Car insurance for New York is more than just a legal requirement; it’s a crucial aspect of responsible driving in the Empire State. Navigating the complex world of insurance policies, coverage options, and regulations can feel overwhelming, but this guide will equip you with the knowledge to make informed decisions and secure the best possible protection for yourself and your vehicle.

From understanding the mandatory coverage types and factors affecting premiums to exploring different insurance options and navigating the claims process, this guide provides a comprehensive overview of car insurance in New York. We’ll delve into the unique aspects of New York’s no-fault insurance system, address specific needs for different drivers, and shed light on the legal implications of driving under the influence.

Understanding New York’s SR-22 Requirement

An SR-22 is a form that proves you have the minimum amount of liability insurance required by the state of New York. It’s a document that your insurance company files with the New York Department of Motor Vehicles (DMV) to show that you meet the financial responsibility requirements.

The Purpose of an SR-22

An SR-22 serves as a guarantee to the state that you’re financially responsible for any damages you may cause in an accident. It’s essentially a promise from your insurance company to the DMV that they will cover any potential claims against you, up to the limits of your insurance policy.

Situations Requiring an SR-22

You’ll need to file an SR-22 in New York if you’ve been convicted of certain driving offenses, including:

- Driving without insurance

- Driving with a suspended license

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Hit-and-run accidents

- Multiple traffic violations

The specific offenses that trigger an SR-22 requirement and the duration of the requirement can vary depending on the severity of the offense and your driving history.

Obtaining and Maintaining an SR-22

To obtain an SR-22, you’ll need to contact an insurance company that offers this service. The insurance company will file the form with the DMV on your behalf. Once you have an SR-22, it’s crucial to maintain continuous insurance coverage throughout the period it’s required. If your insurance policy lapses, your SR-22 will be canceled, and you may face additional penalties.

Impact on Insurance Premiums

An SR-22 typically results in higher insurance premiums. This is because you’re considered a higher risk driver due to your past driving offenses. The increase in your premium will depend on factors such as the severity of your offense, your driving history, and the insurance company you choose.

Addressing Specific Needs for Car Insurance in New York

New York’s diverse population and driving landscape present unique insurance needs. Whether you’re a high-risk driver, a young motorist, or a senior citizen, understanding the available options is crucial. This section explores specialized coverage and tips for navigating the insurance process.

Insurance Coverage Options for Specific Driver Groups

The cost and availability of car insurance can vary depending on your driving history, age, and vehicle. Here’s a breakdown of coverage options for high-risk drivers, young drivers, and seniors:

| Driver Group | Coverage Options | Considerations |

|---|---|---|

| High-Risk Drivers | – High-risk insurance providers – SR-22 filing – Defensive driving courses – Higher deductibles |

– May have higher premiums – Limited coverage options – Stricter eligibility criteria |

| Young Drivers | – Usage-based insurance programs – Good student discounts – Parental coverage options |

– Higher premiums due to inexperience – Potential for lower premiums with good driving records – Limited driving privileges |

| Seniors | – Discounts for safe driving records – Specialized coverage for seniors – Driver safety programs |

– May face higher premiums due to age – Potential for discounts with good driving records – May need to adjust driving habits |

Tips for Obtaining Insurance for Unique Vehicles

New York’s car insurance market caters to various vehicle types. Here are some tips for obtaining insurance for motorcycles, classic cars, and commercial vehicles:

– Motorcycles: Choose a motorcycle-specific insurance policy that provides coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Consider adding custom parts and accessories to your policy.

– Classic Cars: Opt for a classic car insurance policy that considers the vehicle’s value, usage, and storage. Ensure coverage includes agreed value, which guarantees payment based on the car’s appraised value in case of a total loss.

– Commercial Vehicles: Choose a commercial auto insurance policy that provides liability, collision, comprehensive, and cargo coverage. Consider specialized endorsements for specific business needs, such as towing and roadside assistance.

