Cancer insurance, a specialized form of coverage, acts as a financial safety net for individuals facing the unexpected challenges of a cancer diagnosis. Unlike traditional health insurance, which covers a wide range of medical expenses, cancer insurance focuses specifically on providing financial support for cancer-related treatments, procedures, and related expenses. This targeted approach offers peace of mind, knowing that financial burdens won’t add to the stress of a cancer diagnosis.

Cancer insurance policies vary in their coverage and benefits, ranging from lump-sum payments to comprehensive coverage for treatment, rehabilitation, and living expenses. Choosing the right policy requires careful consideration of individual needs, financial situation, and the specific coverage offered by different insurance providers.

Eligibility and Requirements

Cancer insurance, like any other type of insurance, has specific eligibility criteria that individuals must meet to be considered for coverage. This ensures that the insurance company can adequately assess the risk involved and determine the appropriate premium for the policy.

The eligibility and requirements for cancer insurance vary depending on the insurance company and the specific policy. However, there are some general guidelines that most insurers follow.

Medical Underwriting Process

The medical underwriting process is a crucial step in determining an individual’s eligibility for cancer insurance. It involves a thorough review of the applicant’s medical history, including any pre-existing conditions, current health status, and family history of cancer.

The underwriting process helps the insurance company assess the risk of the applicant developing cancer and determine the appropriate premium for the policy. It also helps to identify any potential exclusions or limitations that may apply to the coverage.

Waiting Periods and Exclusions

Waiting periods are a common feature of cancer insurance policies. These periods, typically ranging from 30 to 90 days, are implemented to prevent individuals from purchasing coverage immediately before a cancer diagnosis.

Exclusions are specific conditions or situations that are not covered by the insurance policy. Common exclusions in cancer insurance policies include pre-existing conditions, certain types of cancer, and treatments not considered medically necessary. It is important to carefully review the policy document to understand the specific exclusions that apply.

Cancer insurance can be a valuable addition to your overall financial protection, especially considering the high costs associated with treatment. If you’re looking for a reliable insurance provider, you might want to check out State Farm Insurance Company , which offers a range of insurance options, including cancer insurance.

While it’s important to carefully review the coverage and terms of any insurance policy, having cancer insurance can offer peace of mind and financial security in the face of a challenging diagnosis.

Costs and Premiums

Cancer insurance premiums can vary significantly depending on a number of factors. Understanding these factors can help you make an informed decision about whether cancer insurance is right for you and how much coverage you need.

Factors Influencing Premium Costs

The cost of cancer insurance premiums is determined by a variety of factors, including:

- Age: Younger individuals generally pay lower premiums than older individuals, as they are statistically less likely to develop cancer.

- Health: Individuals with pre-existing health conditions or a family history of cancer may pay higher premiums.

- Coverage Amount: The amount of coverage you choose will directly impact your premium. Higher coverage levels typically result in higher premiums.

- Policy Type: Different types of cancer insurance policies offer varying levels of coverage and benefits, which can affect the premium cost.

- Lifestyle Factors: Factors such as smoking habits, diet, and exercise can also influence premium rates.

- Geographic Location: Premiums may vary depending on the geographic location where you reside.

- Insurance Company: Different insurance companies have their own pricing structures and underwriting criteria, which can lead to variations in premiums.

Comparing Premiums

When comparing cancer insurance premiums from different providers, it’s crucial to consider the following:

- Coverage: Ensure that you understand the specific coverage provided by each policy, including the types of cancer covered, benefit limits, and exclusions.

- Benefits: Compare the benefits offered by different policies, such as lump-sum payments, treatment cost coverage, and living expense benefits.

- Premium Costs: Obtain quotes from multiple insurers to compare premium rates. Consider the overall value of the policy, not just the premium cost.

- Reputation and Financial Stability: Research the financial stability and reputation of the insurance company before making a decision.

Finding Affordable Options

There are several strategies you can employ to find affordable cancer insurance options:

- Shop Around: Get quotes from multiple insurers to compare premiums and coverage.

- Consider a Higher Deductible: A higher deductible can often result in lower premiums.

- Bundle Policies: Some insurers offer discounts for bundling multiple insurance policies, such as health insurance and cancer insurance.

- Look for Discounts: Inquire about potential discounts for non-smokers, healthy lifestyle choices, or group affiliations.

