Car insurance companies in New Jersey play a vital role in protecting drivers and their vehicles. With numerous options available, choosing the right company can be a daunting task. Understanding the factors that influence car insurance premiums, such as coverage options, pricing, and customer service, is crucial to finding the best value for your needs.

New Jersey’s car insurance market is diverse, offering a range of coverage options and discounts to suit different drivers’ requirements. Whether you’re a new driver, an experienced motorist, or someone with a family, it’s essential to compare quotes and policies to find the best fit for your budget and driving habits.

Car Insurance in New Jersey

Navigating the car insurance market in New Jersey can be a complex task. With numerous companies offering a wide range of policies and coverage options, it’s essential to make an informed decision to secure the right insurance for your needs and budget. Choosing the right car insurance company can significantly impact your financial well-being in the event of an accident, and can also influence the overall cost of your insurance premiums.

Factors Influencing Car Insurance Premiums in New Jersey

Several factors contribute to the determination of car insurance premiums in New Jersey. These factors are assessed by insurance companies to evaluate the risk associated with insuring a particular driver and vehicle.

- Driving Record: A clean driving record with no accidents or traffic violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Gender also plays a role, with men typically paying higher premiums than women.

- Vehicle Type and Value: The type and value of your vehicle are crucial factors. Luxury cars or high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Location: The geographic location where you reside influences your premiums. Areas with higher crime rates or accident frequencies may have higher insurance costs.

- Coverage Levels: The level of coverage you choose directly impacts your premium. Higher coverage limits, such as comprehensive and collision coverage, provide greater protection but come with higher premiums.

- Credit Score: In some states, including New Jersey, insurance companies may use your credit score as a factor in determining your premium. A good credit score is generally associated with responsible financial behavior and can lead to lower premiums.

Getting Car Insurance Quotes

Getting car insurance quotes is an essential step in finding the best coverage for your needs and budget. By comparing quotes from different insurance companies, you can ensure that you’re getting the most competitive rates and comprehensive coverage.

Getting Quotes from Different Companies

You can get car insurance quotes from various companies through several methods:

- Online: Most insurance companies have websites where you can get a quick quote by entering your personal and vehicle information. This method is often the fastest and most convenient way to compare quotes.

- By Phone: You can call insurance companies directly and speak with a representative to get a quote. This method allows you to ask questions and get personalized advice.

- In Person: You can visit an insurance agent’s office to get a quote in person. This option gives you the opportunity to discuss your needs in detail and get a personalized recommendation.

Importance of Comparing Quotes

Comparing car insurance quotes is crucial for several reasons:

- Finding the Best Rates: Different insurance companies have varying rates based on factors like your driving history, vehicle type, and location. Comparing quotes allows you to identify the most affordable options available.

- Ensuring Comprehensive Coverage: Not all insurance policies are created equal. Some companies may offer more comprehensive coverage than others, including features like roadside assistance, rental car reimbursement, or accident forgiveness. Comparing quotes helps you find the policy that best meets your needs.

- Avoiding Overpaying: By comparing quotes, you can avoid overpaying for your car insurance. You can identify companies that offer competitive rates without compromising on coverage.

Tips for Saving Money on Car Insurance

Finding affordable car insurance in New Jersey can be a challenge, but there are several steps you can take to reduce your premiums. By understanding the factors that influence your insurance costs and taking advantage of available discounts, you can significantly lower your monthly payments.

Maintain a Good Driving Record

Maintaining a clean driving record is crucial for securing lower insurance premiums. Insurance companies view drivers with a history of accidents, traffic violations, or DUI convictions as higher risk. Here are some tips for keeping your driving record spotless:

- Drive Safely and Defensively: This means following traffic laws, being aware of your surroundings, and anticipating potential hazards. Defensive driving courses can provide valuable insights into safe driving practices.

- Avoid Speeding and Distracted Driving: Speeding tickets and distracted driving citations can significantly increase your insurance premiums. Focus on the road and obey speed limits to avoid these costly violations.

