Children’s health insurance is a crucial investment in your child’s well-being. It provides access to essential medical care, ensuring they receive the treatment they need to thrive. From routine checkups to serious illnesses, having health insurance gives you peace of mind knowing your child is covered.

This guide explores the various aspects of children’s health insurance, covering everything from eligibility and enrollment to the benefits and costs involved. We’ll delve into the importance of preventive care and mental health services, as well as the essential coverage for dental and vision care. By understanding the intricacies of children’s health insurance, you can make informed decisions to secure your child’s health and future.

Understanding Children’s Health Insurance

Children’s health insurance is crucial for ensuring their well-being and providing them with access to essential medical care. It safeguards them from unexpected medical expenses and allows them to receive timely and appropriate medical attention when needed.

Children’s health insurance is crucial for their well-being, providing access to essential medical care and peace of mind for parents. When choosing a provider, consider the reputation and reliability of the company, like security first insurance , which is known for its comprehensive coverage and commitment to customer satisfaction.

With a strong health insurance plan in place, you can ensure your children receive the best possible care and protection throughout their childhood.

Types of Children’s Health Insurance Plans

There are several types of children’s health insurance plans available, each offering different coverage and benefits. Understanding these options can help you choose the plan that best meets your child’s needs and your family’s budget.

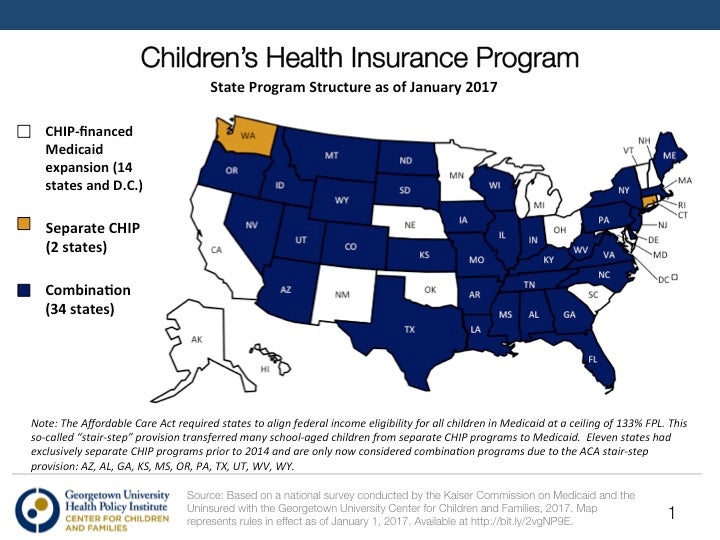

- State Children’s Health Insurance Program (SCHIP): This government-funded program provides affordable health insurance to children in families that may not qualify for Medicaid but still struggle to afford private insurance. SCHIP is available in all 50 states, the District of Columbia, and U.S. territories.

- Medicaid: This federal-state program provides health insurance to low-income individuals and families, including children. Eligibility requirements vary by state, but generally, children in families with incomes below a certain level qualify for Medicaid.

- Private Health Insurance: Many private health insurance companies offer plans that cover children. These plans can be purchased through employers, individually, or through the Health Insurance Marketplace. Private insurance plans typically offer a wider range of coverage options than government-funded programs, but they can also be more expensive.

Eligibility and Enrollment: Children’s Health Insurance

This section provides information on the eligibility requirements for various children’s health insurance programs and Artikels the enrollment process. Understanding these aspects is crucial for families seeking health coverage for their children.

Eligibility Criteria

Eligibility criteria for children’s health insurance programs vary depending on the specific program and the state. However, common factors considered include:

- Age: Most programs cover children up to a certain age, typically 18 or 19 years old.

- Residency: Children must reside in the state where they are applying for coverage.

- Citizenship or Immigration Status: Most programs require children to be U.S. citizens or legal residents.

- Income: Many programs have income limits, meaning a family’s income must fall below a certain threshold to qualify.

- Other Factors: Some programs may consider additional factors, such as family size, disability status, or foster care placement.

Enrollment Process

The enrollment process for children’s health insurance typically involves the following steps:

- Gather Necessary Information: Collect information such as the child’s birth certificate, Social Security number, proof of residency, and income documentation.

- Contact the State’s Health Insurance Program: Each state has a dedicated program for children’s health insurance. You can find contact information for your state’s program online or by contacting your local health department.

