance provider: You can get quotes from multiple insurance providers to compare prices and coverage options.

- Provide your details: You’ll need to share information about yourself, including your age, health, and lifestyle, as well as your mortgage details, such as the amount, term, and interest rate.

- Complete a health questionnaire: You might be required to complete a health questionnaire, depending on the policy type and provider.

- Receive a quote: Based on your information, the insurance provider will provide you with a quote, outlining the premium amount and coverage details.

- Review and accept the policy: Once you’re satisfied with the quote, you can review the policy documents and accept the terms and conditions.

- Make premium payments: You’ll need to make regular premium payments to maintain your coverage.

Types of Mortgage Life Insurance Policies

There are different types of mortgage life insurance policies available, each with its own features and benefits.

Here are some common types:

- Level Term Life Insurance: This type provides a fixed death benefit for a specific term, typically matching the mortgage term. The premiums remain the same throughout the policy term, offering predictable costs.

- Decreasing Term Life Insurance: This type offers a death benefit that decreases over time, mirroring the declining mortgage balance. The premiums are usually lower than level term life insurance, as the coverage amount decreases.

- Whole Life Insurance: This type provides lifelong coverage with a fixed death benefit. It combines life insurance with a savings component, allowing policyholders to accumulate cash value that can be borrowed against or withdrawn.

Factors Influencing the Cost of Mortgage Life Insurance

Several factors influence the cost of mortgage life insurance, including:

- Age: Younger individuals generally pay lower premiums than older individuals, as they have a lower risk of death.

- Health: Individuals with pre-existing health conditions may face higher premiums, as they are considered higher risk.

- Lifestyle: Individuals who engage in risky activities, such as smoking or extreme sports, may face higher premiums.

- Mortgage amount: The larger the mortgage amount, the higher the premium will be.

- Mortgage term: A longer mortgage term generally results in higher premiums, as the coverage period is longer.

- Insurance provider: Different insurance providers offer varying premiums based on their underwriting criteria and risk assessments.

Benefits of Mortgage Life Insurance

Mortgage life insurance provides financial security for your loved ones in the event of your death. It ensures that your family can maintain their home and avoid the burden of a significant financial obligation. This type of insurance offers peace of mind, knowing that your family’s future is protected.

Financial Benefits

Having mortgage life insurance offers several financial benefits. It can help your family:

- Pay off the mortgage: The death benefit from mortgage life insurance can be used to pay off the remaining balance on your mortgage, ensuring your family does not have to shoulder the financial burden of a large debt.

- Avoid foreclosure: Without mortgage life insurance, your family may face foreclosure if you pass away. The insurance provides a safety net to prevent this from happening.

- Maintain financial stability: Mortgage life insurance can help your family maintain financial stability by providing them with a lump sum payment, which can be used to cover living expenses, pay off other debts, or invest for the future.

Peace of Mind

Mortgage life insurance offers peace of mind to your loved ones, knowing that:

- Their home is protected: Your family can remain in their home without the fear of foreclosure, allowing them to maintain a sense of stability and security.

- Financial burden is relieved: Your family will not be burdened with the significant financial responsibility of paying off your mortgage. The insurance payment can help alleviate the financial stress during a difficult time.

- Future is secure: Mortgage life insurance provides a safety net for your family’s financial future, ensuring they have the resources to meet their needs and goals.

Drawbacks of Mortgage Life Insurance

While mortgage life insurance can offer peace of mind, it’s crucial to understand its potential drawbacks before making a decision. This type of insurance is often marketed as a simple and straightforward solution, but it’s essential to consider its limitations and compare it with other life insurance options.

Cost Comparison

Mortgage life insurance is often more expensive than traditional term life insurance. This is because mortgage life insurance policies typically have a shorter coverage term, which is tied to the length of your mortgage, and are designed for a specific purpose, making them less flexible than traditional term life insurance.

- Limited Coverage Term: Mortgage life insurance policies are typically designed to cover the remaining balance of your mortgage. If you pay off your mortgage early, your policy will expire, even if you still need life insurance coverage. This can be a disadvantage if you have other financial obligations or dependents to protect.

- Higher Premiums: Because mortgage life insurance is designed to cover a specific need, it often comes with higher premiums than traditional term life insurance. This is because the premiums are based on your mortgage amount, which is typically a fixed amount, and don’t adjust for changes in your family’s needs or financial situation.

Scenarios Where Mortgage Life Insurance Might Not Be the Best Choice

- Short Mortgage Term: If you have a short mortgage term, the cost of mortgage life insurance may not be justified. It’s important to weigh the cost of the policy against the remaining balance of your mortgage. If the mortgage is nearing its end, it may be more cost-effective to simply pay off the remaining balance with your own savings.

- Large Mortgage Amount: If you have a large mortgage, the premiums for mortgage life insurance can be significantly high. In this case, it might be more affordable and flexible to consider a traditional term life insurance policy, which can provide broader coverage for a longer term.

- Changing Financial Needs: Your life insurance needs may change over time. For example, if your family grows or your financial obligations increase, a mortgage life insurance policy might not provide adequate coverage. Traditional term life insurance offers more flexibility and allows you to adjust your coverage as your needs evolve.

Illustrative Scenarios

To better understand the suitability of mortgage life insurance, let’s explore some common scenarios and analyze the advantages and disadvantages of different options.

Scenario Analysis

Mortgage life insurance can be a valuable tool for some individuals and families, but it’s essential to weigh its benefits against alternative life insurance options. This table presents four illustrative scenarios and analyzes the potential advantages and disadvantages of mortgage life insurance versus other life insurance options.

| Scenario | Mortgage Life Insurance | Alternative Life Insurance | Best Option |

|---|---|---|---|

| Young Family with a Large Mortgage | Provides coverage specifically for the mortgage, offering peace of mind. However, it may be more expensive than term life insurance. | Term life insurance provides broader coverage for a fixed period, often at a lower cost. | Term life insurance is generally the better option as it offers greater flexibility and cost-effectiveness. |

| Individual with Health Concerns | May be difficult to obtain or expensive due to health conditions. | Guaranteed issue life insurance, while offering limited coverage, is accessible to individuals with health concerns. | Guaranteed issue life insurance can provide essential coverage, though at a higher cost and with a smaller death benefit. |

| Person with a High Net Worth | May be less suitable as it only covers the mortgage, leaving other financial obligations uncovered. | Whole life insurance or universal life insurance can provide permanent coverage and build cash value, potentially meeting broader financial needs. | Whole life or universal life insurance can be a better option, offering flexibility and long-term coverage. |

| Individual with a Short-Term Mortgage | May not be necessary as the mortgage will be paid off soon. | Term life insurance for a shorter duration can provide coverage during the remaining mortgage term. | Term life insurance with a shorter term aligns with the remaining mortgage duration, providing cost-effective coverage. |

Wrap-Up

In conclusion, mortgage life insurance can be a valuable tool for safeguarding your family’s financial well-being in the event of your passing. While it may not be the right choice for everyone, carefully considering your individual circumstances and financial needs can help you determine if it is the right solution for you. By understanding the benefits and drawbacks, exploring alternative options, and seeking professional advice, you can make an informed decision that provides peace of mind for your loved ones.

Mortgage life insurance provides peace of mind for your loved ones, ensuring your mortgage is paid off in the unfortunate event of your passing. Just like you need to shop around for the best rates on your mortgage, it’s crucial to compare quotes from different life insurance providers.

And just as you might rely on an auto insurance broker to find the right coverage for your vehicle, seeking advice from a qualified insurance broker can help you navigate the complexities of mortgage life insurance and find the most suitable policy for your needs.