Medicare insurance plans are a crucial part of healthcare for individuals aged 65 and older, as well as those with certain disabilities. Navigating the complexities of Medicare can be daunting, with numerous plans and options available. This comprehensive guide aims to provide a clear understanding of Medicare’s different parts, enrollment processes, and cost considerations, empowering you to make informed decisions about your health insurance.

From the basics of Medicare Part A and Part B to the intricacies of Medicare Advantage and Medigap plans, this guide covers all aspects of Medicare insurance. We’ll delve into the benefits, limitations, and costs associated with each plan, helping you determine the best fit for your individual needs. Understanding Medicare is essential for ensuring you receive the coverage you deserve, so let’s embark on this journey together.

Medicare Basics

Medicare is a federal health insurance program for people 65 and older, as well as certain younger individuals with disabilities. It provides coverage for a wide range of medical expenses, including hospital stays, doctor visits, and prescription drugs.

Medicare Parts

Medicare consists of four main parts: Part A, Part B, Part C, and Part D. Each part covers different services, and you can choose the parts that best fit your needs and budget.

- Part A (Hospital Insurance): This part covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care. It is generally free for most people who have worked and paid Medicare taxes for at least 10 years.

- Part B (Medical Insurance): This part covers doctor visits, outpatient care, preventive services, and medical equipment. You pay a monthly premium for Part B, which is deducted from your Social Security benefits or billed directly to you.

- Part C (Medicare Advantage): This is a private health insurance plan that is offered by private insurance companies and approved by Medicare. Medicare Advantage plans offer a range of benefits, including coverage for prescription drugs, vision, dental, and hearing. You pay a monthly premium for a Medicare Advantage plan, which is typically higher than the premium for Part B.

- Part D (Prescription Drug Coverage): This part covers prescription drugs. You pay a monthly premium for Part D, as well as copays and deductibles.

Medicare Eligibility

To be eligible for Medicare, you must meet one of the following requirements:

- Be 65 years of age or older.

- Be under 65 and have a qualifying disability.

- Be under 65 and have End-Stage Renal Disease (ESRD).

- Be under 65 and have Amyotrophic Lateral Sclerosis (ALS).

Key Benefits Covered by Each Medicare Part

- Part A: Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B: Covers doctor visits, outpatient care, preventive services, and medical equipment.

- Part C: Offers a range of benefits, including coverage for prescription drugs, vision, dental, and hearing.

- Part D: Covers prescription drugs.

Medicare Supplement Plans (Medigap)

