NJ car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance in New Jersey can be a daunting task, but understanding the basics is essential for every driver. From mandatory coverage requirements to finding the best rates, this comprehensive guide provides all the information you need to make informed decisions about your car insurance.

This guide explores the intricacies of NJ car insurance, covering everything from understanding the different types of coverage available to finding the best deals and maximizing discounts. We’ll also delve into factors that influence insurance premiums, including driving history, age, and vehicle type, and provide practical tips for saving money on your car insurance. Whether you’re a seasoned driver or a new car owner, this guide will empower you with the knowledge to make informed decisions and protect yourself on the road.

Understanding NJ Car Insurance Basics

Navigating the world of car insurance in New Jersey can seem daunting, but understanding the basics can make the process much smoother. This guide will provide a comprehensive overview of the mandatory car insurance requirements, different types of coverage, and factors that influence your premiums.

Mandatory Car Insurance Coverage Requirements

New Jersey law mandates that all drivers carry specific car insurance coverage to protect themselves and others on the road. These requirements ensure financial responsibility in case of an accident.

- Liability Coverage: This coverage is crucial and protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the other party’s medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage, often called “no-fault” insurance, provides medical benefits for you and your passengers, regardless of who caused the accident. It covers medical expenses, lost wages, and other related costs.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage safeguards you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and property damage.

Types of Car Insurance Coverage

While the mandatory coverages are essential, you can choose to add optional coverage based on your individual needs and risk tolerance.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. It is often a good idea if you have a newer car or a loan on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It is often included in your car loan agreement.

- Rental Reimbursement: This coverage provides reimbursement for rental car expenses if your vehicle is damaged or stolen and is being repaired or replaced.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, and jump starts.

Factors Influencing Car Insurance Premiums

Several factors determine your car insurance premium in New Jersey. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly influences your premium. A clean driving record often leads to lower premiums.

- Age and Gender: Younger drivers, particularly those under 25, generally pay higher premiums due to higher risk factors. Gender can also play a role, with statistics suggesting men tend to have higher accident rates.

- Vehicle Type and Value: The type, make, model, and value of your vehicle can impact your premium. Sports cars and luxury vehicles are often associated with higher risk and therefore higher premiums.

- Location: Where you live can affect your premium. Areas with higher accident rates or crime rates may have higher insurance premiums.

- Credit Score: In New Jersey, insurance companies can consider your credit score when determining your premium. A good credit score often leads to lower premiums.

Filing a Car Insurance Claim in NJ: Nj Car Insurance

Filing a car insurance claim in NJ can be a stressful experience, but understanding the process can help make it smoother. Here’s a breakdown of the steps involved, along with tips for gathering the necessary documentation and navigating interactions with insurance adjusters.

Steps Involved in Filing a Claim

Following a car accident, you need to take specific steps to file a claim with your insurance company. This ensures you receive the necessary coverage and benefits to cover your losses.

- Contact Your Insurance Company: The first step is to notify your insurance company about the accident. This can usually be done through a phone call, online portal, or mobile app. Provide them with the details of the accident, including the date, time, location, and any injuries involved.

- File a Police Report: If the accident involved injuries, property damage, or a hit-and-run, you’ll need to file a police report. This document serves as official documentation of the accident, which can be essential for your insurance claim.

- Gather Documentation: After the accident, it’s crucial to gather all relevant documentation, including:

- Police report: This document provides a detailed account of the accident, including the parties involved, the cause of the accident, and any injuries or damages.

- Photos and videos: Take pictures and videos of the accident scene, including the damage to your vehicle, the other vehicle(s) involved, and any surrounding factors.

- Witness information: If there were any witnesses to the accident, get their names, contact information, and a brief statement about what they observed.

- Medical records: If you sustained injuries in the accident, collect copies of your medical bills and treatment records.

- Repair estimates: Get estimates from reputable repair shops for the cost of repairing your vehicle.

- Submit Your Claim: Once you’ve gathered all the necessary documentation, you can submit your claim to your insurance company. This is typically done through their online portal, mobile app, or by mail.

- Work with an Insurance Adjuster: After you file your claim, an insurance adjuster will contact you to investigate the accident and assess the damages. They will likely ask you for more information about the accident and review the documentation you’ve provided.

- Negotiate a Settlement: The insurance adjuster will review your claim and make an offer for settlement. If you agree with the offer, you can accept it and receive payment for your losses. However, if you disagree with the offer, you can negotiate with the adjuster to try to reach a more favorable settlement.

Dealing with Insurance Adjusters

Interacting with an insurance adjuster can be a crucial part of the claim process. Here are some key points to remember:

- Be Honest and Accurate: Be upfront and honest with the insurance adjuster about the accident and your losses. Providing false or misleading information can jeopardize your claim.

- Document All Communication: Keep detailed records of all your communication with the insurance adjuster, including dates, times, and summaries of conversations. This will help you keep track of the claim process and provide evidence if any disputes arise.

