Your insurance policy number is more than just a string of digits; it’s your unique identifier within the world of insurance. This number acts as your passport to your coverage, linking you to your policy details, premium payments, and claims information. It’s a vital piece of information that unlocks the protection you’ve secured.

From understanding the structure and components of a policy number to ensuring its security and accessing it when needed, this guide explores the ins and outs of this crucial identifier. We’ll delve into the legal and regulatory aspects of policy numbers, industry best practices, and provide answers to common questions you may have.

Definition and Purpose

An insurance policy number is a unique identifier assigned to each insurance policy. It acts as a key to access information related to the policy, such as coverage details, premiums, and claims history.

The primary purpose of an insurance policy number is to facilitate efficient and accurate record-keeping and management of insurance policies. It helps insurers and policyholders alike to easily identify and retrieve information about specific policies.

Examples of Insurance Policy Numbers

Here are some examples of different types of insurance policies and their corresponding numbers:

- Auto Insurance: A typical auto insurance policy number might be a combination of letters and numbers, such as “ABC1234567.”

- Health Insurance: Health insurance policy numbers are usually a series of numbers, for instance, “1234567890.”

- Life Insurance: Life insurance policy numbers can vary in format, but they often include a combination of letters and numbers, such as “XYZ-123456.”

- Homeowners Insurance: Homeowners insurance policy numbers are typically a combination of letters and numbers, such as “DEF4567890.”

Structure and Components

An insurance policy number is a unique identifier assigned to each insurance policy. It serves as a vital tool for tracking and managing insurance information. This number is typically a combination of letters and numbers, designed to efficiently organize and retrieve policy details.

Components of an Insurance Policy Number

The structure of an insurance policy number can vary depending on the insurance company. However, most policy numbers share common components that provide valuable information about the policy. These components are often arranged in a specific sequence, allowing for efficient retrieval and analysis of policy data.

- Company Code: This component identifies the insurance company that issued the policy. It is usually a series of letters or numbers that uniquely represent the company.

- Policy Type: This component indicates the type of insurance coverage, such as health, auto, or life insurance. It may be represented by a specific letter or number.

- Policy Issue Date: This component often reflects the date the policy was issued, typically in a numerical format like YYYYMMDD.

- Policy Number: This is a unique identifier specific to the policy, usually a combination of letters and numbers. It differentiates one policy from another within the same insurance company.

- Check Digit: This is a single digit calculated using a specific algorithm based on the other components of the policy number. It acts as a validation check to ensure the accuracy of the policy number.

Sample Insurance Policy Number

The following table illustrates the structure and components of a sample insurance policy number:

| Component | Description | Example |

|---|---|---|

| Company Code | Identifies the insurance company | ABC |

| Policy Type | Indicates the type of insurance coverage | H |

| Policy Issue Date | Reflects the date the policy was issued | 20230415 |

| Policy Number | Unique identifier specific to the policy | 1234567890 |

| Check Digit | Validation check for accuracy | 3 |

Sample Policy Number: ABC H 20230415 1234567890 3

Location and Access

Your insurance policy number is a crucial piece of information you’ll need to access your policy, file claims, and manage your insurance. It’s important to keep it in a safe and accessible place.