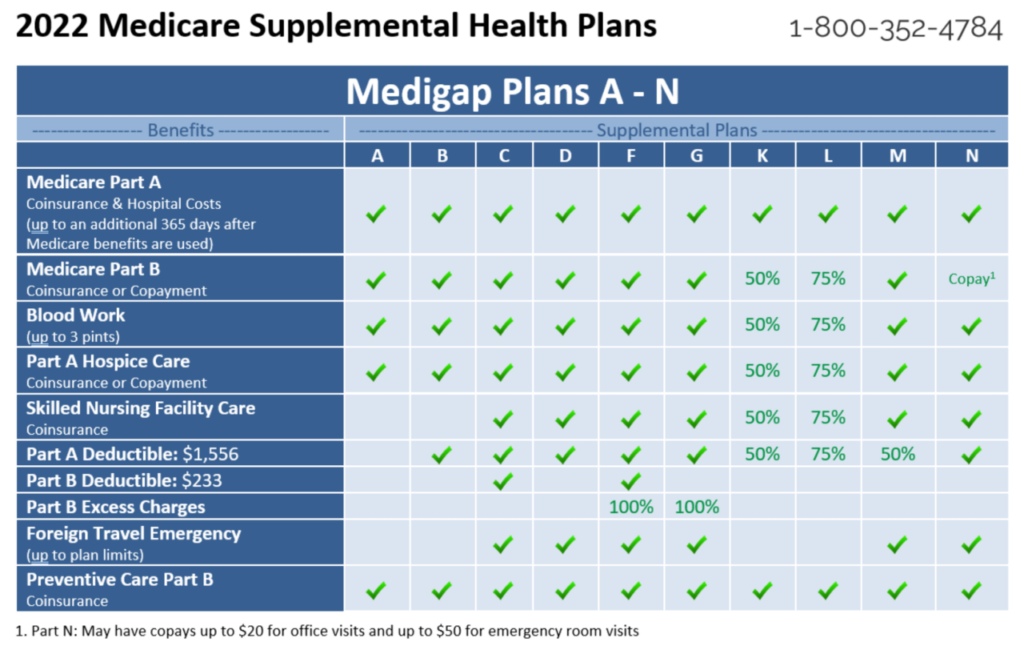

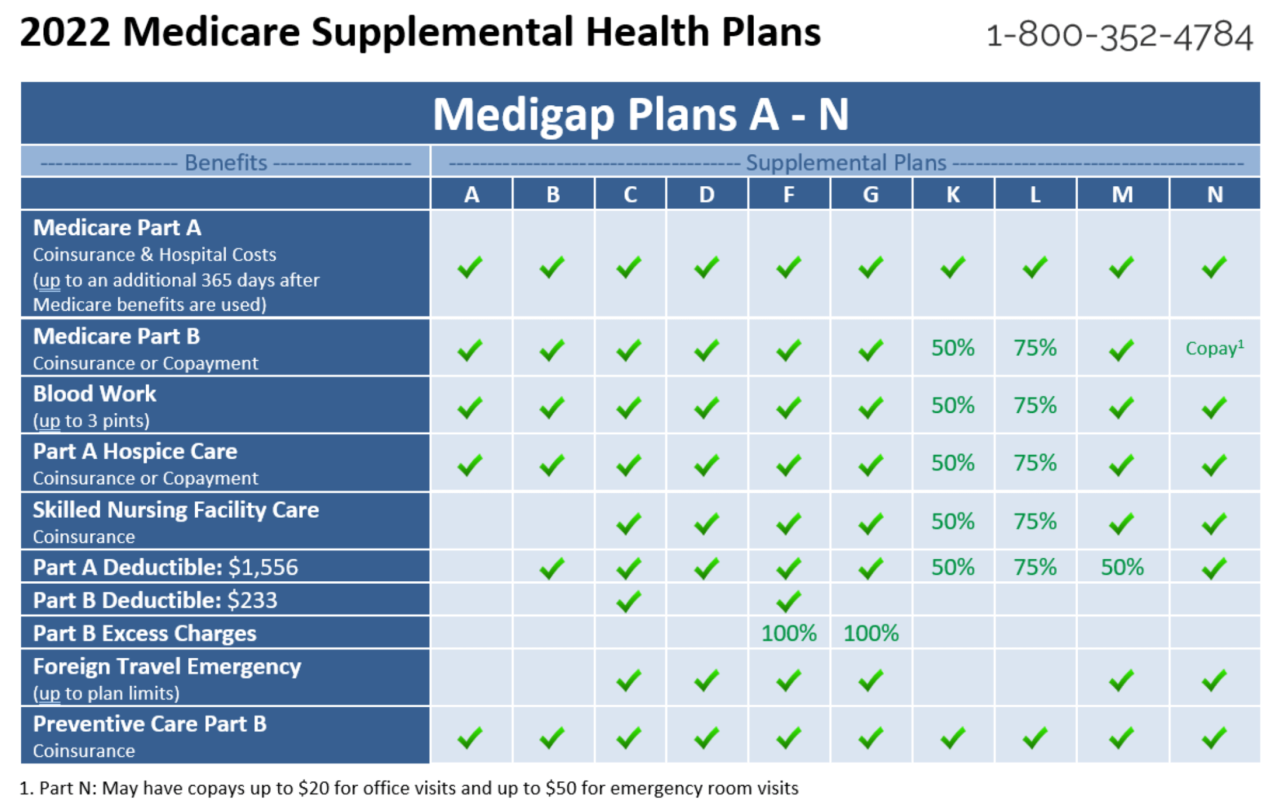

Medicare Supplement Plans, also known as Medigap plans, are private insurance plans that help pay for out-of-pocket costs associated with Original Medicare (Part A and Part B). They are designed to help fill in the gaps in coverage that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copayments.

Medigap plans work by paying a portion or all of these out-of-pocket costs, depending on the specific plan you choose. This can help protect you from high medical bills and give you peace of mind knowing that your costs will be covered.

Medigap Plan Options

Medigap plans are standardized by the federal government, meaning that each plan letter (A through N) offers the same benefits nationwide. However, the specific coverage and costs can vary from one insurance company to another.