- Know Your Rights: Be aware of your rights as a policyholder. Your insurance company has a responsibility to handle your claim fairly and promptly. If you believe your rights are being violated, you can contact the New Jersey Department of Banking and Insurance (DOBI) for assistance.

- Don’t Settle Too Quickly: Take your time and carefully consider any settlement offer you receive. Don’t feel pressured to settle immediately. If you’re unsure about the offer, you can consult with an attorney or a claims advocate for advice.

Tips for Saving on NJ Car Insurance

Car insurance is a necessity in New Jersey, but it can be expensive. Fortunately, there are several ways to save money on your premiums. By taking advantage of these strategies, you can lower your monthly payments and keep more money in your pocket.

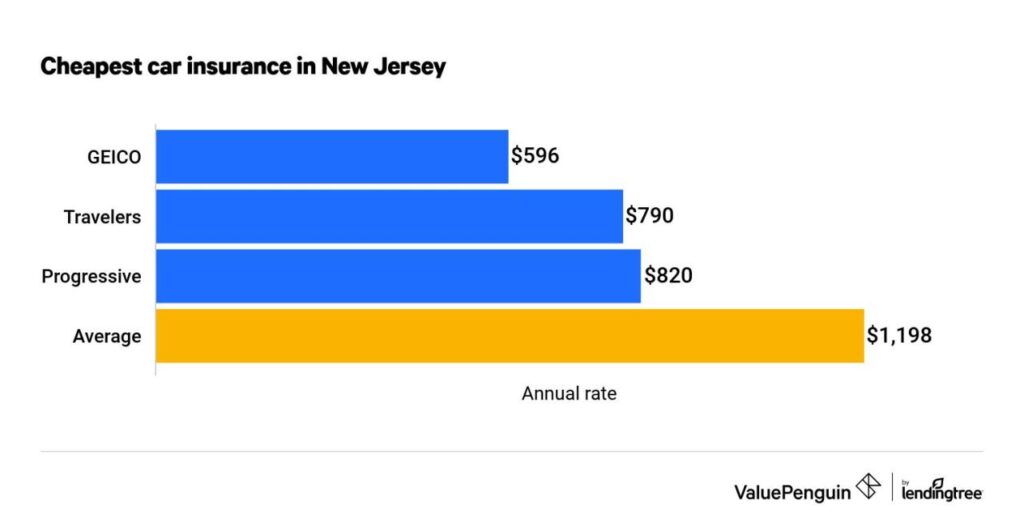

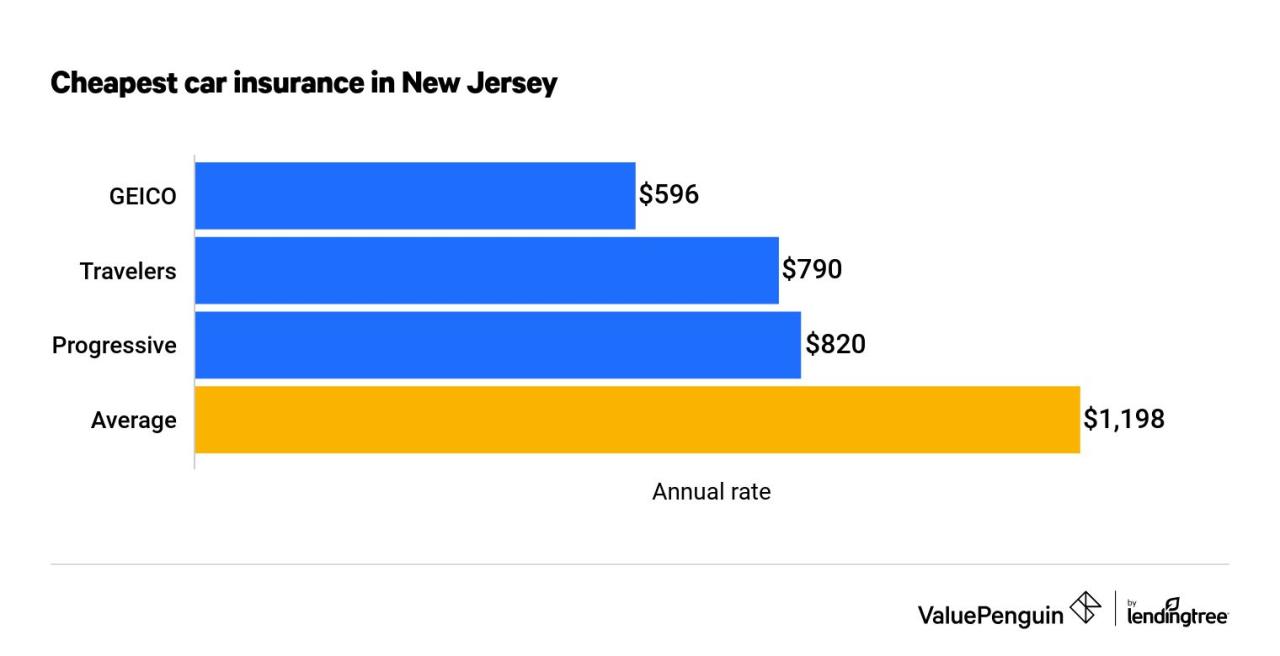

Shop Around for Quotes

It’s crucial to compare quotes from different insurance companies before settling on a policy. Every insurance provider uses its own methods for calculating premiums, so you might find a better deal elsewhere. Utilize online comparison websites or contact insurance agents directly to obtain quotes from multiple companies.