Specialized Insurance Coverage

Beyond standard car insurance, several specialized coverages can enhance your protection.

– Gap Insurance: This coverage bridges the gap between the actual value of your car and the amount your insurance policy pays out in case of a total loss. It’s particularly beneficial for newer vehicles with high loan balances.

– Rental Car Reimbursement: This coverage reimburses you for rental car expenses if your car is damaged or stolen and you need a temporary replacement.

Role of Insurance Agents

Insurance agents play a crucial role in addressing your specific insurance needs. They can:

– Evaluate your situation: Analyze your driving history, vehicle type, and coverage requirements to recommend the best policy options.

– Provide personalized advice: Explain different coverage options, explain policy terms, and answer any questions you may have.

– Negotiate rates: Work with insurance companies to secure the most competitive premiums for your needs.

– Assist with claims: Help you file claims and navigate the process, ensuring a smooth and efficient experience.

New York’s Laws Regarding Driving Under the Influence (DUI)

Driving under the influence (DUI) of alcohol or drugs in New York is a serious offense with severe legal consequences. The state has strict laws in place to deter drunk driving and protect the safety of all road users.

Penalties and Consequences of a DUI Conviction

A DUI conviction in New York can result in a range of penalties, including fines, license suspension, jail time, and even mandatory installation of an ignition interlock device. The severity of the penalties depends on the driver’s blood alcohol content (BAC) and the circumstances surrounding the offense.

- First Offense: A first-time DUI conviction in New York can result in a fine of up to $1,000, a license suspension of 90 days to 1 year, and up to 1 year in jail. The driver may also be required to complete a mandatory alcohol treatment program and install an ignition interlock device in their vehicle.

- Subsequent Offenses: Subsequent DUI convictions carry increasingly harsher penalties. For example, a second DUI offense within 10 years can result in a fine of up to $2,000, a license suspension of 1 to 3 years, and up to 1 year in jail. The driver may also be required to install an ignition interlock device for a longer period.

- Aggravated DUI: If the driver’s BAC is 0.18% or higher, or if the DUI results in an accident involving injury or death, the charges can be elevated to aggravated DUI, leading to more severe penalties.

Impact of a DUI Conviction on Car Insurance Premiums

A DUI conviction can have a significant impact on car insurance premiums in New York. Insurance companies consider DUI convictions to be high-risk factors and will often increase premiums significantly. The increase in premiums can vary depending on the severity of the DUI offense, the driver’s insurance history, and the insurance company’s policies. In some cases, the insurance company may even refuse to renew the driver’s policy.

Availability of DUI Insurance Programs, Car insurance for new york

While DUI convictions can make it difficult to find affordable car insurance, some insurance companies offer specialized DUI insurance programs. These programs are designed for drivers with DUI convictions and may provide more affordable rates than standard car insurance policies. However, these programs typically have higher premiums and may require the driver to meet specific requirements, such as completing an alcohol treatment program or installing an ignition interlock device.

Tips for Preventing DUI Incidents and Ensuring Safe Driving Practices

Preventing DUI incidents is essential for ensuring safe driving practices. Here are some tips:

- Plan Ahead: If you plan to drink, designate a sober driver or arrange for a ride home. Avoid driving if you have consumed alcohol or drugs.

- Use Public Transportation: Consider using public transportation, ride-sharing services, or taxis to get home safely.

- Avoid Drinking and Driving: It’s never safe to drink and drive. Even one drink can impair your judgment and reaction time.

- Be Aware of Your Limits: Know your limits and don’t drink more than you can handle. If you’re unsure, it’s always best to err on the side of caution.

- Don’t Drive Under the Influence of Drugs: Driving under the influence of drugs is just as dangerous as driving under the influence of alcohol. Avoid driving if you have taken any medication or drugs that could impair your driving abilities.

Navigating the Insurance Industry in New York

Navigating the insurance industry in New York can be challenging, especially when you’re dealing with a complex issue or a dispute with your insurer. However, understanding your rights and knowing where to turn for help can make the process much smoother.

