HO6 insurance, also known as condominium insurance, is a specialized type of homeowners insurance designed to protect condo owners from financial losses due to unexpected events. It provides coverage for your personal belongings, liability for injuries or damage you cause to others, and additional living expenses if you’re unable to live in your condo due to a covered incident. Unlike standard homeowners insurance, HO6 insurance focuses on protecting your personal property within your condo unit rather than the structure itself, as the building’s exterior and common areas are typically covered by a separate master policy.

This type of insurance is essential for anyone who owns a condo, as it offers vital protection against a wide range of risks, including fire, theft, vandalism, and natural disasters. Understanding the nuances of HO6 insurance can help you make informed decisions about your coverage and ensure that your investment is adequately protected.

Factors Influencing HO6 Insurance Premiums

HO6 insurance, also known as condominium insurance, is designed to protect your personal belongings and your liability in case of damage or loss. The cost of HO6 insurance premiums can vary significantly depending on several factors. Understanding these factors can help you make informed decisions when purchasing HO6 insurance.

Location

The location of your condominium plays a significant role in determining your HO6 insurance premiums. Insurers consider factors such as:

- Natural Disaster Risk: Condominiums located in areas prone to natural disasters like earthquakes, hurricanes, floods, or wildfires will generally have higher premiums. Insurers assess the likelihood and severity of these risks in different regions.

- Crime Rates: Areas with high crime rates tend to have higher HO6 insurance premiums. Insurers consider the risk of theft and vandalism when setting rates.

- Local Building Codes: Condominiums built to stricter building codes may have lower premiums. These codes often ensure better construction quality and resilience against disasters.

Property Value

The value of your condominium unit is a key factor in determining your HO6 insurance premium. The higher the value of your unit, the more expensive your insurance will be. This is because insurers are covering a greater amount of potential losses.

Coverage Limits

The amount of coverage you choose for your HO6 insurance policy also impacts your premium. Higher coverage limits will generally result in higher premiums. You need to consider the value of your belongings and your liability exposure when deciding on your coverage limits.

Deductible

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums. You should choose a deductible that you can comfortably afford in case of a claim.

Claims History, Ho6 insurance

Your past claims history can affect your HO6 insurance premium. Insurers may charge higher premiums if you have filed multiple claims in the past, as this indicates a higher risk of future claims.

Credit Score

In some states, insurers may use your credit score as a factor in determining your HO6 insurance premium. This is because studies have shown that individuals with poor credit scores tend to file more claims.

Age and Condition of the Building

The age and condition of your condominium building can also impact your premium. Older buildings may have higher premiums due to potential maintenance issues or outdated safety features.

Condominium Association

The rules and regulations of your condominium association can affect your HO6 insurance premium. Associations with strict safety measures and well-maintained common areas may lead to lower premiums.

Average HO6 Premiums in Different Regions

The table below shows the average HO6 insurance premiums in different regions of the United States. These figures are estimates and may vary depending on the specific factors discussed above.