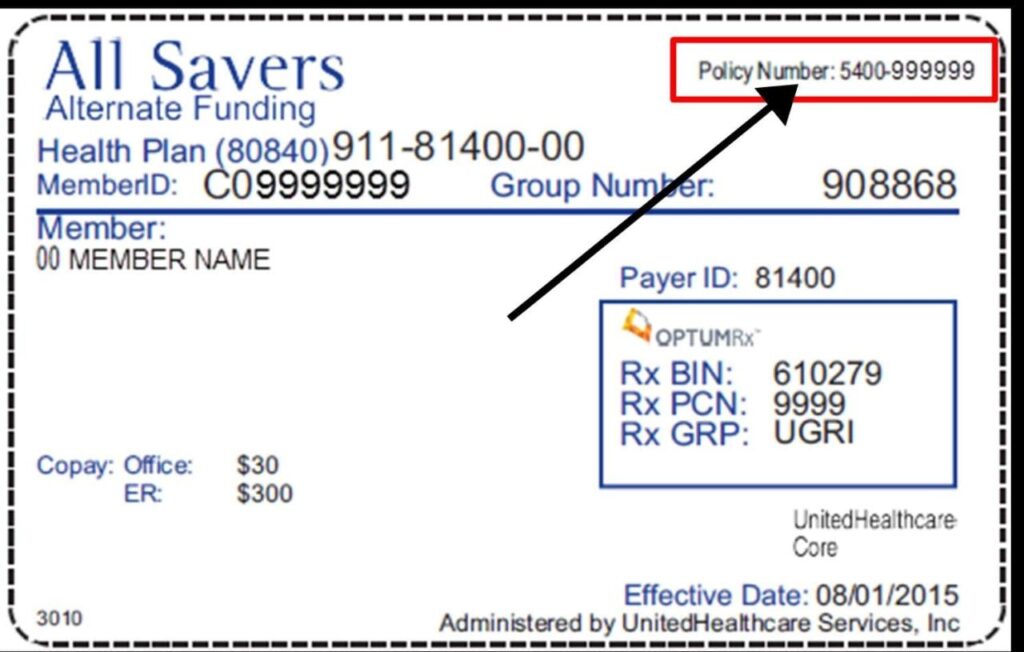

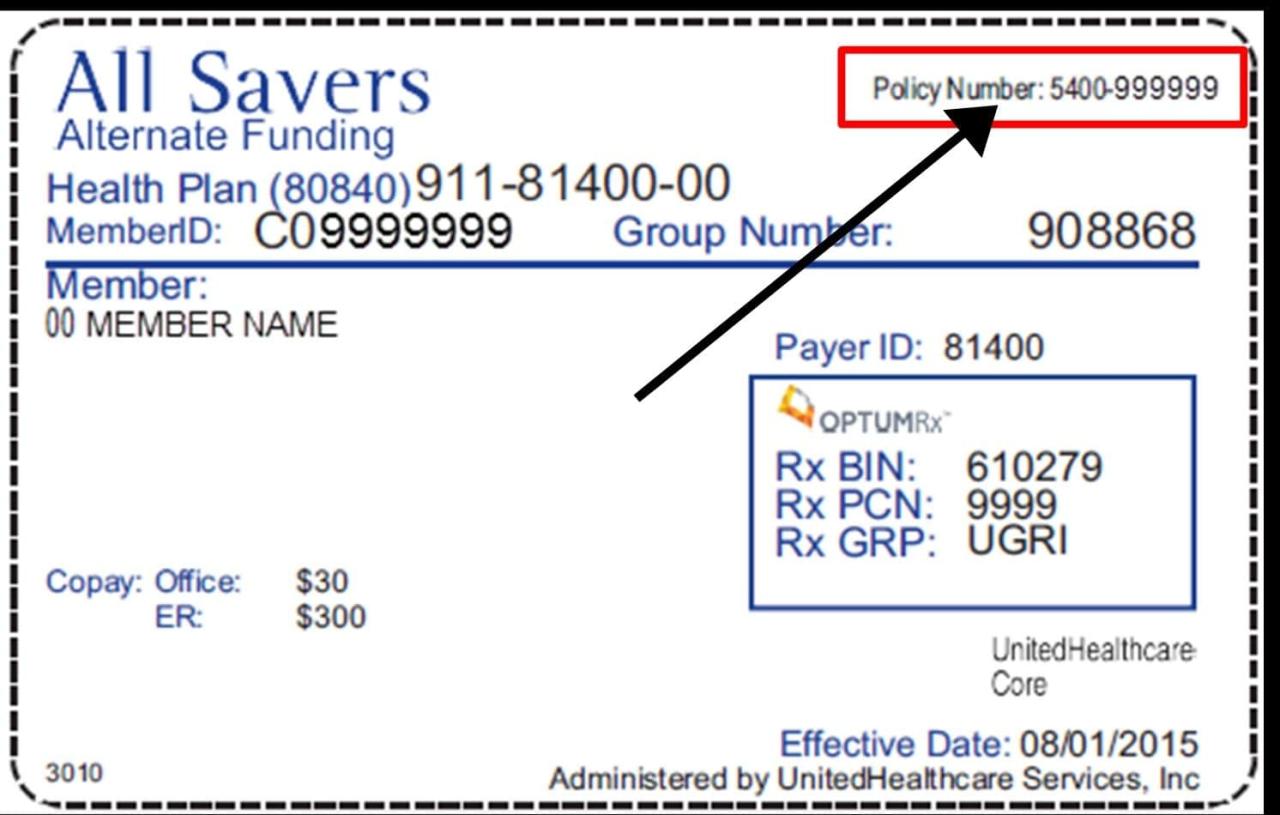

You can find your insurance policy number in several common locations:

Policy Documents

You’ll find your policy number printed prominently on your insurance policy documents. These documents may include:

- Your original insurance policy booklet

- Renewal notices

- Policy summaries

- Claim forms

Insurance Company Websites

Most insurance companies provide online portals where you can access your policy information. You’ll usually need to create an account or log in using your existing credentials. Once logged in, you can typically find your policy number under the “My Account” or “Policy Information” section.

Mobile Apps

Many insurance companies have mobile apps that allow you to manage your policies on the go. These apps often provide a convenient way to access your policy number. Look for a section labeled “Policy Information” or “My Policies.”

Contacting Your Insurance Company

If you’ve lost or forgotten your policy number, you can contact your insurance company directly. They can usually retrieve your policy number using your personal information, such as your name, address, and date of birth.

Role in Insurance Transactions

Policy numbers are crucial for navigating the intricate world of insurance transactions. They serve as unique identifiers, enabling efficient communication and record-keeping throughout the insurance lifecycle.

Importance in Premium Payments

Policy numbers play a pivotal role in premium payments. They ensure that payments are accurately allocated to the correct policyholder. When making a premium payment, the policyholder is required to provide their policy number. This allows the insurance company to identify the policy and process the payment accordingly.

- Payment Processing: Policy numbers are essential for accurate and efficient payment processing. They allow insurance companies to track premium payments, identify overdue payments, and manage customer accounts effectively.

- Payment Records: Policy numbers ensure accurate record-keeping of premium payments. This is crucial for maintaining a clear history of payments, resolving any disputes, and complying with regulatory requirements.