Understanding Your Insurance Policy and Rights

It’s crucial to thoroughly understand your insurance policy, including its coverage limits, exclusions, and any specific requirements. This knowledge will help you avoid surprises and ensure you’re receiving the benefits you’re entitled to. The New York State Department of Financial Services (DFS) offers valuable resources and information on insurance policies and consumer rights. They provide guidance on understanding your policy, filing complaints, and resolving disputes with your insurer.

Resources and Organizations for Insurance Assistance

Several organizations and resources are available to assist you with insurance-related issues in New York. These resources can provide guidance, support, and even legal representation if needed.

- New York State Department of Financial Services (DFS): The DFS is the primary regulator of the insurance industry in New York. They handle consumer complaints, investigate insurance fraud, and educate consumers about their rights. You can reach them through their website or by phone at 1-800-342-3736.

- New York State Insurance Department (NYID): The NYID is a division of the DFS responsible for regulating the insurance industry. They offer information on insurance policies, consumer rights, and how to file complaints.

- Consumer Federation of America (CFA): The CFA is a national non-profit organization that advocates for consumer rights, including insurance. They provide information and resources on insurance issues and can assist with complaints against insurers.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that represents insurance regulators from all 50 states. They provide information on insurance issues, consumer rights, and how to file complaints.

Filing Complaints Against Insurance Companies

If you have a dispute with your insurance company, you can file a complaint with the New York State Department of Financial Services (DFS). The DFS has a dedicated consumer complaint process that allows you to formally express your concerns. The complaint process involves providing detailed information about the issue, including dates, names, and supporting documentation. The DFS will then investigate the complaint and attempt to resolve it between you and the insurance company. If the DFS is unable to resolve the dispute, they can refer it to the New York State Insurance Department (NYID) for further investigation.

Seeking Legal Counsel for Insurance Disputes

If your insurance dispute is complex or involves significant financial implications, seeking legal counsel is advisable. An experienced insurance attorney can help you understand your rights, negotiate with the insurance company, and represent you in court if necessary.

“It’s important to note that legal representation is not always required for insurance disputes. However, if you’re facing a complex issue, have difficulty communicating with the insurance company, or believe your rights have been violated, consulting an attorney can be beneficial.”

Closure: Car Insurance For New York

By understanding the nuances of car insurance in New York, you can confidently navigate the insurance landscape and make informed choices that align with your specific needs and budget. Remember to compare quotes from multiple insurers, explore available discounts, and seek professional advice when necessary. With the right knowledge and strategies, you can secure the peace of mind that comes with adequate and affordable car insurance.