- Plan A: This is the most basic Medigap plan and offers the least coverage. It covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges.

- Plan B: This plan offers more coverage than Plan A and covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges, as well as foreign travel emergency coverage.

- Plan C: This plan offers the most comprehensive coverage of all the Medigap plans and covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges, as well as foreign travel emergency coverage, skilled nursing facility coinsurance, and other benefits.

- Plan D: This plan is similar to Plan C but does not cover foreign travel emergency coverage.

- Plan F: This plan offers the most comprehensive coverage of all the Medigap plans and covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges, as well as foreign travel emergency coverage, skilled nursing facility coinsurance, and other benefits. However, this plan is no longer available to new enrollees.

- Plan G: This plan is similar to Plan F but does not cover the Medicare Part B deductible.

- Plan K: This plan offers a high deductible and covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges, as well as foreign travel emergency coverage. However, you will need to pay the deductible before the plan begins to pay benefits.

- Plan L: This plan is similar to Plan K but does not cover foreign travel emergency coverage.

- Plan M: This plan offers a high deductible and covers the Medicare Part A deductible, Part B coinsurance, and Part B excess charges, as well as foreign travel emergency coverage. However, you will need to pay the deductible before the plan begins to pay benefits. This plan also does not cover the first three pints of blood.

- Plan N: This plan is similar to Plan M but does not cover foreign travel emergency coverage.

Factors to Consider When Choosing a Medigap Plan

Choosing the right Medigap plan is important, as it can affect your out-of-pocket costs. Here are some factors to consider:

- Your health status: If you have a pre-existing condition, you may want to choose a Medigap plan that offers more comprehensive coverage.

- Your budget: Medigap plans can be expensive, so it’s important to choose a plan that you can afford.

- Your coverage needs: Consider your individual needs and how much coverage you need.

- The insurance company: Not all insurance companies are created equal. Research different companies to find one that offers competitive rates and good customer service.

Additional Information

Medigap plans are not available to everyone. You must be enrolled in Original Medicare (Part A and Part B) to be eligible for a Medigap plan. You also cannot purchase a Medigap plan if you are enrolled in Medicare Advantage.

It’s important to note that Medigap plans are not the same as Medicare Advantage plans. Medicare Advantage plans are managed care plans that offer coverage for both medical and prescription drug expenses. Medigap plans, on the other hand, are supplemental insurance plans that help pay for out-of-pocket costs associated with Original Medicare.

Medicare Prescription Drug Coverage (Part D): Medicare Insurance Plans

Medicare Part D is a voluntary program that helps cover the cost of prescription drugs. It is offered by private insurance companies that have contracts with Medicare. Part D plans are available to anyone enrolled in Original Medicare (Parts A and B) or a Medicare Advantage plan.

Types of Medicare Part D Plans

Medicare Part D plans can vary in terms of their coverage, premiums, and formularies. Here’s a breakdown of the main types of Part D plans:

- Stand-Alone Prescription Drug Plans: These plans only cover prescription drugs. They are separate from Original Medicare and Medicare Advantage plans.

- Medicare Advantage Prescription Drug Plans: These plans combine Medicare Part A, Part B, and Part D coverage into one plan.

Enrolling in a Medicare Part D Plan

There are a few ways to enroll in a Medicare Part D plan:

- Initial Enrollment Period: This period is for people who are new to Medicare. It starts three months before your 65th birthday, includes your birthday month, and ends three months after your birthday.

- Open Enrollment Period: This period runs from January 1st to March 31st each year. During this time, you can switch between Part D plans or join a plan for the first time.

- Special Enrollment Period: You may qualify for a special enrollment period if you have certain life changes, such as moving to a new area or losing your current Part D coverage.

Comparing Part D Plans

When choosing a Part D plan, it’s important to compare different plans based on factors such as:

- Formulary: This is a list of prescription drugs covered by the plan. It’s important to make sure that your medications are on the formulary.

- Premiums: These are monthly costs you pay for the plan.

- Copayments: These are fixed amounts you pay for each prescription.

- Deductibles: This is the amount you pay out-of-pocket before the plan starts paying for your prescriptions.