- Review Your Coverage Needs: Assess your specific needs and consider whether you require comprehensive coverage or a more limited policy.

Claims Process

Filing a claim under a cancer insurance policy is a straightforward process designed to provide you with financial support during a challenging time. This section will Artikel the steps involved in filing a claim, the necessary documentation, and the typical timeframe for processing and receiving benefits.

Documentation Required for a Successful Claim

To ensure a smooth claim process, it is crucial to provide the insurance company with the necessary documentation. This typically includes:

- Claim Form: A completed claim form, which can be obtained from your insurance provider, is the starting point. This form will request information about your diagnosis, treatment plan, and financial needs.

- Medical Records: Your medical records, including diagnosis reports, treatment summaries, and pathology reports, are essential to substantiate your claim. These records provide evidence of your cancer diagnosis and the extent of your treatment.

- Policy Documents: You will need to provide your policy documents, including the policy number and details of your coverage, to ensure the claim is processed correctly.

- Proof of Payment: In some cases, you may need to provide proof of payment for medical expenses incurred, such as receipts and invoices, to support your claim.

Claim Processing Timeframe

The time it takes to process a claim and receive benefits can vary depending on the specific insurance provider and the complexity of your case. However, you can expect the following steps:

- Initial Review: The insurance company will initially review your claim form and supporting documentation to ensure all required information is provided.

- Medical Review: A medical professional will review your medical records to verify your diagnosis and treatment plan. This process may involve contacting your doctor for additional information.

- Benefit Determination: Once the medical review is complete, the insurance company will determine the amount of benefits you are eligible for based on your policy coverage and the specific terms of your plan.

- Payment Processing: After the benefit determination is finalized, the insurance company will process your payment. The payment may be sent directly to you or to your healthcare provider, depending on the terms of your policy.

Claim Denial and Appeals Process

While the goal is for claims to be approved smoothly, there may be instances where a claim is denied. In such cases, you have the right to appeal the decision. The appeal process involves providing additional information or documentation to support your claim. You may also have the option to request a review by an independent medical professional.

Alternatives to Cancer Insurance

While cancer insurance provides specific coverage for cancer-related expenses, other financial protection options exist. Understanding these alternatives can help you make informed decisions about your financial preparedness for potential cancer-related costs.

Savings Accounts

Saving money in a dedicated account specifically for healthcare expenses can provide a financial buffer in case of a cancer diagnosis. This strategy allows you to accumulate funds over time, offering control over your savings and flexibility in how you use them.

Benefits of Savings Accounts

- Control and Flexibility: You have complete control over your savings and can use them for any healthcare expenses, not just cancer-related costs.

- Tax Advantages: Some savings accounts, such as Health Savings Accounts (HSAs), offer tax advantages, potentially reducing your overall healthcare costs.

- Predictability: You know exactly how much you’ve saved and can plan your spending accordingly.

Limitations of Savings Accounts

- Time and Effort: Building a substantial savings account requires time and discipline, and it may not be sufficient to cover all potential expenses.

- Potential for Unexpected Expenses: Life’s uncertainties can drain your savings, leaving you unprepared for unforeseen healthcare costs.

- Limited Coverage: Savings accounts may not cover all potential cancer-related expenses, such as long-term care or experimental treatments.

Critical Illness Coverage, Cancer insurance

Critical illness insurance provides a lump sum payment upon diagnosis of a specified critical illness, including cancer. This coverage can help with expenses related to treatment, lost income, and other financial burdens.

Benefits of Critical Illness Coverage

- Lump Sum Payment: Receiving a lump sum payment can alleviate immediate financial stress and allow you to focus on your health.

- Flexibility in Usage: You can use the lump sum payment for various expenses, including medical bills, living expenses, or debt repayment.

- Coverage for Multiple Illnesses: Some critical illness policies cover a range of critical illnesses, providing broader protection.

Limitations of Critical Illness Coverage

- Limited Coverage: Critical illness coverage may not cover all cancer-related expenses, such as long-term care or rehabilitation.

- Waiting Periods: There may be a waiting period before you can claim benefits, potentially delaying financial assistance.

- Premium Costs: Critical illness insurance premiums can be higher than cancer insurance, especially for individuals with pre-existing conditions.

Charitable Organizations

Many charitable organizations provide financial assistance to cancer patients facing financial hardship. These organizations may offer grants, loans, or other support to help cover medical expenses, living costs, or other needs.

