Term insurance quotes are the gateway to securing affordable life insurance, offering peace of mind for you and your loved ones. These quotes provide a snapshot of the cost of coverage, allowing you to compare different policies and find the best fit for your needs. Understanding how these quotes are generated and what factors influence their pricing is crucial in making an informed decision.

This guide delves into the intricacies of term insurance quotes, exploring the key terms, influencing factors, and different types of policies available. We’ll equip you with the knowledge to navigate the world of term insurance quotes and find the most suitable coverage for your individual circumstances.

Factors Influencing Term Insurance Quotes

Term insurance quotes are not one-size-fits-all. They are tailored to each individual’s unique circumstances, considering a range of factors that contribute to the policy’s cost. Understanding these factors is crucial for making informed decisions about your term insurance needs.

Factors Influencing Term Insurance Quotes

The cost of term insurance is determined by several factors, each contributing to the final quote. These factors can be categorized as follows:

| Factor | Description | Impact on Quote | Example |

|---|---|---|---|

| Age | Your age is a significant factor in determining the cost of term insurance. As you age, your risk of mortality increases, leading to higher premiums. | Higher age = Higher premium | A 30-year-old individual will generally pay lower premiums compared to a 50-year-old individual for the same coverage. |

| Health | Your health status plays a crucial role in determining your insurance premium. Individuals with pre-existing medical conditions or a history of health issues may face higher premiums due to a greater risk of claims. | Poor health = Higher premium | Someone with a history of heart disease may be charged a higher premium than someone with a clean bill of health. |

| Smoking Habits | Smoking is a major risk factor for various health problems, including heart disease and cancer. Therefore, smokers generally pay higher premiums than non-smokers. | Smoker = Higher premium | A smoker may pay significantly more for the same coverage compared to a non-smoker of the same age and health. |

| Lifestyle | Your lifestyle choices, such as diet, exercise, and hobbies, can impact your health and, consequently, your insurance premium. Individuals with a healthy lifestyle may be eligible for lower premiums. | Healthy lifestyle = Lower premium | An individual who regularly exercises and maintains a balanced diet may qualify for lower premiums compared to someone who leads a sedentary lifestyle. |

Factors to Consider Before Choosing a Quote

Choosing the right term insurance quote isn’t just about finding the cheapest option. It’s about finding a policy that meets your specific needs and financial goals. You need to take the time to understand your individual circumstances and compare quotes based on factors that matter most to you.

Your Financial Goals

It’s essential to determine how much coverage you need to meet your financial goals. This involves considering your dependents, their financial needs, and your outstanding debts. If you have a spouse and children, for example, you’ll need a larger policy to ensure their financial security in the event of your untimely demise.

Your Dependents

The number and age of your dependents will play a significant role in determining the coverage you require. A larger family with young children will likely need a more substantial policy compared to a single individual without dependents.

Your Risk Tolerance

Your risk tolerance reflects your willingness to accept potential losses. If you have a high risk tolerance, you might be comfortable with a smaller policy with a lower premium. However, if you’re risk-averse, you may prefer a larger policy with a higher premium to ensure your family is well-protected.

Your Health and Lifestyle

Your health and lifestyle choices will also influence the premium you’ll pay. Individuals with pre-existing medical conditions or unhealthy habits will generally pay higher premiums than those in good health.

Your Budget

While it’s important to have adequate coverage, you also need to consider your budget. The premium should be affordable and fit comfortably within your financial plan.

