Chip health insurance is a revolutionary approach to healthcare that leverages technology to provide affordable and accessible coverage. This innovative insurance model utilizes microchips implanted under the skin to track health data, enabling personalized plans and proactive care.

Chip health insurance targets individuals seeking a modern and cost-effective alternative to traditional health insurance. By integrating cutting-edge technology with healthcare, it aims to optimize individual health outcomes while reducing the financial burden associated with healthcare costs.

What is Chip Health Insurance?

Chip Health Insurance is a type of health insurance plan designed to provide affordable and accessible coverage to individuals and families. It is often considered a good option for those who are looking for a more affordable alternative to traditional health insurance plans.

Target Audience

Chip Health Insurance is typically targeted towards individuals and families who:

- Are looking for affordable health insurance coverage.

- Are self-employed or work for small businesses.

- Are healthy and do not require extensive medical care.

- Are on a tight budget.

Benefits and Coverage

Chip Health Insurance plans typically offer a range of benefits and coverage options, including:

- Hospitalization Coverage: This covers the costs associated with inpatient care, including room and board, nursing care, and medical supplies.

- Surgical Coverage: This covers the costs of surgical procedures, including the surgeon’s fees, anesthesia, and operating room costs.

- Outpatient Coverage: This covers the costs of medical services received outside of a hospital setting, such as doctor’s visits, diagnostic tests, and physical therapy.

- Prescription Drug Coverage: This covers the costs of prescription medications.

- Preventive Care Coverage: This covers the costs of routine medical checkups, screenings, and vaccinations.

Key Features

Chip Health Insurance plans often feature the following key features:

- High Deductibles: Chip plans typically have high deductibles, which means you’ll need to pay a significant amount out of pocket before the insurance coverage kicks in.

- Lower Premiums: In exchange for the high deductibles, Chip plans typically have lower premiums than traditional health insurance plans.

- Limited Coverage: Chip plans often have limited coverage compared to traditional plans, which means they may not cover all medical expenses.

Examples

Here are some examples of real-life cases where Chip Health Insurance might be a suitable option:

- A young, healthy individual who is self-employed and does not require extensive medical care might find a Chip plan to be a more affordable option than a traditional plan.

- A family with a low income might choose a Chip plan to help them manage their healthcare costs, even though it may have a high deductible.

Key Features of Chip Health Insurance

Chip Health Insurance stands out from traditional health insurance providers by offering a unique blend of digital convenience, personalized experiences, and innovative coverage options. These features cater to the needs of a modern, tech-savvy generation seeking greater control and transparency in their healthcare.

Transparent Pricing and Coverage

Chip Health Insurance prioritizes transparency by providing clear and concise information about their plans and coverage. This means no hidden fees or complex terms and conditions. You can easily understand what you’re paying for and what’s covered.

- Clear Plan Descriptions: Chip provides detailed descriptions of each plan, outlining coverage limits, deductibles, co-pays, and other essential details. This allows you to compare plans effectively and choose the one that best suits your needs and budget.

- Online Price Calculators: Chip offers user-friendly online tools that allow you to calculate your estimated monthly premiums based on your personal details, such as age, location, and health status. This empowers you to make informed decisions about your coverage.

- Real-Time Claims Tracking: Chip’s digital platform allows you to track the status of your claims in real-time. You can view claim details, upload supporting documents, and communicate with Chip’s customer support team directly through the app.

Personalized Healthcare Experience

Chip Health Insurance goes beyond traditional insurance by offering a personalized healthcare experience that focuses on individual needs and preferences.

- Virtual Care: Chip integrates telehealth services into its plans, providing convenient access to virtual consultations with doctors and specialists. This eliminates the need for in-person visits for non-urgent healthcare needs, saving you time and money.

- Health and Wellness Resources: Chip provides access to a range of health and wellness resources, including educational materials, fitness trackers, and mental health support. This empowers you to take proactive steps towards maintaining your well-being.

- Data-Driven Insights: Chip leverages data analytics to provide personalized insights into your health and coverage. This allows you to identify potential health risks, make informed decisions about your healthcare, and optimize your plan based on your specific needs.

Innovative Coverage Options

Chip Health Insurance offers innovative coverage options that address the evolving needs of individuals and families.

- Telemedicine Coverage: Chip covers virtual consultations with doctors and specialists, allowing you to access healthcare from the comfort of your home. This is particularly beneficial for individuals with busy schedules or those living in remote areas.

- Mental Health Coverage: Chip recognizes the importance of mental health and offers comprehensive coverage for therapy sessions and counseling services. This helps address the growing need for mental health support and promotes overall well-being.