Benefits of Charitable Organizations

- Financial Assistance: Charitable organizations can provide much-needed financial assistance to cancer patients struggling with expenses.

- Emotional Support: These organizations often offer emotional support and resources to patients and their families.

- Access to Services: Some organizations may provide access to transportation, counseling, or other services that can benefit cancer patients.

Limitations of Charitable Organizations

- Eligibility Criteria: Charitable organizations often have specific eligibility criteria, which may limit access to financial assistance.

- Limited Funds: Due to limited funding, charitable organizations may not be able to meet all the needs of every applicant.

- Application Process: The application process for financial assistance can be time-consuming and may involve documentation requirements.

Comparative Analysis

| Feature | Savings Accounts | Critical Illness Coverage | Charitable Organizations |

|---|---|---|---|

| Coverage | Flexible, but may not cover all cancer-related expenses | Lump sum payment for specific illnesses, including cancer | Financial assistance, but may have limited funds and eligibility criteria |

| Cost | Depends on savings habits and investment returns | Premiums can be higher than cancer insurance | Typically free, but may require meeting eligibility requirements |

| Control | Complete control over savings | Limited control, as benefits are predetermined | Limited control, as assistance is based on organization’s policies |

Frequently Asked Questions

Cancer insurance can be a complex topic, and it’s natural to have questions about how it works and if it’s right for you. This section aims to address some of the most common questions about cancer insurance.

Coverage for Different Types of Cancer

This section will discuss what types of cancer are covered by cancer insurance.

