How to become an insurance agent? It’s a question many ask, intrigued by the opportunity to help others secure their financial future while building a rewarding career. The insurance industry is vast and complex, offering diverse career paths and specializations. Whether you’re a recent graduate seeking a stable career or a seasoned professional looking for a change, this guide will equip you with the knowledge and strategies to navigate the world of insurance sales.

Becoming an insurance agent involves more than just selling policies; it’s about building trust, understanding individual needs, and providing tailored solutions. This journey requires a combination of educational qualifications, licensing, and essential skills that will empower you to excel in this dynamic field.

Educational Requirements

Becoming an insurance agent typically involves meeting certain educational requirements and obtaining the necessary licenses. These requirements can vary depending on the state you plan to work in and the specific type of insurance you intend to sell.

Licensing Requirements

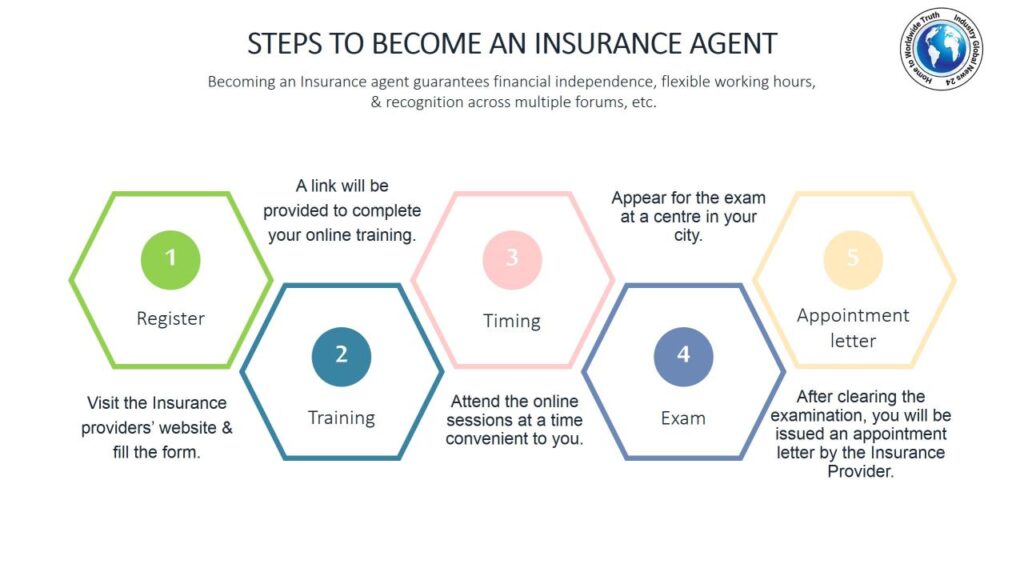

The licensing process for insurance agents involves meeting specific educational and examination requirements. Here’s a breakdown of the process:

- Pre-licensing Education: Most states require insurance agents to complete a pre-licensing education course. These courses cover topics such as insurance principles, laws, and regulations. The duration and specific content of these courses can vary depending on the state and the type of insurance license being sought.

- Examination: After completing the pre-licensing education, aspiring agents must pass a state-administered licensing exam. The exam assesses knowledge of insurance principles, regulations, and practices. The exam format and difficulty level can vary depending on the state and the type of insurance license being sought.

- Background Check: States often require insurance agents to undergo a background check to ensure their suitability for the profession. This check may involve verifying criminal history, creditworthiness, and other relevant factors.

- Continuing Education: Once licensed, insurance agents are generally required to complete continuing education courses to maintain their licenses. These courses help agents stay updated on industry changes, laws, and best practices. The frequency and content of continuing education requirements vary by state and license type.

Importance of Continuing Education

Continuing education is crucial for insurance agents to stay current with industry trends, regulations, and best practices. It helps them:

- Maintain License: Continuing education is often a requirement for license renewal, ensuring agents remain knowledgeable and qualified.