- Preventive Care Coverage: Chip encourages preventive care by offering coverage for routine checkups, screenings, and vaccinations. This helps detect health issues early and promotes proactive healthcare management.

Technology-Driven Platform

Chip Health Insurance leverages technology to enhance the customer experience and streamline processes.

- Mobile App: Chip offers a user-friendly mobile app that allows you to manage your health insurance, access your policy details, submit claims, and communicate with customer support. This provides a convenient and accessible platform for all your insurance needs.

- AI-Powered Chatbots: Chip utilizes AI-powered chatbots to provide instant support and answer common questions. This helps reduce wait times and provides 24/7 access to information and assistance.

- Data Security: Chip prioritizes data security and employs robust measures to protect your personal and medical information. This ensures the privacy and confidentiality of your sensitive data.

Cost and Affordability

Chip Health Insurance plans are designed to be affordable and accessible to a wide range of individuals and families. The cost of your Chip Health Insurance plan will depend on several factors, including your age, location, coverage level, and health status.

Chip Health Insurance plans offer a variety of coverage options and price points to cater to different needs and budgets. You can choose a plan that fits your specific requirements and financial situation.

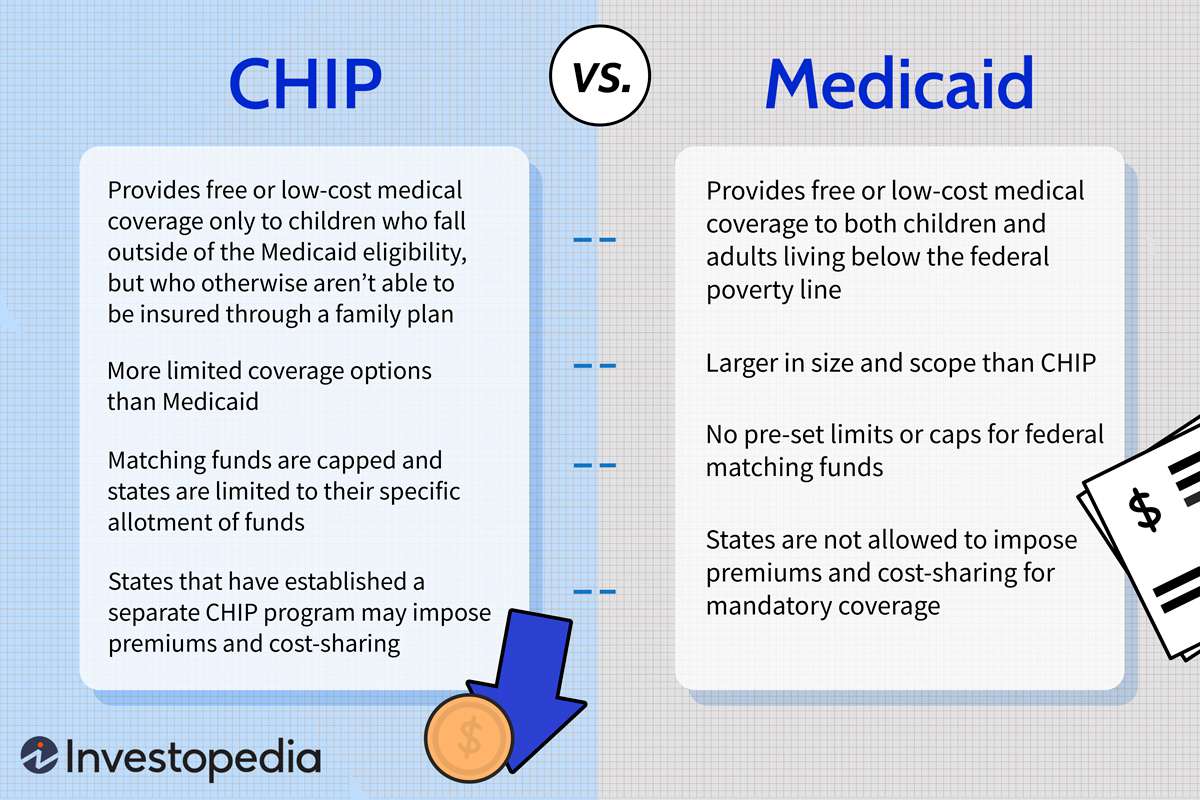

CHIP health insurance provides essential coverage for children in families who may struggle to afford traditional insurance. While CHIP is a government-funded program, some families may also be eligible for private insurance options, such as those offered by the Farmers Insurance Group.

Exploring these alternative options can ensure families have the best possible coverage for their children’s health needs.