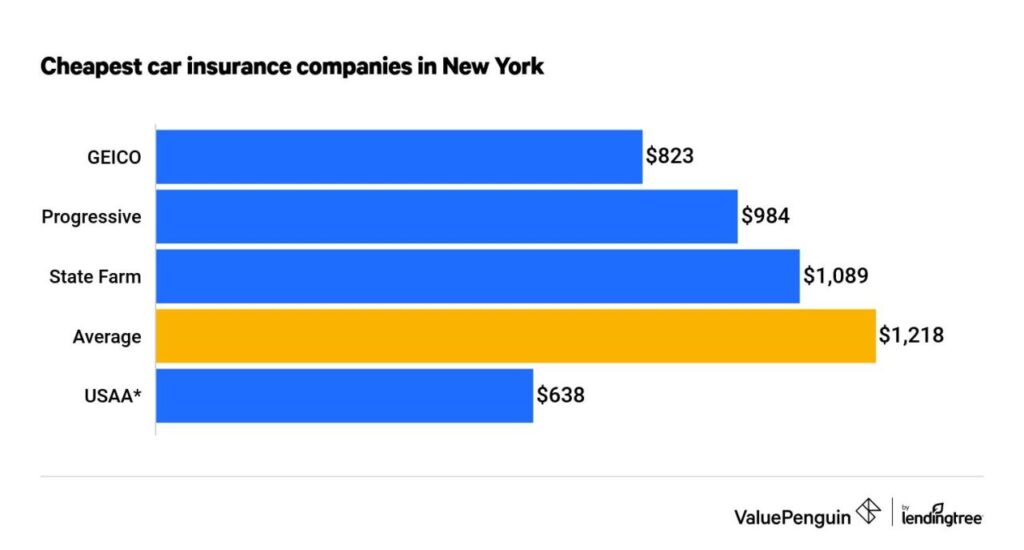

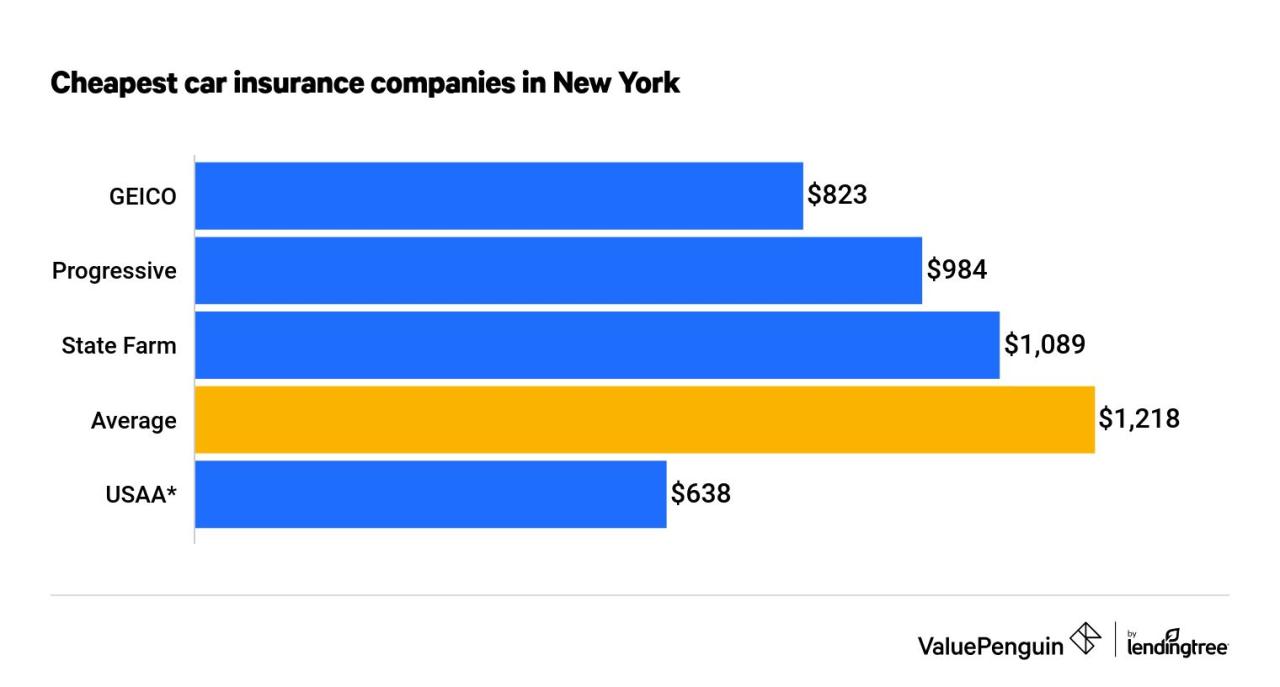

Navigating the world of car insurance in New York can be a bit overwhelming, with numerous factors to consider like your driving history and the type of coverage you need. However, it’s good to know that finding the right insurer is possible.

For example, if you’re moving to Georgia, you might want to check out car insurance companies Georgia offers, as rates and coverage options can vary significantly between states. Ultimately, taking the time to research and compare quotes in New York will help you find the best car insurance for your individual needs and budget.