- Maintain a Clean Driving Record: Avoid any incidents that could lead to accidents or traffic violations. This includes staying alert, being courteous to other drivers, and avoiding risky driving behaviors.

Take a Defensive Driving Course

Completing a defensive driving course can often earn you a discount on your car insurance premiums. These courses teach you valuable techniques for avoiding accidents and staying safe on the road. Many insurance companies offer discounts to drivers who have completed an approved defensive driving course.

Bundle Insurance Policies, Car insurance companies in new jersey

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Many insurance companies offer discounts for bundling multiple policies together.

Choose a Higher Deductible

A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lower your monthly premiums. Consider the potential trade-offs and choose a deductible that balances affordability with your risk tolerance.

Shop Around for Quotes

Comparing quotes from different insurance companies is essential to finding the best rates. Online comparison websites and insurance brokers can help you quickly and easily obtain quotes from multiple providers.

Consider a Less Expensive Car

The type of car you drive can significantly impact your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are often more expensive to insure due to their higher repair costs and increased risk of accidents. If you’re looking to lower your insurance premiums, consider a less expensive and safer car model.

Ask About Available Discounts

Insurance companies offer a variety of discounts to their policyholders. These discounts can include:

- Good Student Discount: This discount is available to students with good grades.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record.

- Multi-Car Discount: This discount is available to policyholders who insure multiple vehicles with the same company.

- Anti-theft Device Discount: This discount is offered to drivers who have installed anti-theft devices in their vehicles.

- Loyalty Discount: This discount is often offered to long-term policyholders.

- Payment Discount: This discount may be available if you pay your premiums in full or set up automatic payments.

Pay Your Premiums on Time

Late payments can result in penalties and increased premiums. Set up automatic payments or reminders to ensure that your premiums are paid on time.

Understanding Your Car Insurance Policy

Your car insurance policy is a legally binding contract between you and your insurance company. It Artikels the terms and conditions of your coverage, including what is covered, what is not covered, and how much you will pay for your coverage. Understanding your policy is essential for ensuring you have the right coverage and that you can file a claim if needed.

Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a covered loss. Each type of coverage has its own limit. For example, your liability coverage limits how much your insurer will pay for bodily injury or property damage you cause to others. Your collision coverage limits how much your insurer will pay to repair or replace your vehicle if you are involved in an accident.

- Liability coverage: This coverage protects you from financial responsibility if you cause an accident that injures another person or damages their property. Liability coverage typically has two limits: a per-person limit and a per-accident limit. The per-person limit is the maximum amount your insurer will pay for injuries to one person in an accident. The per-accident limit is the maximum amount your insurer will pay for all injuries and property damage in a single accident.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault. Collision coverage typically has a deductible, which is the amount you pay out of pocket before your insurance company starts paying for repairs.

- Comprehensive coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than a collision, such as theft, vandalism, or a natural disaster. Comprehensive coverage typically has a deductible.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Medical payments coverage: This coverage pays for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

Deductibles

A deductible is the amount you pay out of pocket before your insurance company starts paying for a covered loss. For example, if you have a $500 deductible for collision coverage and you are involved in an accident that causes $2,000 in damage to your vehicle, you will pay $500 and your insurance company will pay the remaining $1,500.

Deductibles are designed to reduce the cost of your insurance premiums. The higher your deductible, the lower your premiums will be. However, you will have to pay more out of pocket if you file a claim.

Exclusions

Exclusions are specific situations or events that are not covered by your insurance policy. For example, your policy may exclude coverage for damages caused by wear and tear, mechanical breakdowns, or driving under the influence of alcohol or drugs.

Reading and Understanding Your Policy

It is important to carefully read and understand your car insurance policy. Here are some tips:

- Read the entire policy: Don’t just skim through it. Take the time to read every page, including the fine print.

- Ask questions: If you don’t understand something, ask your insurance agent or broker for clarification.

- Keep a copy of your policy: Keep a copy of your policy in a safe place, such as a fireproof safe or a safe deposit box.

- Review your policy annually: Your needs may change over time, so it is important to review your policy annually to ensure you have the right coverage.