Comparison of Chip Health Insurance Plans with Other Options

Chip Health Insurance plans are often more affordable than traditional health insurance plans. This is because Chip Health Insurance plans are designed to be more efficient and streamlined, with lower administrative costs and a focus on preventive care. However, it is important to compare plans carefully and consider your individual needs and circumstances before making a decision.

Here is a table comparing the average monthly premiums for Chip Health Insurance plans with other health insurance options:

| Plan Type | Average Monthly Premium |

|---|---|

| Chip Health Insurance | $200 – $350 |

| Traditional Health Insurance | $300 – $500 |

| High-Deductible Health Plan (HDHP) | $150 – $250 |

Note: These are just average premiums and actual costs may vary depending on individual factors. It is recommended to get a personalized quote from Chip Health Insurance and other insurance providers to compare costs and coverage.

Eligibility and Enrollment

To access the benefits of Chip Health Insurance, you must meet certain eligibility criteria. The enrollment process involves submitting necessary documentation and following a series of steps.

Eligibility Criteria

Eligibility for Chip Health Insurance is based on factors such as age, income, and residency.

- Age: You must be under the age of 19 to qualify for Chip Health Insurance.

- Income: Your family’s income must be below a certain threshold, which varies depending on the state.

- Residency: You must be a resident of the state where you are applying for Chip Health Insurance.

- Citizenship: You must be a U.S. citizen, national, or qualified immigrant to be eligible.

Enrollment Process

The enrollment process for Chip Health Insurance typically involves the following steps:

- Gather necessary documents: This includes proof of age, income, residency, and citizenship.

- Complete an application: The application can be completed online, by phone, or in person.

- Submit your application: Once you have completed the application, you will need to submit it to the appropriate agency.

- Receive a decision: The agency will review your application and notify you of their decision.

Documentation Required

To enroll in Chip Health Insurance, you will need to provide the following documentation:

- Proof of age: This can include a birth certificate, passport, or driver’s license.

- Proof of income: This can include pay stubs, tax returns, or other documentation that shows your income.

- Proof of residency: This can include a utility bill, lease agreement, or other documentation that shows your address.

- Proof of citizenship: This can include a birth certificate, passport, or other documentation that shows your citizenship status.

Step-by-Step Guide

Here is a step-by-step guide to enrolling in Chip Health Insurance:

- Visit the Chip Health Insurance website: The website for Chip Health Insurance will provide you with information about eligibility criteria, enrollment procedures, and documentation requirements.

- Complete the application: You can complete the application online, by phone, or in person.

- Gather necessary documents: Ensure you have all the required documentation, such as proof of age, income, residency, and citizenship.

- Submit your application: Once you have completed the application and gathered all necessary documentation, submit it to the appropriate agency.

- Receive a decision: The agency will review your application and notify you of their decision.

Advantages and Disadvantages: Chip Health Insurance

Choosing the right health insurance plan can be a complex decision, and Chip Health Insurance offers a unique approach that may be a good fit for some individuals and families. This section will explore the advantages and disadvantages of Chip Health Insurance, comparing it to traditional health insurance plans.

Advantages of Chip Health Insurance

Chip Health Insurance presents several potential advantages, including:

- Lower Premiums: Chip Health Insurance plans often have lower premiums compared to traditional health insurance plans. This can be particularly beneficial for individuals and families on a tight budget. This is because Chip plans often have a higher deductible, which means you pay more out-of-pocket before the insurance kicks in.

- Greater Flexibility: Chip plans offer more flexibility in choosing your healthcare providers. You may have access to a wider network of doctors and hospitals, giving you more options to find the best care for your needs.

- Transparency and Simplicity: Chip Health Insurance is known for its transparent pricing and straightforward plan designs. You can easily understand the costs and coverage, making it easier to make informed decisions about your healthcare.

Disadvantages of Chip Health Insurance

While Chip Health Insurance offers advantages, it also has some potential disadvantages:

- Higher Deductibles: As mentioned earlier, Chip plans often have higher deductibles. This means you will need to pay more out-of-pocket before the insurance starts covering your medical expenses. This can be a significant financial burden for individuals with unexpected health issues.

- Limited Coverage: Chip plans may have limited coverage compared to traditional health insurance plans. Some plans may not cover certain services or treatments, which could lead to higher out-of-pocket costs.

- Limited Network: While Chip plans offer flexibility in choosing providers, their networks may be smaller than those of traditional health insurance plans. This could mean that you may not have access to your preferred doctors or hospitals.