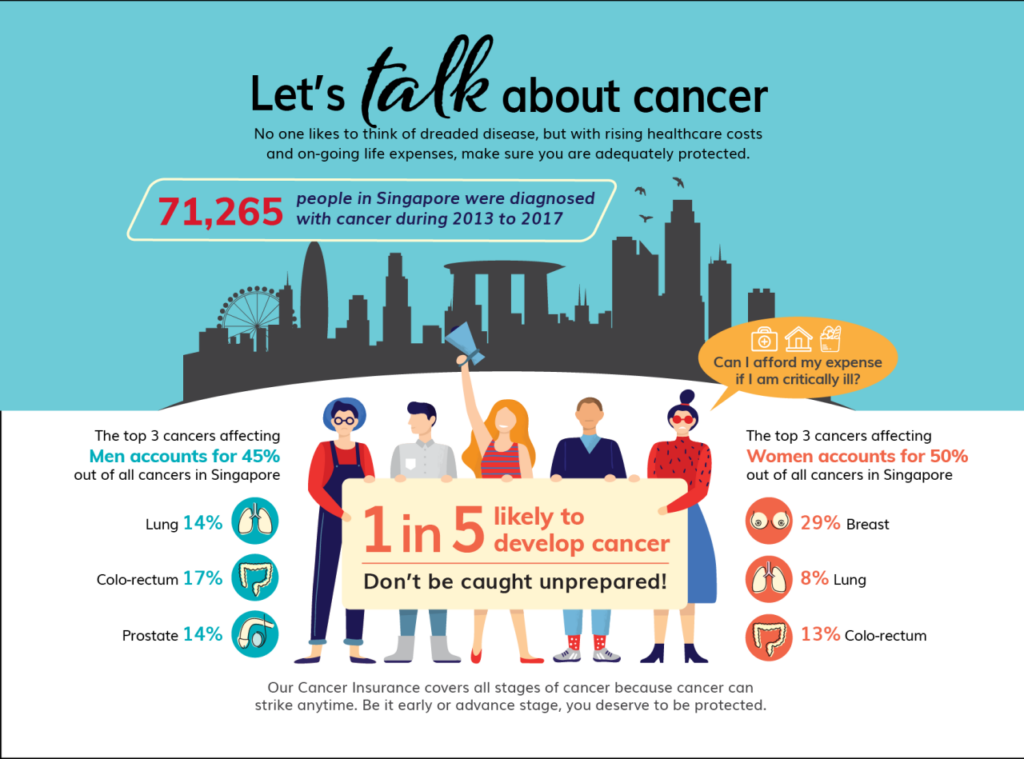

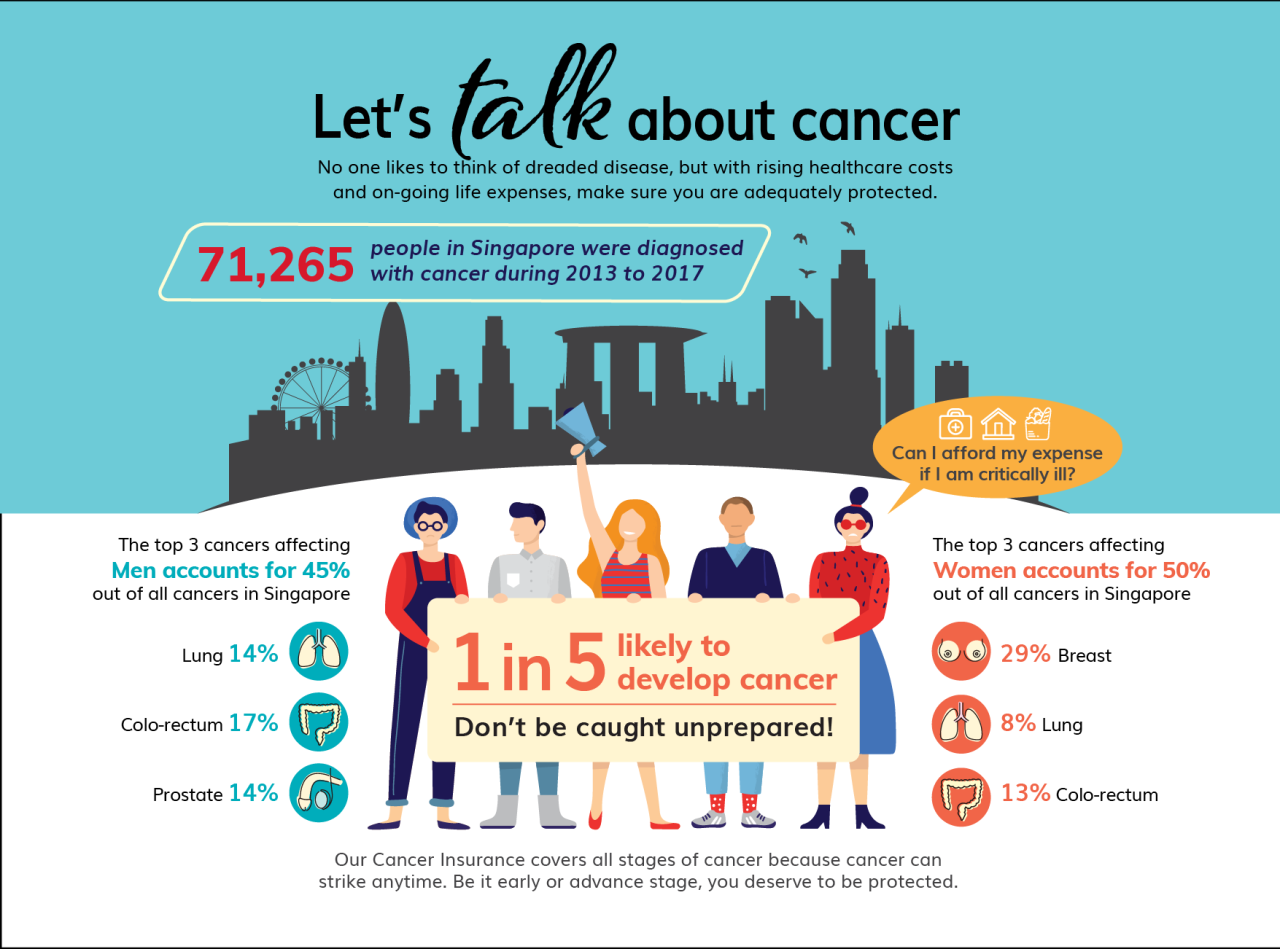

- Most cancer insurance policies cover a wide range of cancers, including common types like breast cancer, lung cancer, prostate cancer, and colorectal cancer.

- However, some policies may have exclusions or limitations for certain types of cancer, such as cancers that are considered pre-existing conditions or cancers that are highly unusual or rare.

It’s essential to carefully review the policy details to understand the specific types of cancer covered.

Waiting Periods

This section will explain the concept of waiting periods in cancer insurance.

- Many cancer insurance policies have a waiting period, which is the time you need to be insured before the policy starts covering cancer-related expenses.