Resources for Car Insurance Information

Navigating the world of car insurance in New Jersey can feel overwhelming, but thankfully, several resources are available to help you make informed decisions and protect your interests.

New Jersey Department of Banking and Insurance

The New Jersey Department of Banking and Insurance (DOBI) is your primary source for car insurance information in the state. They oversee the insurance industry, ensuring fair practices and consumer protection. You can access a wealth of information on their website, including:

- Consumer guides and publications: These resources provide comprehensive information on car insurance, including policy types, coverage options, and how to file claims.

- Insurance company licensing and financial information: DOBI maintains a database of licensed insurance companies operating in New Jersey, allowing you to verify their legitimacy and financial stability.

- Consumer complaint resolution: If you experience issues with your car insurance company, DOBI offers a formal complaint resolution process to help you resolve disputes.

- Information on insurance fraud: DOBI provides resources to help you understand insurance fraud, identify potential scams, and report suspicious activity.

Consumer Protection and Dispute Resolution

- New Jersey Division of Consumer Affairs: The Division of Consumer Affairs offers a range of consumer protection services, including information on your rights as a car insurance policyholder and guidance on resolving disputes with insurance companies.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to protect consumers and promote fair insurance practices. Their website offers valuable information on car insurance, including consumer guides, complaint resolution resources, and state-specific regulations.

- Better Business Bureau (BBB): The BBB is a non-profit organization that accredits businesses based on their ethical practices and customer service. You can use their website to research car insurance companies and see their customer reviews and ratings.

Conclusion

Finding the right car insurance company in New Jersey is essential for protecting yourself financially in case of an accident. By carefully comparing quotes, understanding your policy coverage, and taking advantage of discounts, you can ensure you have the right coverage at a price you can afford.