Comparison with Traditional Health Insurance

Chip Health Insurance is different from traditional health insurance plans in several key ways:

- Premiums and Deductibles: Chip plans typically have lower premiums but higher deductibles. Traditional plans often have higher premiums but lower deductibles.

- Coverage: Chip plans may have limited coverage compared to traditional plans, especially for preventive care and prescription drugs.

- Network: Chip plans often have a wider network of providers, giving you more flexibility in choosing your healthcare. However, traditional plans may have more established networks with a higher concentration of specialists.

Market Trends and Future Outlook

The health insurance industry is constantly evolving, driven by technological advancements, changing demographics, and evolving consumer preferences. Chip Health Insurance, with its innovative approach and focus on affordability, is well-positioned to capitalize on these trends and shape the future of health insurance.

Impact of Technology on Chip Health Insurance

Technological advancements are significantly influencing the health insurance landscape. Chip Health Insurance is leveraging technology to enhance its services, improve customer experience, and drive efficiency.

- Artificial Intelligence (AI): AI is playing a crucial role in automating processes, personalizing customer experiences, and improving risk assessment. Chip Health Insurance is integrating AI into its operations to streamline claims processing, provide personalized recommendations, and offer tailored insurance plans.

- Telemedicine: The increasing adoption of telemedicine is transforming healthcare delivery. Chip Health Insurance is embracing telemedicine by offering virtual consultations, remote monitoring, and other telehealth services, making healthcare more accessible and convenient for its customers.

- Blockchain: Blockchain technology can enhance transparency, security, and efficiency in health insurance operations. Chip Health Insurance is exploring the potential of blockchain to streamline data management, improve claims processing, and enhance data security.

“Technology is not just about gadgets, it’s about the impact it has on people’s lives. Chip Health Insurance is committed to using technology to improve healthcare access and affordability for everyone.” – [Name of Chip Health Insurance CEO or Spokesperson]

Future Developments and Innovations in Chip Health Insurance

Chip Health Insurance is constantly innovating to meet the evolving needs of its customers. The company is exploring several future developments and innovations, including:

- Personalized Health Plans: Chip Health Insurance is developing personalized health plans that are tailored to individual needs and risk profiles. These plans will leverage data analytics and AI to offer customized coverage and cost-effective solutions.

- Wellness Programs: Chip Health Insurance is investing in wellness programs that promote healthy lifestyles and preventive care. These programs will offer incentives for healthy behaviors and help reduce healthcare costs in the long run.

- Value-Based Care: Chip Health Insurance is exploring value-based care models that focus on improving health outcomes and reducing costs. These models will incentivize providers to deliver high-quality care and manage patient health effectively.

“The future of health insurance is about personalized care, preventive health, and value-based outcomes. Chip Health Insurance is committed to leading the way in this evolution.” – [Name of Chip Health Insurance CEO or Spokesperson]

Comparison with Other Health Insurance Providers

Choosing the right health insurance plan can be a daunting task, especially when considering the wide range of options available. Comparing Chip Health Insurance with other major providers can help you make an informed decision that best suits your needs and budget. This section delves into the key differences between Chip and other prominent health insurance providers, focusing on coverage, cost, and customer service.

Key Differences in Coverage, Cost, and Customer Service

Chip Health Insurance, like other providers, offers various plans with different coverage levels and costs. Understanding these differences is crucial to making a well-informed decision. Here’s a breakdown of key factors to consider:

Coverage

Coverage is a fundamental aspect of health insurance. It refers to the medical services and expenses covered by the plan. Different providers offer varying levels of coverage, impacting the types of treatments and services you can access.

- Chip Health Insurance: Chip typically offers comprehensive plans that cover a wide range of medical services, including preventive care, hospitalization, surgeries, and prescription drugs. However, specific coverage details may vary depending on the chosen plan. It’s essential to review the policy documents carefully to understand the scope of coverage.

- Other Major Providers: Other prominent providers like Anthem, UnitedHealthcare, and Blue Cross Blue Shield also offer diverse plans with varying coverage levels. Some providers might specialize in specific areas, such as Medicare or Medicaid, while others might cater to specific demographics or industries. Comparing coverage details across providers is essential to determine the best fit for your individual needs.

Cost

The cost of health insurance is a significant consideration for individuals and families. Premiums, deductibles, copayments, and coinsurance all contribute to the overall cost. Understanding the cost structure of different providers is essential for budget planning.

- Chip Health Insurance: Chip aims to offer affordable plans by leveraging technology and simplifying processes. However, the actual cost will depend on factors such as your age, location, health status, and the chosen plan. It’s important to compare quotes from Chip with other providers to ensure you’re getting the best value for your money.

