Cheap home owners insurance – Cheap homeowners insurance is a common goal for many property owners, but finding the right balance between affordability and comprehensive coverage can be a challenge. Navigating the complex world of insurance policies, deductibles, and coverage options can be overwhelming, especially for those new to the process. Understanding the key factors that influence insurance premiums, exploring discounts and savings opportunities, and comparing quotes from multiple providers are essential steps in securing affordable homeowners insurance.

This guide will provide you with the knowledge and strategies to find cheap homeowners insurance that meets your specific needs and protects your valuable assets. From understanding the basics of homeowners insurance to navigating the claims process, we’ll cover all the essential aspects of finding affordable coverage while ensuring adequate protection.

Understanding Homeowners Insurance Basics

Homeowners insurance is a crucial aspect of protecting your biggest investment – your home. It safeguards you against financial losses due to unforeseen events like fire, theft, or natural disasters. Understanding the fundamentals of homeowners insurance is essential for making informed decisions about your coverage.

Types of Coverage

Homeowners insurance policies typically include several types of coverage to protect your home and belongings. These are the main components:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, foundation, and attached structures like garages and porches. It also covers repairs or replacement costs in case of damage due to covered perils.

- Other Structures Coverage: This protects detached structures on your property, such as fences, sheds, or detached garages. The coverage amount is usually a percentage of your dwelling coverage.

- Personal Property Coverage: This covers your belongings inside your home, including furniture, appliances, clothing, electronics, and personal items. It provides financial protection for damage or theft of these items.

- Liability Coverage: This protects you from financial liability if someone is injured on your property or if you are held responsible for damage to someone else’s property.

- Additional Living Expenses Coverage: This covers temporary living expenses if you are unable to live in your home due to a covered event. This can include costs like hotel stays, meals, and other necessities.

Deductible

The deductible is the amount you are responsible for paying out-of-pocket before your insurance policy kicks in. A higher deductible typically leads to lower premiums, while a lower deductible means higher premiums. Choosing the right deductible is a balance between cost and coverage.

Perils

Perils are the events that are covered by your homeowners insurance policy. Common covered perils include:

- Fire: This covers damage caused by fire, smoke, or soot.

- Windstorm: This covers damage caused by high winds, such as from a hurricane or tornado.

- Hail: This covers damage caused by hailstorms.

- Lightning: This covers damage caused by lightning strikes.

- Theft: This covers theft of your personal property.

- Vandalism: This covers damage caused by vandalism or malicious mischief.

- Some Natural Disasters: This can include earthquakes, floods, or landslides, but coverage for these events can vary depending on your location and the specific policy.

Exclusions

It’s important to understand that homeowners insurance policies also have exclusions. These are events or situations that are not covered by your policy. Common exclusions include:

- Acts of War: Damage caused by war or terrorism is typically excluded.

- Earthquakes: Earthquake coverage is often optional and may require an additional premium.

- Flooding: Flood insurance is typically separate from homeowners insurance and is purchased through the National Flood Insurance Program (NFIP).

- Neglect: Damage caused by negligence or failure to maintain your property is usually excluded.

Factors Influencing Homeowners Insurance Costs

Your homeowners insurance premium is determined by a variety of factors, each contributing to the overall cost. Understanding these factors can help you make informed decisions to potentially lower your premiums and ensure you have the right coverage for your needs.

