Home insurance calculator is a powerful tool that helps you determine the right amount of coverage for your home and belongings. By inputting key information about your property, you can receive personalized quotes from different insurance providers. This allows you to compare prices and coverage options, ensuring you have the protection you need without overpaying.

Understanding home insurance is crucial for protecting your biggest investment. Home insurance provides financial security in the event of unforeseen events like fire, theft, or natural disasters. A home insurance calculator simplifies this process by providing a clear overview of your coverage needs and costs.

What is Home Insurance?

Home insurance is a type of insurance that protects your home and belongings from unexpected events, providing financial coverage for repairs, replacements, and other expenses. It safeguards you from significant financial losses that can arise from unforeseen circumstances, such as fires, theft, or natural disasters.

Types of Coverage

Home insurance policies typically include various types of coverage designed to protect different aspects of your property and belongings. These coverages are designed to provide financial support for various situations.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, foundation, and attached structures like garages or decks. It covers repairs or replacement costs in case of damage from covered perils.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, clothing, electronics, and other personal possessions. It provides financial assistance for replacement or repair in case of loss or damage.

- Liability Coverage: This coverage protects you from financial liability if someone is injured on your property or if you accidentally cause damage to someone else’s property. It helps cover legal expenses, medical bills, and property damage costs.

- Additional Living Expenses (ALE): This coverage provides temporary financial support for living expenses if you are unable to live in your home due to a covered event. It can cover costs like hotel stays, meals, and other essential living expenses.

Common Perils Covered

Home insurance policies typically cover a range of common perils, or events, that can cause damage to your property. These perils are broadly categorized as follows:

- Fire: This covers damage caused by fire, smoke, and soot, including accidental fires and those caused by natural disasters like lightning.

- Windstorm and Hail: This coverage protects against damage caused by strong winds, hailstorms, and tornadoes, including damage to the roof, siding, windows, and other exterior elements.

- Theft: This coverage protects against losses due to theft or burglary, covering stolen belongings and damage caused during the theft.

- Vandalism: This coverage protects against damage caused by vandalism, including graffiti, broken windows, and other intentional acts of destruction.

- Natural Disasters: Many home insurance policies also cover damage caused by natural disasters like earthquakes, floods, hurricanes, and landslides, although coverage for these perils may vary depending on the specific policy and location.

Why Use a Home Insurance Calculator?

A home insurance calculator is a valuable tool for homeowners seeking to understand their coverage needs and potential costs. It simplifies the process of determining the right amount of insurance, allowing you to make informed decisions about your protection and premiums.

Determining the Right Coverage Amount

Using a home insurance calculator helps you assess the value of your home and its contents, which is crucial for determining the appropriate coverage amount. By inputting details such as the square footage, age, and construction materials of your home, along with the value of your belongings, the calculator provides an estimated replacement cost. This helps you avoid underinsurance, which can lead to significant financial losses in the event of a claim.

The estimated replacement cost is crucial because it reflects the actual cost of rebuilding or repairing your home and replacing your belongings at current market prices.

Saving Money on Premiums

A home insurance calculator can also help you save money on your premiums. By providing accurate information about your home and its contents, the calculator helps you avoid overpaying for unnecessary coverage. For instance, if you have a high-value item like jewelry or artwork, the calculator can help you determine if you need additional coverage for these specific items.

By accurately assessing your needs and avoiding overinsurance, you can potentially lower your premiums and save money in the long run.

Key Factors Influencing Home Insurance Costs

Your home insurance premium is determined by a variety of factors, each playing a role in shaping the final cost. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Location

Your home’s location significantly impacts your insurance cost. Factors like the risk of natural disasters, crime rates, and the density of your neighborhood all contribute to your premium.

- Natural Disasters: Homes located in areas prone to hurricanes, earthquakes, wildfires, or floods will generally have higher premiums. Insurers assess the risk of these events and adjust premiums accordingly.

- Crime Rates: Areas with high crime rates often have higher insurance costs due to the increased risk of theft or vandalism. Insurers consider crime statistics when determining premiums.

- Neighborhood Density: Homes in densely populated areas may have higher premiums due to the proximity of other homes, increasing the risk of fire spreading.

Property Value

The value of your home is a primary factor influencing your insurance premium. The higher the value of your property, the more it costs to rebuild or repair it in case of damage, leading to higher premiums.

- Replacement Cost: Insurance premiums are calculated based on the cost to rebuild or replace your home in the event of a covered loss. The higher the replacement cost, the higher the premium.

- Appraisals: Insurers may require an appraisal to determine the current market value of your home. This helps ensure accurate coverage and premium calculations.

Coverage Options

The type and amount of coverage you choose directly influence your premium. Higher coverage levels, including comprehensive coverage for various perils, typically lead to higher premiums.