- Other Major Providers: Other providers have varying pricing structures, influenced by their coverage levels, network size, and administrative costs. Some providers might offer lower premiums but higher deductibles, while others might have higher premiums but lower out-of-pocket costs. Comparing quotes and understanding the cost breakdown is crucial to making an informed financial decision.

Customer Service

Customer service plays a vital role in the overall health insurance experience. Having access to reliable and responsive support can be crucial when navigating the complexities of health insurance.

- Chip Health Insurance: Chip focuses on providing a user-friendly and accessible customer service experience. They often offer online resources, mobile apps, and dedicated customer support channels to assist policyholders.

- Other Major Providers: Other providers also offer customer service channels, but their responsiveness and accessibility may vary. Some providers might have a strong reputation for customer service, while others might struggle with long wait times or limited support options. Researching customer reviews and comparing service offerings can help you assess the quality of customer support provided by different providers.

Key Features and Benefits of Different Health Insurance Providers

To provide a clearer picture of the differences between Chip and other major health insurance providers, the following table summarizes key features and benefits:

| Provider | Key Features | Benefits |

|---|---|---|

| Chip Health Insurance |

|

|

| Anthem |

|

|

| UnitedHealthcare |

|

|

| Blue Cross Blue Shield |

|

|

Legal and Regulatory Aspects

Chip health insurance, like any other health insurance product, operates within a complex legal and regulatory framework. Understanding these aspects is crucial for both insurance providers and consumers to ensure compliance and transparency.

Relevant Regulations and Compliance Requirements

The legal framework governing Chip health insurance encompasses various regulations and compliance requirements, ensuring its fair and responsible operation. These regulations are designed to protect consumers, promote competition, and maintain financial stability within the insurance industry.

- The Affordable Care Act (ACA): The ACA plays a significant role in regulating health insurance, including Chip plans. It mandates essential health benefits, prohibits pre-existing condition exclusions, and sets affordability standards.

- State Insurance Laws: In addition to federal regulations, individual states have their own insurance laws that apply to Chip health insurance. These laws may cover specific aspects like premium rates, coverage requirements, and consumer protection.

- HIPAA (Health Insurance Portability and Accountability Act): HIPAA sets standards for the privacy and security of protected health information (PHI), ensuring that Chip plans comply with data protection regulations.

Role of Regulatory Bodies

Regulatory bodies play a crucial role in overseeing Chip health insurance, ensuring compliance with legal requirements and protecting consumers.

- The Centers for Medicare & Medicaid Services (CMS): CMS is the primary federal agency responsible for administering the ACA and overseeing health insurance programs, including Chip. It sets standards, monitors compliance, and investigates potential violations.

- State Insurance Departments: Each state has an insurance department responsible for regulating insurance companies within its jurisdiction. They ensure that Chip plans comply with state-specific laws and regulations.

Conclusion

This article has provided a comprehensive overview of Chip Health Insurance, exploring its key features, costs, eligibility, advantages, disadvantages, and its position within the broader healthcare landscape. We have also examined its legal and regulatory aspects, as well as its competitive landscape and future outlook.

Summary of Key Points, Chip health insurance

The key takeaways from this exploration can be summarized as follows:

- Chip Health Insurance offers a unique blend of affordability and comprehensive coverage, making it an attractive option for individuals and families seeking quality healthcare at a reasonable price.

- Its emphasis on preventive care and wellness programs aligns with the growing trend towards proactive healthcare management, promoting long-term health and well-being.

- Chip Health Insurance’s digital platform and streamlined processes contribute to a user-friendly experience, making it accessible and convenient for policyholders.

- While it presents certain limitations, such as limited network options in some regions, Chip Health Insurance remains a competitive player in the market, offering a viable alternative to traditional health insurance plans.

Significance of Chip Health Insurance in the Healthcare Landscape

Chip Health Insurance represents a significant development in the healthcare landscape, offering a fresh perspective on healthcare access and affordability. Its innovative approach, coupled with its commitment to customer satisfaction, has the potential to disrupt the traditional health insurance model and create a more equitable and accessible healthcare system.

The company’s focus on technology and data-driven insights allows for personalized care and efficient claim processing, contributing to a more streamlined and responsive healthcare experience. As the healthcare industry continues to evolve, Chip Health Insurance’s commitment to innovation and customer-centricity positions it as a key player in shaping the future of healthcare.

Outcome Summary

Chip health insurance represents a significant paradigm shift in the healthcare landscape. Its potential to enhance accessibility, affordability, and personalized care is undeniable. As technology continues to advance, chip health insurance is poised to play an increasingly pivotal role in shaping the future of healthcare.