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,000 – $1,500 |

| Southeast | $800 – $1,200 |

| Midwest | $700 – $1,000 |

| Southwest | $600 – $900 |

| West Coast | $900 – $1,400 |

Common Exclusions and Limitations

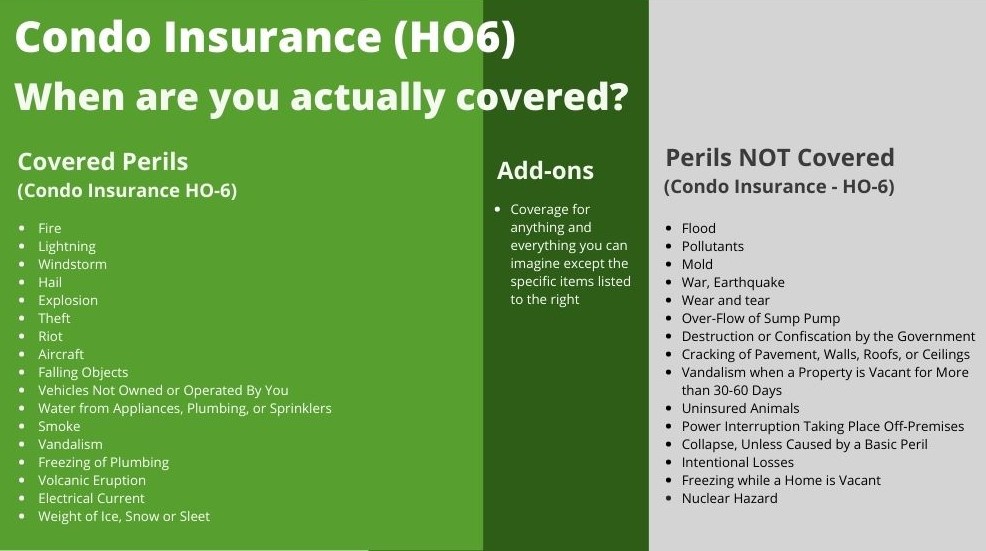

HO6 insurance policies, like all insurance policies, come with exclusions and limitations. These provisions help insurers manage risk and ensure fair premiums for all policyholders. Understanding these exclusions is crucial for homeowners to ensure they have adequate coverage for their specific needs.

Exclusions Related to Building Coverage

HO6 policies primarily cover personal property and not the building itself. This means that damage to the building, even if caused by a covered peril, is not covered under the policy.

Exclusions Related to Personal Property

- Wear and Tear: HO6 policies typically exclude coverage for damage caused by normal wear and tear. This means that gradual deterioration of items due to age or use is not covered.

- Neglect: Damage caused by negligence, such as leaving a window open during a storm, is often excluded.

- Intentional Acts: Damage caused intentionally by the insured or their family members is not covered. This includes acts of vandalism or arson committed by the insured.

- Certain Valuables: Some items, such as cash, securities, and collectibles, may have coverage limitations or require additional endorsements. These items are often subject to sublimits or require separate coverage.

- Pets: Damage caused by pets is generally excluded. This includes damage caused by biting, scratching, or accidents.

Limitations on Coverage

- Deductible: The policyholder is responsible for paying a deductible for each claim. The deductible amount is specified in the policy and varies depending on the coverage level and the insurer.

- Coverage Limits: Each coverage section of the policy has a limit on the amount that will be paid for a claim. This limit is typically based on the value of the insured property or the coverage level chosen.

- Coverage Periods: Coverage under the policy is typically limited to a specific period, such as a year. Any losses that occur outside of the coverage period are not covered.

- Sublimits: Some coverage sections may have sublimits, which are specific limits on the amount that will be paid for certain types of losses. For example, there may be a sublimit on the amount paid for jewelry or other valuables.

Examples of Coverage Denial or Limitation

- Damage to Building: If a fire damages the building, HO6 insurance will not cover the cost of repairs or replacement, as the building is not covered under the policy.

- Wear and Tear on Furniture: If a sofa is damaged due to normal wear and tear, such as fabric fading or sagging cushions, HO6 insurance will not cover the cost of replacement or repair.

- Neglect: If a homeowner leaves a window open during a rainstorm and the furniture is damaged by water, HO6 insurance may not cover the damage due to negligence.

- Intentional Act: If a homeowner intentionally damages their apartment by setting a fire, HO6 insurance will not cover the cost of repairs or replacement.

- Valuable Items: If a homeowner loses a collection of rare coins in a theft, HO6 insurance may have a sublimit on the amount paid for valuables, limiting the coverage amount.

Choosing the Right HO6 Insurance Policy

Selecting the right HO6 insurance policy is crucial for condo owners, as it safeguards their personal belongings and provides financial protection against various risks. To make an informed decision, condo owners should carefully consider several factors that influence the policy’s coverage and cost.

