Restaurant insurance is essential for any food service establishment, providing financial protection against a wide range of risks. From unexpected fires and accidents to lawsuits and business interruptions, the right insurance policy can safeguard your investment and ensure the continued success of your restaurant.

Understanding the different types of restaurant insurance, the key considerations for coverage, and the importance of choosing the right policy are crucial steps in mitigating potential risks and securing the financial stability of your business. This comprehensive guide will provide valuable insights into the world of restaurant insurance, empowering you to make informed decisions that protect your investment and peace of mind.

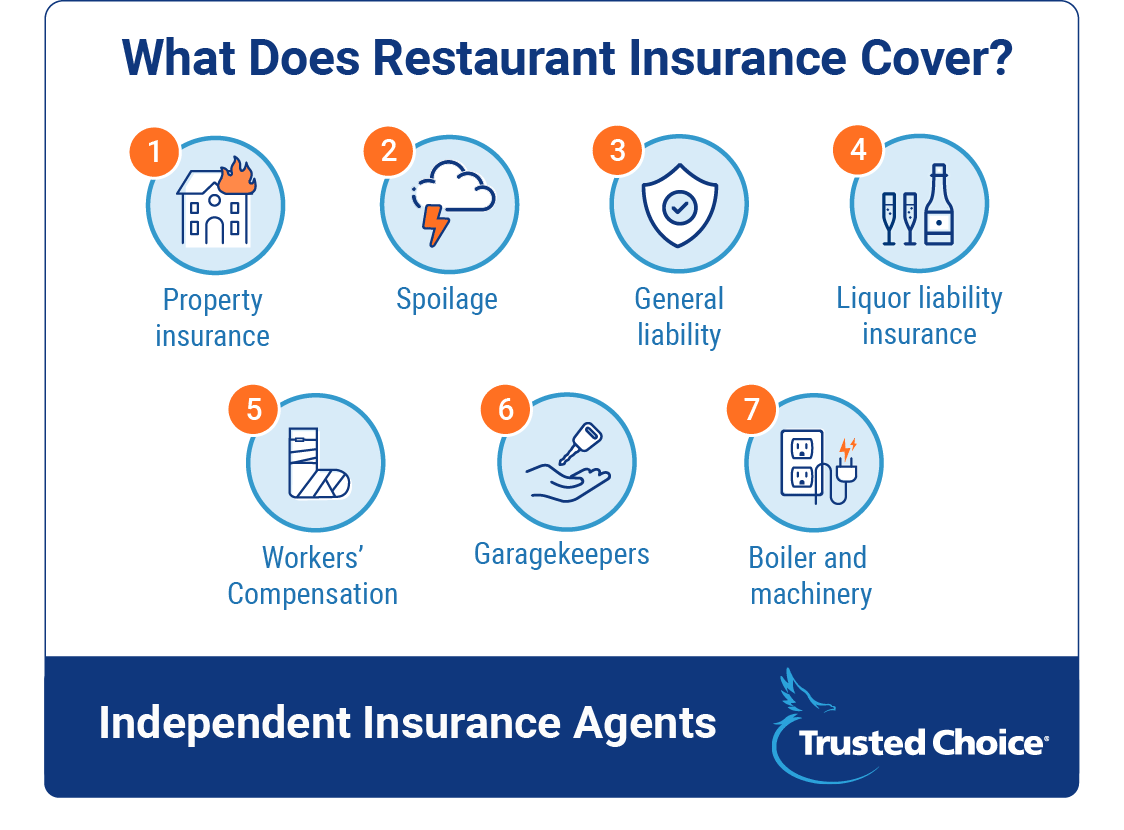

Types of Restaurant Insurance

Restaurant insurance is a vital aspect of running a successful and sustainable business. It provides a safety net against unforeseen events, ensuring your financial stability and protecting your assets. Different types of insurance cater to specific needs and risks associated with restaurant operations.

Property Insurance

Property insurance covers your restaurant’s physical assets, including the building, equipment, furniture, and inventory, against various perils. These perils may include fire, theft, vandalism, natural disasters, and other unforeseen events. This insurance policy provides financial compensation to rebuild or replace damaged or lost assets, allowing you to resume operations quickly and minimize financial losses.