- Automated Systems: Many insurance companies utilize automated systems for premium payment processing. Policy numbers are essential for these systems to identify the correct policy and process payments efficiently.

Importance in Claims Submissions

Policy numbers are equally important in claims submissions. They connect the claim to the correct policy and policyholder, enabling the insurance company to assess coverage, process the claim, and issue any payments.

- Claim Identification: Policy numbers help identify the specific policy associated with a claim. This allows the insurance company to verify coverage, determine the applicable terms and conditions, and assess the claim based on the policy details.

- Claim Processing: Policy numbers are essential for efficient claim processing. They allow insurance companies to track the claim, communicate with the policyholder, and manage the claim process effectively.

- Claim Payment: Policy numbers are crucial for ensuring that claim payments are made to the correct policyholder. They help prevent fraud and ensure that funds are disbursed appropriately.

Role in Policy Renewals and Cancellations

Policy numbers are indispensable for managing policy renewals and cancellations. They enable insurance companies to identify the policy and process the renewal or cancellation request accurately.

- Renewal Process: Policy numbers are used to track policy renewal dates, process renewal payments, and issue renewal notices. This ensures that policies are renewed on time and that coverage remains in effect.

- Cancellation Process: Policy numbers are essential for processing policy cancellations. They allow insurance companies to identify the policy, process the cancellation request, and issue any refunds or outstanding balances.

- Policy History: Policy numbers provide a comprehensive record of policy renewals and cancellations. This information is valuable for understanding policyholder behavior, managing risk, and making informed business decisions.

Legal and Regulatory Aspects

Insurance policy numbers are not just arbitrary strings of characters; they are crucial components of the insurance ecosystem, subject to legal and regulatory frameworks. These frameworks ensure transparency, accountability, and consumer protection within the insurance industry.

