NJ Auto Insurance plays a crucial role in safeguarding drivers and ensuring financial protection in the event of an accident. This guide delves into the complexities of New Jersey’s auto insurance landscape, providing valuable insights for both seasoned and new drivers.

From understanding mandatory coverages and factors influencing premiums to navigating the claims process and exploring future trends, this comprehensive resource empowers you to make informed decisions about your auto insurance needs.

Understanding New Jersey Auto Insurance: Nj Auto Insurance

Navigating the world of auto insurance in New Jersey can be a bit overwhelming, especially with the unique regulations and requirements specific to the state. Understanding the ins and outs of New Jersey auto insurance is crucial to ensure you have adequate coverage and are paying a fair premium. This guide will delve into the distinctive features of New Jersey auto insurance, shedding light on the mandatory coverages and the factors influencing your insurance costs.

Mandatory Coverages in New Jersey

New Jersey law mandates specific auto insurance coverages to protect drivers and their passengers. Understanding these requirements is crucial for all motorists in the state.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage. New Jersey requires a minimum of $15,000 per person and $30,000 per accident for bodily injury liability and $5,000 for property damage liability.

- Personal Injury Protection (PIP): This coverage provides medical benefits for you and your passengers, regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related costs. New Jersey requires a minimum of $15,000 in PIP coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage. New Jersey requires UM/UIM coverage with limits equal to your liability coverage.

Factors Influencing Insurance Premiums

Your auto insurance premiums in New Jersey are determined by various factors. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving History: Your driving record is a significant factor in determining your premium. Accidents, traffic violations, and DUI convictions can significantly increase your rates. Maintaining a clean driving record is crucial for keeping your premiums affordable.

- Vehicle Type: The type of vehicle you drive plays a role in your insurance cost. Higher-performance cars or luxury vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Age and Gender: Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. Gender can also be a factor, as statistics show that young men are more likely to be involved in accidents than young women.

- Location: Where you live can impact your insurance rates. Areas with high crime rates or heavy traffic congestion tend to have higher insurance premiums.

- Credit Score: In some states, including New Jersey, insurers may use your credit score as a factor in determining your premiums. A good credit score can potentially lead to lower rates.

- Discounts: Many insurance companies offer discounts for various factors, such as safe driving, good student status, multi-car policies, and anti-theft devices. Taking advantage of these discounts can significantly reduce your premiums.

Finding the Right Auto Insurance Policy

Finding the right auto insurance policy in New Jersey is crucial for protecting yourself financially in case of an accident. With so many different providers and policy options available, it can be overwhelming to navigate the process. Understanding your needs, comparing quotes, and negotiating for the best rates are essential steps to secure affordable and comprehensive coverage.

Factors to Consider When Choosing an Auto Insurance Policy

Choosing the right auto insurance policy involves considering various factors that directly impact your premiums and coverage. These factors are crucial in determining the level of protection and financial security you need.

- Your Driving History: Your driving record plays a significant role in determining your insurance premiums. A clean driving record with no accidents or violations will result in lower premiums compared to drivers with a history of accidents, speeding tickets, or DUI convictions.

- Your Vehicle: The make, model, and year of your vehicle influence your insurance premiums. Newer, more expensive vehicles typically have higher insurance premiums due to their greater repair costs and potential for theft.

- Your Coverage Needs: Assess your specific coverage needs based on your financial situation and risk tolerance. Consider factors like the value of your vehicle, your driving habits, and the amount of financial protection you require.

- Your Location: Your location in New Jersey can affect your insurance premiums. Areas with higher crime rates or more traffic congestion may have higher premiums due to a greater risk of accidents or theft.