Liability Insurance

Liability insurance protects your restaurant from financial claims arising from injuries or property damage caused to third parties. This type of insurance covers legal expenses, medical bills, and other costs associated with lawsuits or claims. Liability insurance is crucial for protecting your restaurant from significant financial burdens and legal complications.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in most states and covers employees’ medical expenses and lost wages in case of work-related injuries or illnesses. This insurance policy safeguards your restaurant from lawsuits and financial liabilities related to employee injuries, ensuring a safe and secure work environment.

Business Interruption Insurance

Business interruption insurance compensates for lost revenue and ongoing expenses when your restaurant is forced to close due to unforeseen events covered under your policy. These events may include natural disasters, fires, power outages, or government-mandated closures. This insurance helps to maintain your financial stability during business disruptions, allowing you to cover operating costs and ensure a smooth transition back to normal operations.

Key Features, Benefits, and Costs of Restaurant Insurance

The table below summarizes the key features, benefits, and costs of different types of restaurant insurance:

| Type of Insurance | Key Features | Benefits | Costs |

|---|---|---|---|

| Property Insurance | Covers building, equipment, furniture, and inventory against various perils | Financial compensation for damaged or lost assets, allowing for quick resumption of operations | Cost varies based on coverage amount, location, and risk factors |

| Liability Insurance | Protects against financial claims arising from injuries or property damage to third parties | Covers legal expenses, medical bills, and other costs associated with lawsuits or claims | Cost varies based on coverage amount, location, and risk factors |

| Workers’ Compensation Insurance | Covers employee medical expenses and lost wages in case of work-related injuries or illnesses | Protects against lawsuits and financial liabilities related to employee injuries, ensuring a safe work environment | Cost varies based on industry, number of employees, and claims history |

| Business Interruption Insurance | Compensates for lost revenue and ongoing expenses during business disruptions | Maintains financial stability during closures, allowing for coverage of operating costs and a smooth transition back to normal operations | Cost varies based on coverage amount, location, and risk factors |

Key Considerations for Restaurant Insurance

Restaurant insurance premiums are influenced by various factors, and understanding these factors can help restaurant owners make informed decisions about their coverage and potentially save money.

Factors Affecting Restaurant Insurance Costs

Several factors contribute to the cost of restaurant insurance. These include:

- Size of the Restaurant: Larger restaurants generally require more extensive coverage, leading to higher premiums. For example, a large restaurant with multiple dining areas and a full kitchen will likely require more liability coverage than a small, single-room restaurant.

- Location: Restaurants in high-crime areas or areas with a higher risk of natural disasters may face higher premiums due to the increased likelihood of claims. For example, a restaurant located in an earthquake-prone region might need to pay higher premiums for earthquake insurance.

- Type of Cuisine: Restaurants serving specific types of cuisine, such as those handling raw seafood or using open flames, may have higher insurance costs. This is due to the increased risk of foodborne illnesses or fire hazards associated with these cuisines.

- Number of Employees: The number of employees working at a restaurant can impact insurance costs. A restaurant with a larger staff will have a higher risk of workplace accidents, potentially leading to higher workers’ compensation premiums.

- Claims History: Restaurants with a history of insurance claims may face higher premiums. Insurance companies consider past claims as an indicator of future risk.

Strategies to Reduce Restaurant Insurance Premiums

Restaurant owners can take steps to minimize their insurance premiums:

- Implement Safety Measures: Implementing safety measures, such as fire extinguishers, smoke detectors, and non-slip flooring, can reduce the risk of accidents and claims, potentially leading to lower premiums.

- Maintain a Clean and Safe Environment: Regularly cleaning and maintaining the restaurant, including equipment and surfaces, can reduce the risk of foodborne illnesses and other hazards, potentially lowering insurance costs.

- Provide Employee Training: Training employees on food safety, handling hazardous materials, and workplace safety can reduce the risk of accidents and claims, potentially resulting in lower premiums.

- Shop Around for Insurance: Comparing quotes from multiple insurance providers can help restaurant owners find the best rates and coverage options.

- Consider Bundling Policies: Bundling multiple insurance policies, such as property, liability, and workers’ compensation, with the same insurer can often result in discounts.

Choosing the Right Insurance Policy

Finding the right restaurant insurance policy is crucial for protecting your business from unexpected risks. By carefully considering the factors Artikeld below, you can ensure you have the coverage you need at a price that fits your budget.