Common Mistakes to Avoid When Choosing a Quote: Term Insurance Quotes

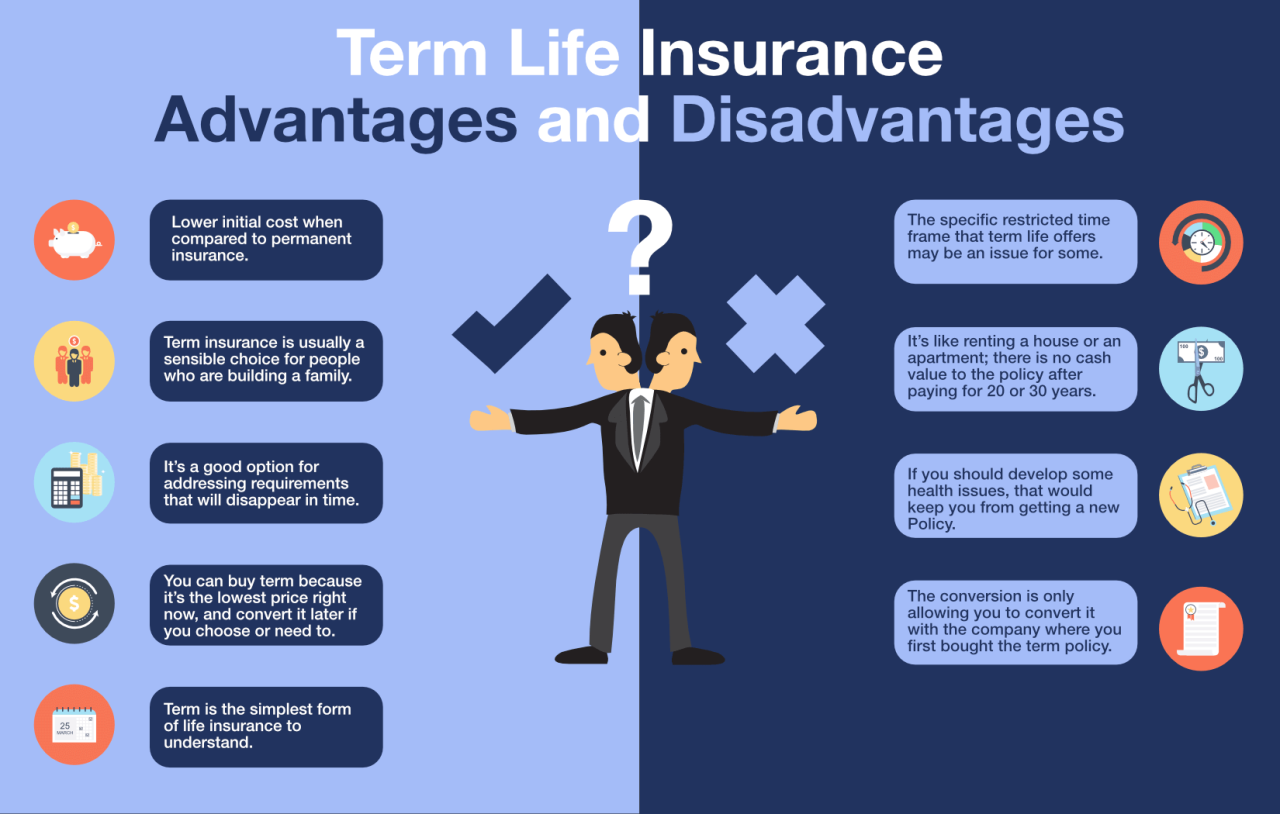

Choosing the right term insurance policy can be a daunting task, especially with the wide range of options available. However, making informed decisions can save you from potential regrets and financial burdens in the future. To help you navigate this process effectively, let’s explore some common mistakes people make when selecting term insurance quotes and how to avoid them.

Focusing Solely on the Lowest Premium

It’s tempting to go for the cheapest quote, but this can be a costly mistake in the long run. The lowest premium might not offer the coverage you need, such as adequate sum assured or a long enough policy term.

For instance, a policy with a lower premium might have a shorter coverage period, leaving you vulnerable if you need protection beyond that time.

Instead of solely focusing on the premium, compare quotes based on the coverage they offer, the insurer’s reputation, and the policy’s features.

Ignoring the Insurer’s Financial Stability, Term insurance quotes

While a low premium might be attractive, it’s crucial to consider the financial stability of the insurer.

An insurer with a poor financial track record might not be able to pay out your claim when you need it most.

Research the insurer’s financial health, including their claims settlement ratio and solvency rating, to ensure they are financially sound and reliable.

Not Understanding the Policy’s Exclusions

Every term insurance policy has exclusions, which are specific events or circumstances not covered by the policy.

For example, some policies might exclude coverage for pre-existing conditions or certain risky activities.

Carefully read the policy document and understand the exclusions before making a decision. This will help you avoid unpleasant surprises later.

Not Considering Your Future Needs

Your insurance needs might change over time. For example, you might need more coverage if you have children or take on a larger mortgage.

A young professional might choose a shorter policy term, but as they start a family, they might need a longer term.

Consider your future financial needs and choose a policy that can adapt to your changing circumstances.

Not Seeking Professional Advice

Term insurance is a complex product, and it’s always advisable to seek professional advice from a qualified insurance advisor. They can help you understand your needs, compare different quotes, and choose the most suitable policy for your situation.

Wrap-Up

Ultimately, securing term insurance is about ensuring your loved ones’ financial security in the event of your untimely demise. By understanding the nuances of term insurance quotes, you can make a well-informed decision that provides the necessary coverage without breaking the bank. Remember to carefully review the policy document, consider your individual needs, and seek professional advice when necessary. Armed with this knowledge, you can confidently navigate the world of term insurance and find the right policy to protect your family’s future.

When comparing term insurance quotes, it’s essential to consider your individual needs and budget. Just like you’d want to shop around for the best deal on national general car insurance , the same applies to term insurance. By carefully reviewing quotes from different providers, you can find a policy that offers the right coverage at a price that fits your financial situation.