- Enhance Knowledge: New products, laws, and technologies emerge regularly in the insurance industry. Continuing education helps agents stay informed about these changes and expand their expertise.

- Improve Client Service: By staying updated on industry best practices, agents can provide better advice and service to their clients.

- Boost Career Prospects: Continuing education can demonstrate commitment to professional development and enhance career opportunities.

Finding an Insurance Agency: How To Become An Insurance Agent

Once you have your insurance license, the next step is to find an insurance agency to work for. There are many different types of insurance agencies, and each one has its own unique benefits and drawbacks.

Large vs. Small Insurance Agencies

The size of an insurance agency can have a significant impact on your career. Large agencies offer more opportunities for growth and development, but they may also be more competitive. Small agencies may offer a more personalized experience and a closer relationship with your clients, but they may have fewer opportunities for advancement.

- Large Agencies: Large agencies typically have more resources and support, such as marketing and training departments. They may also offer more opportunities for advancement and specialization. Large agencies may also have a wider range of clients, which can give you exposure to different types of insurance products and services. However, large agencies can also be more bureaucratic and less personal. You may have to compete with more experienced agents for clients and opportunities.

- Small Agencies: Small agencies offer a more personalized experience and a closer relationship with your clients. You may have more autonomy and control over your business. Small agencies may also have a more relaxed and friendly atmosphere. However, small agencies may have fewer resources and support, such as marketing and training departments. They may also have fewer opportunities for advancement and specialization. Small agencies may also have a smaller client base, which can limit your earning potential.

Researching and Selecting the Right Agency, How to become an insurance agent

Once you have decided whether you want to work for a large or small agency, it’s time to start researching potential employers. There are a few key factors to consider when choosing an agency, including:

- Culture: The culture of an agency is important, as it will impact your work environment and your overall experience. You want to work for an agency that has a positive and supportive culture. You can learn about an agency’s culture by talking to current or former employees, reading online reviews, or visiting the agency’s website.

- Compensation and Benefits: Compensation and benefits are important factors to consider when choosing an agency. You want to make sure that the agency offers a competitive salary and benefits package. You can research the average salary and benefits for insurance agents in your area. You can also ask potential employers about their compensation and benefits package during the interview process.

- Training and Development: Insurance is a complex industry, and it’s important to have the right training and development opportunities. You want to work for an agency that provides ongoing training and support. You can ask potential employers about their training programs and their commitment to employee development.

- Reputation: The reputation of an agency is important, as it can impact your ability to attract clients. You want to work for an agency that has a good reputation in the community. You can research an agency’s reputation by reading online reviews, talking to current or former clients, or checking with the Better Business Bureau.

Questions to Ask Potential Employers

Once you have narrowed down your list of potential employers, it’s time to start interviewing. Here are some questions to ask potential employers:

- What is the agency’s culture like?

- What are the agency’s goals for the next year?

- What are the opportunities for advancement within the agency?

- What kind of training and development programs does the agency offer?

- What is the agency’s compensation and benefits package?

- What are the agency’s expectations for new agents?

- What is the agency’s approach to customer service?

- What are the agency’s marketing and sales strategies?

- What is the agency’s commitment to diversity and inclusion?

- What is the agency’s approach to technology?

Summary

The path to becoming a successful insurance agent is filled with challenges and rewards. By understanding the industry, acquiring the necessary qualifications, and developing strong communication and problem-solving skills, you can build a fulfilling career that makes a positive impact on the lives of your clients. Remember, continuous learning, professional development, and ethical conduct are essential for navigating the ever-evolving landscape of insurance sales.

Becoming an insurance agent often involves obtaining a license, passing exams, and gaining experience. A great place to start your journey is by checking out the cross insurance center , where you can find valuable resources and guidance on the licensing process and industry best practices.

Once you’re licensed and equipped with the right knowledge, you’ll be well on your way to a successful career in insurance.