- Waiting periods typically range from 30 to 90 days, but they can vary depending on the insurer and the specific policy.

- This waiting period is designed to prevent people from buying insurance only when they are diagnosed with cancer.

Understanding the waiting period is crucial for making informed decisions about cancer insurance.

Maximum Benefit Limits

This section will provide details about the maximum benefit limits associated with cancer insurance.

- Cancer insurance policies often have maximum benefit limits, which are the total amount of money the insurer will pay out for covered expenses during your lifetime.

- Benefit limits can vary widely depending on the policy, but they are typically in the range of $100,000 to $1 million.

- It’s important to consider your potential cancer treatment costs and choose a policy with a benefit limit that is sufficient to cover your needs.

Knowing the maximum benefit limit helps you understand the financial protection offered by the policy.

Premium Increases

This section will discuss the possibility of premium increases in cancer insurance.

- Some cancer insurance policies may have provisions for premium increases, especially if the insurer experiences higher-than-expected claims costs.

- However, reputable insurers typically have clear and transparent policies regarding premium increases, and they may not increase premiums for all policyholders.

- It’s essential to read the policy documents carefully to understand the insurer’s policy on premium increases.

Understanding the possibility of premium increases allows you to make informed decisions about long-term affordability.

Pre-Existing Conditions

This section will clarify how pre-existing conditions are handled in cancer insurance.

- Cancer insurance policies typically exclude coverage for pre-existing conditions, which are medical conditions you had before purchasing the insurance.

- For example, if you were diagnosed with a non-cancerous tumor before getting cancer insurance, the policy might not cover any related expenses.

- It’s essential to disclose any pre-existing conditions to the insurer during the application process to avoid potential coverage issues later.

Transparency about pre-existing conditions is crucial for ensuring accurate coverage.

Exclusions and Limitations

This section will explain common exclusions and limitations found in cancer insurance policies.

- Cancer insurance policies often have exclusions and limitations that specify what expenses are not covered.

- These exclusions may include expenses related to certain types of cancer treatment, such as experimental therapies or treatments not approved by the insurer.

- It’s crucial to carefully review the policy documents to understand the exclusions and limitations to avoid surprises later.

Understanding the exclusions and limitations allows you to make informed decisions about whether the policy meets your specific needs.

Renewability

This section will discuss the renewability of cancer insurance policies.

- Most cancer insurance policies are renewable, meaning you can renew them for a certain period, typically until a specific age.

- However, the insurer may have the right to increase premiums at renewal, based on factors like your age and health status.

- It’s important to understand the policy’s renewability provisions to ensure long-term coverage.

Renewability provides a sense of security regarding long-term coverage.

Claim Process

This section will address the claim process for cancer insurance.

- The claim process for cancer insurance typically involves filing a claim with the insurer, providing documentation of your diagnosis and treatment, and receiving reimbursement for eligible expenses.

- The specific steps and documentation required may vary depending on the insurer and the policy.

- It’s essential to understand the claim process before you need to file a claim to ensure a smooth and timely experience.

Understanding the claim process helps you prepare for any potential claims in the future.

Tax Implications

This section will discuss the potential tax implications of cancer insurance.

- The tax implications of cancer insurance can vary depending on the specific policy and your individual circumstances.

- In some cases, premiums paid for cancer insurance may be tax-deductible, while the benefits received may be taxable.

- It’s essential to consult with a tax professional to understand the tax implications of cancer insurance in your specific situation.

Seeking professional advice on tax implications is crucial for financial planning.

Alternatives to Cancer Insurance

This section will highlight alternative options to cancer insurance.

- There are several alternatives to cancer insurance, such as comprehensive health insurance, critical illness insurance, and savings plans.

- Each option has its own benefits and drawbacks, and it’s important to compare them carefully to determine the best fit for your individual needs and circumstances.

Exploring alternatives allows for a more comprehensive understanding of your options.

Closing Notes

Navigating the complex world of cancer insurance can be daunting, but understanding its purpose, coverage, and benefits empowers individuals to make informed decisions. By carefully evaluating their options, individuals can find a policy that aligns with their needs and provides financial security during a challenging time. Remember, cancer insurance is a valuable tool for mitigating the financial impact of a cancer diagnosis and allowing individuals to focus on their health and well-being.