- Deductibles: A higher deductible, which is the amount you pay out-of-pocket before your insurance kicks in, generally results in lower premiums. Conversely, a lower deductible leads to higher premiums.

- Coverage Limits: The maximum amount your insurance policy will pay for a covered loss is known as the coverage limit. Higher coverage limits typically result in higher premiums.

- Perils Covered: The specific risks your policy covers, such as fire, theft, or natural disasters, can also affect your premium. Comprehensive policies covering a wider range of perils usually have higher premiums.

Personal Factors

Your individual circumstances, such as credit score and claims history, also play a role in determining your home insurance premium.

- Credit Score: A good credit score often indicates financial responsibility and can lead to lower premiums. Insurers may use your credit score as a proxy for your overall risk.

- Claims History: A history of filing claims, especially multiple claims, can increase your premiums. Insurers may view frequent claims as an indicator of higher risk.

Understanding Home Insurance Quotes: Home Insurance Calculator

Home insurance quotes are essential for understanding the cost of protecting your property. They provide a detailed breakdown of the coverage you’ll receive and the premium you’ll pay.

Understanding the Components of a Home Insurance Quote

A home insurance quote typically includes several key components:

- Coverage Limits: This refers to the maximum amount the insurer will pay for covered losses, such as damage to your home or belongings. It’s crucial to choose coverage limits that adequately protect your assets.

- Deductible: This is the amount you’ll pay out-of-pocket for each covered claim before your insurance kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Premium: This is the regular payment you make to maintain your home insurance policy. The premium is calculated based on various factors, including your home’s value, location, coverage limits, and deductible.

- Discounts: Insurers often offer discounts for various factors, such as having a security system, fire alarms, or a good credit score. These discounts can significantly reduce your premium.

- Exclusions: This refers to specific events or circumstances that are not covered by your policy. It’s important to carefully review the exclusions to ensure you’re adequately protected.

Comparing Quotes from Various Insurance Providers, Home insurance calculator

Comparing quotes from different insurance providers is crucial for finding the best coverage at the most affordable price.

- Use Online Comparison Tools: Several websites and apps allow you to compare quotes from multiple insurers simultaneously. This saves you time and effort.

- Contact Insurance Agents: Agents can help you understand different policy options and find the best coverage for your needs. They can also provide personalized advice and guidance.

- Consider Factors Beyond Price: While price is important, it’s also crucial to consider factors such as the insurer’s reputation, customer service, and claims handling process.

Negotiating a Better Rate with Insurers

Once you’ve received quotes from several insurers, you can negotiate a better rate by:

- Shop Around: Don’t settle for the first quote you receive. Get quotes from multiple insurers and use them as leverage to negotiate a lower price.

- Highlight Your Positive Factors: Emphasize any factors that make you a good risk, such as a good credit score, security system, or a history of no claims.

- Ask for Discounts: Inquire about available discounts, such as multi-policy discounts, bundling your home and auto insurance, or loyalty discounts.

- Consider Increasing Your Deductible: A higher deductible generally leads to a lower premium. Consider whether increasing your deductible is a viable option for you.

How to Use a Home Insurance Calculator

Home insurance calculators are user-friendly tools that can help you estimate your home insurance costs. They simplify the process by asking you a series of questions about your property and coverage preferences.