Factors to Consider When Choosing an HO6 Policy

Understanding the factors that influence HO6 insurance premiums is essential for making informed decisions. Condo owners should consider the following:

- Coverage Limits: Determining the appropriate coverage limits for personal belongings is crucial. Consider the value of your possessions and choose limits that adequately protect you against financial loss in case of damage or theft.

- Deductible: A higher deductible generally leads to lower premiums. However, it also means you will pay more out of pocket in case of a claim. Evaluate your financial situation and risk tolerance to choose a deductible that suits your needs.

- Coverage for Specific Risks: Condo owners should consider their specific needs and potential risks. For example, if you live in an area prone to flooding, ensure your policy includes flood insurance. Other optional coverages might include earthquake insurance, identity theft protection, or personal liability coverage.

- Condo Association’s Master Policy: It is important to understand the coverage provided by the condo association’s master policy. The master policy typically covers the building’s structure and common areas, while your HO6 policy covers your personal belongings and liability within your unit. Ensure there are no gaps in coverage between the master policy and your HO6 policy.

Comparing Quotes from Multiple Insurers

Shopping around and comparing quotes from multiple insurers is essential for finding the best HO6 insurance policy. Different insurers offer varying premiums and coverage options. Obtain quotes from at least three insurers to ensure you get the most competitive rates and coverage that meets your specific needs.

Role of an Insurance Agent

An insurance agent can be a valuable resource when choosing an HO6 insurance policy. Agents can:

- Provide Expert Advice: Agents possess extensive knowledge of insurance policies and can help you understand the different coverage options and their implications.

- Assist in Policy Selection: They can analyze your individual needs and risk profile to recommend the most suitable policy for your situation.

- Negotiate Rates and Coverage: Agents can negotiate with insurers on your behalf to secure favorable premiums and coverage terms.

- Handle Claims: In the event of a claim, your agent can guide you through the process and ensure you receive the appropriate compensation.

Filing a Claim Under HO6 Insurance

Filing a claim under an HO6 insurance policy is a crucial process that can help you recover from unexpected losses. It’s important to understand the steps involved, the necessary documentation, and tips to ensure your claim is processed smoothly.

Steps Involved in Filing a Claim

- Report the Incident: Immediately contact your insurance company to report the incident. Provide details about the event, the date and time it occurred, and the extent of the damage.

- File a Claim: Your insurance company will provide you with a claim form to fill out. This form will require information about the incident, the insured property, and the estimated amount of loss.

- Provide Documentation: Gather all relevant documentation, including photos, receipts, and repair estimates, to support your claim.

- Cooperate with the Insurance Company: Be prepared to answer questions and provide any additional information the insurance company may require.

- Negotiate a Settlement: Once the insurance company has reviewed your claim, they will provide you with a settlement offer. You have the right to negotiate the settlement amount if you feel it is insufficient.

Documentation and Information Required

- Proof of Ownership: Provide evidence that you own the condo unit, such as a deed or purchase agreement.

- HO6 Policy: Have your insurance policy readily available, as it contains essential information about coverage limits and exclusions.

- Photos and Videos: Capture detailed photos and videos of the damaged property from multiple angles, focusing on the extent of the damage.

- Repair Estimates: Obtain estimates from qualified contractors for the cost of repairing or replacing the damaged property.

- Police Report: If the damage was caused by a crime, file a police report and obtain a copy.

- Medical Records: If you sustained injuries due to the incident, provide medical records documenting your treatment and expenses.

Tips for Maximizing Claim Approval

- Act Promptly: Report the incident and file a claim as soon as possible after the event.

- Be Honest and Thorough: Provide accurate and complete information about the incident and your claim.

- Keep Detailed Records: Maintain a record of all communications, documentation, and expenses related to the claim.

- Seek Professional Help: If necessary, consult with a public adjuster or legal professional to assist you with the claim process.

Importance of Regular Policy Reviews

Your HO6 insurance policy is designed to protect your valuable condo unit and belongings, but its effectiveness depends on its ability to reflect your current needs and risks. Regularly reviewing and updating your policy is crucial to ensure that you have the right coverage in place.