- Complete an Application: Submit an application form, which may be available online, by mail, or through a local office.

- Provide Documentation: Provide supporting documentation to verify the information provided in the application.

- Review and Approval: The program will review your application and determine your eligibility.

- Enroll in Coverage: Once approved, you will be enrolled in the health insurance plan.

Coverage and Benefits

Children’s health insurance plans provide essential coverage to help your child stay healthy and well. They cover a wide range of medical services, from routine checkups to serious illnesses. These plans are designed to ensure that children have access to the care they need, when they need it.

Essential Coverage

Children’s health insurance plans typically cover a wide range of essential medical services. These services are designed to ensure that children have access to the care they need to stay healthy and well.

- Preventive Care: This includes routine checkups, immunizations, and screenings for common childhood illnesses. Preventive care is essential for catching health problems early and preventing them from becoming more serious.

- Doctor’s Visits: Children’s health insurance plans cover visits to a primary care physician for routine checkups, sick visits, and other health concerns.

- Hospitalization: These plans cover hospital stays for illnesses or injuries, including inpatient care, surgery, and other related services.

- Prescription Drugs: Children’s health insurance plans cover a wide range of prescription medications that are necessary for treating illnesses and managing chronic conditions.

- Mental Health Services: These plans often include coverage for mental health services, such as counseling, therapy, and medication.

- Dental Care: Some children’s health insurance plans also offer coverage for dental care, including checkups, cleanings, and fillings.

- Vision Care: Similar to dental care, some plans offer coverage for vision care, including eye exams and glasses.

Benefits of Children’s Health Insurance

Children’s health insurance plans offer a variety of benefits that can help families save money and ensure their children receive the care they need.

- Financial Assistance: Children’s health insurance plans are often subsidized by the government, making them more affordable for families with low incomes.

- Peace of Mind: Knowing that your child has access to quality healthcare can provide peace of mind and reduce stress for parents.

- Early Detection and Prevention: Regular checkups and screenings can help identify health problems early, when they are easier to treat.

- Improved Health Outcomes: Children with health insurance are more likely to receive necessary medical care, which can lead to improved health outcomes.

Types of Coverage

Different children’s health insurance plans offer varying levels of coverage. Some plans may be more comprehensive than others, while some may have specific limitations or exclusions. It’s important to carefully compare plans to find one that best meets your family’s needs.

- State-Based Programs: Many states have their own children’s health insurance programs, such as CHIP (Children’s Health Insurance Program). These programs typically offer more comprehensive coverage than private insurance plans, but they may have income eligibility requirements.

- Private Insurance: Private health insurance plans can also provide coverage for children. These plans may offer a wider range of options, but they can also be more expensive.

- Employer-Sponsored Plans: Many employers offer health insurance plans to their employees, which may include coverage for children. These plans can be a good option for families who are already covered by their employer’s plan.

Cost and Affordability

The cost of children’s health insurance can vary depending on several factors, including the child’s age, location, and the type of coverage chosen. However, there are many resources and financial assistance programs available to help families afford health insurance for their children.

Financial Assistance Programs

There are various financial assistance programs available to help families pay for children’s health insurance. These programs can help reduce the cost of premiums or provide subsidies to make coverage more affordable.

- The Children’s Health Insurance Program (CHIP): CHIP is a federal and state partnership that provides health insurance to children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

- Medicaid: Medicaid is a federal and state program that provides health insurance to low-income individuals and families, including children.

- Premium Tax Credits: The Affordable Care Act (ACA) offers premium tax credits to help families afford health insurance purchased through the Health Insurance Marketplace.

- Cost-Sharing Reductions: The ACA also offers cost-sharing reductions to help families with lower incomes pay for out-of-pocket costs like deductibles and copayments.

Cost Variations

The cost of children’s health insurance can vary significantly depending on several factors, including:

- Age: Younger children typically cost less to insure than older children.

- Location: The cost of health insurance can vary by state and even by region within a state.

- Coverage: The level of coverage chosen can also affect the cost of insurance. More comprehensive plans with higher coverage limits will typically cost more than basic plans.

| Plan Type | Age | Location | Monthly Premium |

|---|---|---|---|

| Basic Plan | 5 years old | Texas | $50 |

| Comprehensive Plan | 17 years old | California | $150 |

| Basic Plan | 10 years old | New York | $75 |

Importance of Preventive Care

Preventive care plays a crucial role in keeping children healthy and thriving. It involves regular checkups and screenings that help identify potential health issues early on, allowing for timely interventions and minimizing the risk of complications.