Comparing Insurance Quotes from Different Providers

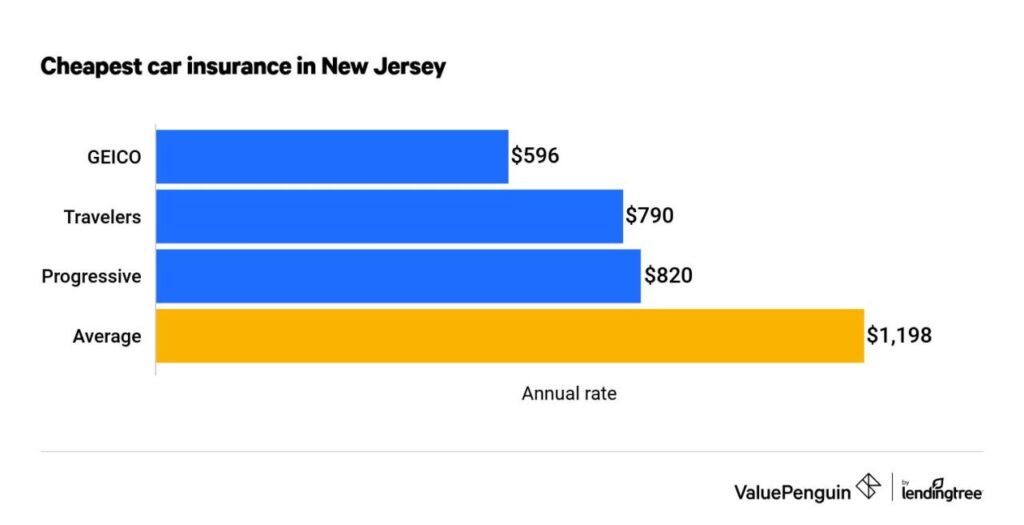

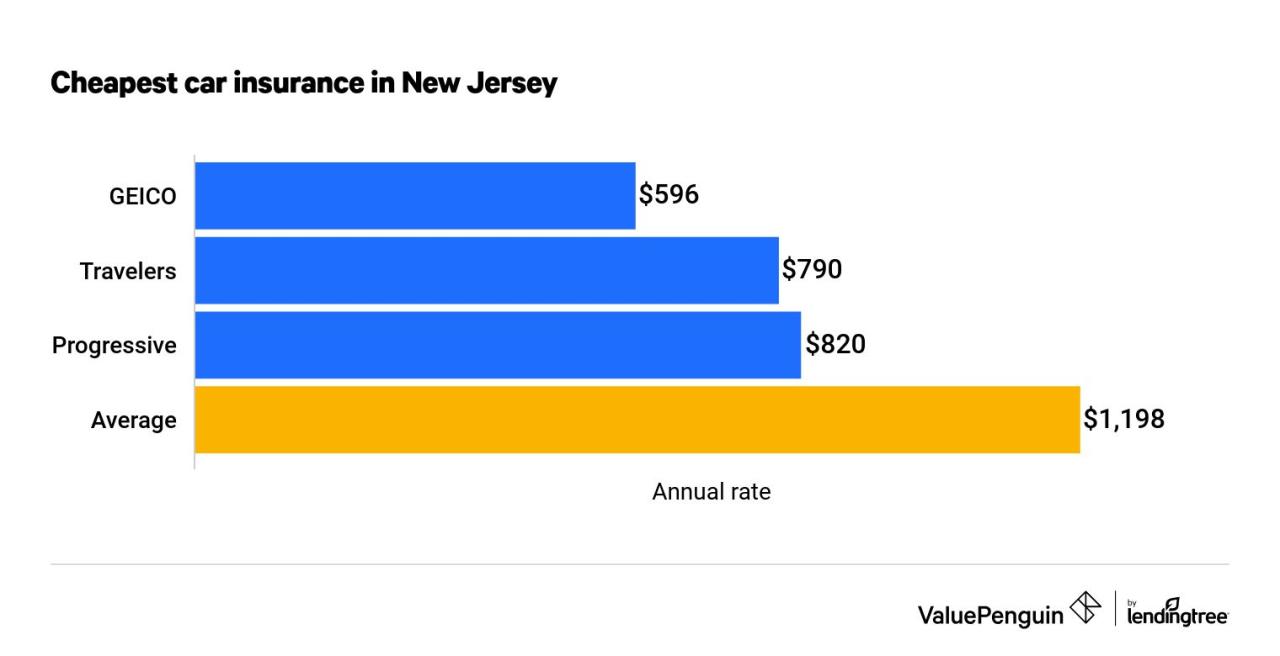

Once you’ve considered the factors mentioned above, you can start comparing insurance quotes from different providers. This process helps you find the most competitive rates and coverage options.

- Gather Information: Begin by gathering your personal information, including your driving history, vehicle details, and coverage needs. This information will be required when requesting quotes from insurance providers.

- Use Online Comparison Tools: Utilize online comparison tools that allow you to enter your information and receive quotes from multiple insurance providers simultaneously. These tools simplify the comparison process and save you time.

- Contact Insurance Providers Directly: After using online comparison tools, contact insurance providers directly to discuss your specific needs and obtain personalized quotes.

- Review and Compare Quotes: Once you’ve gathered quotes from multiple providers, carefully review them to compare premiums, coverage options, and any additional features or discounts.

Negotiating for Lower Premiums, Nj auto insurance

After comparing quotes, you can explore ways to negotiate for lower premiums.

- Bundle Your Policies: Consider bundling your auto insurance with other insurance policies, such as homeowners or renters insurance. Many insurance providers offer discounts for bundling multiple policies.

- Increase Your Deductible: Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lower your premiums.

- Ask About Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, or discounts for installing anti-theft devices.

- Shop Around Regularly: It’s beneficial to shop around for insurance quotes periodically, even if you’re satisfied with your current provider. Insurance rates can fluctuate, and you may be able to find better deals by comparing quotes.

Filing a Claim and Coverage

In New Jersey, filing an auto insurance claim is a straightforward process, but understanding the steps and necessary information is crucial. This section will guide you through the process and explain the different types of claims and coverage provided.

The Claim Process

When you’re involved in an accident, it’s essential to act quickly and accurately to ensure your claim is processed smoothly. The following steps Artikel the general process for filing an auto insurance claim in New Jersey:

- Contact Your Insurance Company: Immediately after the accident, contact your insurance company to report the incident. Provide them with the necessary details, including the date, time, and location of the accident, as well as the names and contact information of all parties involved.

- File a Claim: Your insurance company will provide you with the necessary forms to file a claim. Complete the forms accurately and thoroughly, including information about the accident, your vehicle, and any injuries sustained.

- Provide Documentation: Your insurance company will likely request supporting documentation, such as a police report, medical records, and repair estimates. Gather and submit these documents promptly.

- Claim Review: Your insurance company will review your claim and assess the coverage and benefits you are entitled to. This may involve an inspection of your vehicle and communication with the other parties involved.

- Claim Settlement: Once your claim is reviewed and approved, your insurance company will settle the claim. This could involve paying for repairs, medical expenses, or other related costs.

Information Needed for a Claim

To ensure your claim is processed efficiently, you should have the following information readily available:

- Policy Information: Your insurance policy number and contact information for your insurance agent.

- Accident Details: Date, time, location, and a description of the accident.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), and license plate number.

- Driver Information: Your name, address, driver’s license number, and contact information.

- Passenger Information: Names and contact information of any passengers in your vehicle.

- Other Party Information: Names, addresses, driver’s license numbers, and contact information of the other parties involved in the accident.

- Witness Information: Names and contact information of any witnesses to the accident.

- Police Report Number: If a police report was filed, obtain a copy and provide the report number to your insurance company.

- Medical Records: If you sustained injuries, gather and submit medical records to your insurance company.

- Repair Estimates: Obtain repair estimates from reputable repair shops and provide them to your insurance company.