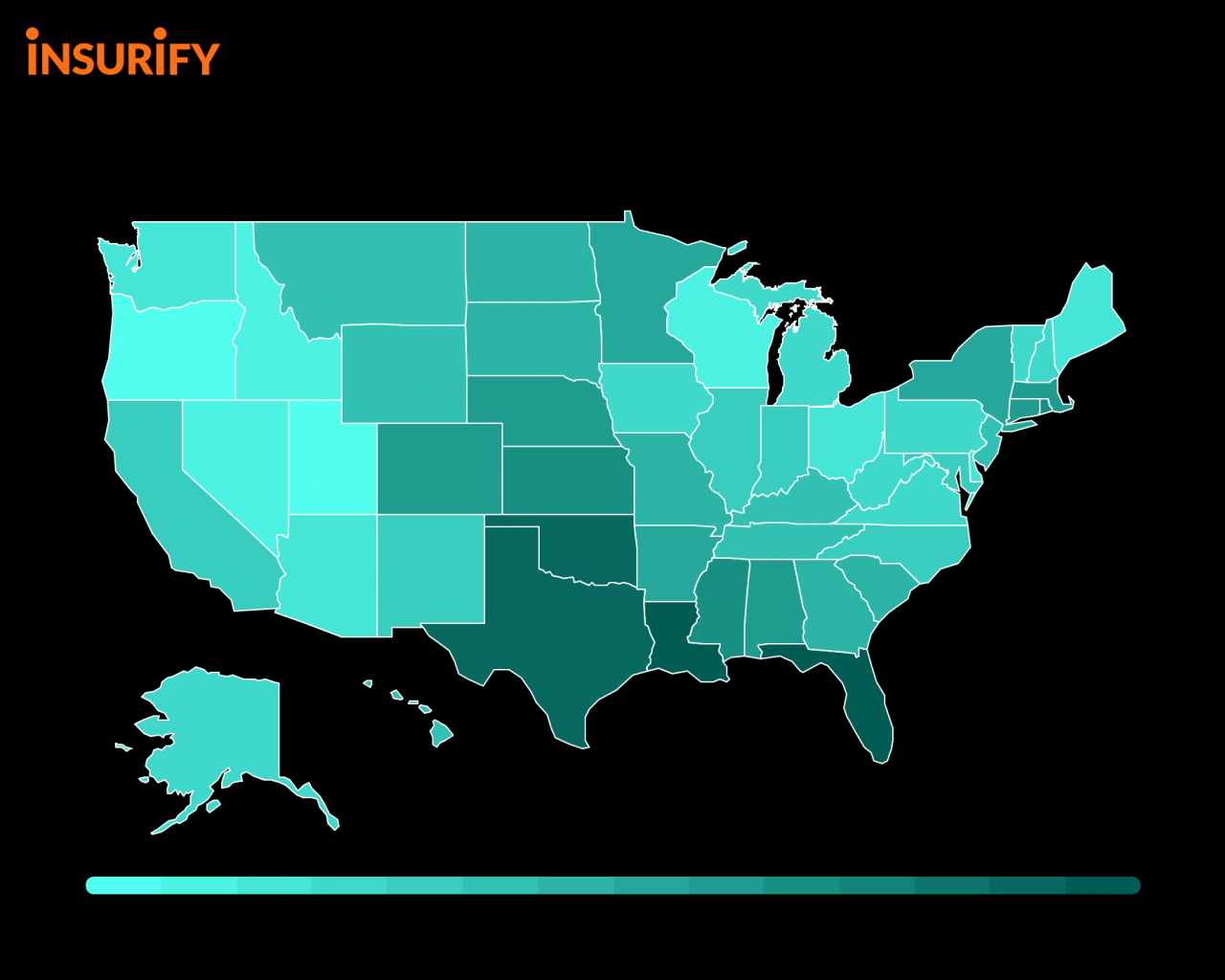

Location

Your location plays a significant role in determining your homeowners insurance costs. Factors such as natural disaster risk, crime rates, and the cost of rebuilding in your area influence premiums. For example, homes in areas prone to hurricanes, earthquakes, or wildfires will generally have higher insurance costs due to the increased risk of damage. Similarly, homes in areas with high crime rates may also have higher premiums due to the increased risk of theft or vandalism.

Home Value

The value of your home is a key factor in determining your homeowners insurance premium. The higher the value of your home, the more it will cost to rebuild or repair it in case of damage. Therefore, insurance companies charge higher premiums for homes with higher values to cover the potential costs of rebuilding.

Coverage Amount

The amount of coverage you choose for your homeowners insurance policy also affects your premium. Higher coverage amounts generally result in higher premiums. It’s crucial to choose a coverage amount that adequately protects your home and belongings against potential losses. Consider the replacement cost of your home, personal property, and other liabilities when determining the appropriate coverage amount.

Deductibles

Your deductible is the amount you agree to pay out of pocket in case of a claim. Choosing a higher deductible can lower your premium, as you are taking on more financial responsibility in case of a loss. However, it’s essential to consider your financial situation and ability to cover a higher deductible if a claim occurs.

Insurance Company and Offerings, Cheap home owners insurance

Different insurance companies offer varying premiums and coverage options. It’s essential to compare quotes from multiple companies to find the best rates and coverage for your specific needs. Consider factors such as financial stability, customer service, and claims handling processes when comparing insurance companies.

Discounts and Savings Opportunities

Lowering your homeowners insurance premiums can be a significant financial advantage. Fortunately, many insurance companies offer a variety of discounts to help you save money. These discounts can be applied to your policy based on your individual circumstances, home features, and safety practices.

Discounts for Safety Features

Many insurance companies offer discounts for safety features that can reduce the risk of accidents and damage to your home.

- Smoke Detectors: Installing smoke detectors in your home can significantly reduce the risk of fire damage, making your home safer and potentially lowering your insurance premiums.

- Fire Sprinklers: Homes with fire sprinkler systems often qualify for discounts. Sprinkler systems are highly effective in suppressing fires, minimizing damage, and increasing the safety of your home.

- Deadbolt Locks: Installing deadbolt locks on your exterior doors can help deter burglars and lower your insurance premiums.