Understanding NJ’s Uninsured Motorist Coverage

Uninsured motorist coverage is a vital component of car insurance in New Jersey. It safeguards you and your passengers in the event of an accident caused by a driver without insurance or with insufficient coverage. This coverage is mandatory in New Jersey, ensuring that you have financial protection when you need it most.

Examples of When Uninsured Motorist Coverage is Crucial, Nj car insurance

Uninsured motorist coverage is essential in various scenarios where you might be involved in an accident with an uninsured or underinsured driver. Consider these examples:

- Hit-and-Run Accidents: If a driver hits your car and flees the scene, you may not be able to identify or locate the responsible party. Uninsured motorist coverage will help cover your medical expenses and vehicle repairs.

- Drivers with Lapsed Insurance: Some drivers may have allowed their insurance to lapse, leaving them without coverage. Uninsured motorist coverage protects you if you are involved in an accident with such a driver.

- Out-of-State Drivers Without Coverage: Drivers from other states may not be required to carry the same level of insurance as New Jersey drivers. If you are involved in an accident with such a driver, uninsured motorist coverage can cover your losses.

Importance of Adequate Limits for Uninsured Motorist Coverage

The minimum amount of uninsured motorist coverage required in New Jersey is the same as your liability limits. However, it’s crucial to consider increasing your coverage limits to ensure adequate protection in case of a serious accident.

For example, if your liability limits are $15,000 per person and $30,000 per accident, you may want to consider increasing your uninsured motorist coverage to $100,000 per person and $300,000 per accident.

Increasing your limits will provide you with greater financial protection if you suffer significant medical expenses or vehicle damage in an accident with an uninsured or underinsured driver.

The Future of Car Insurance in NJ

The car insurance landscape in New Jersey is constantly evolving, driven by technological advancements and changing driving habits. As we move forward, it’s crucial to understand the emerging trends that will shape the future of car insurance in the state.

Telematics and Usage-Based Insurance

Telematics technology is playing a significant role in transforming the car insurance industry. Telematics devices, such as those found in smartphones or connected car systems, can track driving behavior, including speed, braking, and mileage. This data can be used by insurance companies to create personalized insurance premiums based on individual driving habits.

- Usage-based insurance (UBI) programs leverage telematics data to offer discounts to safe and responsible drivers. This approach allows drivers to be rewarded for their good driving behavior, potentially leading to lower premiums.

- Pay-per-mile insurance is another UBI model that charges drivers based on the actual distance they drive. This can be particularly beneficial for low-mileage drivers who may find traditional insurance policies too expensive.

Autonomous Vehicles and Car Insurance

The rise of autonomous vehicles is poised to significantly impact the car insurance industry in New Jersey. Autonomous vehicles are expected to reduce accidents by minimizing human error, which could lead to lower insurance premiums.

- Liability issues are still being debated, as it’s unclear who will be held responsible in the event of an accident involving an autonomous vehicle. Will it be the driver, the manufacturer, or the software developer?

- Data privacy is another concern, as autonomous vehicles collect vast amounts of data about driving habits and location. Ensuring the secure and ethical use of this data is crucial.

- New insurance models are being developed to address the unique challenges posed by autonomous vehicles. These models may focus on factors such as vehicle performance, software updates, and data security.

Predictions for the Future of Car Insurance in NJ

- Increased use of telematics and UBI: As technology continues to advance, more drivers are expected to adopt telematics devices and participate in UBI programs. This will lead to more personalized and accurate insurance premiums.

- New insurance products for autonomous vehicles: Insurance companies are actively developing specialized insurance products tailored to the unique needs of autonomous vehicles. These products may cover aspects like liability, data security, and software updates.

- Shift towards usage-based pricing: Traditional insurance models based on factors like age, gender, and vehicle type may become less relevant as usage-based pricing gains traction.

Last Recap

As you navigate the world of car insurance in New Jersey, remember that understanding your options and taking advantage of available resources is key to finding the right coverage for your needs. By following the tips and strategies Artikeld in this guide, you can secure affordable and comprehensive car insurance that provides peace of mind on the road. Stay informed, shop around, and make smart choices to ensure you’re protected and financially secure.

Navigating New Jersey’s car insurance landscape can be a bit tricky, especially with the varying coverage options and regulations. If you’re looking for a good resource to understand your rights and responsibilities as a driver, the department of insurance california website provides a wealth of information, though it’s geared towards California residents.

While it might not be directly relevant to NJ car insurance, it can offer valuable insights into how insurance works and how to make informed decisions about your coverage.