Essential Preventive Care Services

Children’s health insurance typically covers a wide range of preventive care services that are essential for maintaining good health. These services aim to detect potential problems early and prevent them from becoming more serious.

| Service | Description |

|---|---|

| Well-Child Visits | Regular checkups to monitor growth and development, provide immunizations, and address any health concerns. |

| Immunizations | Vaccinations that protect children from serious diseases like measles, mumps, rubella, and polio. |

| Dental Checkups | Regular dental examinations and cleanings to prevent cavities and maintain oral health. |

| Vision Screenings | Checks for vision problems that can affect a child’s learning and development. |

| Hearing Screenings | Tests for hearing loss, which can impact speech and language development. |

| Lead Screening | Blood tests to check for lead poisoning, which can damage a child’s brain and nervous system. |

Benefits of Early Detection and Treatment

Early detection and treatment of health issues through preventive care can significantly improve a child’s health outcomes. By identifying problems before they become severe, preventive care can:

* Reduce the risk of serious complications.

* Prevent long-term health problems.

* Minimize the need for expensive and invasive treatments.

* Improve a child’s overall well-being.

* Enhance a child’s quality of life.

“Preventive care is the best way to keep children healthy and thriving. It helps identify potential problems early on, allowing for timely interventions and minimizing the risk of complications.”

Mental Health and Well-being

Taking care of your child’s mental health is just as important as taking care of their physical health. Children’s health insurance plans often cover mental health services, ensuring that your child can access the support they need to thrive.

Mental Health Services Covered

Mental health services covered by children’s health insurance plans can vary depending on the specific plan. However, many plans cover a wide range of services, including:

- Therapy and counseling

- Psychiatric evaluations

- Medication management

- Crisis intervention

- Inpatient and outpatient treatment

Importance of Mental Health Care for Children

Mental health care is essential for children’s overall well-being. It helps children develop healthy coping mechanisms, manage stress, and build strong relationships. Early intervention can prevent more serious mental health problems from developing later in life.

Mental Health Resources for Children and Families

There are many resources available to children and families who are struggling with mental health challenges. Here are a few examples:

- National Alliance on Mental Illness (NAMI): NAMI provides support groups, educational resources, and advocacy for people with mental illness and their families.

- The Jed Foundation: The Jed Foundation focuses on preventing suicide and promoting mental health among teens and young adults.

- Child Mind Institute: The Child Mind Institute offers information, resources, and treatment for children with mental health disorders.

Finding the Right Plan

Finding the right children’s health insurance plan can feel overwhelming, but it doesn’t have to be. By taking the time to understand your options and compare plans, you can find the best coverage for your child’s needs and your budget.

Factors to Consider When Selecting a Plan

Before you start comparing plans, it’s helpful to have a checklist of factors to consider. These will help you narrow down your choices and find a plan that meets your specific needs.

- Your child’s health needs: Does your child have any pre-existing conditions or require specialized care? Consider the plan’s coverage for these needs.

- Your budget: How much can you afford to pay for health insurance? Look at monthly premiums, deductibles, and copayments.

- The plan’s network: Make sure the plan includes doctors, hospitals, and other healthcare providers in your area.

- The plan’s coverage: Review the plan’s benefits, such as preventive care, prescription drug coverage, and mental health services.

- Customer service: Look for a plan with a good reputation for customer service. You want to be able to easily get in touch with the insurance company if you have questions or need help.

Comparing Plans and Coverage Options

Once you have a list of potential plans, it’s important to compare them side-by-side. This will help you see the differences in coverage, costs, and benefits.

- Use a comparison tool: Many websites offer comparison tools that can help you quickly and easily compare plans.

- Read the plan documents: Don’t just rely on summaries. Take the time to read the plan documents carefully so you understand exactly what’s covered and what’s not.

- Ask questions: If you have any questions about a plan, don’t hesitate to contact the insurance company.

Common Health Issues in Children

Children are prone to various health issues, some common and some more specific. Understanding these issues and the coverage provided by children’s health insurance is crucial for parents and guardians.

Common Childhood Illnesses, Children’s health insurance

Children’s health insurance typically covers common childhood illnesses, such as:

- Ear Infections: Frequent ear infections are common in young children due to their developing immune systems and Eustachian tube structure. Children’s health insurance covers doctor visits, diagnostic tests, and treatments like antibiotics.