- Security Systems: A well-maintained security system can deter burglars and protect your home from theft. Insurance companies often offer discounts for homes equipped with security systems.

Discounts for Bundling Policies

Bundling your homeowners insurance with other types of insurance, such as auto or renters insurance, can often lead to significant savings. Insurance companies often offer discounts for bundling policies, as it simplifies their administration and reduces their risk.

- Auto Insurance: Bundling your homeowners and auto insurance policies can result in substantial discounts, as insurance companies often reward policyholders for consolidating their coverage.

- Renters Insurance: Even if you rent, you can still benefit from bundling your renters insurance with your homeowners insurance. This can lower your overall premiums and provide comprehensive coverage for your belongings.

Other Common Discounts

Beyond safety features and bundling policies, many insurance companies offer other discounts to make homeowners insurance more affordable.

- Loyalty Discounts: Many insurance companies reward loyal customers with discounts for maintaining continuous coverage.

- Claims-Free Discounts: If you have a good claims history, you may qualify for a discount. This demonstrates your responsible driving habits and responsible homeownership.

- Homeowner Association Discounts: Some homeowners associations have partnerships with insurance companies, which can lead to discounts for members.

- Home Improvement Discounts: Upgrading your home with energy-efficient features, such as new windows or insulation, can qualify you for discounts. These improvements can reduce your energy consumption and lower your insurance premiums.

| Discount Category | Eligibility Criteria |

|---|---|

| Safety Features | Installation of smoke detectors, fire sprinklers, deadbolt locks, security systems |

| Bundling Policies | Combining homeowners insurance with auto or renters insurance |

| Loyalty Discounts | Maintaining continuous coverage with the same insurance company |

| Claims-Free Discounts | Having a good claims history with no recent accidents or incidents |

| Homeowner Association Discounts | Membership in a homeowners association with a partnership with the insurance company |

| Home Improvement Discounts | Upgrading your home with energy-efficient features, such as new windows or insulation |

Tips for Preventing Claims

Preventing homeowners insurance claims is not just about saving money on premiums; it’s about protecting your home, your belongings, and your peace of mind. By taking proactive steps to minimize risks, you can significantly reduce the likelihood of experiencing a covered event and the associated financial and emotional burden.

Finding cheap homeowners insurance is a smart move, but don’t forget about the importance of insurance general liability , especially if you have a business operating from your home. This type of coverage protects you from financial losses in case someone gets injured on your property or you cause damage to someone else’s property.

While it might seem like an added expense, it can be a lifesaver in the long run and is worth considering when you’re looking for affordable home insurance.

Fire Safety

Fire is one of the most common causes of property damage and can result in devastating losses. Implementing fire safety measures is crucial for protecting your home and family.

- Install and maintain smoke detectors on every level of your home, including the basement and attic. Test them monthly and replace batteries at least once a year.

- Develop and practice a fire escape plan with your family, ensuring everyone knows how to exit the house safely in case of a fire. Designate a meeting point outside the home where everyone can gather.

- Keep flammable materials away from heat sources, such as stoves, fireplaces, and heaters. Avoid overloading electrical outlets and use surge protectors to prevent electrical fires.

- Regularly inspect and clean chimneys and vents to remove creosote buildup, which can ignite easily. Hire a professional chimney sweep for regular inspections and cleaning.

- Store flammable liquids, such as gasoline and kerosene, in properly labeled and sealed containers in a well-ventilated area away from the house.

Theft Prevention

Theft can be a significant source of stress and financial loss for homeowners. By implementing effective security measures, you can deter potential burglars and protect your valuables.

- Install a home security system with alarms, motion sensors, and cameras. Consider a system that can be monitored remotely and connected to local authorities.

- Use strong, deadbolt locks on all exterior doors and windows. Replace old or damaged locks with high-quality ones.

- Install motion-activated outdoor lighting to illuminate your property and deter potential intruders. Use timers to ensure lights are on during evening hours.

- Keep valuables out of sight and avoid displaying expensive items in windows or near entrances. Consider using a safe or vault to store important documents and jewelry.

- Trim bushes and trees around your home to eliminate hiding places for potential burglars. Maintain clear lines of sight to all entrances and windows.

- Inform neighbors when you are away from home and ask them to keep an eye on your property. Consider asking a trusted neighbor to collect mail and newspapers to create the impression that someone is home.

Natural Disaster Preparedness

Natural disasters can cause significant damage to homes and belongings. Preparing for these events can mitigate potential losses and ensure your safety.

- Develop a plan for evacuating your home in case of a natural disaster. Identify safe routes and designate a meeting point for your family.

- Secure your home against potential damage. Install hurricane shutters or board up windows in areas prone to hurricanes. Secure loose objects in your yard to prevent them from becoming projectiles.

