GEICO auto insurance phone number is a vital resource for policyholders seeking assistance, information, or support. Whether you need to file a claim, make a payment, or simply ask a question, having access to the right phone number can make all the difference.

This comprehensive guide explores the various aspects of GEICO’s phone number, from finding the right number for your specific needs to understanding the different services available over the phone. We’ll delve into the advantages and disadvantages of using the phone number, as well as provide insights into customer experiences and best practices for making the most of this valuable contact method.

Finding the GEICO Phone Number: Geico Auto Insurance Phone Number

Getting in touch with GEICO is easy. Their website offers multiple ways to contact them, including their phone number. You can find it directly on their website or through various other channels.

Finding the Phone Number on the GEICO Website

To find the GEICO phone number on their website, follow these steps:

- Visit the GEICO website: https://www.geico.com/

- Hover over the “Contact Us” tab at the top of the page.

- Select “Phone” from the dropdown menu.

- You will be presented with the main GEICO customer service phone number, which is 1-800-434-2426.

Phone Numbers for Specific GEICO Departments

GEICO offers dedicated phone numbers for different departments. Here is a table listing some of the most common departments and their respective phone numbers:

| Department | Phone Number |

|—|—|

| Claims | 1-800-434-2426 |

| Customer Service | 1-800-434-2426 |

| New Business | 1-800-434-2426 |

| Billing | 1-800-434-2426 |

| Policy Changes | 1-800-434-2426 |

Finding the Phone Number for a Specific GEICO Representative

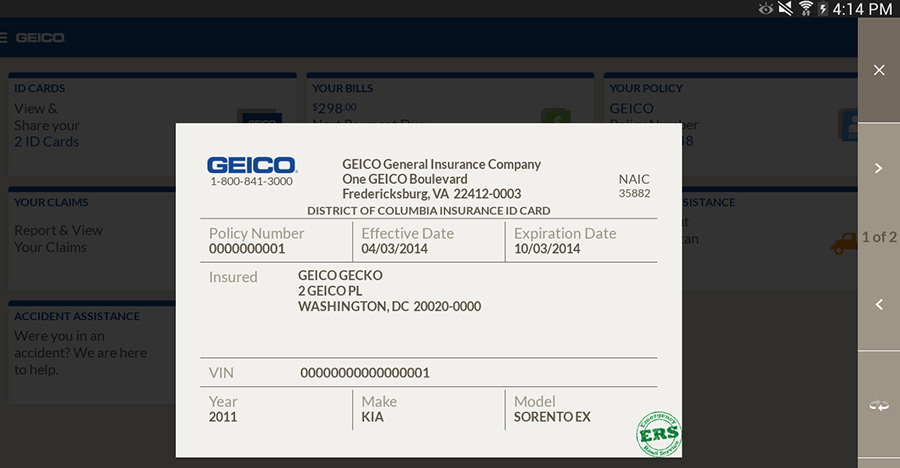

You can find the phone number for a specific GEICO representative through your policy documents or by logging into your GEICO account online. Your policy documents will include the phone number of your assigned representative. If you are logged into your online account, you can typically find the phone number for your representative under your policy information or by contacting customer service.

Using the GEICO Phone Number

Once you have the GEICO phone number, you’re ready to connect with a representative. However, it’s helpful to know a bit about the typical wait times and how to get through quickly.

Typical Wait Times

Call wait times for GEICO can vary depending on the time of day, day of the week, and the volume of calls. You may experience shorter wait times during off-peak hours, such as early mornings or late evenings, and longer wait times during busy periods, like lunch hour or right after a major holiday.

Tips for Getting Through Quickly

Here are some tips for reaching a GEICO representative faster:

- Call during off-peak hours: As mentioned earlier, early mornings and late evenings often have fewer callers.

- Use the GEICO mobile app: The GEICO mobile app allows you to manage your policy, make payments, and contact customer service directly.

- Use the GEICO website: You can find answers to many common questions and access self-service options on the GEICO website.

- Use the GEICO automated system: The automated system can help you quickly access information about your policy or make simple changes.

Services Handled Over the Phone

You can handle a wide range of services over the phone with GEICO, including:

- Getting a quote: You can request a quote for car insurance over the phone.

- Making a payment: You can make a payment on your insurance policy over the phone.

- Reporting a claim: You can report an accident or other claim over the phone.

- Making policy changes: You can make changes to your policy, such as adding or removing a driver or vehicle.

- Getting policy information: You can access information about your policy, such as your coverage details or payment history.

- Speaking to a representative: You can speak to a GEICO representative about any other questions or concerns you may have.

GEICO Phone Number Availability

The GEICO phone number is available to customers for a variety of reasons, including getting a quote, making a payment, reporting a claim, or simply asking a question. However, there are certain times when the phone line is unavailable, and there are also regional differences in availability.

Hours of Operation

The GEICO phone line is open 24 hours a day, 7 days a week. This means that customers can call GEICO at any time, day or night, to get the help they need. However, it’s important to note that wait times may be longer during peak hours, such as during the morning and evening rush.

Regional Availability

The GEICO phone line is available to customers in all 50 states and the District of Columbia. However, there may be some regional differences in availability, such as the availability of certain languages or the availability of certain services. For example, some services may not be available in all states, such as roadside assistance.

Language Support

The GEICO phone line offers language support in English and Spanish. Customers can choose to speak to a representative in either language by pressing the appropriate button on the automated phone system.

GEICO Phone Number Security

Protecting your personal information is a top priority for GEICO, and they take various measures to ensure the security of phone calls. These measures are designed to safeguard your sensitive data from unauthorized access or disclosure.

Security Measures, Geico auto insurance phone number

GEICO implements robust security measures to protect the confidentiality and integrity of your information during phone calls. These measures include:

- Encryption: GEICO uses encryption technology to secure phone calls, making it difficult for unauthorized individuals to intercept or eavesdrop on conversations.

- Authentication: GEICO uses authentication procedures to verify your identity before accessing sensitive information. This may involve asking for personal details or using a secure password.

- Secure Call Centers: GEICO’s call centers are located in secure facilities with restricted access and advanced security systems to prevent unauthorized entry.

- Employee Training: GEICO employees are trained on data security protocols and are required to follow strict guidelines to protect customer information.

Protecting Your Information

While GEICO takes comprehensive security measures, it’s also essential to protect your personal information when calling them. Here are some tips:

- Avoid Sharing Sensitive Information Over Public Wi-Fi: Public Wi-Fi networks are less secure and can be vulnerable to hacking. If you must call GEICO from a public location, use a secure network or consider using a VPN.

- Be Cautious of Phishing Attempts: Be aware of phishing scams that may attempt to trick you into providing personal information over the phone. Verify the caller’s identity before sharing any sensitive details.

- Review Your Account Statements: Regularly review your GEICO account statements for any suspicious activity. Report any unauthorized transactions or changes to your account immediately.

Potential Risks

While GEICO implements robust security measures, it’s important to acknowledge that no system is entirely immune to security risks. Here are some potential risks associated with using the GEICO phone number:

- Data Breaches: Although unlikely, data breaches could potentially compromise sensitive information. GEICO continuously monitors for security threats and implements safeguards to mitigate such risks.

- Social Engineering: Social engineering attacks involve manipulating individuals into revealing personal information. Be cautious of unsolicited calls or emails that request sensitive data.

Closing Summary

Ultimately, GEICO’s phone number is a testament to their commitment to providing exceptional customer service. By understanding the various features and benefits of this contact method, policyholders can leverage its potential to streamline their interactions with the company and ensure a smooth and satisfying experience.