- Respiratory Infections: Children are susceptible to colds, flu, bronchitis, and pneumonia. Coverage includes doctor visits, medications, and sometimes hospitalization.

- Gastrointestinal Issues: Diarrhea, vomiting, and stomach aches are common childhood ailments. Children’s health insurance covers doctor visits, medications, and treatment for dehydration.

- Skin Conditions: Eczema, rashes, and allergies are common skin conditions in children. Coverage includes doctor visits, medications, and sometimes specialized treatment.

Vaccines

Children’s health insurance covers routine vaccinations, which are essential for preventing serious childhood diseases.

- Vaccines protect children from preventable diseases such as measles, mumps, rubella, polio, tetanus, diphtheria, and pertussis.

- Coverage includes the cost of vaccines and administration fees.

- It’s crucial to follow the recommended vaccination schedule for optimal protection.

Chronic Conditions

Children’s health insurance also covers treatment for chronic conditions, which can significantly impact a child’s well-being and development.

- Asthma: A common chronic respiratory condition characterized by inflammation and narrowing of the airways, causing wheezing, coughing, and shortness of breath. Coverage includes doctor visits, medications, and sometimes specialized therapies.

- Diabetes: A chronic metabolic disorder affecting how the body regulates blood sugar. Coverage includes doctor visits, medications, supplies like insulin, and educational programs.

- Attention-Deficit/Hyperactivity Disorder (ADHD): A neurodevelopmental disorder characterized by inattention, hyperactivity, and impulsivity. Coverage includes doctor visits, medication, and behavioral therapy.

Mental Health

Mental health issues are increasingly recognized in children, and children’s health insurance plays a vital role in supporting their well-being.

- Anxiety and Depression: Common mental health conditions in children, often stemming from stress, trauma, or family issues. Coverage includes therapy, medication, and support services.

- Behavioral Disorders: These can include conduct disorder, oppositional defiant disorder, and disruptive mood dysregulation disorder. Coverage includes therapy, medication, and family support.

- Autism Spectrum Disorder (ASD): A neurodevelopmental disorder affecting communication, social interaction, and behavior. Coverage includes therapy, educational support, and specialized services.

Resources for Children with Specific Health Conditions

Several resources can provide support and information for children with specific health conditions.

- National organizations: Organizations like the American Academy of Pediatrics (AAP) and the National Institutes of Health (NIH) offer comprehensive information, research, and resources for parents and healthcare providers.

- Support groups: Connecting with other families facing similar challenges can provide valuable support and understanding.

- Online communities: Online forums and social media groups dedicated to specific health conditions can offer a platform for sharing experiences, advice, and resources.

Resources and Support

Navigating the world of children’s health insurance can sometimes feel overwhelming. But remember, you’re not alone! There are various resources and support systems available to help families like yours.

This section will provide information on government agencies and organizations that can assist you with children’s health insurance. You’ll also find a list of resources that offer valuable information and guidance. Let’s explore these resources to ensure your child receives the best possible healthcare.

Government Agencies and Organizations

Government agencies and organizations play a crucial role in supporting children’s health insurance programs. They offer financial assistance, program enrollment guidance, and other essential services.

- The Centers for Medicare & Medicaid Services (CMS): This federal agency administers the Children’s Health Insurance Program (CHIP) and Medicaid. CMS provides information about these programs, eligibility requirements, and enrollment procedures. You can visit their website or contact them directly for assistance.

- State Health Insurance Assistance Programs (SHIP): Each state has a SHIP program that offers free, unbiased counseling and assistance to individuals seeking health insurance coverage. SHIP counselors can help you understand your options, compare plans, and navigate the enrollment process.

- Your State’s CHIP Office: Every state has a dedicated CHIP office that handles program administration and outreach. You can find contact information for your state’s CHIP office on the CMS website.

Resources for Families

In addition to government agencies, several non-profit organizations and online resources provide valuable information and support for families seeking children’s health insurance.

- The National Association of Children’s Hospitals and Related Institutions (NACHRI): This organization advocates for children’s health and provides resources for families, including information about CHIP and Medicaid.

- The National Health Law Program (NHeLP): This non-profit organization focuses on improving access to healthcare for low-income and underserved populations. They offer resources and legal assistance related to health insurance.