- Create an emergency kit that includes essential supplies such as food, water, first aid, medication, flashlights, batteries, and a battery-powered radio.

- Keep important documents, such as insurance policies, birth certificates, and medical records, in a waterproof and fireproof container. Consider storing these documents in a safe deposit box or with a trusted friend or family member.

- Stay informed about weather forecasts and warnings. Monitor local news and weather websites for updates and heed evacuation orders from authorities.

Home Maintenance

Regular home maintenance is essential for preventing costly repairs and ensuring the safety of your home.

- Inspect your roof regularly for damage, leaks, and missing shingles. Hire a professional roofer for inspections and repairs.

- Clean gutters and downspouts to prevent clogs and water damage. Ensure water is flowing away from your foundation.

- Inspect and maintain plumbing fixtures, pipes, and appliances to prevent leaks and water damage. Address any issues promptly.

- Check electrical wiring and appliances for signs of damage or wear. Hire a licensed electrician for any repairs or upgrades.

- Trim trees and branches that are close to your home to prevent damage from falling limbs. Maintain a safe distance between trees and power lines.

Navigating the Claims Process

Filing a homeowners insurance claim can be a stressful experience, but understanding the process can help you navigate it smoothly. This section will guide you through the steps involved, explain the required documentation, and provide tips for effective communication with your insurance company.

Steps Involved in Filing a Claim

The process of filing a homeowners insurance claim typically involves the following steps:

- Contact your insurance company immediately after the incident. This is crucial to initiate the claims process and ensure timely assistance.

- Provide a detailed description of the incident. Include the date, time, location, and circumstances surrounding the event. Be specific and accurate in your account.

- Gather necessary documentation. This may include photographs or videos of the damage, receipts for repairs, and any other relevant information.

- Cooperate with the insurance adjuster. The adjuster will inspect the damage and assess the extent of the loss. Provide them with access to your property and answer their questions truthfully and thoroughly.

- Negotiate the claim settlement. Review the adjuster’s estimate and discuss any discrepancies. You may need to provide additional documentation or evidence to support your claim.

- Receive payment for the claim. Once the claim is settled, your insurance company will issue payment for the covered damages. This may be in the form of a check or direct deposit.

Documentation Required for a Claim

To ensure a smooth claims process, it’s essential to have the following documentation readily available:

- Your insurance policy. This document Artikels your coverage details, including deductibles and limits.

- Proof of ownership. Provide evidence that you are the legal owner of the property.

- Photographs or videos of the damage. These visual records will help support your claim and provide a clear picture of the extent of the loss.

- Receipts for repairs. If you have already made repairs, keep all receipts and invoices.

- Police report. If the incident involved a crime, obtain a copy of the police report.

- Witness statements. If anyone witnessed the incident, gather their contact information and statements.

Communication with Insurance Companies

Clear and effective communication with your insurance company is vital throughout the claims process. Here are some tips:

- Keep a detailed record of all communication. Note the date, time, and content of each interaction, including phone calls, emails, and letters.

- Be polite and respectful. Even when dealing with frustrating situations, maintain a professional tone.

- Request everything in writing. This creates a paper trail and ensures that all agreements are documented.

- Don’t be afraid to ask questions. If you are unsure about anything, clarify it with your insurance company.

Handling Insurance Adjusters

Insurance adjusters are responsible for assessing the damage and determining the amount of compensation you will receive. It’s important to understand your rights and responsibilities when dealing with them:

- You have the right to be present during the inspection. This allows you to observe the adjuster’s assessment and ensure that all damage is documented.

- Be prepared to provide documentation and answer questions. The adjuster will need information to determine the cause of the damage and the cost of repairs.

- Don’t agree to anything you don’t understand. If you have any questions or concerns, ask for clarification.

- Don’t sign anything you haven’t read and understood. Take your time to review any documents before signing.

Navigating Claim Disputes

In some cases, you may disagree with the insurance company’s assessment of your claim. Here are some tips for resolving disputes:

- Document everything. Keep a record of all communication and any evidence that supports your claim.

- Negotiate with the insurance company. Try to reach a mutually agreeable settlement.

- Seek mediation or arbitration. If you can’t reach an agreement, consider involving a neutral third party.

- Consider legal counsel. If all other options fail, consult with an attorney specializing in insurance law.

Final Summary: Cheap Home Owners Insurance

Finding cheap homeowners insurance doesn’t have to be a daunting task. By understanding the key factors that influence premiums, exploring discounts and savings opportunities, and comparing quotes from multiple providers, you can secure affordable coverage that meets your specific needs and protects your valuable assets. Remember, investing in adequate insurance provides peace of mind and financial security in the event of an unexpected event. So, take the time to research, compare, and choose a policy that offers the best value for your unique situation.