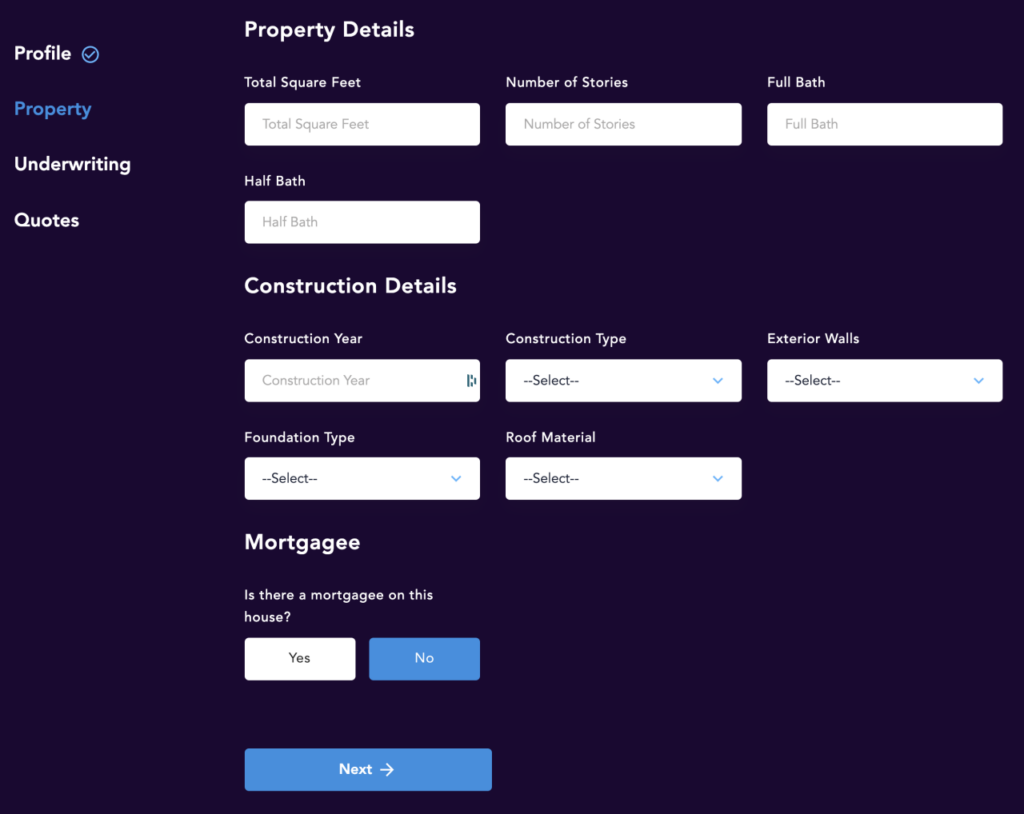

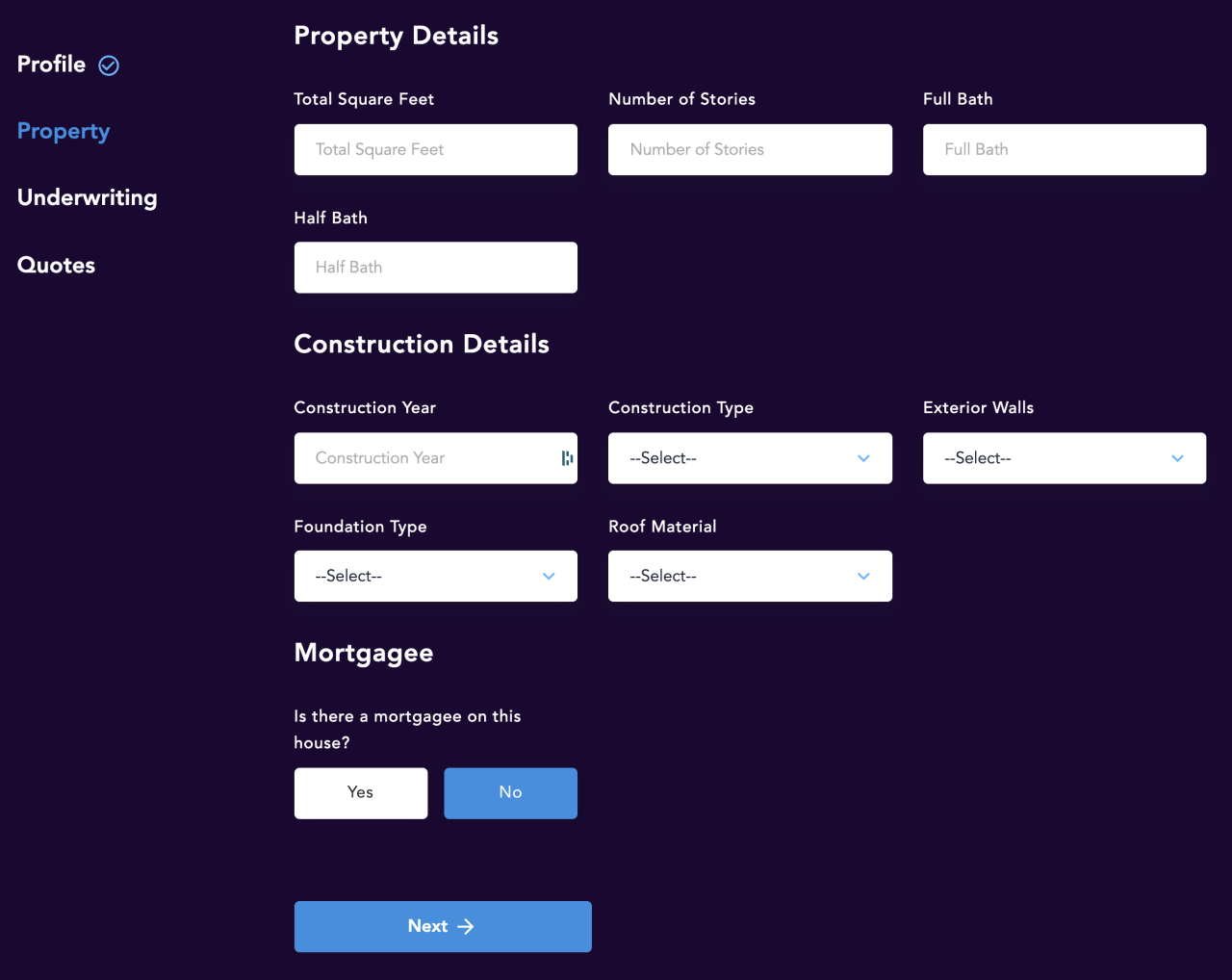

Entering Property Details

The calculator will first ask you to provide information about your property. This includes basic details like:

- Property type: Single-family home, condo, townhouse, etc.