- HealthCare.gov: This website is the official marketplace for health insurance plans, including CHIP and Medicaid. You can use this platform to compare plans, check eligibility, and enroll in coverage.

Contact Information

Below is a table outlining contact information for some of the key organizations and support services mentioned above.

| Organization | Website | Phone Number |

|---|---|---|

| Centers for Medicare & Medicaid Services (CMS) | www.cms.gov | 1-800-MEDICARE (1-800-633-4227) |

| National Association of Children’s Hospitals and Related Institutions (NACHRI) | www.nachri.org | (202) 785-0155 |

| National Health Law Program (NHeLP) | www.healthlaw.org | (202) 662-9040 |

Future Trends in Children’s Health Insurance

The landscape of children’s health insurance is constantly evolving, driven by technological advancements, shifting demographics, and evolving healthcare needs. Understanding these trends is crucial for ensuring that children continue to have access to quality, affordable healthcare.

Emerging Trends in Children’s Health Insurance

Several emerging trends are shaping the future of children’s health insurance. These trends present both challenges and opportunities for improving access to healthcare for children.

- Expansion of Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) are crucial sources of coverage for low-income children. The expansion of these programs, particularly under the Affordable Care Act, has significantly increased the number of children with health insurance. Future efforts to expand eligibility and access to these programs will likely continue, further enhancing coverage for children.

- Telehealth and Virtual Care: The increasing use of telehealth and virtual care technologies offers a convenient and cost-effective way for children to access healthcare services. Telehealth platforms can connect children with healthcare providers remotely, reducing the need for travel and facilitating access to specialists. This trend is particularly beneficial for children in rural areas or those with mobility challenges.

- Value-Based Care: The shift towards value-based care models emphasizes quality and efficiency in healthcare delivery. This approach focuses on improving health outcomes and reducing unnecessary costs. In children’s health insurance, value-based care models can encourage preventative care, early interventions, and coordinated care to optimize children’s health and well-being.

- Data Analytics and Predictive Modeling: The use of data analytics and predictive modeling is becoming increasingly prevalent in healthcare. These technologies can help identify children at risk for health issues, predict future healthcare needs, and tailor interventions to specific populations. By leveraging data, health insurers can improve care coordination, optimize resource allocation, and enhance the overall quality of care for children.

Potential Challenges and Opportunities

The emerging trends in children’s health insurance present both challenges and opportunities.

- Addressing Health Disparities: Despite progress in expanding coverage, disparities in access to healthcare persist among children. Factors such as race, ethnicity, socioeconomic status, and geographic location can influence a child’s access to quality care. Future efforts in children’s health insurance must prioritize addressing these disparities and ensuring equitable access to healthcare for all children.

- Managing Rising Healthcare Costs: Rising healthcare costs pose a significant challenge to the sustainability of children’s health insurance programs. Strategies to manage costs effectively while maintaining quality care are essential. This may involve exploring innovative payment models, promoting preventative care, and utilizing technology to streamline processes and reduce administrative burdens.

- Integrating Emerging Technologies: The integration of emerging technologies like telehealth and data analytics requires careful planning and implementation to ensure patient privacy, security, and equitable access. It’s essential to develop policies and guidelines that address the ethical and practical considerations of these technologies in children’s health insurance.

Impact on Access to Healthcare

The trends discussed above have the potential to significantly impact access to healthcare for children.

- Improved Access to Care: Expanding Medicaid and CHIP, the growing use of telehealth, and the adoption of value-based care models can all contribute to improved access to healthcare for children. These trends can help reduce barriers to care, such as distance, cost, and lack of access to specialists.

- Enhanced Care Coordination: Data analytics and predictive modeling can help improve care coordination, ensuring that children receive timely and appropriate care. By identifying children at risk for health issues, health insurers can implement targeted interventions and prevent unnecessary hospitalizations and complications.

- Focus on Preventative Care: Value-based care models encourage preventative care, which can help reduce the incidence of chronic diseases and improve overall health outcomes for children. This approach emphasizes early interventions and personalized care to address individual needs and prevent health problems from escalating.

Final Thoughts

Navigating the world of children’s health insurance can seem overwhelming, but with the right information and resources, you can make informed choices to safeguard your child’s well-being. Remember, investing in their health is an investment in their future. By understanding the benefits, costs, and available options, you can empower yourself to provide the best possible healthcare for your little ones.