Potential Consequences of Failing to Review Policies

Failing to review your HO6 insurance policy can lead to significant financial consequences if you experience a covered loss. Here are some potential scenarios:

- Underinsurance: If your policy’s coverage limits are too low, you may not receive enough compensation to fully rebuild or replace your belongings after a covered event. This could leave you with a substantial financial burden.

- Coverage Gaps: Over time, your needs and risks may change. You might acquire new valuable possessions, undertake renovations, or face increased risks due to changes in your neighborhood. If your policy doesn’t reflect these changes, you could find yourself without adequate coverage for specific losses.

- Outdated Coverage: Insurance policies are constantly evolving, and new types of coverage may become available. Failing to review your policy could mean you’re missing out on valuable protections that could benefit you.

- Increased Premiums: If you fail to update your policy with relevant information, you might end up paying higher premiums than necessary. For instance, if you’ve made significant improvements to your condo, you might qualify for a lower premium if you update your policy accordingly.

Frequency of Policy Reviews

- Annually: It’s recommended to review your HO6 insurance policy at least once a year. This allows you to assess whether your coverage is still adequate and if there are any changes you need to make.

- After Significant Life Events: You should also review your policy after significant life events, such as:

- Purchasing new valuable possessions

- Undertaking renovations or additions to your condo

- Moving to a new condo unit

- Changes in your family structure

Resources for Obtaining HO6 Insurance

Finding the right HO6 insurance policy can be a daunting task, but there are several resources available to help you navigate this process. You can choose from various insurance companies, brokers, and online platforms, each offering unique features and benefits.

Insurance Companies

Insurance companies specialize in providing various insurance products, including HO6 insurance. They offer a wide range of coverage options, premium rates, and customer service levels. Some popular insurance companies offering HO6 insurance include:

- State Farm

- Allstate

- Nationwide

- Progressive

- Liberty Mutual

Insurance Brokers

Insurance brokers act as intermediaries between you and insurance companies. They represent your interests and help you find the most suitable HO6 insurance policy based on your specific needs and budget. Brokers often have access to a broader range of insurance companies and can compare different policies to find the best fit.

Online Platforms

Online platforms provide a convenient way to compare HO6 insurance quotes from multiple insurance companies. These platforms allow you to enter your details, such as your condo’s location, value, and coverage needs, and receive customized quotes. Popular online platforms for comparing HO6 insurance include:

- The Zebra

- Policygenius

- Insurify

Tips for Finding Reputable Insurance Providers

When searching for an HO6 insurance provider, it’s crucial to prioritize reputation and reliability. Here are some tips for finding a trustworthy provider:

- Check the insurance company’s financial stability by reviewing its ratings from agencies like AM Best and Standard & Poor’s.

- Read online reviews and customer testimonials to gain insights into the company’s reputation and customer service.

- Look for insurance companies with a strong track record of handling claims efficiently and fairly.

- Consider the insurance company’s availability and accessibility in your area.

Seeking Advice from an Insurance Professional

Consulting an insurance professional can be invaluable in finding the right HO6 insurance policy. Insurance agents or brokers can provide personalized advice, explain complex insurance terms, and help you understand your coverage options. They can also help you identify any potential gaps in your coverage and recommend appropriate solutions.

Conclusive Thoughts

Navigating the world of condo insurance can be challenging, but with careful consideration of your individual needs and a thorough understanding of HO6 insurance, you can make informed choices to safeguard your valuable assets. Remember, HO6 insurance is a crucial component of condo ownership, providing financial security and peace of mind in the face of unforeseen circumstances. By investing in the right coverage, you can protect your investment and enjoy the benefits of owning a condo with confidence.

HO6 insurance, specifically designed for condominium owners, offers protection against various perils. However, it doesn’t cover long-term care expenses, which can be substantial. To understand the potential financial burden of long-term care, it’s helpful to research the cost of long-term care insurance and consider supplemental coverage options.

This information can guide your decision regarding additional insurance policies for your condo, ensuring you have adequate protection for unexpected events.