- Location: City, state, and zip code.

- Year built: The year your home was constructed.

- Square footage: The total living area of your home.

- Construction materials: The materials used to build your home, such as brick, wood, or concrete.

- Roof type: The type of roof on your home, such as asphalt shingles, metal, or tile.

These details help the calculator assess the potential risks associated with your property.

Choosing Coverage Options

Next, the calculator will guide you through selecting the coverage options you need. You’ll be asked to consider:

- Dwelling coverage: This covers the structure of your home, including the foundation, walls, roof, and other attached structures.

- Personal property coverage: This protects your belongings inside your home, such as furniture, appliances, electronics, and clothing.

- Liability coverage: This protects you financially if someone is injured on your property or if you accidentally damage someone else’s property.

- Additional living expenses: This coverage helps pay for temporary housing and other expenses if your home is damaged and uninhabitable.

The calculator will provide you with a range of coverage options and allow you to choose the level of protection that best suits your needs and budget.

Providing Personal Information

Finally, the calculator will ask for some basic personal information. This typically includes:

- Your name and contact information: This allows the calculator to generate a personalized quote.

- Your age and credit score: These factors can influence your insurance premiums.

- Your claims history: Information about any previous insurance claims you have filed.

Providing accurate and complete information ensures you receive the most accurate insurance quote.

Obtaining a Personalized Quote

Once you have entered all the required information, the home insurance calculator will process your data and generate a personalized quote. This quote will estimate your monthly or annual premium based on your specific circumstances. It’s important to note that this is just an estimate, and the actual premium you pay may vary depending on the insurance company and other factors.

The calculator may also provide you with additional information about your quote, such as:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Coverage limits: The maximum amount your insurance company will pay for a covered loss.

- Discounts: Any potential discounts you may be eligible for, such as discounts for safety features, bundling policies, or being a good driver.

Reviewing this information carefully will help you understand the details of your quote and make an informed decision about your home insurance needs.

Factors to Consider When Choosing Coverage

Choosing the right home insurance coverage is crucial for protecting your financial well-being in case of unexpected events. To make an informed decision, you need to carefully consider various factors that influence the extent of your coverage and the associated costs.

Understanding Coverage Limits and Deductibles

Coverage limits and deductibles are two essential aspects of home insurance policies that determine how much you pay in the event of a claim.

- Coverage Limits: These limits define the maximum amount your insurance company will pay for a covered loss. For example, a dwelling coverage limit of $300,000 means your insurer will cover up to $300,000 for damage to your home’s structure. It’s crucial to ensure your coverage limits are sufficient to rebuild or repair your home and replace your belongings.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically leads to lower premiums, while a lower deductible results in higher premiums. When choosing a deductible, consider your financial capacity and risk tolerance.

Key Coverage Options

Home insurance policies typically include several essential coverage options:

- Dwelling Coverage: This covers damage to your home’s structure, including the foundation, walls, roof, and plumbing. It’s the most important coverage option, as it protects your most significant asset.

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and jewelry, against damage or theft. It’s essential to have sufficient coverage to replace these items in case of a loss.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or you cause damage to someone else’s property. Liability coverage is crucial to protect you from potential lawsuits and significant financial burdens.

Customizing Coverage Based on Individual Needs

While standard coverage options are available, you can customize your policy to meet your specific needs and circumstances.

- Additional Coverage: Consider adding coverage for specific risks like flooding, earthquakes, or valuable possessions.

- Endorsements: These are add-ons that extend your coverage to include specific situations, such as coverage for personal belongings while traveling or for certain types of business activities conducted at home.

- Adjusting Deductibles: You can adjust your deductible to find a balance between premium costs and out-of-pocket expenses. A higher deductible can lead to lower premiums, but you’ll pay more out-of-pocket if you need to file a claim.

Conclusive Thoughts

Navigating the world of home insurance can be overwhelming, but a home insurance calculator empowers you to make informed decisions. By understanding your needs and comparing quotes, you can find the best coverage at the right price. Take advantage of this valuable tool to secure your home and peace of mind.

A home insurance calculator can help you determine the right coverage for your property, but it’s also important to consider other insurance needs. If you use a vehicle for business purposes, you’ll need business vehicle insurance to protect yourself from liability and financial loss.

This type of insurance is different from personal auto insurance and is tailored to the specific risks of using a vehicle for work. Once you’ve secured the right coverage for your home and business vehicles, you can rest assured knowing your assets are protected.