Key Features of Different Part D Plans

Here’s a table comparing key features of different Part D plans:

| Plan Type | Formulary | Premiums | Copayments | Deductibles |

|---|---|---|---|---|

| Stand-Alone Prescription Drug Plan | Varies by plan | Varies by plan | Varies by plan | Varies by plan |

| Medicare Advantage Prescription Drug Plan | Varies by plan | Varies by plan | Varies by plan | Varies by plan |

Cost Considerations

Understanding the costs associated with Medicare plans is crucial for making informed decisions about your health insurance coverage. There are several factors that influence the cost of Medicare plans, including premiums, deductibles, and copayments.

Premiums

Medicare premiums are monthly payments you make for your health insurance coverage. The amount you pay depends on your income, the type of Medicare plan you choose, and whether you have other health insurance coverage.

- Original Medicare (Part A and Part B): Premiums for Part A are typically free for most people who have worked and paid Medicare taxes for at least 10 years. However, there are some situations where you may have to pay a premium. For example, if you have not worked long enough to qualify for premium-free Part A, you will have to pay a premium. Part B premiums are based on your income, and they can vary significantly from person to person.

- Medicare Advantage (Part C): Premiums for Medicare Advantage plans vary by plan and location. Some plans may have lower premiums than Original Medicare, while others may have higher premiums.

- Medicare Prescription Drug Coverage (Part D): Premiums for Part D plans vary by plan and location. You can choose a plan with a lower premium, but it may have a higher deductible or copayments.

Deductibles

Medicare deductibles are the amount you pay out-of-pocket before Medicare starts covering your medical expenses. Deductibles can vary by plan and type of service.

- Original Medicare (Part A): There is a deductible for inpatient hospital stays. The deductible is the amount you pay for the first few days of your hospital stay.

- Original Medicare (Part B): There is a deductible for outpatient services. The deductible is the amount you pay for the first part of your outpatient medical expenses.

- Medicare Advantage (Part C): Deductibles for Medicare Advantage plans vary by plan. Some plans may have lower deductibles than Original Medicare, while others may have higher deductibles.

- Medicare Prescription Drug Coverage (Part D): There is a deductible for prescription drugs. The deductible is the amount you pay for your prescription drugs before Medicare starts covering your costs.

Copayments, Medicare insurance plans

Medicare copayments are the fixed amount you pay for covered services. Copayments can vary by plan and type of service.

- Original Medicare (Part A): There are copayments for inpatient hospital stays after you meet the deductible.

- Original Medicare (Part B): There are copayments for outpatient services, such as doctor visits and medical tests.

- Medicare Advantage (Part C): Copayments for Medicare Advantage plans vary by plan. Some plans may have lower copayments than Original Medicare, while others may have higher copayments.

- Medicare Prescription Drug Coverage (Part D): There are copayments for prescription drugs. The copayment is the amount you pay for each prescription you fill.

Factors That Influence Medicare Plan Costs

Several factors can influence the cost of Medicare plans, including:

- Your income: Your income can affect your Part B premium.

- Your location: The cost of Medicare plans can vary by location.

- Your health status: If you have a chronic health condition, you may need to choose a plan with higher premiums or deductibles to cover your medical expenses.

- Your drug needs: If you take a lot of prescription drugs, you will need to choose a Part D plan that covers your medications.

Common Medicare Plan Expenses

Here are some common Medicare plan expenses you should be aware of:

- Premiums: As mentioned above, premiums are monthly payments you make for your health insurance coverage.

- Deductibles: Deductibles are the amount you pay out-of-pocket before Medicare starts covering your medical expenses.

- Copayments: Copayments are fixed amounts you pay for covered services.

- Out-of-pocket maximum: The out-of-pocket maximum is the most you will have to pay for covered services in a year. Once you reach the out-of-pocket maximum, Medicare will cover 100% of your covered medical expenses for the rest of the year.

Final Summary

Choosing the right Medicare plan is a significant decision that can impact your health and finances for years to come. By carefully evaluating your needs, exploring the available options, and seeking professional guidance when necessary, you can navigate the Medicare landscape confidently. Remember, your health is paramount, and having the right Medicare coverage can provide peace of mind and ensure access to quality healthcare.

Medicare insurance plans can be a great way to save money on healthcare, but they can also be confusing to navigate. If you’re looking for a way to save money on your car insurance, consider checking out cheap insurance car near me.

Once you’ve found a good deal on your car insurance, you can focus on finding the right Medicare plan for your needs.