Understanding Coverage Limits, Deductibles, and Exclusions

The coverage limits, deductibles, and exclusions are key components of any insurance policy. It’s essential to understand these elements to make an informed decision.

- Coverage Limits: These limits define the maximum amount your insurer will pay for a covered claim. It’s essential to choose limits that adequately cover your restaurant’s assets and potential liabilities. For example, if your restaurant has a high-value inventory, you’ll need a higher coverage limit for property damage.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. You should choose a deductible you can comfortably afford while still having adequate coverage.

- Exclusions: Exclusions are specific events or situations that are not covered by your policy. It’s essential to review the policy carefully and understand the exclusions to avoid surprises when you need to file a claim.

Comparing Insurance Providers and Policies

Once you understand the key components of restaurant insurance, it’s time to compare different providers and their policies.

- Get Quotes from Multiple Providers: Don’t settle for the first quote you receive. Contact several insurance companies to get a range of prices and coverage options. Online comparison tools can be helpful for this process.

- Review Policy Details Carefully: Don’t just focus on the premium price. Thoroughly review the policy details to ensure the coverage meets your specific needs. Pay attention to the coverage limits, deductibles, exclusions, and any additional benefits or services offered.

- Consider the Provider’s Reputation and Financial Stability: Choose a provider with a strong reputation for customer service and financial stability. You want to be sure they’ll be there to pay your claims when you need them.

Filing a Claim

Filing a claim under your restaurant insurance policy is a crucial step in protecting your business after an incident. It ensures you receive the financial assistance you need to recover and rebuild.

Understanding the Process, Restaurant insurance

When you experience a covered event, such as a fire, theft, or liability lawsuit, promptly notify your insurance company. The insurer will then guide you through the claims process.

Documenting the Incident

It’s essential to gather comprehensive documentation about the incident. This helps expedite the claims process and ensures a smooth transition.

Checklist of Documents and Information

- Policy Information: Your insurance policy number, the date of the policy, and the name of your insurance agent.

- Incident Details: A detailed description of the event, including the date, time, and location. Include a list of any damages or losses incurred.

- Proof of Loss: This may include photographs, videos, repair estimates, and invoices. For example, if a fire damaged your kitchen equipment, provide photos of the damaged equipment and estimates for repairs or replacements.

- Police Report: If the incident involved a crime, such as theft or vandalism, obtain a copy of the police report. This provides official documentation of the incident.

- Witness Statements: Gather contact information and statements from any witnesses to the incident. This can be crucial for establishing the circumstances of the event.

- Inventory Records: Provide a detailed inventory of your restaurant’s assets, including equipment, furniture, and supplies. This allows the insurance company to accurately assess the value of your losses.

- Financial Records: Provide your insurance company with financial records, such as bank statements and tax returns. This helps them determine the extent of your financial losses.

Insurance for Specific Restaurant Operations: Restaurant Insurance

Different types of restaurants have unique needs when it comes to insurance. From fine dining establishments to fast-food chains and catering businesses, each faces specific risks and requires tailored coverage. Understanding these differences is crucial for choosing the right insurance policy and protecting your business.

Fine Dining Establishments

Fine dining restaurants often serve high-end clientele and handle expensive ingredients, making them susceptible to certain risks.

- Liquor Liability: Serving alcohol exposes fine dining establishments to liability for injuries caused by intoxicated patrons. A dedicated liquor liability policy provides coverage for lawsuits, medical expenses, and other costs associated with such incidents.

- Property Damage: Fine dining restaurants often have valuable furnishings, artwork, and equipment. A comprehensive property insurance policy protects against damage or loss due to fire, theft, vandalism, or natural disasters.

- Business Interruption: A business interruption policy covers lost income and expenses if the restaurant is forced to close temporarily due to an insured event, such as a fire or flood. This coverage ensures that the restaurant can resume operations as quickly as possible.

- Employee Dishonesty: Fine dining establishments often handle large amounts of cash and valuable inventory. An employee dishonesty policy provides coverage for losses caused by employee theft or fraud.

Fast-Food Restaurants

Fast-food restaurants face different risks than fine dining establishments. Their high volume of customers and reliance on drive-thru service create unique challenges.

- Slip and Fall: Fast-food restaurants often have high foot traffic, increasing the risk of slip and fall accidents. General liability insurance covers medical expenses and legal costs associated with such incidents.