Key Takeaways

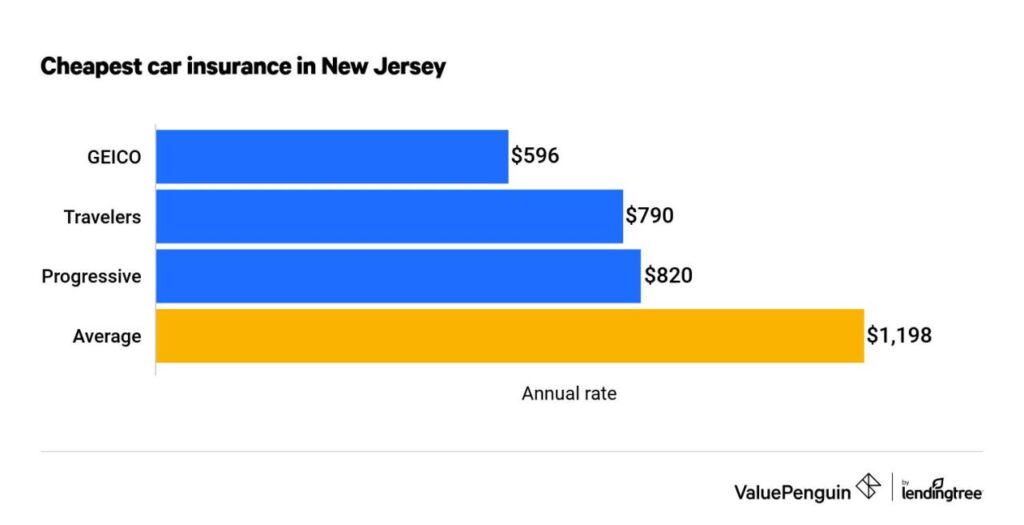

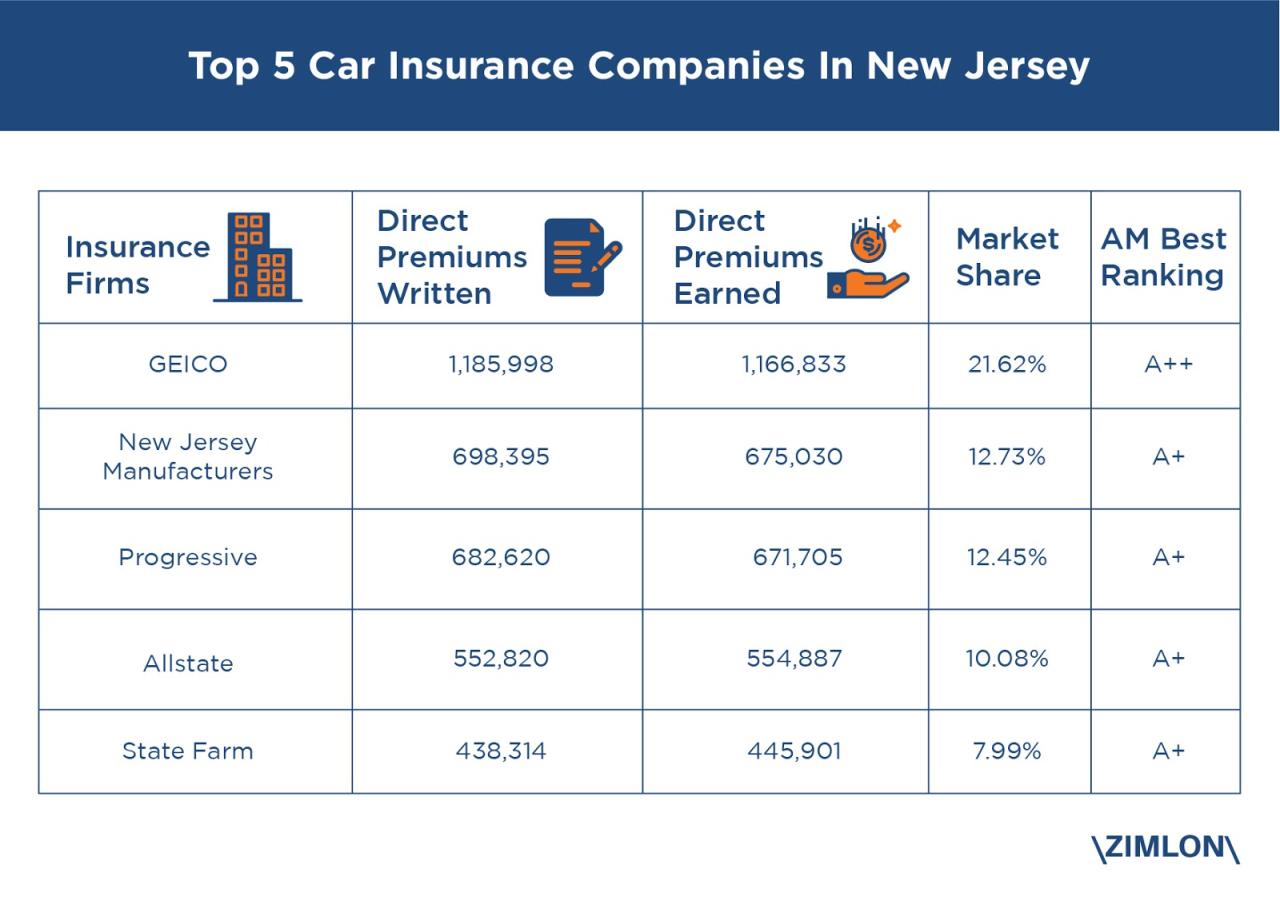

- Compare quotes from multiple companies to find the best rates and coverage options.

- Understand your policy coverage to ensure you have the right protection for your needs.

- Take advantage of discounts to lower your premiums.

- Consider factors like your driving history, vehicle type, and location when choosing a company.

- Review your policy periodically to ensure it still meets your needs.

Conclusive Thoughts: Car Insurance Companies In New Jersey

Navigating the car insurance landscape in New Jersey can be challenging, but with careful research and consideration, drivers can find a policy that provides adequate protection and financial security. Remember to compare quotes, understand your policy’s terms and conditions, and explore available discounts to optimize your car insurance experience.