Types of Claims and Coverage

New Jersey auto insurance policies typically provide coverage for various types of claims, including:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It covers the other party’s medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This coverage provides medical and rehabilitation benefits for you and your passengers, regardless of fault, in the event of an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured by an uninsured or underinsured driver.

Claim Denial

While insurance companies strive to resolve claims fairly and efficiently, there are instances where a claim may be denied. Here are some common reasons for claim denials:

- Failure to Meet Policy Requirements: If your claim does not meet the specific requirements Artikeld in your insurance policy, it may be denied.

- Fraudulent Claim: If your claim is found to be fraudulent, it will be denied.

- Pre-existing Condition: If the damage or injury was caused by a pre-existing condition, your claim may be denied.

- Failure to Cooperate: If you fail to cooperate with your insurance company’s investigation, your claim may be denied.

Special Considerations

Not everyone has the same insurance needs. Certain situations require special considerations to ensure you have the right coverage. This section will discuss unique insurance needs for high-risk drivers, classic car owners, and those affected by driving under the influence.

High-Risk Drivers

Drivers with a history of accidents or violations are considered high-risk. This can significantly impact their insurance premiums. Insurance companies assess your driving history and assign a risk score, which determines your premium. High-risk drivers may face:

- Higher premiums

- Limited coverage options

- Potential denial of coverage

However, there are ways for high-risk drivers to manage their insurance costs:

- Improve Driving Record: Avoid traffic violations and accidents to improve your risk score over time.

- Defensive Driving Course: Completing a certified defensive driving course can demonstrate a commitment to safe driving and potentially lower your premium.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Consider a High-Risk Insurance Provider: Some insurers specialize in covering high-risk drivers, offering more competitive rates.

Classic Car Insurance

Classic cars are often considered collector’s items and require specialized insurance policies. These policies address the unique needs of classic car owners, including:

- Agreed Value Coverage: This coverage sets a predetermined value for your classic car, ensuring you receive the full amount in case of a total loss, regardless of the car’s market value at the time.

- Limited Mileage Coverage: Classic cars are often driven less frequently, so policies may offer lower premiums for reduced mileage.

- Specialized Coverage: Classic car insurance policies may include additional coverage for things like restoration costs, spare parts, and transportation to specialized repair facilities.

Classic car owners should consider the following:

- Appraisal: Get a professional appraisal to determine the agreed value for your car.

- Storage: Secure storage can help lower your premium by reducing the risk of damage.

- Specialized Insurers: Look for insurers specializing in classic car insurance for better coverage options and rates.

Driving Under the Influence (DUI)

Driving under the influence (DUI) has a significant impact on insurance premiums. A DUI conviction can lead to:

- Higher Premiums: Insurance companies consider DUI a major risk factor, leading to substantial premium increases.

- Limited Coverage Options: Some insurers may refuse to cover drivers with DUI convictions.

- SR-22 Filing Requirement: Many states require drivers with DUI convictions to file an SR-22 form, which proves financial responsibility.

The impact of a DUI on your insurance rates depends on factors like the severity of the offense, your driving history, and the state you live in. The best way to mitigate the impact of a DUI is to avoid driving under the influence altogether.

End of Discussion

As you navigate the world of NJ auto insurance, remember that knowledge is power. By understanding the nuances of coverage options, discounts, and regulations, you can secure the best possible protection at a price that fits your budget. Embrace the information provided in this guide, and drive with confidence, knowing you’re well-equipped to handle any situation that may arise.

Navigating New Jersey’s auto insurance landscape can be a bit of a maze, but it’s important to find the right coverage to protect yourself and your vehicle. While you’re focusing on your car insurance, it’s also a good time to consider your health insurance needs, as it’s equally crucial for your well-being.

You can find valuable information on how to get health insurance here , which can help you make informed decisions about your health coverage. Once you’ve secured the right auto and health insurance, you can drive with confidence knowing you’re protected on the road and in life.