- Product Liability: Fast-food restaurants are responsible for ensuring the safety of their food. Product liability insurance protects against claims related to foodborne illnesses or other product-related injuries.

- Cybersecurity: Fast-food restaurants rely heavily on technology for ordering, inventory management, and payment processing. Cybersecurity insurance provides coverage for data breaches, ransomware attacks, and other cyber threats.

- Workers’ Compensation: Fast-food restaurants have a high turnover rate, which can lead to increased risk of workplace injuries. Workers’ compensation insurance covers medical expenses, lost wages, and other costs associated with employee injuries.

Catering Businesses

Catering businesses operate in a variety of locations and serve a wide range of clients. Their unique business model requires specific insurance coverage.

- General Liability: Catering businesses are exposed to liability for injuries or property damage that occurs at events they cater. General liability insurance provides coverage for lawsuits, medical expenses, and other costs associated with such incidents.

- Foodborne Illness: Catering businesses are responsible for ensuring the safety of the food they prepare and serve. Foodborne illness insurance protects against claims related to food poisoning or other food-related illnesses.

- Liquor Liability: Catering businesses that serve alcohol at events need liquor liability insurance to protect them from claims related to intoxicated patrons.

- Auto Liability: Catering businesses often use vehicles to transport food, equipment, and staff. Auto liability insurance provides coverage for accidents involving the business’s vehicles.

Emerging Trends in Restaurant Insurance

The restaurant industry is constantly evolving, driven by technological advancements and changing consumer preferences. These shifts have a significant impact on the risks restaurants face, and consequently, the insurance landscape is adapting to provide comprehensive coverage for these emerging challenges.

Impact of Technology and Innovation

Technology is transforming the restaurant industry in numerous ways, from online ordering and delivery platforms to smart kitchen equipment and data analytics. This technological revolution presents both opportunities and risks for restaurants.

- Increased Cyber Security Risks: Restaurants increasingly rely on digital systems for operations, making them vulnerable to cyberattacks. This necessitates specialized cyber liability insurance to cover data breaches, ransomware attacks, and other cyber threats.

- Data Privacy Concerns: Restaurants collect vast amounts of customer data, which must be protected under evolving data privacy regulations like GDPR and CCPA. This calls for robust data breach insurance to mitigate financial and reputational risks associated with data breaches.

- Automation and Robotics: The adoption of robots and automation in kitchens and delivery services poses new challenges for traditional insurance policies. Insurers are developing specialized coverage for these technologies, addressing potential liabilities and risks associated with their use.

- Delivery Services and Third-Party Platforms: The rise of food delivery platforms like Uber Eats and DoorDash has created new insurance needs for restaurants. Insurers are adapting their policies to cover risks associated with third-party delivery drivers, including accidents, injuries, and property damage.

New and Emerging Insurance Products and Services

The evolving risks and needs of the restaurant industry are driving the development of innovative insurance products and services specifically tailored to meet these challenges.

- Cyber Liability Insurance: This specialized coverage protects restaurants from financial losses resulting from cyberattacks, data breaches, and other digital threats. It can cover expenses related to data recovery, legal defense, and regulatory fines.

- Data Breach Insurance: This insurance policy helps restaurants manage the financial and reputational consequences of data breaches. It covers expenses related to notifying affected individuals, credit monitoring services, and legal defense.

- Robotics and Automation Insurance: This emerging coverage addresses the unique risks associated with using robots and automation in restaurants. It can cover potential liabilities arising from accidents, injuries, or malfunctions related to these technologies.

- Delivery Service Insurance: This type of insurance provides coverage for restaurants that partner with third-party delivery platforms. It can cover accidents, injuries, and property damage caused by delivery drivers, as well as liability for foodborne illnesses.

Concluding Remarks

In conclusion, restaurant insurance is an indispensable tool for any food service establishment. By carefully considering the various types of coverage, the factors influencing premium costs, and the specific risks faced by your restaurant, you can choose a policy that provides adequate protection and peace of mind. By investing in the right insurance, you are not only safeguarding your financial future but also ensuring the continued success and stability of your restaurant business.

Restaurant insurance is a vital component of any food service establishment, protecting against a wide range of risks. From property damage to liability claims, a comprehensive policy can provide peace of mind. If you’re looking for a reliable partner in securing the right insurance coverage, consider insurance king , known for their expertise in tailoring policies to meet the unique needs of restaurants.