Compliance and Reporting

Insurance policy numbers play a vital role in compliance and reporting requirements. They serve as unique identifiers for individual policies, enabling regulators and insurance companies to track and manage policies effectively.

- Policy Data Management: Policy numbers are essential for maintaining accurate and up-to-date policy records. They facilitate the efficient storage, retrieval, and management of policy data, including policyholder information, coverage details, and premium payments.

- Regulatory Reporting: Insurance companies are required to submit regular reports to regulatory bodies, such as state insurance departments. Policy numbers are used to aggregate and analyze policy data for these reports, providing insights into market trends, risk profiles, and compliance with regulations.

- Fraud Detection: Policy numbers are crucial for detecting and preventing insurance fraud. By linking policy numbers to specific policyholders and claims, insurers can identify patterns of fraudulent activity and take appropriate action.

Examples of Regulations

Numerous regulations govern the use of insurance policy numbers, ensuring their consistency, accuracy, and effectiveness.

- National Association of Insurance Commissioners (NAIC): The NAIC, a non-governmental organization, develops model laws and regulations for the insurance industry. These models often include provisions related to policy numbers, such as standardized formats and data elements.

- State Insurance Departments: Each state has its own insurance department responsible for regulating the insurance industry within its jurisdiction. These departments often have specific regulations regarding policy numbers, including requirements for issuance, format, and reporting.

- Federal Regulations: While federal regulations are less specific to policy numbers, laws like the Gramm-Leach-Bliley Act (GLBA) and the Health Insurance Portability and Accountability Act (HIPAA) address data privacy and security, which have implications for the handling and protection of policy numbers.

Industry Best Practices

Industry best practices for managing and using insurance policy numbers aim to ensure accuracy, consistency, and efficiency in policy administration. By adhering to these practices, insurance companies can minimize errors, streamline processes, and enhance customer satisfaction.

Consistency and Accuracy in Recording Policy Numbers

Maintaining consistency and accuracy in recording policy numbers is crucial for effective policy management. Inconsistent or inaccurate recording can lead to errors in policy identification, premium calculation, and claims processing, ultimately impacting customer experience and financial stability.

- Standardized Data Entry: Implement standardized data entry procedures across all departments and systems to ensure consistency in recording policy numbers. This includes using consistent formats, character limitations, and validation rules to minimize errors.

- Regular Data Validation: Conduct regular data validation checks to identify and correct any inconsistencies or errors in recorded policy numbers. This can be achieved through automated data quality checks or manual reviews.

- Data Integrity Monitoring: Establish robust data integrity monitoring systems to track and analyze the frequency and nature of errors in policy number recording. This helps identify areas for improvement and prevent future errors.

Optimizing Policy Number Management Processes

Optimizing policy number management processes involves streamlining workflows, leveraging technology, and implementing best practices to enhance efficiency and accuracy.

- Centralized Policy Number Database: Implement a centralized database to store and manage all policy numbers. This ensures a single source of truth for policy information and facilitates efficient data retrieval and analysis.

- Automated Policy Number Generation: Leverage automated policy number generation systems to reduce manual errors and ensure unique and consistent policy numbers. These systems can incorporate rules and validation checks to prevent duplicates or invalid numbers.

- Integration with Other Systems: Integrate the policy number management system with other core insurance systems, such as claims, billing, and underwriting, to ensure seamless data flow and eliminate the need for manual data entry.

- Regular Audits and Reviews: Conduct regular audits and reviews of policy number management processes to identify areas for improvement and ensure compliance with industry best practices.

Closing Summary: Insurance Policy Number

Understanding your insurance policy number is essential for navigating the world of insurance. By safeguarding this vital information and knowing how to access it, you can ensure smooth and efficient interactions with your insurer. Remember, your policy number is your key to accessing your coverage, so treat it with care and keep it readily available.

Your insurance policy number is a vital piece of information to keep safe and readily accessible. If you’re insured with the golden rule insurance company , you can find your policy number on your insurance card or by logging into your online account.

Having your policy number readily available can make filing claims and managing your policy much easier.